- Home

- Temporarily Expanding Child Tax Credit A...

Temporarily Expanding Child Tax Credit and Earned Income Tax Credit Would Deliver Effective Stimulus, Help Avert Poverty Spike

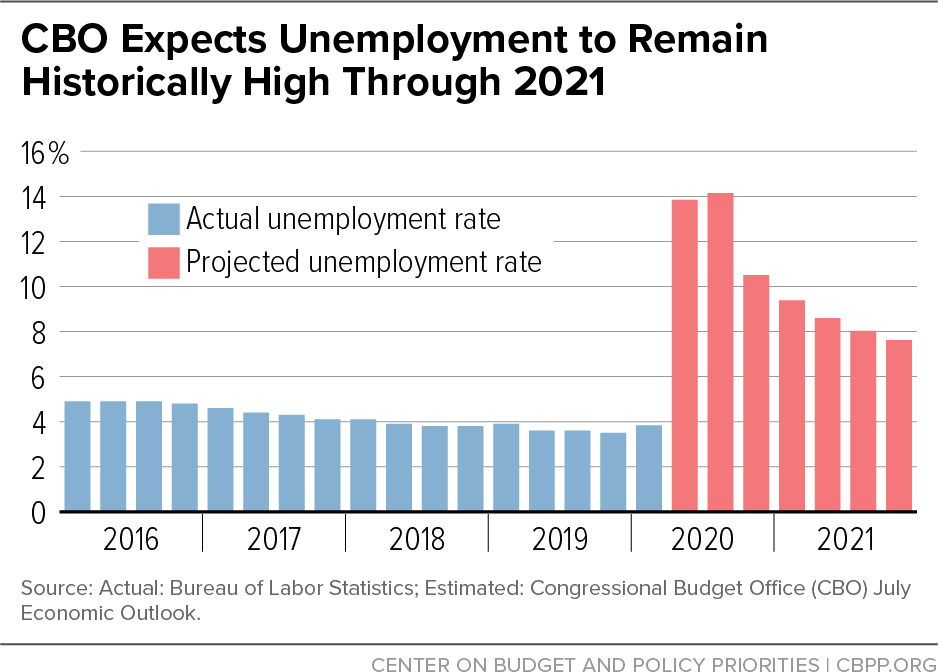

The COVID-19 pandemic has triggered a severe economic crisis whose fallout will likely persist for some time. The Congressional Budget Office (CBO) forecasts that the unemployment rate will still exceed 9 percent early next year, average 8.4 percent in 2021 — more than twice its pre-pandemic level — and still be at 7.6 percent at the end of next year. Although the initial federal response has helped prevent a sharp rise in poverty despite huge job losses, there is serious risk that as that support dwindles or expires, poverty and the hardship that goes with it will rise sharply.[1]

Federal policymakers should enact stronger policies now to avoid a steep poverty spike, help people meet basic needs, and boost the economy. Alongside strengthened state fiscal relief, nutrition assistance, unemployment insurance, and Medicaid funding, the next fiscal stimulus package should include specific expansions for tax year 2020 of the Child Tax Credit and Earned Income Tax Credit (EITC) that would deliver well-timed, high bang-for-the-buck economic stimulus to millions of low-income households when they file their taxes in early 2021. The House included such expansions, detailed below, in the Heroes Act, which it approved on May 15.

Specifically, the next fiscal stimulus package should make the Child Tax Credit of $2,000 per child fully available (i.e., fully refundable) for tax year 2020 to the 27 million children in low-income families who currently receive a partial tax credit or no credit at all because their families’ earnings are too low. A group of prominent conservatives recently wrote to congressional leaders that the Child Tax Credit “reduces poverty while fostering some of our nation’s most critical investments: those that parents make for their children. At a time when family budgets are under great stress and many parents have stopped working to care for their children, enlarging the child credit would offer much needed relief.”[2]

Similarly, before the pandemic, a National Academy of Sciences expert panel made an expanded child credit that’s fully available to the poorest children the centerpiece of a proposal to cut child poverty in half. Measures like the Child Tax Credit reduce poverty and improve children’s long-term educational and health outcomes, research indicates. But the tax credit can and should do more, especially with poor children now at heightened risk, living in economically vulnerable families and facing closed schools and scarce resources.

"Making the Child Tax Credit fully available would lift more than 3 million people — including 2 million children — above the poverty line."

Making the Child Tax Credit fully available would lift more than 3 million people — including 2 million children — above the poverty line. It would lift another 13.6 million poor people, including 6.8 million children, closer to the poverty line. And for more than 1 million of these people, including 770,000 children, the expansion would lift them out of deep poverty by raising their income above half of the poverty line.[3] By increasing the purchasing power of very poor families, this also would be highly effective economic stimulus, since these hard-pressed families will spend virtually all of any additional income they receive.

In addition to making the Child Tax Credit fully available, the Heroes Act would increase the value of the credit from $2,000 per child to $3,000 per child (and $3,600 per child under age 6), and raise the age of eligible children to include 17-year-olds. These improvements have substantial merit. The coordinated letter from conservatives alternatively proposes that an additional fully refundable Child Tax Credit of $2,000 “should be issued in the fall of 2020 to all American families.”[4] This paper focuses on making the current Child Tax Credit fully available, a change present in both the Heroes Act and letter. It is the single most crucial of the Child Tax Credit changes at this time, as it would best target assistance to low-income families — who are especially vulnerable — and hence would also provide the most effective stimulus per dollar of cost. Ultimately, policymakers should make the Child Tax Credit fully available on a permanent basis. For now, they should do so for tax year 2020.

The next legislative package also should increase for tax year 2020 the miniscule EITC for low-wage adults who aren’t raising children. This, too, would boost the economy, and it would help millions of people while encouraging and rewarding work. The federal tax code currently taxes about 5.8 million low-wage workers aged 19-65 into or deeper into poverty, because the payroll and (in some cases) federal income taxes they pay exceed any EITC they receive.[5] An obvious way to help avoid a bigger spike in poverty is to stop taxing people into poverty. The EITC expansion for these workers in the Heroes Act would benefit 15.4 million working childless adults and reduce the number of them whom the federal tax code taxes into, or deeper into, poverty by 96 percent.[6] That proposal would raise the maximum EITC for childless adults from roughly $530 to close to $1,500, raise the income limit for the credit from about $16,000 to about $21,000, and expand the age range of childless workers eligible for the credit from 25-64 to 19-65 (excluding full-time students aged 19-24).

Of note, the top occupations that would benefit from these Child Tax Credit and EITC expansions include home health aides, cashiers, and food preparation and serving occupations. One silver lining of this pandemic has been Americans’ growing appreciation of the essential role these workers and millions of others who work for low pay — and often lack benefits that many other workers take for granted, such as paid sick days — play in keeping this economy running. They deserve better, and the policies outlined here would provide concrete, meaningful help. Consider two examples:

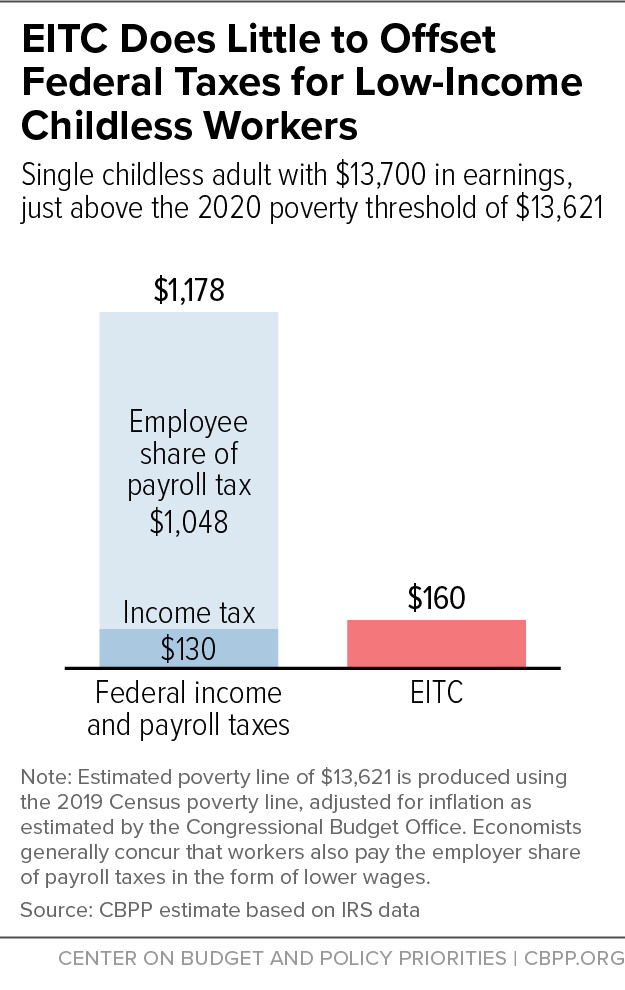

- A convenience store cashier works 35 hours a week and earns just above the federal minimum wage of $7.25 an hour, making $13,700, which is slightly above the poverty line for a single individual ($13,621 in 2020). She now pays nearly $1,200 in combined federal income and payroll taxes (counting just the employee share of the payroll tax) and receives a small EITC of $160. As a result, the tax code pushes her below the poverty line. Under the Heroes Act’s EITC expansions, she would no longer be taxed into poverty.

- A mother with a 2-year-old daughter and 7-year-old son works part time as a cleaner at an assisted living complex, earning $9,000 a year. Her family receives a Child Tax Credit of $975, or less than $500 per child. If the full $2,000-per-child credit were fully available to low-income families (rather than only to those with higher incomes), she would receive a credit of $4,000, a gain of over $3,000.

Finally, policymakers also should make a one-time change in the EITC’s and Child Tax Credit’s[7] designs to make them more effective now as counter-cyclical measures. When the economy weakens, many single-earner families, including single mothers with children, who lose their jobs or a portion of their work hours — and hence lose earnings — face an additional hit because they lose part or all of their EITC and Child Tax Credit as well. To address this problem, policymakers should allow filers to use their income from either 2019 or 2020 when calculating their 2020 EITC. And if policymakers do not make the Child Tax Credit fully available to children in low-income families irrespective of the level of their parents’ earnings, families should have the same option with respect to the low-income component of the Child Tax Credit. Policymakers have provided this “look-back” option in the past for families affected by various hurricanes and natural disasters. For instance, anyone who lived in a presidentially declared disaster zone during tax year 2018, 2019, or early 2020 could use either their current or previous year’s income to file for their EITC and Child Tax Credit.[8]

A recent bipartisan, bicameral look-back proposal would enable people whose income falls in 2020 to use their higher 2019 income to avoid a cut in their EITC and Child Tax Credit.[9] During this pandemic, which the President declared a national emergency, the provision should be available to anyone who otherwise qualifies for the credit. (The look-back provision would raise somewhat our estimates of the numbers of people helped through these proposals.) The CARES Act included a similar provision for businesses, which allows them to deduct interest expenses equal to up to 50 percent of their adjusted taxable income and lets them use their 2019 income to make this calculation. Businesses that experienced lower income in 2020 can use their higher 2019 income and, as a result, deduct more interest and gain a larger tax benefit. Policymakers should extend the same type of look-back provision to hard-working families.

CBO Expects Economy to Remain Weak Through 2021

CBO’s latest economic and budget projections show that the unemployment rate will remain above 10 percent through the end of the year and that it won’t return to the levels in CBO’s pre-pandemic (January 2020) economic projections until late in the decade.[10] CBO projects that the unemployment rate will be 9.4 percent early next year when people will file for their EITC and Child Tax Credit refunds, will average 8.4 percent for all of 2021 (more than twice the rate in 2019; see Figure 1), and won’t drop below 6 percent until mid-2024. CBO also projects that real GDP over 2020-2021 will be 6.7 percent below CBO’s forecast from January 2020.[11] The even-more-recent projections of the Organisation for Economic Co-operation and Development, issued on July 7, are more pessimistic, forecasting an unemployment rate averaging between 8.5 percent and 11.5 percent in 2021, depending on the scope of the pandemic.[12]

This deep economic weakness means that additional and aggressive fiscal policy measures will be needed, and for an extended period of time, to strengthen demand in the economy.

CBO Finds Expanding EITC and Child Tax Credit Provides Effective Stimulus

Expansions of the Child Tax Credit and the EITC represent effective policies to help stimulate a weak economy. They deliver high bank-for-the-buck stimulus because the money flows to lower-income people, who tend to spend rather than save what modest income they have in order to meet basic needs. Moody’s Analytics has estimated the bang for the buck for the Heroes Act provisions.[13] It found that the EITC expansion for childless workers would generate $1.20 in economic activity per dollar of cost. It looked at the Child Tax Credit expansion along with the bill’s expansion of the Child and Dependent Care Tax Credit and estimated those policies would yield $1.08 in economic activity per dollar of cost; making the Child Tax Credit fully available would itself generate a higher bang for the buck than that because it would expand benefits entirely for lower-income people, who are likelier than people at higher income levels to spend rather than save any additional funds they receive.

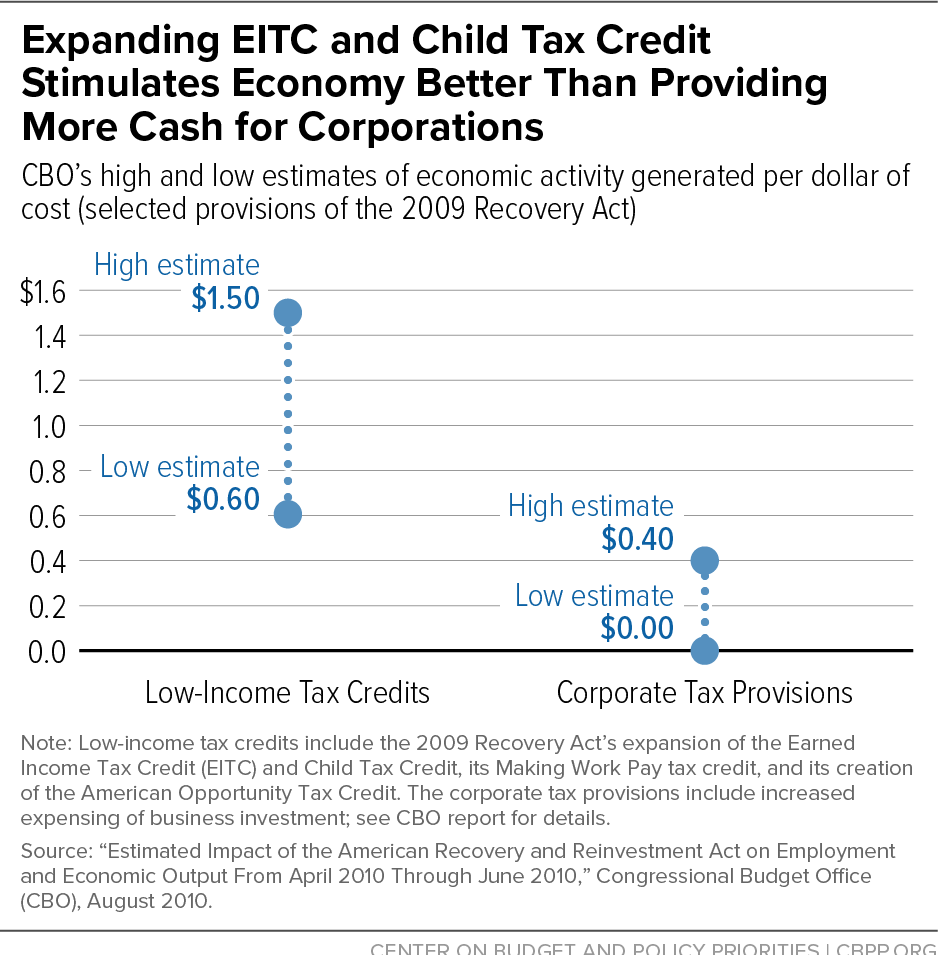

During the Great Recession, the 2009 Recovery Act’s expansions of these and similar tax credits generated between 60 cents and $1.50 in economic activity per dollar of cost, CBO estimated, compared to zero to 40 cents per dollar for the Recovery Act’s corporate tax cuts that mostly affected cash flow such as “expensing” (which allows firms to deduct the full cost of machinery and equipment purchases immediately;[14] see Figure 2).

This comparison is particularly relevant today. The CARES Act includes an expensing provision for retailers and restaurants but not EITC and Child Tax Credit expansions despite the fact that such expansions would provide higher bang-for-the-buck economic stimulus.[15] Moreover, the Trump Administration is reportedly preparing to ask Congress to include in the next package the extension of a similar expensing provision that was enacted as part of the 2017 tax law and is slated to expire at the end of 2022.[16] A much better approach would be to focus on more effective stimulus measures, including the Child Tax Credit and EITC expansions noted above.

Making the Child Tax Credit Fully Available

Approximately 27 million children in low-income families do not receive the full $2,000-per-child Child Tax Credit because their parents lack earnings or have earnings that are too low. Children in families that have less than $2,500 in annual earnings are ineligible. The credit begins phasing in for a low-income parent at a rate of 15 cents in the tax credit for each dollar of earnings above $2,500, and the refundable amount is capped at $1,400 per child (compared to the full $2,000-per-child tax credit for eligible people at higher income levels). Because of this structure, a single mother with two children who works full time at the minimum wage and earns $14,500 a year receives $1,800 — or $900 per child — much less than the $4,000 her family would receive if she had higher income.

Consider a mother with a 2-year-old daughter and 7-year-old son who works part time in a convenience store, earning $9,000 a year. Her family receives a Child Tax Credit of $975, or less than $500 per child. If the $2,000-per-child credit were fully available to low-income families like hers, she would receive a credit of $4,000 — a gain of over $3,000. (See Figure 3.)

Some momentum is building in Congress to make the Child Tax Credit fully available. Multiple bills with wide co-sponsorship[17] have been introduced to accomplish this. In addition, late in 2019, Senator Mitt Romney became the first Republican lawmaker to propose extending part of the Child Tax Credit to low-income families irrespective of whether they have earnings.[18]

For Puerto Rico, Strengthening Tax Credits Would Cut Poverty, Promote Work

Puerto Rico entered the pandemic following more than a decade of economic decline and several devastating natural disasters, exacerbated by unequal access to the U.S. safety net. Puerto Rico residents are ineligible for the federal EITC, and only families with three or more children can receive the Child Tax Credit.

Measures such as the Heroes Act would provide a crucial supplement to Puerto Rico’s modest local EITC, helping the Commonwealth tackle its acute poverty rate (43 percent in 2018a) and chronically low labor-force participation.

The Heroes Act would also give Puerto Rico residents the same access to the Child Tax Credit as residents of the states, by extending the credit to families in the Commonwealth with one or two children, including those with the lowest incomes. Making the Child Tax Credit fully available to the lowest-income families, as discussed in this paper, would significantly help families in Puerto Rico.

Expanding Puerto Rico’s EITC and making the Child Tax Credit fully available in Puerto Rico would take an important step toward tackling child poverty on the island, which stood at an even higher 57 percent in 2018.b

a Census QuickFacts: Puerto Rico, https://www.census.gov/quickfacts/PR.

b Annie E. Casey Foundation Kids Count Data Center, “Children in poverty (100 percent poverty) in Puerto Rico,” https://datacenter.kidscount.org/data/tables/43-children-in-poverty-100-percent-poverty?loc=53&loct=4#detailed/4/any/false/37,871,870,573,869,36,868,867,133,38/any/321,322.

The current pandemic and the associated economic downturn make enacting such a proposal more urgent. Policymakers should do what they can to reduce the likelihood of a sharp spike in child poverty, which could undermine the future promise of a generation of children. As a National Academy of Sciences (NAS) expert committee recently concluded, “the weight of the causal evidence indicates that income poverty itself causes negative child outcomes, especially when it begins in early childhood and/or persists throughout a large share of a child’s life.” [19] Child poverty can harm children’s health, school performance, and long-term well-being.

Substantially reducing child poverty can hence provide long-term benefits for both children and society by lowering future medical spending and other poverty-related costs and increasing children’s earnings and contributions to the economy in adulthood, the NAS panel observed. One of the panel’s two proposals to cut child poverty in half had a “child allowance” as its centerpiece. A fully available Child Tax Credit is a form of such an allowance.[20]

Making the full $2,000 Child Tax Credit available to the lowest-income families, including those who lack earnings in the tax year in question, would reduce poverty markedly. Specifically, it would:

- Lift more than 3 million people — including 2 million children — above the poverty line;

- Reduce the child poverty rate by about one-fifth, from 13.7 percent to 10.9 percent;

- Lift 13.6 million poor people, including 6.8 million children, closer to the poverty line; and

- Lift more than 1 million people, including 770,000 children, out of deep poverty by raising their income above half of the poverty line. Making the Child Tax Credit fully available to children in low-income families would shrink the deep child poverty rate by almost a third.

A fully available Child Tax Credit would lift out of poverty 1 million Black, 1 million Latino, 850,000 non-Hispanic white, 120,000 Asian and Pacific Islander, and 70,000 Native American individuals, including children. It would be particularly beneficial for children of color; it would lift an estimated 710,000 Black children, 700,000 Latino children, 60,000 Asian and Pacific Islander children, and 41,000 Native American children out of poverty, and lift millions more children closer to the poverty line. The impacts on deep poverty would be even larger for Black and Latino children than for non-Hispanic white children.

The families that would benefit from this measure (see Table 1) perform important work, often for low pay and few benefits. The current crisis has made it clear how essential their work is.

| TABLE 1 | ||

|---|---|---|

| Workers in Selected Occupations Who Would Benefit From Fully Available Child Tax Credit of $2,000 per Child | ||

| Occupation | Number of workers who would gain | Workers who would gain as a share of all in occupation |

| Cashiers | 544,000 | 15% |

| Nursing, psychiatric, and home health aides | 355,000 | 16% |

| Cooks | 315,000 | 14% |

| Personal and home care aides | 246,000 | 15% |

| Janitors and building cleaners | 244,000 | 10% |

| Child care workers | 175,000 | 13% |

| Food preparation workers | 166,000 | 15% |

| Miscellaneous agricultural workers, including animal breeders | 147,000 | 15% |

| Hand packers and packagers | 79,000 | 12% |

| Medical assistants | 76,000 | 12% |

| Combined food preparation and serving workers, including fast food | 73,000 | 22% |

| Bus drivers | 61,000 | 9% |

| All occupations | 8,648,000 | 5% |

Source: CBPP analysis of data from the U.S. Census Bureau’s March 2019 Current Population Survey

Providing a Stronger EITC for Low-Wage Childless Adults

The EITC is a pro-work success story: numerous studies have found that it encourages work, boosts incomes, and reduces poverty among families with children. Low-income adults not raising children, however, largely or entirely miss out on these benefits because their EITC is small or nonexistent.

This is an especially appropriate time to address that design flaw, given the examples we see every day of people doing essential jobs during the pandemic despite low pay — preparing food, providing in-home health services, and handling, packaging, or transporting goods, among other services. Expanding the EITC for childless adults would supplement the limited earnings of several million of these cashiers, home health aides, delivery people, and other people working in essential occupations. (See Table 2.)

| TABLE 2 | ||

|---|---|---|

| Childless Workers in Selected Occupations Who Would Benefit From Heroes Act’s EITC Expansion for Such Workers | ||

| Occupation | Number of workers who would gain | Workers who would gain as a share of all in occupation |

| Cashiers | 1,016,000 | 26% |

| Cooks | 615,000 | 26% |

| Retail salespersons | 600,000 | 17% |

| Laborers and hand freight, stock, and material movers | 500,000 | 21% |

| Janitors and building cleaners | 451,000 | 17% |

| Personal and home care aides | 379,000 | 24% |

| Stock clerks and order fillers | 354,000 | 22% |

| Truck and delivery drivers | 347,000 | 9% |

| Nursing, psychiatric, and home health aides | 341,000 | 15% |

| Food preparation workers | 303,000 | 25% |

| Child care workers | 275,000 | 19% |

| Hand packers and packagers | 175,000 | 26% |

| Miscellaneous agricultural workers, including animal breeders | 163,000 | 15% |

| Dishwashers | 102,000 | 35% |

| First-line supervisors/managers of food preparation and serving workers | 86,000 | 14% |

| Cleaners of vehicles and equipment | 83,000 | 24% |

| Shipping, receiving, and traffic clerks | 81,000 | 13% |

| Combined food preparation and serving workers, including fast food | 77,000 | 21% |

| Health diagnosing and treating practitioner support technicians | 61,000 | 9% |

| All occupations | 15,433,000 | 5% |

Note: Childless workers who would benefit from the Heroes Act EITC expansion are those aged 19-65 (excluding full-time students 19-24).

Source: CBPP estimates based on U.S. Census Bureau’s March 2019 Current Population Survey, using 2020 tax parameters and incomes adjusted to 2020 dollars.

Moreover, policymakers need to take strong action to prevent the current sharp economic decline from causing poverty to spike dramatically, and one way to help do that would be to stop taxing people into — or deeper into — poverty. Currently, about 5.8 million workers aged 19-65 who are not raising children are taxed into or deeper into poverty each year because their EITC is too small to offset their federal income and payroll taxes.[21]

To address this problem and help avoid a poverty spike among this group, policymakers can, for tax year 2020, adopt a provision of the Heroes Act that would raise the maximum EITC for childless adults from roughly $530 to roughly $1,500 and raise the income limit to qualify for the childless workers’ EITC from about $16,000 to at least $21,000. The provision also would expand the age range of childless workers eligible for the credit from 25-64 to 19-65, making workers aged 19-24 who aren’t full-time students, as well as workers aged 65,[22] eligible for the first time. The provision would benefit 15.4 million working childless adults across the country, ranging from 31,000 in Wyoming to 1.8 million in California.

Consider, for example, a 25-year-old single woman who works roughly 35 hours a week throughout the year as a cashier at a convenience store and earns just above the federal minimum wage of $7.25 an hour. Her annual earnings of $13,700 are just above the poverty line of $13,621 for a single individual. But federal taxes push her into poverty:

- Some $1,048 — 7.65 percent of her earnings — is withheld from her paychecks for Social Security and Medicare payroll taxes.

- On the income tax side, she can claim a $12,400 standard deduction, which leaves her with $1,300 in taxable income. Since she is in the 10 percent tax bracket, she owes $130 in federal income tax.

- Thus, her combined federal income and payroll liability (before the EITC) is $1,178. (This counts the employee but not the employer share of her payroll taxes.) She is eligible today for a small EITC of $160. So, her net federal income and payroll tax liability is $1,018.

In other words, federal taxes push this woman making poverty-level wages about $940 below the poverty line. (See Figure 4.) The EITC expansion in the Heroes Act described here would increase her EITC to $1,145, raising her income after federal income and payroll taxes to $46 above the poverty line. She would no longer be taxed into poverty. Overall, the EITC expansion would slash the number of workers aged 19-65 (other than full-time students) taxed into, or deeper into, poverty by about 96 percent: from about 5.8 million down to roughly 200,000, our analysis of Census data suggests.

Improving the Tax Credits’ Effectiveness in the Recession

Policymakers also should consider tweaking the EITC’s design on a temporary basis to make it a more effective counter-cyclical program during the current downturn. When the economy weakens, many two-earner families lose income and newly qualify for the EITC, which helps stabilize their income and avoid an even larger drop in household consumption. For single-earning families, including single mothers with children, in contrast, “the EITC acts as an income de-stabilizer” (emphasis added)[23] during recessions, because job losses or other earnings reductions cause many of these mothers to lose part or all of their EITC. [24]

To address this problem, policymakers should incorporate the look-back proposal that allows filers to use their income from either 2019 or 2020 when calculating their 2020 EITC, which would cost a modest $3 billion. And if policymakers do not make the Child Tax Credit fully available to children in low-income families irrespective of their parents’ earnings, families should have the same option with respect to the low-income component of the Child Tax Credit. The look-back proposal was included in the Heroes Act and in bipartisan, bicameral legislation introduced by Senators Brown and Cassidy (S. 3542), and Representatives Higgins and Kelly (H.R. 6762).

People whose incomes fall this year, making them newly eligible for the EITC during the downturn, could use their 2020 income, as under current law. But lower-income workers who lose a job or have their hours and earnings cut could use their 2019 income to avoid losing some or all of their EITC.

Consider two examples:

- A family of four whose income falls from $50,000 in 2019 to $35,000 in 2020 would qualify for an EITC of $2,257 in 2020. This family would use 2020 income when calculating its 2020 EITC, as under current law.

- But a single mother with two children whose earnings fall from $15,000 last year to just $5,000 this year would not only lose $10,000 in wages but her 2020 EITC would fall from $5,920 to $2,010 if she used her 2020 income. Allowing her to use her 2019 income would eliminate that added income loss.

Providing this choice would be sound fiscal policy and provide important income insurance to families hurt by this deep downturn by ensuring that people don’t receive a smaller credit if their earnings fall in the current year due to the disaster. And there is strong precedent for such a provision. Last year policymakers enacted the Taxpayer Certainty and Disaster Relief Tax Act of 2019, which allowed people who lived in presidentially declared disaster zones in tax years 2018, 2019, or early 2020 to use their current or previous year’s income to calculate their EITC and Child Tax Credit.[25] Policymakers first extended the look-back provision to survivors of hurricanes Katrina, Rita, and Wilma in 2005, and have used it as a response to many disasters since then.[26] While the pandemic isn’t a typical natural disaster, its impacts are similar, and in some cases more severe; people should have access to the same look-back provision for tax year 2020.

More recently, the CARES Act created an analogous relief mechanism for businesses. It not only allows businesses to deduct interest expenses equal to up to 50 percent of their adjusted taxable income (versus 30 percent previously) but also gives them the option of using their 2019 income to make this calculation. Because of the recession, many businesses will have much smaller taxable incomes in 2020 than 2019, so using their larger 2019 income will let them deduct more in interest expenses and therefore obtain larger tax refunds. Policymakers should now extend this kind of option to hard-pressed working families as well.

Appendix: Boosting Incomes of Millions of Working People and Their Families, Including Many on Front Lines

| APPENDIX TABLE 1 | |

|---|---|

| Children Under Age 17 Who Would Benefit From Fully Available Child Tax Credit of $2,000 per Child, by State | |

| State | Estimated number of children |

| Total U.S. | 27,000,000 |

| Alabama | 458,000 |

| Alaska | 58,000 |

| Arizona | 701,000 |

| Arkansas | 322,000 |

| California | 3,514,000 |

| Colorado | 369,000 |

| Connecticut | 189,000 |

| Delaware | 67,000 |

| Dist. of Columbia | 47,000 |

| Florida | 1,673,000 |

| Georgia | 1,020,000 |

| Hawaii | 92,000 |

| Idaho | 148,000 |

| Illinois | 993,000 |

| Indiana | 577,000 |

| Iowa | 216,000 |

| Kansas | 225,000 |

| Kentucky | 453,000 |

| Louisiana | 500,000 |

| Maine | 75,000 |

| Maryland | 366,000 |

| Massachusetts | 358,000 |

| Michigan | 837,000 |

| Minnesota | 341,000 |

| Mississippi | 354,000 |

| Missouri | 514,000 |

| Montana | 76,000 |

| Nebraska | 161,000 |

| Nevada | 271,000 |

| New Hampshire | 55,000 |

| New Jersey | 560,000 |

| New Mexico | 234,000 |

| New York | 1,539,000 |

| North Carolina | 929,000 |

| North Dakota | 41,000 |

| Ohio | 992,000 |

| Oklahoma | 395,000 |

| Oregon | 295,000 |

| Pennsylvania | 891,000 |

| Rhode Island | 67,000 |

| South Carolina | 449,000 |

| South Dakota | 66,000 |

| Tennessee | 628,000 |

| Texas | 2,979,000 |

| Utah | 248,000 |

| Vermont | 34,000 |

| Virginia | 542,000 |

| Washington | 492,000 |

| West Virginia | 161,000 |

| Wisconsin | 396,000 |

| Wyoming | 34,000 |

Source: CBPP estimates based on data from 2015-2017 American Community Survey, March 2019 Current Population Survey, and Tax Policy Center

| APPENDIX TABLE 2 | |

|---|---|

| Childless Workers Who Would Benefit from Heroes Act’s EITC Expansion for Such Workers, by State | |

| State | Estimated Number of Childless Workers Benefiting From EITC Expansion |

| Total U.S. | 15,433,000 |

| Alabama | 257,000 |

| Alaska | 37,000 |

| Arizona | 346,000 |

| Arkansas | 155,000 |

| California | 1,795,000 |

| Colorado | 266,000 |

| Connecticut | 134,000 |

| Delaware | 40,000 |

| Dist. of Columbia | 32,000 |

| Florida | 1,131,000 |

| Georgia | 510,000 |

| Hawaii | 61,000 |

| Idaho | 100,000 |

| Illinois | 539,000 |

| Indiana | 340,000 |

| Iowa | 152,000 |

| Kansas | 140,000 |

| Kentucky | 239,000 |

| Louisiana | 264,000 |

| Maine | 79,000 |

| Maryland | 222,000 |

| Massachusetts | 265,000 |

| Michigan | 521,000 |

| Minnesota | 251,000 |

| Mississippi | 153,000 |

| Missouri | 319,000 |

| Montana | 72,000 |

| Nebraska | 85,000 |

| Nevada | 152,000 |

| New Hampshire | 56,000 |

| New Jersey | 318,000 |

| New Mexico | 121,000 |

| New York | 882,000 |

| North Carolina | 522,000 |

| North Dakota | 33,000 |

| Ohio | 603,000 |

| Oklahoma | 207,000 |

| Oregon | 242,000 |

| Pennsylvania | 592,000 |

| Rhode Island | 44,000 |

| South Carolina | 272,000 |

| South Dakota | 43,000 |

| Tennessee | 349,000 |

| Texas | 1,225,000 |

| Utah | 122,000 |

| Vermont | 32,000 |

| Virginia | 377,000 |

| Washington | 335,000 |

| West Virginia | 94,000 |

| Wisconsin | 276,000 |

| Wyoming | 31,000 |

Note: Childless workers who would benefit from the HEROES Act EITC expansion are those aged 19-65 (excluding full-time students 19-24).

Source: CBPP estimates based on U.S. Census Bureau's March 2019 Current Population Survey and 2015-2017 American Community Survey, using 2020 tax parameters and incomes adjusted to 2020 dollars.

End Notes

[1] Chye-Ching Huang and Chuck Marr, “Failed Reopenings Highlight Urgent Need to Build on Federal Fiscal Support for Households and States,” Center on Budget and Policy Priorities, July 9, 2020, https://www.cbpp.org/research/federal-budget/failed-reopenings-highlight-urgent-need-to-build-on-federal-fiscal-support.

[2] Institute for Family Studies, “Conservative Scholars and Leaders Call for Expanded EITC and CTC for Families,” July 16, 2020, https://ifstudies.org/blog/conservative-scholars-and-leaders-call-for-expanded-eitc-and-ctc-for-families. The letter’s signers are: W. Bradford Wilcox, Rachel Anderson, John A. Burtka IV, Robert P. George, Michael Hernon, Johann Huleatt, Yuval Levin, Kathryn Jean Lopez, Abby McCloskey, Rev. Dean Nelson, Ramesh Ponnuru, Mark Rodgers, Samuel Rodriguez, Terry Schilling, Michael R. Strain, and J.D. Vance.

[3] Our poverty-reduction impacts are based on the U.S. Census Bureau's March 2019 Current Population Survey and use the Supplemental Poverty Measure, which most analysts view as more accurate than the official poverty measure because it counts major non-cash and tax-based assistance, including refundable tax credits. Impacts would very likely be still larger in the weakened economies of 2020 and 2021.

[4] Institute for Family Studies.

[5] CBPP estimates based on the U.S. Census Bureau's March 2019 Current Population Survey, using 2020 tax parameters and incomes adjusted to 2020 dollars. The estimate includes all eligible workers aged 19-65 whom federal income tax liability (if any) and the employee share of the payroll tax push below the poverty line, or who already are poor (based on their cash income before income and payroll taxes) and are pushed further into poverty by those taxes. Poverty status is determined at the level of the tax filing unit. We use the 2019 Census official poverty threshold appropriate for the tax unit based on the number and age of the tax unit members, inflated to 2020 dollars.

[6] The number of working childless adults benefitting would be even higher when accounting for 18-year-old former foster youth and youth experiencing homelessness, whom the Heroes Act makes eligible.

[7] This proposal would be unnecessary for the Child Tax Credit if it is made fully available, as proposed here.

[8] The look-back provision was available to eligible people between January 1, 2018 and January 19, 2020.

[9] “COVID-19 Earned Income Act,” co-sponsored in the House (H.R. 6762) by Democratic Rep. Brian Higgins and Republican Reps. Mike Kelly and Brian Fitzpatrick, https://www.congress.gov/bill/116th-congress/house-bill/6762/text, and in the Senate (S. 3542) by Democratic Sen. Sherrod Brown and Republican Sen. Bill Cassidy, https://www.congress.gov/bill/116th-congress/senate-bill/3542/text. The Heroes Act would authorize look-back treatment for the EITC, but its proposal to make the Child Tax Credit fully available makes look-back treatment for that credit unnecessary.

[10] Congressional Budget Office, “An Update to the Economic Outlook: 2020 to 2030,” July 2, 2020, https://www.cbo.gov/publication/56442.

[11] CBPP analysis of CBO data.

[12] Organisation for Economic Co-operation and Development, “OECD Employment Outlook 2020,” July 7, 2020, https://www.oecd-ilibrary.org/employment/oecd-employment-outlook_19991266.

[13] Mark Zandi, “HEROES Act to the Rescue,” Moody’s Analytics, June 17, 2020, https://www.economy.com/getfile?q=0A18590F-F506-47BA-9D9C-5550ACE09CC1&app=download.

[14] “Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output From April 2010 Through June 2010,” Congressional Budget Office, August 2010, https://www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/08-24-arra.pdf

[15] Chuck Marr, “When Helping Retailers, Don’t Forget Their Workers,” Center on Budget and Policy Priorities, March 20, 2020, https://www.cbpp.org/blog/when-helping-retailers-dont-forget-their-workers

[16] Erica Werner, Seung Min Kim, Josh Dawsey and Jeff Stein, “Trump and Congress spar over next coronavirus economic package as CBO paints grim picture of what’s to come,” The Washington Post, April 24, 2020, https://www.washingtonpost.com/us-policy/2020/04/24/trump-cbo-congress-coronavirus/

[17] American Family Act, H.R. 1560/S. 690, https://www.congress.gov/bill/116th-congress/senate-bill/690/text, and the Working Families Tax Relief Act, S. 1138/H.R. 3157, https://www.congress.gov/bill/116th-congress/senate-bill/1138/text.

[18] Senator Mitt Romney, “Romney, Bennet Offer Path to Bipartisan Compromise on Refundable Credits, Business Tax Fixes,” December 15, 2019, https://www.romney.senate.gov/romney-bennet-offer-path-bipartisan-compromise-refundable-credits-business-tax-fixes.

[19] Committee on Building an Agenda to Reduce the Number of Children in Poverty by Half in 10 Years, “A Roadmap to Reducing Child Poverty,” National Academies of Sciences, Engineering, and Medicine, 2019, https://www.nap.edu/read/25246.

[20] The NAS “Universal Supports and Work Package” was estimated to cut child poverty in half and included a $2,700-per-child allowance, as well as other measures.

[21] This estimate excludes full-time students aged 19-23, who under current law can be claimed by their parents as qualifying children for the larger EITC for families with children.

[22] We recommend raising the maximum eligibility age to 66 so the EITC is available until workers reach Social Security’s full retirement age.

[23] Marianne Bitler, Hilary Hoynes, and Elira Kuka, “Do In-Work Tax Credits Serve as a Safety Net?” National Bureau of Economic Research, January 2014, https://www.nber.org/papers/w19785.pdf.

[24] Bitler, Hoynes, and Kuka, p. 25.

[25] Further Consolidated Appropriations Act, 2020, P.L. 116-94, 133 STAT. 3244.

[26] Congressional Research Services, “Tax Policy and Disaster Recovery,” February 11, 2020, https://fas.org/sgp/crs/misc/R45864.pdf.

More from the Authors

Areas of Expertise

Recent Work:

Recent Work:

Areas of Expertise

Recent Work:

Recent Work: