Adequate cash assistance is essential to help families maintain stability and to support children’s healthy development, especially when families with low incomes experience a job loss or other crisis. Yet since the early 20th century, cash assistance programs have provided very low benefits. And, due in part to racist and sexist narratives about Black mothers, cash assistance programs deliberately excluded Black families or provided lower average benefits in states with high concentrations of Black families in those early years.[2] Today’s cash assistance program, Temporary Assistance for Needy Families (TANF), continues to provide very low benefits — at or below 60 percent of the poverty line in every state. Moreover, benefits vary widely from state to state, and Black and Latinx children are likelier than white children to live in one of the 16 states where benefits don’t even reach 20 percent of the poverty line, or about $366 a month for a family of three in 2021.[3]

Low family grants and wide state-by-state variation started under the state- and locally funded mothers’ pension programs of the early 1900s, the first publicly funded cash assistance programs for children of single mothers. In creating the federal Aid to Dependent Children (ADC, later renamed Aid to Families with Dependent Children or AFDC) program in 1935, federal policymakers followed the mothers’ pension model. At ADC’s creation and in succeeding decades, Southern members of Congress blocked efforts to set federal benefit standards for the program, thereby maintaining state control.

For Black and other marginalized single mothers, state control over ADC/AFDC often meant exclusion, coercion to work for low wages, or lower grants overall. Southern states and other states with higher Black populations generally provided lower average benefits than other states. Overall, the situation hasn’t much improved since TANF’s enactment in 1996; while a few states have raised the value of their benefits, many more have let benefits deteriorate.[4]

TANF cash assistance has a role to play to support families when they fall on hard times. It can provide stability and support children’s development. But to do so, the program must move in an antiracist direction and recognize the dignity and power of Black mothers and their role in caring for their children. This paper — part of a series on TANF and race, which examines how racist and sexist attitudes toward Black women have helped shape the history and design of cash assistance[5] — presents policy recommendations to improve TANF that follow the “Black Women Best” (BWB) framework. Janelle Jones, now Chief Economist at the Department of Labor, developed the BWB framework, which “argues if Black women — who, since our nation’s founding, have been among the most excluded and exploited by the rules that structure our society — can one day thrive in the economy, then it must finally be working for everyone.”[6]

To reimagine TANF through a Black Women’s Best framework, we propose:

- Establishing a federal minimum benefit so that no family of any race falls below a certain income level.

- Changing TANF’s funding structure to retarget TANF resources to basic assistance, address funding inequities, and prevent erosion over time.

- Increasing benefits at the state level, without waiting for federal policy changes. States, especially Southern states with high Black populations, should raise benefits significantly and create a mechanism to maintain their purchasing power over time.

Another paper in this series, “Cash Assistance Should Promote Equity: Applying the ‘Black Women Best’ Framework to Temporary Assistance for Needy Families,” outlines other recommended changes to TANF to improve access to the program and supports for families, such as ending and barring work requirements, behavioral policies, and time limits.[7]

Illinois established the first mothers’ pension program in 1911. These programs, which were state or locally funded, were among the first public payments for children of single mothers and were created so children could continue to be cared for by their mother after the loss of the family breadwinner. By 1930, localities in dozens of states had established mothers’ pension programs.[8]

However, there was little public investment in mothers’ pension programs, so average benefits — which varied widely by state and locality — were generally low and did not cover the essentials.[9] (See Appendix Table 1.) In 1931, most states with programs had average monthly grants at or below $30 a month, or about $452 a month in 2021 dollars.[10]

Many local administrators and other officials were hesitant to give mothers much money. Some, reflecting traditional gender norms of the day, worried that women would leave their husbands if they could gain economic independence through mothers’ pension programs.[11] Others wondered if mothers would spend the resources recklessly or choose not to work for low wages.[12] (Claims that cash benefits discourage work would reappear in debates over later cash programs, especially as Black mothers gained more access to this aid.[13] Unfortunately, even today, over 20 states’ TANF benefits are at or below $452 a month for a family of three.)

Administrators of mothers’ pension programs targeted the program only to white widows. Programs largely operated under judgments about a family’s “deservingness” that, in turn, were based on caseworkers’ judgements about a mother’s character.[14] Unmarried and Black mothers were generally excluded from local programs. Fewer than 0.1 percent of children aided by mothers’ pension programs had unwed mothers, a 1931 study found.[15] The same study found that only 1,456 families, or 3 percent of the families for whom race was reported, were headed by a Black mother.[16] This is despite the fact that 739,000 Black families lived in areas where mothers pension programs operated,[17] and research indicates that Black families often experienced hard economic conditions during this era.[18]

Aid to Dependent Children, created by the 1935 Social Security Act, provided federal funding to the states to assist children who were “deprived of parental support or care by reason of death, continued absence from the home, or physical incapacity of a parent” and who lived with a parent or relative.[19] Black families eventually gained somewhat more access to ADC than to the previous mothers’ pension programs.[20] ADC was one of the few programs available to Black mothers, who were effectively excluded from the law’s more generous social insurance programs. Unemployment Insurance and Old Age Insurance, the two major programs within the Social Security Act, excluded agricultural and domestic workers, which included 90 percent of Black women workers at the time.[21]

This exclusion was especially harmful given Black families’ greater levels of need. Black communities faced deep, ongoing poverty, due in part to structural racism and sexism in the labor market that severely limited Black women’s employment prospects and depressed their wages.

Congress Rejected Federal Benefit Standards

The Roosevelt Administration initially proposed that ADC benefits should create “reasonable subsistence compatible with decency and health,”[22] an effort to ensure mothers could adequately care for their children with ADC benefits. But powerful Southern Democrats mirrored the views of employers and local policymakers who, like mothers’ pension administrators before them, believed higher benefits would discourage work among people they wanted to work.[23] The House Ways and Means Committee, chaired by Rep. Robert L. Doughton of North Carolina, removed “reasonable subsistence” from the legislation and instead established benefit maximums of $18 for the first child and $12 for each additional child. States would receive federal reimbursement for one-third of benefits up to those maximums but would have to cover all benefit costs beyond those limits.[24] The Senate Finance Committee, led by Sen. Pat Harrison of Mississippi, agreed to the maximums and also removed the “decency and health” language from the bill.

Without federal standards, state officials had full control over benefit levels, allowing them to set benefits that were quite low, especially compared to other social programs such as cash assistance for the elderly.[25] States could also set their own eligibility standards. The Roosevelt Administration agreed to these changes as part of a compromise to move the Social Security Act forward.[26]

Giving states nearly full control of their ADC programs allowed them to structure programs so that they would not compete with low-paid jobs. Southern legislators wanted to preserve the economic system that relied on Black workers in the South and Latinx workers in the Southwest.[27] As explained below, states used this flexibility to force Black women to rely on low-paid, exploitative work.

States employed different strategies to restrict access to benefits and to keep benefits low, and these efforts often disproportionately affected Black families. In the late 1930s and early 1940s, some states sought to prevent Black families from receiving ADC if mothers could work. As a field report from the late 1930s explained:

There is hesitancy on the part of many [officials administering ADC in the South] to advance too rapidly over the thinking of their own communities, which see no reason why the employable Negro mother should not continue her usually sketchy seasonal labor or indefinite domestic service rather than receive a public assistance grant.[28]

When one Southern county begrudgingly provided aid to 250 Black families, the field reporter noted that program officials had “grave doubt about the wisdom of this decision but otherwise [the families] would have starved.”[29]

States in the South, Northeast, and Midwest instituted policies to try to coerce Black mothers to work. “Farm policies,” which reduced a family’s benefit or ended assistance completely during the growing season, were implemented in states such as Arkansas, Illinois, Louisiana, and New Jersey. A Black resident of Cairo, Illinois, for example, later told federal officials that the state cut his family’s benefits at the start of the growing season without confirmation a job was available or that he would earn enough to provide for his family.[30] In 1952, Georgia barred families with earnings from receiving ADC benefits to supplement those earnings; this and other new rules severely constrained the growth of Black families receiving ADC.[31]

A number of states also blocked many families, especially Black families, from accessing aid on conduct or moral grounds. Some states imposed “suitable home” requirements, which denied aid to families that the state claimed were unfit for child rearing.[32] Some states also considered a family’s ability to manage money in determining its eligibility for benefits, often excluding Black and American Indian families on this basis.[33]

Southern states consistently attempted to keep benefits low. Twenty states set a maximum family grant irrespective of family size by 1958.[34] Fifteen of them were in the South, a region that included half of the country’s Black population.[35] The South was also home to the states with the lowest average ADC benefits in the country as of 1958: Alabama, Florida, Mississippi, South Carolina, and Texas. All five states were well below the national average. (See Table 1.)

| TABLE 1 |

|---|

|

| | Average benefit, 1958 | Value of average 1958 benefit in 2021 dollars |

|---|

| Alabama | $27.09 | $215.23 |

| Mississippi | $40.28 | $320.02 |

| South Carolina | $54.90 | $436.18 |

| Florida | $59.07 | $469.31 |

| Texas | $67.63 | $537.32 |

| National | $99.83 | $793.15 |

Federal policymakers made several attempts to provide more adequate benefits through ADC (renamed Aid to Families with Dependent Children or AFDC in 1962). In 1950, the program added mothers and relative caregivers to the benefit determination so that payments would help cover living costs for those adults as well as children. Federal policymakers also incentivized states to increase benefits by raising the federal matching rate several times between 1939 and 1965, yet few states responded. In 1967, President Johnson proposed requiring each state to set benefits at 100 percent of the state’s “standard of need,” or the amount of income and other resources a family required in order to live. This would have forced many states to increase benefits, but Congress rejected the idea. Two decades later, in 1987, a proposal to establish a minimum federal benefit for AFDC passed the House Ways and Means Committee and had broad congressional support but was blocked by Southern lawmakers.[36]

Several proposals in the 1960s and 1970s would have established a basic income program for a wider group of families with low incomes, including but not limited to those headed by single mothers. Other proposals called for a negative income tax, which would have provided a refundable tax credit to everyone below a certain income level.[37] President Nixon’s Family Assistance Program proposal in 1969 would have replaced AFDC with a basic income to families, providing $1,600 a year (a little more than $10,000 in 2021 dollars) for a family of four. It also included a work requirement — reduction of benefits if a parent didn’t meet certain work-related obligations.[38] The proposal passed the House but drew criticism from liberals who argued the benefit was too low and conservatives who argued the work requirement was not strict enough. With AFDC closely associated with stereotypes of Black mothers, some conservative opponents invoked racist ideas of Black women in criticizing the Family Assistance Program; “there’s not going to be anybody left to roll these wheelbarrows and press these shirts,” Rep. Philip Landrum of Georgia complained.[39] The program was never enacted.

The Family Assistance Program and other basic income proposals, such as the National Welfare Rights Organization’s Adequate Income proposal (see box, “Black Mothers Set Basic Income Agenda to Support Motherhood”), would have moved cash assistance in a fundamentally different direction than AFDC (and eventually TANF), eliminating the wide state-by-state variation in benefits and providing more adequate cash support than many state AFDC programs offered. These proposals represented the crossroads cash assistance was entering in the 1970s: whether to better support mothers caring for children regardless of their labor market participation, as these proposals would have done, or instead to tie assistance more tightly to work, as TANF would do.

The National Welfare Rights Organization (NWRO), created in 1966, brought together Black, brown, and white mothers receiving cash assistance who had been organizing locally for dignity and more benefits since the 1950s.a NWRO’s Adequate Income proposal, introduced in the House in 1970, would have provided $5,500 a year (about $35,000 in 2021 dollars) to a family of four with a head of household who was not working; working families could receive federal assistance until their annual income reached $10,000.b In 1971 NWRO amended the benefit to $6,500 a year (about $38,000 in 2021 dollars) for a family of four. The proposal did not have a work requirement but did include a work incentive.

However, the NWRO faced internal division over its stance on work-related policies. The predominately male leadership in the national office did not oppose work requirements and work training, especially for mothers with older children and when jobs were available, but many of the Black women leaders saw work requirements as coercive and pointed out that the work programs available to AFDC recipients were low quality and many only provided training for service jobs.c As NRWO executive committee member Beulah Sanders stated, “Surely the mother is in the best position to know what effect her taking a particular job would have on her young school child, but now we are told that for welfare mothers the choice will be made for them.”d

NWRO mother activists argued that mothers needed economic security so they could have a real choice between staying home with their children or working outside the home. They believed the Adequate Income proposal would provide that security. This argument differed from other prominent ideas around cash assistance to single mothers, such as from “maternalists” — mainly white, middle-class women reformers who had led the charge for mothers’ pension programs in the early 1900s, who mainly wanted mothers in the home caring for children — and policymakers and employers who feared that aiding mothers would disrupt the low-wage labor market.

a Nadasen, p. 3.

b Nadasen, p. 180.

c One program in East St. Louis, “Maid to Order,” prepared AFDC recipients for house cleaning jobs in wealthy homes. Premilla Nadasen, Jennifer Mittelstadt, and Marisa Chappell, Welfare in the United States: A History with Documents, 1935-1996, Routledge, 2009, pp. 34-35.

d Nadasen, pp. 178-179.

The lack of federal benefit standards led to wide variation in state AFDC benefit levels, which particularly disadvantaged Black families. Between the 1960s and 1990s, states with higher Black populations or higher shares of Black families in the AFDC caseload had smaller average AFDC benefits than states with lower Black populations or lower shares of Black families in the caseload, studies consistently found. This link was strongest in the South but not exclusive to the region.[40]

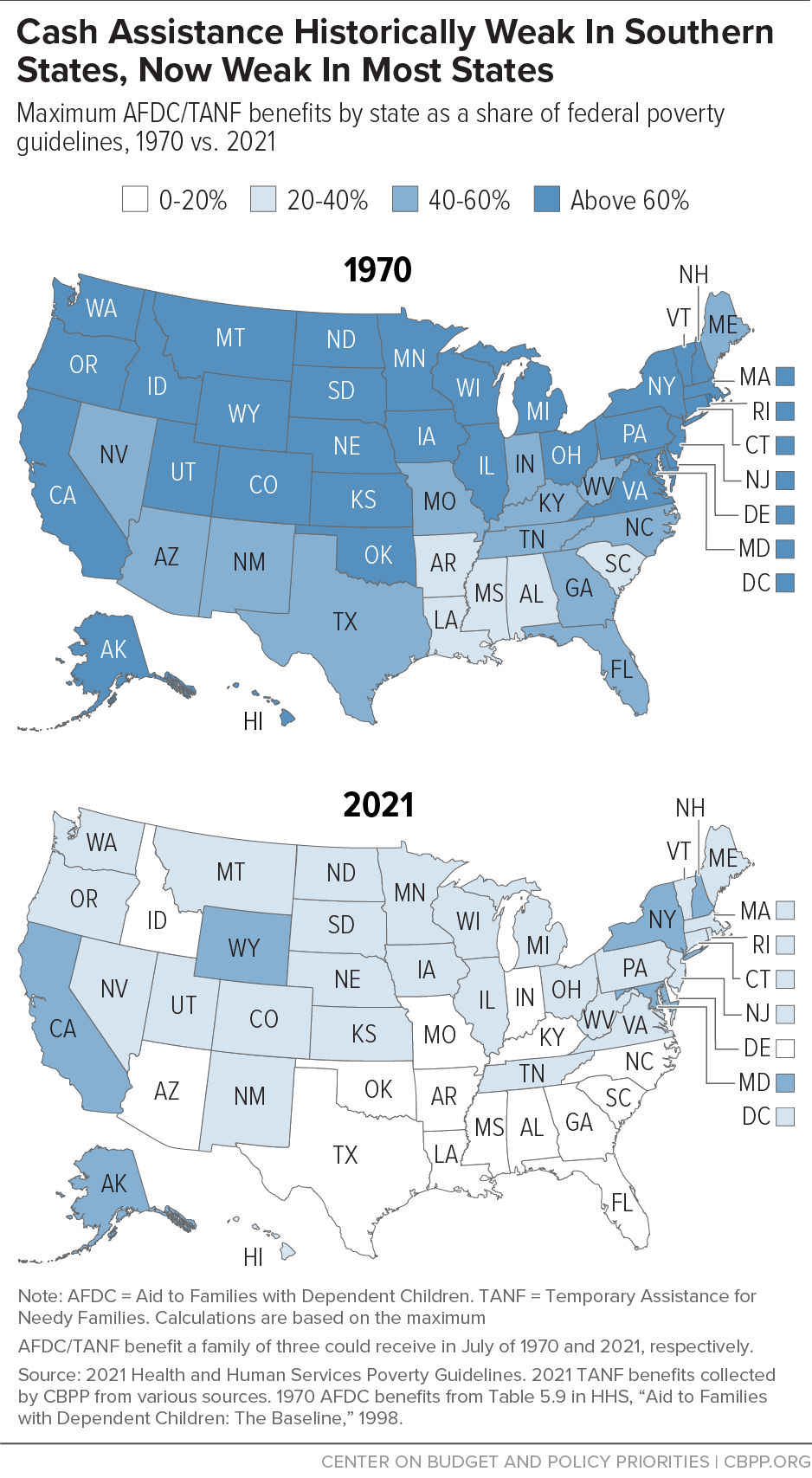

Another study found that between 1982 and 1996, the size of a state’s Black population strongly predicted its average benefit levels, regardless of the state’s ideological leanings.[41] Overall, Southern states have consistently had the lowest benefits.[42] (See Figure 1.) In 1990, for example, the average maximum grant for a family of three in the South was $255, compared to $399, $442, and $528 in the Midwest, West, and Northeast, respectively. (See Appendix Table 2.)

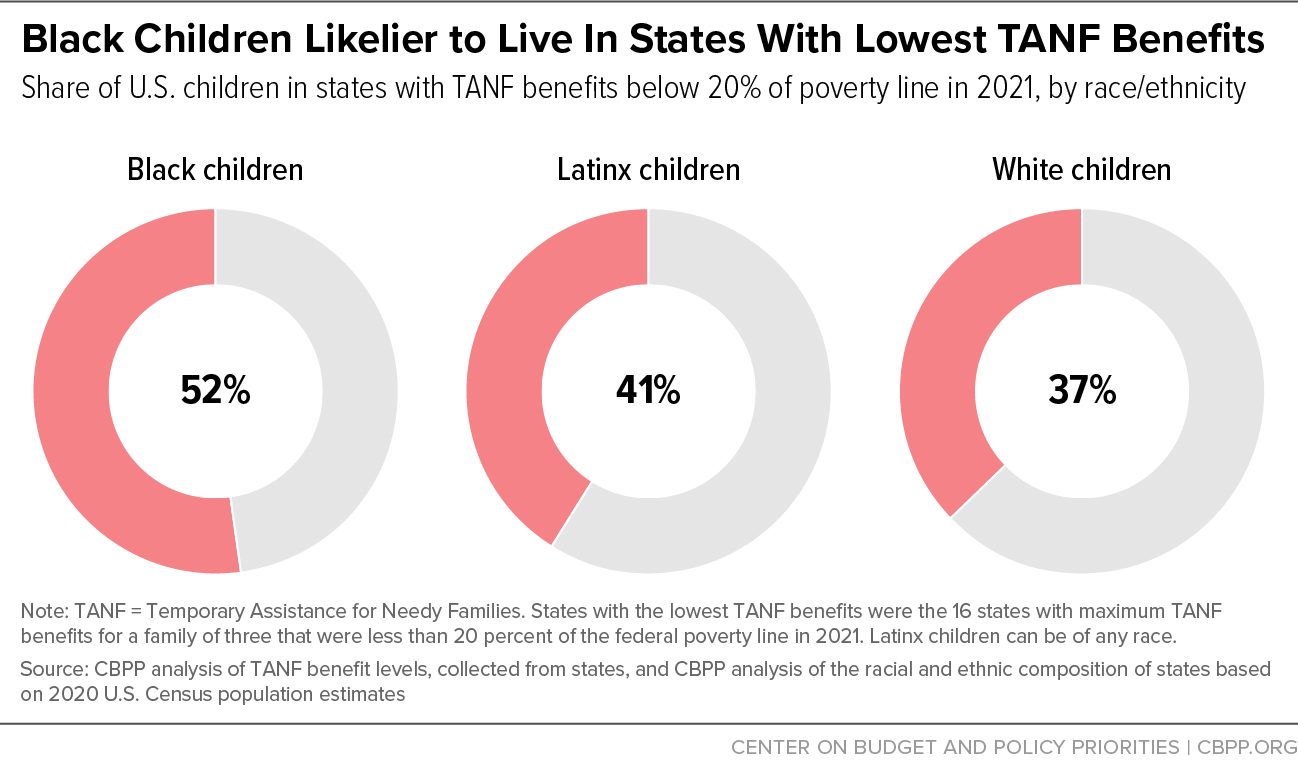

Today as well, benefits under TANF are lower in places where Black families tend to live. A majority (52 percent) of Black children in the country live in a state with benefits at or below 20 percent of the poverty line, compared to 41 percent of Latinx children and 37 percent of white children.[43] (See Figure 2.) Relatedly, states with larger shares of Black residents tend to spend smaller shares of their TANF funds on basic assistance.[44]

Over recent decades, even as states where more Black people live have consistently provided smaller benefits than other states, states across the country have allowed their benefits to shrink in value. A key factor was the pervasive anti-Black narratives around AFDC between the 1960s and the 1990s (such as attacks on “welfare queens” by President Reagan and others), which helped give many Americans an unfavorable view of the program.[45] Since 1970, every state has let the purchasing power of its benefits decline. Benefits quickly lost value during the 1970s due to high inflation,[46] and while inflation later moderated, most states have not increased grants enough to offset the decline. Between 1970 and 2021, benefits in 36 states fell by at least 50 percent, after adjusting for inflation.[47]

Some states have done even less to preserve benefits during TANF’s 25 years than in the previous quarter century. While every state increased benefits at least in nominal terms between 1970 and 1996, 12 states have not done so since 1996[48] and four states[49] have cut benefits without later restoring them. The decline in benefits has gradually weakened AFDC/TANF as an anti-poverty program — not just for Black families, but for all families with low incomes.

Many states across the country also responded to declining public support for cash assistance by making their programs harder to access. By the early 2000s, 22 states had imposed family caps, which limited or denied more cash assistance to families that have another child while enrolled in AFDC or TANF. States also implemented time limits on the receipt of benefits and took away some or all of a family’s benefits for not complying with a work or other requirement.[50] Between 1996 and 2020, the number of families receiving TANF for every 100 families in poverty dropped from 68 to 21.[51]

Cash assistance for families who experience a crisis or struggle to pay for the basics needs to be a critical component of our economic support system. However, TANF, with its history of anti-Black racism, must be fundamentally reformed to realize its potential for providing support to families when they have no or limited income from other sources.

Racial discrimination in employment, housing, education, and social programs has contributed to higher rates of poverty and insecurity among Black families and other families of color. Racism and low, unstable income contribute to toxic stress (the excessive or prolonged activation of the body’s “fight or flight” response) in children, recent research shows.[52] Stress from racist experiences is associated with increased inflammation, which can lead to chronic disease.[53] Black and other parents of color constantly worrying about their ability to pay the rent or afford food cannot effectively buffer children from stresses caused by racism or deprivation; this persistent adversity can overload children’s bodies and minds, with negative long-term consequences for their health, education, and employment.[54] Robust anti-poverty programs that boost income, like cash assistance, can promote stability, relieving parental stress and improving children’s academic, health, and economic outcomes, a National Academies of Sciences, Engineering, and Medicine report on reducing childhood poverty finds.[55]

Other anti-poverty programs, like SNAP and refundable tax credits, have grown significantly in recent decades and have reduced hardship substantially, especially among Black and Latinx families and individuals. Yet families with little or no cash income still need monthly cash assistance to be more economically secure. They have needs that may vary month to month — diapers, period products, personal hygiene and cleaning supplies, and utilities, for example — and that only cash can cover. Providing adequate, unconditional cash assistance also affirms the dignity of parents and caregivers and presumes they know how to best care for their children.

A reimagined TANF program also could complement a permanent extension of the American Rescue Plan’s temporary Child Tax Credit expansion. An expanded Child Tax Credit would give households with low or moderate incomes additional resources to cover the expenses associated with child-rearing. But when a family falls on hard times, they need additional cash assistance from TANF to prevent a downward spiral that can result in eviction and homelessness, among other negative outcomes. Together, an expanded Child Tax Credit and TANF could provide meaningful cash resources for families to cover their monthly essentials and maintain economic stability when their other income drops or is very low.

In reshaping TANF’s approach to basic assistance, policymakers should adopt a Black Women’s Best framework.[56] Black mothers need a cash program that provides stability through life’s challenges, protects their children from hardship, and affirms and supports parents’ autonomy over their families. Increased federal power is critical to move the states most resistant to improving their programs in an antiracist direction. Federal policymakers should:

- Establish a federal minimum benefit so that no family falls below a certain income level. As noted, TANF benefits vary greatly by state and the lowest benefits tend to be in Southern states, which have larger Black populations and deeper-seated legacies of enslavement and Jim Crow. A minimum federal benefit would establish a necessary floor to mitigate these disparities and better protect Black, brown, and white families. This would not only improve the lives of parents and children receiving TANF but also help local communities, as families in poverty would quickly put that money into the local economy.

Change TANF’s funding structure to retarget TANF resources to basic assistance, address funding inequities, and prevent erosion over time. States have used TANF resources to pay for other things besides cash aid to families; notably, states with high Black populations tend to spend less on basic assistance and to redirect these funds elsewhere. Federal policymakers based the original TANF block grant allocation on states’ AFDC spending amounts; this approach locked in some of the lowest TANF funding levels per poor child in states where Black children disproportionately live.[57] Furthermore, the original block grant formula has lost about 40 percent of its value since its creation due to inflation, which makes it harder for states that want to adequately invest in families to do so.

Federal policymakers should require states to spend a greater share of TANF resources on basic assistance, establish an equitable formula allocation, and increase TANF funding and index it to inflation to encourage states, especially those with lower benefits and higher Black populations, to increase benefits and serve more families.

States need not wait on federal changes before improving their programs. State policymakers should:

- At minimum, raise their benefit levels to make up for the loss of inflation-adjusted value since 1996. Higher benefits for all families in poverty, especially in states with larger Black populations, would have a meaningful impact on children’s futures.

- Establish mechanisms to prevent benefits from eroding in the future.[58] Adjusting TANF benefits yearly in step with inflation, such as through a statutory cost-of-living adjustment, would maintain families’ purchasing power and help them meet basic needs.

| APPENDIX TABLE 1 |

|---|

|

| States | Average mothers’ pension monthly benefits in 1931 (nominal dollars) | Benefits in 2021 dollars |

|---|

| Massachusetts | $69.31 | $1,045.09 |

| Rhode Island | $55.09 | $830.67 |

| New York | $52.62 | $793.43 |

| Connecticut | $45.91 | $692.25 |

| Pennsylvania | $37.45 | $564.69 |

| Michigan | $37.04 | $558.51 |

| California | $31.40 | $473.47 |

| Maryland | $30.52 | $460.20 |

| Maine | $30.16 | $454.77 |

| New Jersey | $30.03 | $452.81 |

| Minnesota | $29.35 | $442.55 |

| Tennessee | $26.78 | $403.80 |

| Indiana | $26.73 | $403.05 |

| Colorado | $26.50 | $399.58 |

| Missouri | $26.22 | $395.36 |

| Illinois | $26.11 | $393.70 |

| Montana | $24.78 | $373.65 |

| Nevada | $24.76 | $373.34 |

| Delaware | $23.69 | $357.21 |

| North Dakota | $22.93 | $345.75 |

| Wyoming | $22.55 | $340.02 |

| South Dakota | $21.78 | $328.41 |

| Ohio | $21.68 | $326.90 |

| Wisconsin | $21.66 | $326.60 |

| Oregon | $21.35 | $321.93 |

| Vermont | $21.11 | $318.31 |

| Iowa | $20.81 | $313.78 |

| New Hampshire | $19.77 | $298.10 |

| Washington | $19.66 | $296.44 |

| Nebraska | $17.81 | $268.55 |

| Arizona | $17.25 | $260.10 |

| North Carolina | $16.64 | $250.91 |

| Virginia | $16.52 | $249.10 |

| West Virginia | $15.46 | $233.11 |

| Kansas | $14.05 | $211.85 |

| Idaho | $13.16 | $198.43 |

| Utah | $11.77 | $177.47 |

| Mississippi | $11.11 | $167.52 |

| Texas | $10.07 | $151.84 |

| Louisiana | $10.06 | $151.69 |

| Florida | $10.01 | $150.94 |

| Oklahoma | $7.29 | $109.92 |

| Arkansas | $4.33 | $65.29 |

| APPENDIX TABLE 2 |

|---|

|

| | | 1970 | 1980 | 1990 | 1996 | 2010 | 2021 |

|---|

Midwest

(IL, IN, IA, KS, MI, MN, MO, NE, ND, OH, SD, WI) | Nominal | $196 | $334 | $399 | $407 | $444 | $489 |

| 2021 | $1,207 | $1,043 | $790 | $685 | $538 | $489 |

Northeast

(CT, ME, MA, NH, NJ, NY, PA, RI, VT) | Nominal | $254 | $383 | $528 | $520 | $576 | $701 |

| 2021 | $1,570 | $1,178 | $1,047 | $876 | $697 | $701 |

South

(AL, AR, DE, DC, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV) | Nominal | $127 | $191 | $255 | $259 | $300 | $362 |

| 2021 | $785 | $597 | $505 | $436 | $363 | $362 |

West

(AK, AZ, CA, CO, HI, ID, MT, NV, NM, OR, UT, WA, WY) | Nominal | $199 | $344 | $442 | $478 | $515 | $562 |

| 2021 | $1,226 | $1,074 | $875 | $804 | $623 | $562 |

| APPENDIX TABLE 3 |

|---|

|

| | July 1996

(nominal dollars) | July 2021

(nominal dollars) | Loss in Value, 1996-2021

(inflation-adjusted) |

|---|

| Alabama | $164 | $215 | -22% |

| Alaska | 923 | 923 | -41% |

| Arizona | 347 | 278 | -52% |

| Arkansas | 204 | 204 | -41% |

| California1 | 596 | 878 | -12% |

| Colorado | 356 | 508 | -15% |

| Connecticut2 | 636 | 709 | -34% |

| Delaware | 338 | 338 | -41% |

| District of Columbia | 415 | 658 | -6% |

| Florida | 303 | 303 | -41% |

| Georgia | 280 | 280 | -41% |

| Hawai’i | 712 | 610 | -49% |

| Idaho | 317 | 309 | -42% |

| Illinois | 377 | 543 | -14% |

| Indiana | 288 | 288 | -41% |

| Iowa | 426 | 426 | -41% |

| Kansas3 | 429 | 429 | -41% |

| Kentucky | 262 | 262 | -41% |

| Louisiana | 190 | 240 | -25% |

| Maine | 418 | 620 | -12% |

| Maryland | 373 | 727 | 16% |

| Massachusetts | 525 | 712 | -19% |

| Michigan | 459 | 492 | -36% |

| Minnesota | 532 | 632 | -29% |

| Mississippi | 120 | 260 | 29% |

| Missouri | 292 | 292 | -41% |

| Montana | 438 | 588 | -20% |

| Nebraska | 364 | 485 | -21% |

| Nevada | 348 | 386 | -34% |

| New Hampshire | 550 | 1,098 | 19% |

| New Jersey | 424 | 559 | -22% |

| New Mexico | 389 | 447 | -32% |

| New York4 | 577 | 789 | -19% |

| North Carolina | 272 | 272 | -41% |

| North Dakota | 431 | 486 | -33% |

| Ohio | 341 | 512 | -11% |

| Oklahoma | 307 | 292 | -43% |

| Oregon | 460 | 506 | -35% |

| Pennsylvania5 | 403 | 403 | -41% |

| Rhode Island6 | 554 | 721 | -23% |

| South Carolina | 200 | 305 | -9% |

| South Dakota | 430 | 630 | -13% |

| Tennessee | 185 | 387 | 24% |

| Texas | 188 | 308 | -3% |

| Utah | 416 | 498 | -29% |

| Vermont7 | 597 | 699 | -30% |

| Virginia8 | 354 | 559 | -6% |

| Washington | 546 | 654 | -29% |

| West Virginia | 253 | 542 | 27% |

| Wisconsin | 517 | 653 | -25% |

| Wyoming | 360 | 726 | 20% |