Millions of low-income families are at risk of missing out on stimulus payments of $1,200 per adult and $500 per dependent child provided through the CARES Act because they do not file taxes or receive certain federal benefits and thus have to submit a form to get the payments. These payments would provide a lifeline to low-income families, especially those who have lost income due to the pandemic. Many of these families are enrolled in Medicaid, which creates an opportunity for Medicaid application assisters, providers, and state and local agencies to conduct outreach to ensure they get the payments.

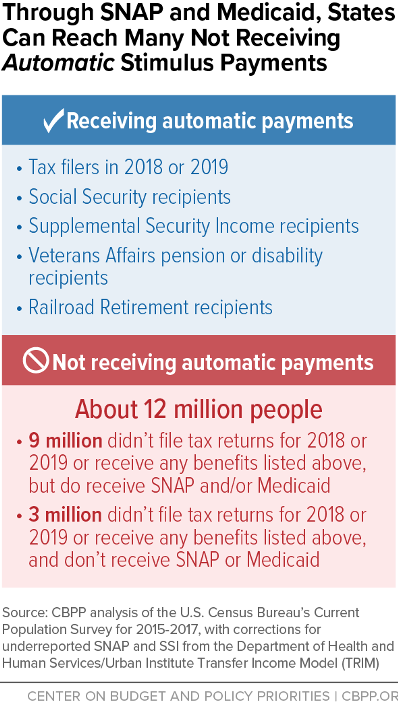

The IRS is automatically delivering Economic Impact Payments (EIPs) to families that regularly file federal income taxes or receive certain federally administered benefits such as Social Security. This method, however, misses an estimated 12 million people because their income is too low to owe federal income tax and they do not participate in any of the specified federal programs.[1] But about 9 million of these people do participate in SNAP or Medicaid. (See Figure 1.)

Entities that regularly interact with Medicaid beneficiaries can provide essential outreach and assistance to inform low-income families about the EIPs and how to file for one. These entities also can assure beneficiaries that the EIP does not count as income for Medicaid and most other programs and will not affect their eligibility.

Individuals not receiving the EIP automatically must file the IRS “Non-Filer” form (a simplified online form for people not required to file a tax return) by November 21 to receive the payment this year, or file a 2020 tax return next year to receive it in 2021.[2] The Non-Filer tool requires a user to create an online account, enter certain personal information (including direct deposit information, if available), verify their email address, and submit the form.

While the Non-Filer tool is easier to complete than a full tax return, individuals must have internet access, an email address, and a direct deposit account or address to which the payment can be delivered; they also must have comfort and familiarity with online accounts to claim their payment. Many individuals will need help from human service agencies and community partners to complete the necessary forms and avoid delays in getting their payments.

The connection to Medicaid provides a key opportunity to reach those who may miss out. For example:

- State and local Medicaid agencies can use their regular contacts with enrollees by phone, in person, and in writing to inform them about the EIP, refer them to the Non-Filer website or free tax preparation services for assistance, and help them complete the necessary forms. Though health and human service agencies are experiencing high demand for their services due to the pandemic, they have relatively low-cost ways to help enrollees get their EIPs. Agencies can add messages to their websites and online portals, include fliers on the EIPs with regular mailings, send informational texts and emails, add recorded messages for callers waiting on hold for call centers, and incorporate information into scripts for caseworkers who speak directly with clients. CBPP is preparing templates for scripts, messages, and fliers to support state and local agency outreach efforts.[3]

- Application assisters and other community organizations can screen individuals seeking assistance with basic needs or those they help apply for Medicaid. They can refer individuals eligible for the EIP to tax preparation organizations or directly help them in completing the necessary paperwork.[4]

- Health care providers are a trusted source of information for low-income families. They can provide information about the EIP in conversations with patients or at registration, post fliers in waiting rooms, or share information through outreach channels like email, phone, and text.

- Managed care organizations (MCOs) often have staff and programs to support Medicaid enrollees’ overall well-being, such as case managers, and their call centers regularly interact with their members. MCOs can provide information, referrals, and assistance during these interactions.

Helping more Medicaid enrollees receive their EIPs would have several benefits. The size of the payment is substantial for low-income families and can help pay for essentials like rent, utilities, and car repairs. By reducing financial strain for families, the payments may also benefit their health.[5] Further, the money will boost consumer demand, providing stimulus to state and local economies.