- Home

- Where Do Federal Tax Revenues Come From?

Note: The COVID-19 recession and subsequent relief packages have dramatically changed spending and revenue levels for fiscal years 2020 and 2021. We use pre-pandemic figures below to illustrate the composition of the federal budget and taxes under more normal circumstances.

Policy Basics: Where Do Federal Tax Revenues Come From?

In fiscal year 2019, the federal government spent $4.4 trillion on the services it provides, such as national defense, health care programs like Medicare and Medicaid, Social Security benefits for the elderly and disabled, and investments in infrastructure and education, in addition to interest on the debt (see our related Policy Basics: Where Do Our Federal Tax Dollars Go?). Federal revenues financed over $3.5 trillion of that $4.4 trillion. Borrowing financed the remaining amount ($984 billion).

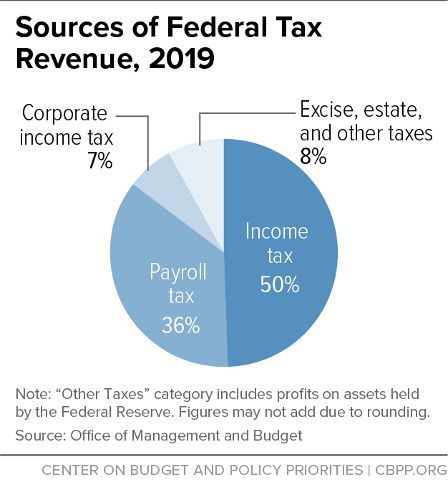

Half of all federal revenue (50 percent) comes from individual income taxes. The income tax is generally progressive: higher-income households generally pay a larger share of their income in income taxes than lower-income households do.

Another 36 percent of revenue comes from payroll taxes, which are assessed on the wage or salary paychecks of almost all workers and are used to fund Social Security, Medicare Hospital Insurance, and unemployment insurance. By law, employers and employees split the cost of payroll taxes, but research has shown that employers pass their portion of the cost on to workers in the form of lower wages.

Payroll taxes as a whole are regressive: they collect a higher percentage of total earnings from lower-income workers than higher-income ones. However, if one looks at the overall effect of Social Security, Medicare, and unemployment insurance — the benefits they provide as well as the taxes they collect — these programs are progressive. (See our related Policy Basics: Top Ten Facts About Social Security and Policy Basics: Federal Payroll Taxes.)

Corporate income taxes make up about 7 percent of federal revenue, with the remaining 8 percent coming from excise taxes, estate taxes, and other revenue sources. Excise taxes are collected on the sale of certain goods (e.g., fuel, alcohol, and tobacco); they are intended to raise revenue and, in some cases, discourage consumption of the taxed product. These made up about 3 percent of federal receipts in 2019.

The estate tax is a tax on assets, such as cash, real estate, or stock, that are transferred from deceased persons to their heirs. Because the first $22.8 million of a married couple’s estate was exempt from the estate tax in 2019, and due to other special exemptions from the estate tax, fewer than 1 of every 1,000 estates owed the estate tax in 2019. Because it affects only those who are most able to pay, the estate tax is the most progressive component of the tax code. Estate tax revenues made up 0.5 percent of total federal receipts in 2019.

The small remainder of federal revenues comes from various sources such as some regulatory fees and custom duties.

While the federal tax code has both progressive and regressive components, it is progressive overall. The lowest-income 60 percent of households will pay about 8 percent of their incomes in federal taxes in 2020, the Tax Policy Center estimates, while the top 1 percent will pay 30 percent, on average. This progressivity modestly reduces the income and wealth gaps between the top and bottom of the income distribution.

It also reduces racial disparities in income and wealth, but federal tax policies could do more to advance racial equity and counter centuries of racist actions by policymakers and the private sector that have hampered economic opportunity for people of color. Black and Latino households, for example, are overrepresented in the lowest-income 60 percent of the income distribution and dramatically underrepresented in the top 1 percent.

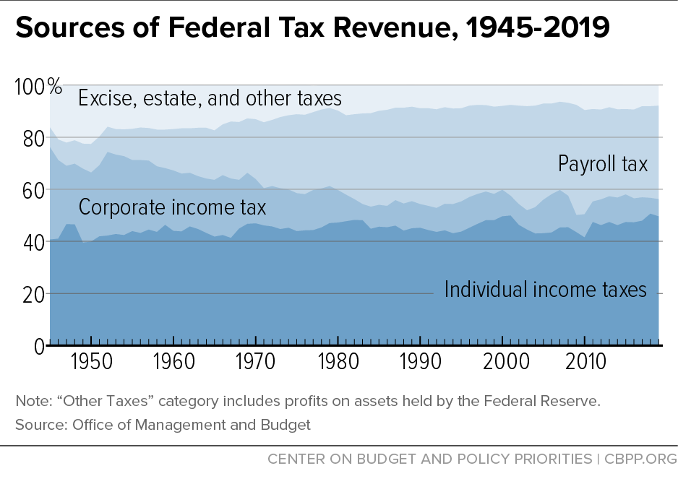

Over recent decades, the share of federal revenues coming from individual income plus payroll taxes has grown, while the share coming from corporate taxes and other revenues has fallen. The Great Recession — one of the worst economic downturns since the Great Depression — and the policies enacted to combat it, including temporary tax cuts, depressed federal revenues below the typical levels of recent decades. Revenues fell from 18.0 percent of gross domestic product in 2007 (the last fiscal year before the recession) to 14.6 percent in 2009 and 2010. Revenues recovered with the economy but were still only 16.3 percent of gross domestic product in 2019 — well below the prior 40-year average of 17.4 percent of GDP — largely due to the enactment of the 2017 tax law. Because of the recession caused by the COVID-19 pandemic, revenues as a share of GDP are expected to be 4.8 percent lower in fiscal year 2020 than the level projected pre-crisis.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.