As the House begins work on fiscal year 2022 appropriations bills, President Biden’s 2022 budget provides a good starting point. It proposes a one-year, 15.5 percent increase for non-defense appropriations, reflecting the fact that many programs and services need substantial increases — whether due to past budget cuts, long-standing unmet needs, looming challenges such as climate change, or the urgency to address persistent racial and ethnic inequalities that COVID-19 and the associated deep recession spotlighted.

Non-defense appropriations — often called “non-defense discretionary” (NDD) funding — support a wide range of important services, including aid to education, job training, medical care for veterans, scientific and medical research, housing and other assistance for families in need, public health measures, treatment for substance use disorders, national parks and forests, weather forecasting, the Coast Guard, international assistance, air traffic control, rural development, and upgrades to wastewater and drinking water treatment.

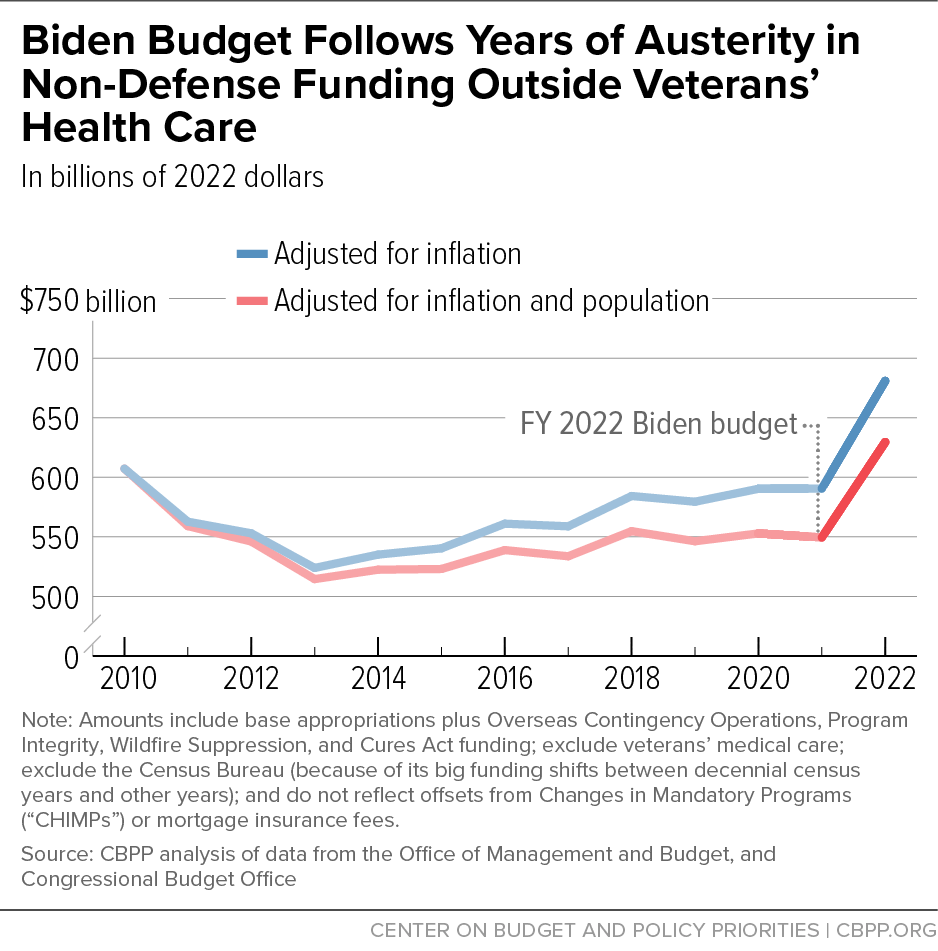

For the past decade, NDD (and defense) appropriations have been governed by the tight annual caps of the 2011 Budget Control Act (BCA). While lawmakers took steps on several occasions to make the caps less stringent, the overall result during the past decade was still considerable austerity. Aside from veterans’ medical care, for which policymakers increased appropriations substantially to meet rising costs and address long-standing shortcomings, by 2021 the rest of NDD funding was about 10 percent below the comparable 2010 level after adjusting for inflation and population growth. The BCA caps expire on September 30 of this year, however, leaving policymakers free to set appropriations levels for 2022 and beyond based on their current judgment rather than the enacted limits of earlier years.

The Biden budget departs sharply from the last decade of austerity. It proposes, for example, substantial increases in education, including measures to address racial and economic disparities. It calls for more child care, Head Start, and housing assistance funding. It reverses a decade of Environmental Protection Agency cuts and strengthens efforts to promote environmental justice. And it gives various agencies the operating funds to do their jobs, such as managing Social Security benefits, fairly and efficiently administering tax laws, or enforcing rules that protect civil rights, labor standards, or workplace health and safety.

In ending the austerity of the last decade, the President’s proposed NDD appropriations would be roughly consistent with historical trends. The budget would lift 2022 NDD funding other than veterans’ medical care to about 4 percent above the comparable 2010 level, adjusted for inflation and population growth, after more than a decade below that level. Relative to Gross Domestic Product (GDP) — a standard way of making comparisons over long periods — NDD funding under the Biden budget would equal 3.3 percent of GDP in 2022, below the 3.6 percent average since 1976.

The Biden NDD Budget and Its Priorities

President Biden’s budget calls for a 15.5 percent ($105 billion) increase in regular NDD funding to better meet national needs.[1] (That increase, and other numbers in this section, pertain only to non-emergency appropriations and do not reflect emergency supplemental funding that policymakers enacted to address the pandemic. The Biden budget does not propose any emergency appropriations for 2022.)

While the budget includes new initiatives in NDD, much of the proposed funding increases go to rebuilding and strengthening long-standing functions and programs. Some proposals would reverse funding cuts of the past decade that made it harder for agencies to provide basic services, protect health or the environment, enforce the law, or invest in infrastructure. Other proposed increases come in areas such as housing or child care, where federal programs have long met only a fraction of need. Still others tackle emerging challenges such as climate change. These proposals in large measure reflect the high priority that the budget places on addressing racial inequality by strengthening protections against discrimination, fostering opportunity, and assisting those in need. In contrast to recent supplemental funding to address immediate needs that arose from the pandemic and deep recession, the Biden budget focuses on funding ongoing programs and meeting program requirements.

Table 1 shows the President’s funding proposals for the major non-defense agencies. While most receive significant increases, the President’s priorities are reflected in the particularly large funding growth that he proposed for some of them:

- The Education Department receives the largest increase in both dollar and percentage terms: $29.8 billion or 41 percent, with substantial increases for both K-12 and higher education and a strong focus on boosting equity.

- Department of Health and Human Services (HHS) funding would rise by $25.5 billion or 23 percent, supporting substantial increases for the National Institutes of Health, Centers for Disease Control and Prevention, Indian Health Service, mental health and substance use treatment, child care assistance, and Head Start, among other priorities.

- Commerce Department funding would rise by $2.6 billion or 30 percent, with increases for climate observation, forecasting and research, and next generation weather satellites at the National Oceanic and Atmospheric Administration and manufacturing technology programs at the National Institute of Standards and Technology.

- The Energy Department’s NDD funding would increase by $3.7 billion or 25 percent, with much of it allocated to clean energy and climate-related programs.

- Environmental Protection Agency funding would rise by $2.0 billion or 22 percent, with the funds used to roll back funding and staff cuts of the past decade and increase funding to address climate change, boost environmental justice, and support water treatment and drinking water infrastructure.

| TABLE 1 |

| Not adjusted for inflation or population, and excluding emergency funding. $ in billions |

| |

|

|

Change, 2021 to 2022 |

| Agency |

FY 2021 |

FY 2022 |

dollar |

percent |

| Education |

73.0 |

102.8 |

29.8 |

40.8% |

| Commerce |

8.8 |

11.4 |

2.6 |

29.6% |

| Energy |

14.6 |

18.3 |

3.7 |

25.1% |

| Health & Human Services |

109.4 |

134.8 |

25.5 |

23.3% |

| Environmental Protection Agency |

9.2 |

11.2 |

2.0 |

21.6% |

| National Science Foundation |

8.4 |

10.1 |

1.7 |

20.0% |

| Interior |

15.3 |

17.8 |

2.5 |

16.5% |

| Agriculture |

26.0 |

30.0 |

4.1 |

15.7% |

| Housing & Urban Development* |

59.6 |

68.7 |

9.0 |

15.2% |

| Treasury |

13.5 |

15.4 |

1.9 |

14.4% |

| Labor |

12.5 |

14.3 |

1.8 |

14.3% |

| State & International Programs |

57.3 |

63.6 |

6.3 |

11.0% |

| Social Security Administration |

10.3 |

11.2 |

1.0 |

9.4% |

| Veterans Affairs |

104.6 |

113.1 |

8.5 |

8.2% |

| National Aeronautics & Space Admin |

23.3 |

24.8 |

1.5 |

6.6% |

| Justice |

27.8 |

29.2 |

1.4 |

5.2% |

| Transportation |

25.0 |

25.4 |

0.4 |

1.6% |

| Homeland Security |

51.9 |

49.5 |

-2.4 |

-4.6% |

| Corps of Engineers |

7.5 |

6.8 |

-0.8 |

-10.0% |

| Other Agencies |

22.5 |

27.1 |

4.6 |

20.6% |

| Total** |

680.5 |

785.7 |

105.2 |

15.5% |

| To switch to OMB numbers used in Biden budget presentation: |

| Remove program integrity, wildfire suppression, and CURES Act funding |

-4.7 |

-5.5 |

|

|

| Apply FHA/GNMA mortgage insurance receipts |

-15.1 |

-10.5 |

|

|

| Equals "base" NDD funding as shown in Biden budget*** |

660.7 |

769.6 |

108.9 |

16.5% |

Some proposed increases in particular help illustrate the breadth and nature of the Biden proposals.

Fostering Equity in Elementary and Secondary Education. The Biden budget more than doubles “Title I” Aid to Disadvantaged Students grants, from $16.5 billion to $36.5 billion. This program provides funds to local school districts for additional services and supports to help students in high-poverty schools succeed. The $20 billion increase would go for a new “Equity Grants” component of Title I, designed to target funds to schools with the highest concentrations of poverty and provide incentives for more equitable school funding systems, leaving fewer disparities between high- and low-poverty school districts and schools.

The budget also proposes a 21 percent ($3.0 billion) increase in grants under the Individuals with Disabilities Education Act, which help states and school districts cover the cost of special education services for children with disabilities.[2]

Increasing Financial Aid for College Students. The President’s budget proposes a significant increase in Pell Grants, which are the main form of federal financial aid for undergraduate students from low- and middle-income families and which currently assist 6.5 million students. Pell Grants are funded from a combination of discretionary and mandatory funding. The budget calls for a $3 billion increase in NDD appropriations to support a $400 increase in the maximum annual grant amount. That would be combined with mandatory funding in the President’s American Families Plan and would bring the total maximum grant to $8,370 — $1,875, or 29 percent, more than the current level.

Strengthening Public Health. The Centers for Disease Control and Prevention (CDC) is the lead federal agency for public health functions such as detecting and tracking infectious diseases, laboratory testing to identify disease outbreaks, coordinating responses to epidemics, and developing and leading public health responses to chronic diseases and other health threats. The CDC budget also provides important support to state and local agencies that are on the front lines of public health. Over the past decade, however, the CDC budget eroded, with its 2021 non-emergency funding about 8 percent below the 2010 level in inflation-adjusted terms.

The Biden budget proposes a 21 percent ($1.7 billion) increase in the regular CDC budget to better support ongoing operations. Additional funding would go to strengthening state and local public health capacity, training public health professionals, modernizing how CDC collects and uses data, and increasing global cooperation. The budget also supports efforts to study and address racial and ethnic health disparities.

Meeting Health Care Obligations to Tribal Nations. The President’s budget proposes a 36 percent ($2.2 billion) increase for the Indian Health Service (IHS), which provides health care to eligible American Indians and Alaska Natives, either directly or through programs and facilities that tribes and tribal organizations operate, to fulfill the federal government’s trust responsibilities. The funding would go to expand access to health services, address serious health disparities, modernize aging facilities, and deal with urgent health issues such as HIV, maternal mortality, and opioid use.

In addition, the budget calls on Congress to begin making future appropriations for the IHS a year in advance, as is currently done for the Department of Veterans Affairs health system (which is the other major federal health care system funded through NDD appropriations). The purpose of advance appropriations for health care agencies is to prevent disruptions and uncertainties when the government is operating on short-term continuing resolutions at the beginning of a fiscal year or partially shut down due to a lapse in appropriations.

Addressing Mental Health and Substance Use. The President’s budget proposes a 62 percent increase for HHS’ Substance Abuse and Mental Health Services Administration (SAMHSA) to help address mental health and opioid and other substance use problems. These SAMHSA programs play a vital role in filling coverage gaps for treatment, in training and supporting service providers, and in funding prevention efforts.

In particular, the budget would more than double the Community Mental Health Services Block Grant, to $1.6 billion; increase the Substance Use Prevention, Treatment and Recovery Block Grant by 89 percent, to $3.5 billion; and increase State Opioid Response formula grants by 50 percent, to $2.25 billion.

Bolstering Civil Rights Enforcement. The Biden budget proposes several increases to strengthen civil rights enforcement. For the Justice Department, it proposes a $25 million (16 percent) increase for the Civil Rights Division, to better enforce anti-discrimination laws, prosecute hate crimes, protect voting rights, reform law enforcement, and boost other civil rights priorities. The increase would reverse cuts since 2010 and bring the 2022 appropriation 2 percent above the 2010 level in inflation-adjusted terms.

The budget also seeks increases for civil rights offices at other federal departments, including a $9 million (24 percent) increase at HHS and a $13 million (10 percent) increase at the Education Department. It also proposes a $12 million (17 percent) increase for fair housing activities at the Department of Housing and Urban Development (HUD), reversing all but 3 percent of the inflation-adjusted cuts since 2010.

Supporting Legal Services for Low-Income People. The Biden budget proposes a major increase for the Legal Services Corporation (LSC), from $465 million in 2021 to $600 million in 2022. The LSC funds more than 130 independent non-profit legal aid agencies across the country. Those grantees help people with incomes at or below 125 percent of the federal poverty line in non-criminal matters such as housing, adoption, child custody, access to health care, income support and other benefits, employment law, and debt collection.

The LSC has been chronically underfunded, with a 2021 appropriation that is less than half its level of 40 years ago in inflation-adjusted terms. Its grantees were able to provide adequate services to less than half of those seeking help for a legal problem, a 2017 LSC-commissioned study found, mostly due to insufficient funding.[3]

Expanding Housing Assistance. The Biden budget proposes a $9 billion (15 percent) increase for HUD.[4] That includes increases of $500 million (17 percent) for Homeless Assistance Grants, $175 million (21 percent) for Native American Housing Programs, and $500 million (37 percent) for the HOME Investment Partnerships Program, which supports the development of low-income housing. Of the HOME increase, a fifth would go for down payment assistance to first-generation, first-time homebuyers.

The budget funds an additional 200,000 Housing Choice Vouchers, which help low-income households afford decent, stable housing. That, according to HUD, would be the largest one-year increase in the number of vouchers since policymakers authorized the program. The increase is modest compared to the need, however. Due to funding limitations, the program currently serves only 1 out of 4 eligible families.[5] In addition to the new vouchers, the budget would provide $491 billion for new services to help families rent housing in a wider range of neighborhoods, including well-resourced neighborhoods with strong schools that can expand opportunities for their children.

Improving Service at the Social Security Administration. The Social Security Administration (SSA) operating budget fell by 13 percent in inflation-adjusted terms between 2010 and 2021, while the number of Social Security beneficiaries rose by 22 percent. The budget cuts hampered SSA’s ability to perform essential services such as determining eligibility for benefits in a timely manner; paying benefits accurately and on time; responding to questions from the public; and updating benefits promptly when circumstances change.[6]

The Biden budget proposes a 10 percent increase for SSA’s operating budget, to begin improving service to the public.

Rebuilding IRS Capacity. The President’s budget proposes $13.6 billion in total IRS appropriations in 2022, a $1.7 billion or 14 percent increase over the 2021 level.[7]

The increase follows dramatic IRS budget cuts over the past decade, and it’s designed to begin rebuilding the agency’s capacity to enforce tax laws, collect revenues that are due, and help taxpayers navigate the tax system. IRS appropriations in 2021 are 19 percent below their 2010 inflation-adjusted level. There are 30 percent fewer enforcement staff, and the audit rate for millionaires has fallen from 8.4 percent in 2010 to 2.4 percent in 2019. Taxpayers with questions find it hard to reach the IRS by phone, and the agency has a large backlog of mail correspondence. Hundreds of billions of taxes owed are going uncollected, various estimates suggest.[8] The President’s 2022 appropriations proposal is part of a multi-year plan to address these problems, involving mandatory as well as discretionary funding; the plan also includes a new information reporting requirement for financial institutions to improve tax compliance.[9]

While the proposed 2022 increase for NDD is large, it comes after a decade of relative austerity in NDD funding. Consequently, the Biden budget would bring NDD as a whole roughly back to where it was at the beginning of the last decade — a bit above or below depending on the specific measure used.

The past decade’s austerity resulted mostly from the BCA’s tight caps on appropriations for each year from 2012 through 2021. The starting point was the 2011 level, thus locking in the substantial cuts of that year. Beginning in 2013 the caps were further reduced through a “sequestration” process that the BCA triggered when Congress failed to agree on other deficit-reduction measures.

A common way to evaluate appropriations bills is to look at the dollar or percent change from the year before, as we did in the previous section. Putting them in a longer-term context, however, requires accounting for factors that affect program costs and public needs. Prices, and hence program costs, rise over time. In addition, the nation’s population continues to grow, increasing the number of people that the federal government serves. Adjusted for inflation and population growth, by 2013 the combined effect of the caps and sequestration left NDD funding 13 percent below its 2010 level.

After that low point in NDD funding, the President and Congress enacted measures to scale back the BCA cuts two years at a time, recognizing that the caps were too tight to meet national needs. As a result, the NDD cap for 2021 — the BCA’s last year — wound up only about 4 percent below the 2010 NDD funding level after adjusting for inflation and population growth.

For most NDD programs, however, the constraints were significantly tighter due to the large funding increases needed to maintain and improve medical care for veterans, which has been a very high priority for Congress. Veterans’ medical care is NDD’s largest program, now accounting for roughly a seventh of all regular NDD funding. Its inflation-adjusted appropriations grew by 67 percent between 2010 and 2021. Over that period, funding for all NDD programs other than veterans’ medical care fell by 3 percent after adjusting for inflation and 10 percent after adjusting for both inflation and population growth.

The Biden increases would reverse the rest of the last decade’s cuts and bring the inflation- and population-adjusted NDD total (excluding veterans’ medical care) to about 4 percent above its level of 12 years ago. (See Figure 1.) In short, what looks like a dramatic increase on a year-to-year basis is much more modest when viewed over the longer term.[10]

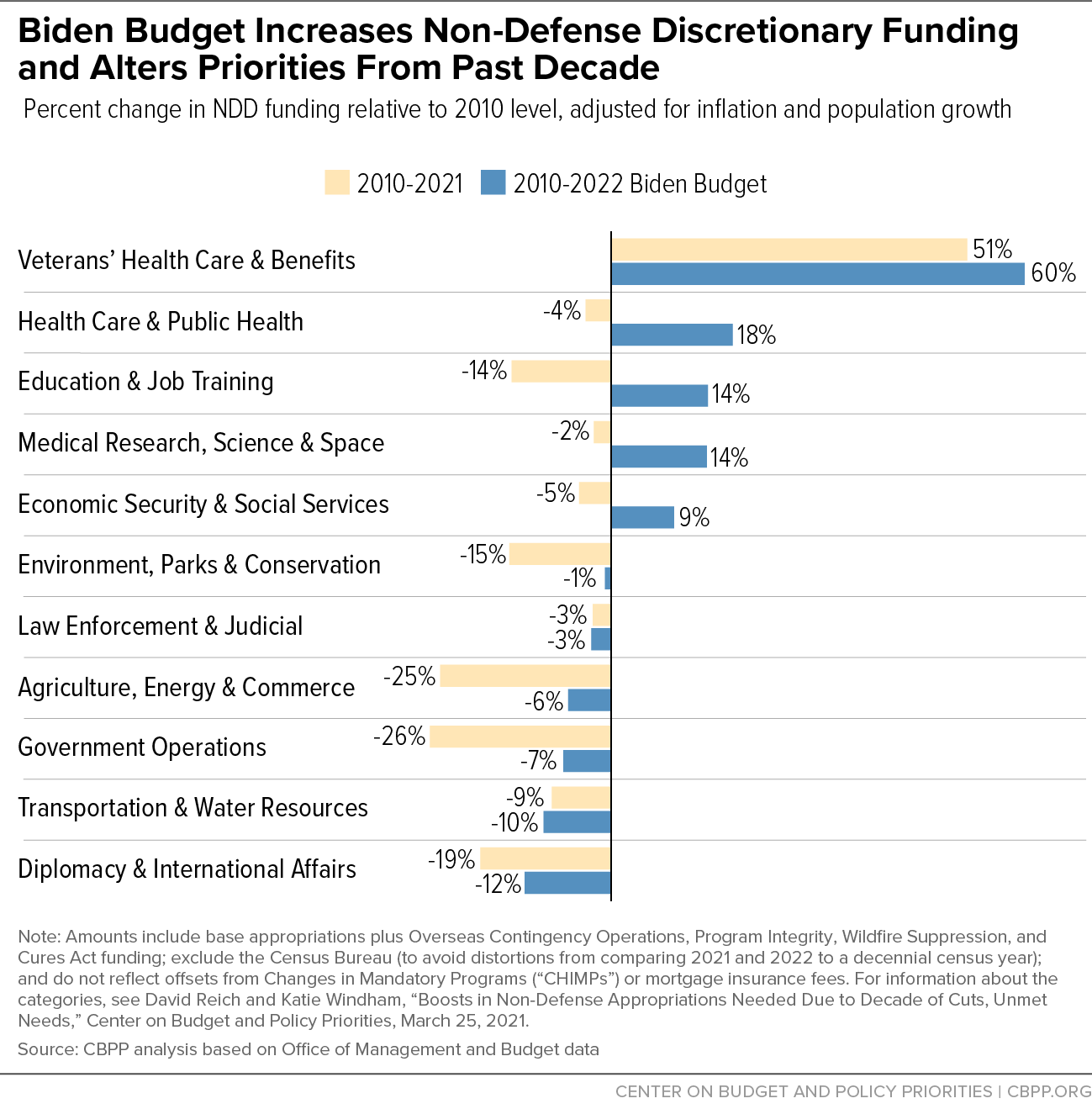

While the Biden budget reverses the last decade’s cuts in the aggregate, it does not put everything back to where it was. Instead, it targets major increases to what the President considers current priorities. See Figure 2, showing percentage changes from 2010 by major categories, adjusted for inflation and population. The red bars show the change between 2010 and 2021, while the blue bars show the change from 2010 to the 2022 Biden budget.[11]

As Figure 2 shows, veterans’ health care and benefits received by far the largest increase over that period, reflecting steady annual increases mainly due to rising funding for medical care (which comprises more than 90 percent of this category), and the Biden budget continues that trend.[12] But the Biden budget also proposes very substantial increases in health care and public health, education and job training, medical research and other science, and economic security and social services — reflecting the President’s priorities. Through 2021, all of these spending categories were below their adjusted 2010 level, ranging from minus 2 percent for medical research and science to minus 14 percent for education and training. The Biden increases would lift funding in 2022 for these areas above their adjusted 2010 levels. Even with the Biden budget’s substantial overall NDD increase, several other categories would remain below the adjusted 2010 levels.

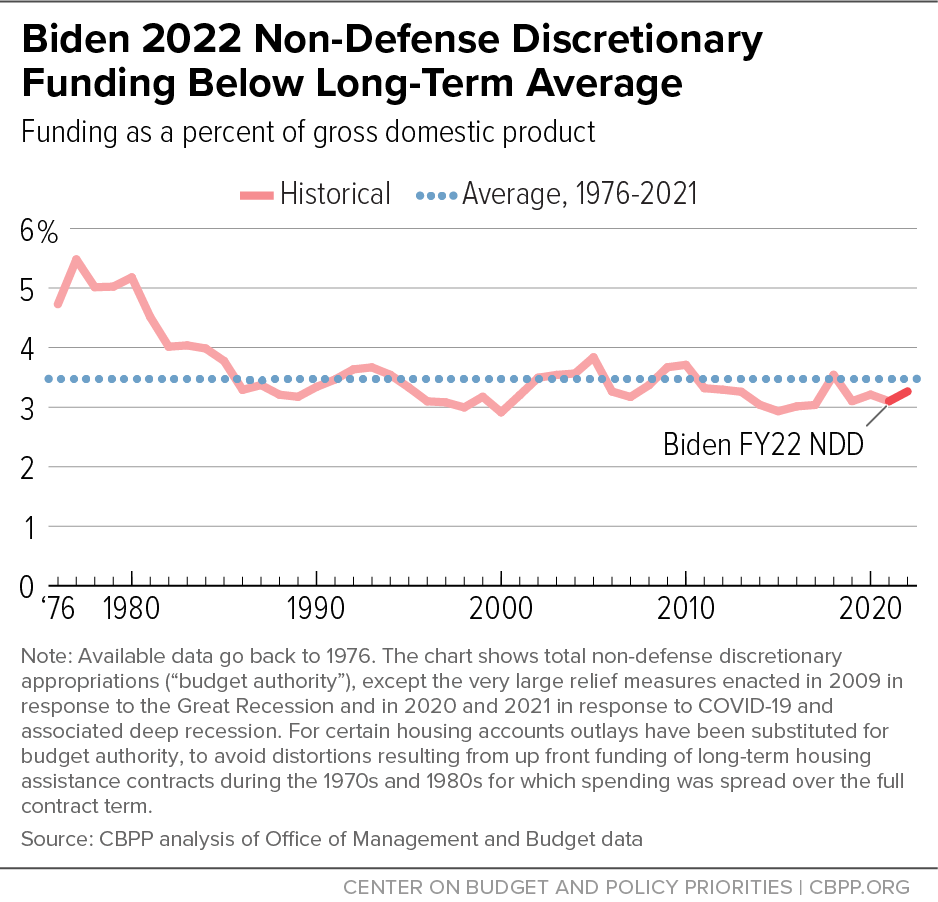

As noted earlier, another standard way to look at budget levels over time is as percentages of GDP. That approach puts funding in the context of the economy. Data on this basis are available for appropriated funding back to 1976 and are shown in Figure 3.[13] These long-term data include all classifications of NDD funding, including emergency funding. It is generally impossible to remove NDD funding for natural disasters and other emergencies from the historical data, but we were able to pull out the Congressional Budget Office’s estimates of 2009 Recovery Act funding and 2020-21 COVID-19 funding. Due to their size, those amounts are extreme outliers and, in our view, their inclusion would distort the meaning of historical averages.[14]

Since 1976, NDD funding has averaged 3.6 percent of GDP and, over this period, it has been as high as 5.5 percent and as low as 2.9 percent. Funding as a percent of GDP tends to rise during recessions, as policymakers enact more recession-relief spending measures at the same time that GDP is shrinking. The percentage usually falls as the economy returns to growth and temporary recession-relief spending expires. NDD funding also tends to rise as a percent of GDP in years with major natural disasters or other emergencies, similarly because policymakers enact measures to respond to them. For example, NDD funding rose sharply from 3.0 percent of GDP in 2017 to 3.5 percent in 2018 because of large emergency appropriations enacted to deal with the consequences of Hurricanes Harvey, Irma, and Maria. It remained stable as a percent of GDP in 2013 even though regular NDD appropriations were being cut because of emergency appropriations for relief and recovery from Hurricane Sandy.

Over the past decade, NDD funding fell from 3.7 percent of GDP in 2010 to 3.1 percent in 2019. Since then, it has remained in the 3.1 to 3.2 percent range (excluding emergency funding in response to COVID-19 and the recession). Even with the increases in the President’s 2022 budget, NDD funding would equal an estimated 3.3 percent of GDP — still below the long-term average of 3.6 percent or the 2010 level of 3.7 percent.[15]

In sum, the austerity of the last decade brought NDD funding to unusually low levels relative to GDP. Reversing that austerity, as the Biden budget proposes, would cause the percentage to rise somewhat, but it would still remain below the average of the past four-and-a-half decades.