- Home

- Under President’s Budget, TANF Would Lik...

Under President’s Budget, TANF Would Likely Provide Fewer Families with Cash Assistance and Work Opportunities, New Details Show

On the heels of enacting tax cuts that will mainly benefit the wealthy, the President has proposed funding cuts and spending requirements in the Temporary Assistance for Needy Families (TANF) block grant that will reduce the federal government’s commitment to providing assistance to our country’s poorest families. In his fiscal year 2019 budget, released in February, President Trump proposed $2.2 billion in cuts to the TANF block grant, which provides funds to states for short-term income assistance, work programs, and other crucial supports for poor families with children.[1] Additional details that the Department of Health and Human Services (HHS) released in March, related to state-specific cuts and other changes to how states can spend TANF funds, reveal how the budget would further weaken the program.

To pay for these various cuts, states would likely cut basic assistance under TANF — the funds that go directly to families — as they have in the past.The budget proposes to cut 10 percent of the block grant, eliminate the Contingency Fund — an additional support to states when they are in hard economic times — and establish a minimum requirement for state spending on work programs and supports. [2] Moreover, proposals to reduce or eliminate other low-income programs would create even greater demand for the flexible, but fixed, funding that the TANF block grant provides. To pay for these various cuts, states would likely cut basic assistance under TANF — the funds that go directly to families — as they have in the past. As a result, even fewer poor families would benefit from TANF, a program whose reach has already shrunk dramatically since its inception, putting such families at risk of even greater hardship.

The TANF proposals in the President’s budget that impact the amount and uses of the block grant, including those detailed by HHS, are:

- A permanent 10 percent reduction in the block grant and the elimination of the Contingency Fund. Beginning in 2019, the budget would cut the TANF block grant by 10 percent, from $16.2 billion[3] to $14.7 billion, and eliminate the $608 million Contingency Fund — bringing the total 2019 cut to about $2.2 billion. The cuts would reduce every state’s TANF block grant funds by at least 10 percent. A third of states that currently receive contingency funding would see a greater reduction in federal TANF funds, up to an 18 percent cut.

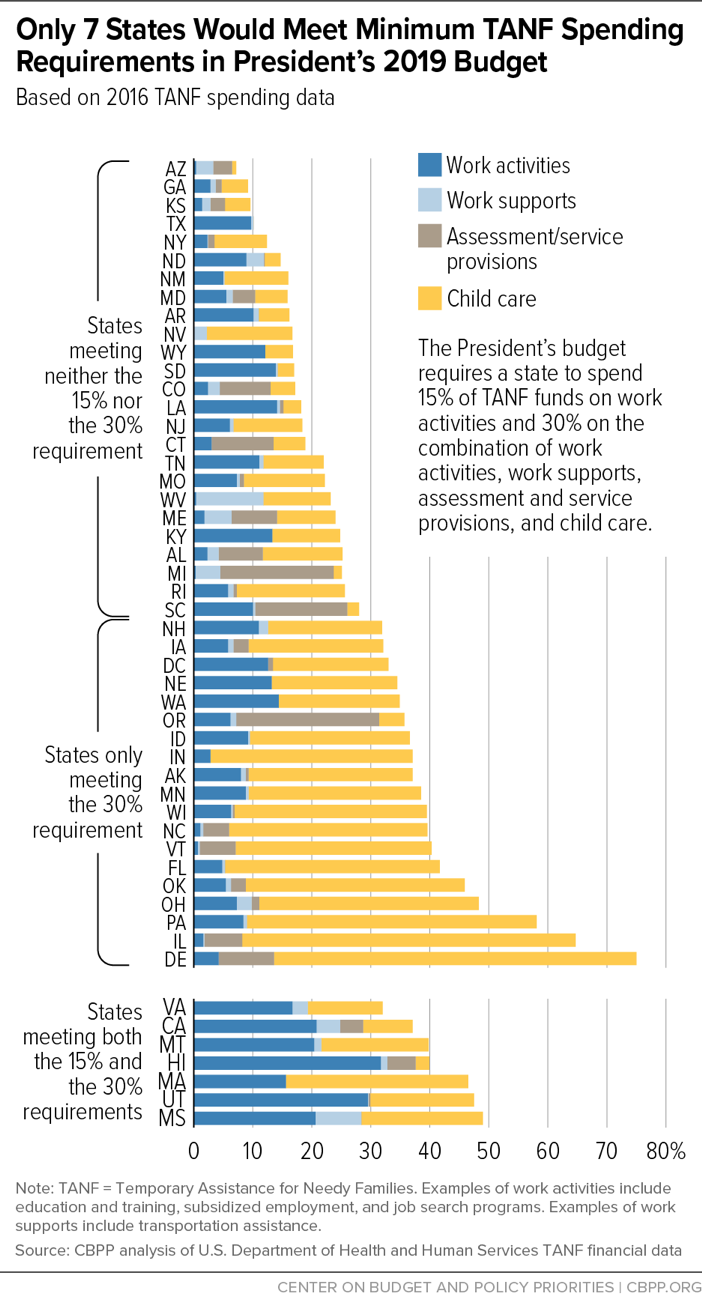

- A requirement for minimum spending on work and work-related activities. The budget would require states to spend at least 30 percent of federal and state TANF dollars on work activities, such as education, training, and subsidized employment; work supports, such as transportation assistance; child care; and assessment and provision of services such as case management. Half of the required spending (or 15 percent of total spending) would have to be in work and training. Basic assistance, or cash grants to families, is not included in the required spending. States would have to have shift funds from other areas to meet these new requirements.

The budget proposes other changes to TANF that are not related to the amount and uses of the block grant. There are proposed changes to TANF’s primary work performance measure, the Work Participation Rate. Beyond the TANF changes, the HHS budget proposal calls for the wholesale elimination of programs that provide critical assistance to low-income families, including the Social Services Block Grant (SSBG),[4] the Low Income Home Energy Assistance Program (LIHEAP), and the Community Services Block Grant (CSBG).[5] Together, these changes represent significant efforts to cut programs that help very low-income families meet their basic needs and address their social service needs.

The President’s budget purports to strengthen TANF’s focus on getting parents to work, but the proposed cuts run counter to that aim. Without any protections for basic assistance, the budget’s proposals will surely reduce access to TANF, leaving even fewer families with access to the services that work programs are supposed to provide. To truly get families started on a path to self-sufficiency, TANF must both be accessible to those in need and provide them adequate work opportunities.

TANF Cuts Would Fall Heaviest on Basic Assistance

The proposed 10 percent cut to TANF would exacerbate the decline in the value of the block grant and would likely fall heaviest on basic assistance — cash grants that go directly to families. The TANF block grant has already lost more than a third of its inflation-adjusted value since 1996. Without cuts, the block grant is projected to lose 39 percent of its inflation-adjusted value by 2019. Under the President’s budget, the projected value decline would be 45 percent.[6] And the elimination of the Contingency Fund would only make things worse for the third of the states that receive funding from it, as they would lose even more under the President’s budget (see Appendix). Not only would states have fewer TANF resources after the cuts and elimination of the Contingency Fund, but states might also look to TANF to fill in budget holes left by the elimination of other block grants for low-income people, such as SSBG. In short, the budget would restrict TANF’s ability to address economic hardship and boost opportunity.

States generally have broad flexibility in how they allocate TANF funds, so they could respond to the cuts in a number of ways. They could, for instance, cut all of their TANF-funded programs by an equal percentage, or they could target the cuts in one area such as basic assistance. History shows many states would likely look for savings in basic assistance first, especially since it would not be a part of the new minimum spending requirements. When faced with tight budgets, as during the Great Recession, a number of states disproportionally targeted basic assistance programs for cuts.[7] For example, starting in 2009 Arizona cut benefits, shortened time limits, and imposed other eligibility restrictions to help address its budget problems. Washington State, responding to the cost of rising needs in the state, cut benefits and tightened its time-limit policies in 2011. Neither state fully restored those cuts when economic conditions improved.

Basic assistance has not been protected in the past and access to TANF has declined significantly since the start of the program in 1996. Today, just 23 of every 100 poor families with children receive cash benefits through TANF, down from 68 of every 100 poor families in 1996 under the former Aid to Families with Dependent Children (AFDC) program, which TANF replaced.[8]

In many states, basic assistance alone would not be able to cover the proposed funding reductions or the possible shifts in funding to other areas. Some 17 states spend less than 15 percent on basic assistance and nine states spend less than 10 percent. They would likely need to consider cuts in other areas funded with TANF dollars in programs like child care, working family tax credits, and child welfare.

Minimum Spending Requirement a Reasonable Approach, but President’s Proposal Misses Mark

Requiring minimum spending for specific core TANF areas like basic assistance, work programs and supports, and child care is not an unreasonable limit to state flexibility. Proponents of the TANF block grant design argued states would use the program’s flexibility to reinvest in work and work supports. That is not what happened over the long term. While there was some initial investment in the early years, the level of spending on work, work supports, and child care has remained flat since the early 2000s. Instead, states have increasingly used the money for programs beyond the original purposes of TANF.[9] In 2016, states spent only 9 percent on work and training, 2 percent on work supports, and 17 percent on child care. Forty percent of TANF spending was in other areas like pre-kindergarten programs and child welfare. A minimum spending requirement could protect core TANF areas from disinvestment and limit spending in other areas.

However, as designed, the President’s proposal is problematic. Because it leaves out basic assistance, it puts one of TANF’s core purposes at risk of being cut to levels not conceived of when policymakers first created TANF. And the proposal would need additional funds, not less, in order for states to provide parents with expanded work opportunities. Requiring states to spend more on work at the expense of providing cash assistance to families would result in fewer rather than more families receiving the assistance they need to find work and move into better jobs. Based on 2016 TANF spending data, the vast majority of states would fail to meet the new requirements:

- Only seven states — California, Hawaii, Massachusetts, Mississippi, Montana, Utah, and Virginia — would meet both the 30 percent and 15 percent spending requirements based on those states’ spending levels in 2016 (see Figure 1). [10]

- Some 19 states would meet the 30 percent requirement, but not the 15 percent requirement. Eleven of these states would need to more than double their spending on work and training to meet that required spending level. Most of them meet the 30 percent requirement because they spend a significant amount on child care.[11]

- The remaining half of the states would not meet either requirement. Sixteen states would need to more than double their spending on work and training to meet the 15 percent requirement. Even if they met the spending level for work and training, 15 states would still be below the 30 percent requirement. Looking at spending for these states broadly, a number of them spend at least half of their TANF funds on non-core activities.

What a Minimum Spending Requirement Should Look Like

TANF needs a renewed commitment to serve more families and connect those families to work opportunities. However, over the past two decades states have spent more and more TANF funds in other areas, in part because federal investments have failed to meet the growing needs in programs like child welfare and states have not adequately funded their priority initiatives like pre-K and state tax credits for low-income families. For too long, TANF funds have been the go-to source for funding special initiatives. If TANF is going to provide work opportunities for unemployed parents, TANF funds should be used primarily for core activities — cash assistance, work activities, and work supports — not other areas. Mandating that states spend a minimum share on core activities is a reasonable approach as it could redirect funds toward the key welfare reform goals of providing cash aid to poor families with children and moving parents into work. A stronger spending requirement should:

- Include all core TANF activities — temporary basic assistance, work and training, work supports, and child care — in a minimum spending requirement. When basic assistance is not protected, more and more families lose access to the program, leaving fewer families able to take advantage of the expanded work programs.[12]

- Require that 60 percent of TANF federal and state funds be spent on core activities. This level of spending would reflect the addition of basic assistance to the minimum requirement. In the early years of TANF, core areas accounted for more than 70 percent of total spending nationally; in 2016 they made up a little more than half of total spending. In ten states, spending on core activities was less than 30 percent of total spending. A 60 percent requirement would ensure most TANF resources go towards activities that represent key welfare reform goals.

- Come with increased federal TANF funding and restrictions on how the new funds can be spent. In addition to shifting current resources to core activities, states will need additional federal support. The loss of the value of the block grant limits how much states can do to invest in opportunity for TANF families. New funds will help states make new investments, but they should be limited to core activities for TANF families.

- Institute a reasonable phase-in period to give states time to comply. Several states currently spend very little on core activities and would need time to adjust their spending to meet requirements even if there were additional federal resources.

| Appendix: Proposed TANF Cuts in President’s 2019 Budget, by State | ||||||

|---|---|---|---|---|---|---|

| Current TANF levels | President’s proposed reduction for FY 2019 | |||||

| State block grant* | Contingency Fund | State block grant after reduction | Elimination of Contingency Fund | Total estimated federal funds cut | Percent cut in first year | |

| U.S. Total | $16,237,475,198 | $608,000,000 | $14,662,112,847 | -$608,000,000 | $-2,183,362,351 | -13% |

| (State amounts based on 2017 awards) | (State amounts based on loss of 2017 awards) | |||||

| Alabama | $93,007,267 | $9,876,594 | $83,983,688 | -$9,876,594 | $-18,900,173 | -18% |

| Alaska | 44,397,466 | 40,090,017 | -4,307,449 | -10% | ||

| Arizona | 199,407,313 | 21,183,201 | 180,060,785 | -21,183,201 | -40,529,729 | -18% |

| Arkansas | 56,545,640 | 6,004,678 | 51,059,573 | -6,004,678 | -11,490,745 | -18% |

| California | 3,637,996,759 | 3,285,037,750 | -352,959,009 | -10% | ||

| Colorado | 135,607,703 | 14,400,411 | 122,451,023 | -14,400,411 | -27,557,091 | -18% |

| Connecticut | 265,907,706 | 240,109,299 | -25,798,407 | -10% | ||

| Delaware | 32,184,421 | 3,417,717 | 29,061,884 | -3,417,717 | -6,540,254 | -18% |

| District of Columbia | 92,304,203 | 9,801,938 | 83,348,835 | -9,801,938 | -18,757,306 | -18% |

| Florida | 560,484,398 | 506,106,115 | -54,378,283 | -10% | ||

| Georgia | 329,650,291 | 297,667,569 | -31,982,722 | -10% | ||

| Hawaii | 98,578,402 | 10,468,204 | 89,014,310 | -10,468,204 | -20,032,296 | -18% |

| Idaho | 30,307,166 | 27,366,760 | -2,940,406 | -10% | ||

| Illinois | 583,126,272 | 526,551,271 | -56,575,001 | -10% | ||

| Indiana | 206,116,672 | 186,119,201 | -19,997,471 | -10% | ||

| Iowa | 130,558,068 | 117,891,304 | -12,666,764 | -10% | ||

| Kansas | 101,477,697 | 91,632,315 | -9,845,382 | -10% | ||

| Kentucky | 180,689,420 | 163,158,905 | -17,530,515 | -10% | ||

| Louisiana | 163,430,877 | 147,574,788 | -15,856,089 | -10% | ||

| Maine | 77,863,090 | 70,308,801 | -7,554,289 | -10% | ||

| Maryland | 228,342,008 | 24,248,021 | 206,188,231 | -24,248,021 | -46,401,798 | -18% |

| Massachusetts | 457,855,191 | 48,620,404 | 413,434,010 | -48,620,404 | -93,041,585 | -18% |

| Michigan | 772,794,194 | 697,817,582 | -74,976,612 | -10% | ||

| Minnesota | 259,826,186 | 234,617,809 | -25,208,377 | -10% | ||

| Mississippi | 86,481,245 | 78,090,821 | -8,390,424 | -10% | ||

| Missouri | 216,335,469 | 195,346,568 | -20,988,901 | -10% | ||

| Montana | 37,888,854 | 34,212,872 | -3,675,982 | -10% | ||

| Nebraska | 56,627,234 | 51,133,251 | -5,493,983 | -10% | ||

| Nevada | 43,762,394 | 4,647,226 | 39,516,560 | -4,647,226 | -8,893,060 | -18% |

| New Hampshire | 38,394,141 | 34,669,136 | -3,725,005 | -10% | ||

| New Jersey | 402,701,508 | 363,631,345 | -39,070,163 | -10% | ||

| New Mexico | 109,919,847 | 11,678,096 | 99,255,406 | -11,678,096 | -22,342,537 | -18% |

| New York | 2,434,868,931 | 258,562,787 | 2,198,637,571 | -258,562,787 | -494,794,147 | -18% |

| North Carolina | 300,437,627 | 31,904,255 | 271,289,122 | -31,904,255 | -61,052,760 | -18% |

| North Dakota | 26,312,690 | 23,759,829 | -2,552,861 | -10% | ||

| Ohio | 725,565,965 | 655,171,443 | -70,394,522 | -10% | ||

| Oklahoma | 144,792,997 | 130,745,158 | -14,047,839 | -10% | ||

| Oregon | 166,244,478 | 17,654,171 | 150,115,413 | -17,654,171 | -33,783,236 | -18% |

| Pennsylvania | 717,124,957 | 647,549,383 | -69,575,574 | -10% | ||

| Rhode Island | 94,708,016 | 85,519,430 | -9,188,586 | -10% | ||

| South Carolina | 99,637,930 | 10,580,716 | 89,971,043 | -10,580,716 | -20,247,603 | -18% |

| South Dakota | 21,207,402 | 19,149,857 | -2,057,545 | -10% | ||

| Tennessee | 190,891,768 | 172,371,419 | -18,520,349 | -10% | ||

| Texas | 484,652,105 | 51,466,013 | 437,631,083 | -51,466,013 | -98,487,035 | -18% |

| Utah | 75,355,939 | 68,044,894 | -7,311,045 | -10% | ||

| Vermont | 47,196,916 | 42,617,864 | -4,579,052 | -10% | ||

| Virginia | 157,762,831 | 142,456,657 | -15,306,174 | -10% | ||

| Washington | 379,058,185 | 40,262,428 | 342,281,901 | -40,262,428 | -77,038,712 | -18% |

| West Virginia | 109,812,728 | 99,158,680 | -10,654,048 | -10% | ||

| Wisconsin | 312,845,980 | 33,223,140 | 282,493,615 | -33,223,140 | -63,575,505 | -18% |

| Wyoming | 18,428,651 | 16,640,701 | -1,787,950 | -10% | ||

To Promote Equity, States Should Invest More TANF Dollars in Basic Assistance

Many States Cutting TANF Benefits Harshly Despite High Unemployment and Unprecedented Need

Policy Basics

Income Security

End Notes

[1] This proposal is different from the recently passed legislation to fund the government for the rest of fiscal year 2018.

[2] Department of Health and Human Services, “Administration for Children and Families: Justification of Estimates for Appropriations Committee, Fiscal Year 2019,” March 2019, https://www.acf.hhs.gov/sites/default/files/olab/acf_master_cj_acf_final_3_19_0.pdf.

[3] The TANF block grant was authorized at $16.5 billion. However, some states transfer funds to American Indian tribes for Tribal TANF programs. Additionally, in fiscal years 2017 and 2018 every state’s block grant was reduced by 0.33 percent to fund TANF-related research, technical assistance, and evaluation under the 2017 Consolidated Appropriations Act. The remaining block grant to states is currently about $16.2 billion.

[4] SSBG is funding for specialized services for the most vulnerable populations.

[5] CSBG is funding to communities to address local poverty issues.

[6] CBPP analysis of TANF block grant adjusted for inflation using the CPI-U-RS.

[7] Liz Schott and LaDonna Pavetti, “Many States Cutting TANF Benefits Harshly Despite High Unemployment and Unprecedented Need,” Center on Budget and Policy Priorities, updated October 3, 2011, https://www.cbpp.org/research/many-states-cutting-tanf-benefits-harshly-despite-high-unemployment-and-unprecedented-need.

[8] Ife Floyd, LaDonna Pavetti, and Liz Schott, “TANF Reaching Few Poor Families,” Center on Budget and Policy Priorities, updated December 13, 2017, https://www.cbpp.org/research/family-income-support/tanf-reaching-few-poor-families.

[9] Liz Schott and Ife Floyd, “How States Use Funds Under the TANF Block Grant,” Center on Budget and Policy Priorities, January 5, 2017, https://www.cbpp.org/research/family-income-support/how-states-use-funds-under-the-tanf-block-grant.

[10] Moreover, spending in some states — for example, in California, Hawaii, and Massachusetts — that appears to involve TANF work and training programs is actually college financial aid spending for students who traditionally have higher incomes than TANF families; thus, it does not represent investments in work and training for cash assistance families.

[11] Oregon is the only state in this group that spends more than half of its required spending on something other than child care.

[12] Even with the spending requirement, a state could shift funds away from basic assistance. Therefore, states should also be held accountable for serving families in need. See LaDonna Pavetti and Liz Schott, “TANF at 20: Time to Create a Program that Supports Work and Helps Families Meet Their Basic Needs,” Center on Budget and Policy Priorities, August 15, 2016, https://www.cbpp.org/research/family-income-support/tanf-at-20-time-to-create-a-program-that-supports-work-and-helps.

More from the Authors