The Build Back Better (BBB) legislation before the House would raise a reported $1.85 trillion over ten years to pay for critical investments to reduce child poverty; make health care, child care, and housing more affordable; and address climate change. Moreover, while many of the BBB investments are temporary, the bulk of the tax provisions are permanent and so would continue raising revenue after ten years. The legislation would raise revenue in three main ways: requiring people with high incomes to pay a fairer amount of tax, reducing unwarranted tax advantages for profitable corporations (particularly large multinationals), and improving enforcement of the nation’s tax laws to close the roughly $600 billion annual gap between taxes legally owed and taxes paid — a gap disproportionately due to high-income filers’ noncompliance with the law. Together, these measures would make the tax code more equitable and adequate.

Much of the income of very wealthy households doesn’t appear on their annual tax returns, unlike the vast majority of households, whose incomes come mainly from wages and salaries. And when wealthy households do pay tax, they often benefit from special tax breaks or discounted rates. Changes in tax policy since the late 1990s have expanded these advantages, particularly President George W. Bush’s tax cuts of 2001 and 2003 and President Trump’s 2017 tax cuts.

BBB includes several policy changes to begin to address — though not eliminate — these tax advantages. They include:

Surtax on multi-millionaires. BBB imposes a new 5 percent surtax on households with adjusted gross income (AGI) above $10 million and an additional 3 percent tax (for a combined 8 percent) on those with AGI above $25 million.[1] This would raise $230 billion over ten years, according to the Biden Administration.[2]

A major advantage of this provision is the relatively broad base of income types it applies to, including realized capital gains, dividends, pass-through income, and wage and salary income, and it is applied before most deductions are taken into account. Thus, the surtax applies both to labor income (such as wages) and capital income (such as realized[3] capital gains and other income from wealth, which is concentrated at the top of the income scale). In contrast, an increase in ordinary income tax rates would apply to income after all deductions are considered and not to most capital income, which is subject to separate, preferential rates.

While BBB doesn’t eliminate certain existing tax breaks, such as preferential treatment for carried interest or the 20 percent deduction for pass-through income, the surtax applies to these types of income for very high-income people.[4] Similarly, while BBB doesn’t directly raise the tax rates on capital gains and dividends, the surtax effectively raises these tax rates for multi-millionaires.

One drawback of the provision is that its high threshold means that it only applies to a very small share of the very highest-income households — that is, those with taxable incomes above $10 million. Moreover, the high threshold combined with other tax advantages for high-wealth households — in particular, the ability to defer capital gains by waiting to sell investment assets —opens up the surtax to gaming. For example, a wealthy person who wants to sell appreciated stock with a $50 million gain could sell the stock evenly over six years to stay under the $10 million threshold and avoid the surtax. While the proposed threshold raises sufficient revenue to finance the legislation as it now stands, in the future this income threshold should be set at a much lower level.

Net investment income loophole. High-income people pay a 3.8 percent Medicare tax on their wages and self-employment income. In 2010, Congress enacted a parallel 3.8 percent tax on high-income people’s net investment income. The tax, however, was designed with a large loophole: some income of high-income people who own pass-through businesses — including partnerships and S corporations — doesn’t face either 3.8 percent tax. This gives high-income professionals, such as lawyers or investment fund managers, a significant incentive to recharacterize their income, or rearrange their business operations, to avoid the tax.[5] BBB closes this loophole, raising $250 billion over ten years.

Limitation on excess business losses. BBB makes permanent a provision of the 2017 tax law that limits the amount of business losses that high-income owners of pass-through businesses can deduct from their non-business income, such as capital gains. Specifically, the 2017 provision allows pass-through business owners to deduct up to $500,000 of losses from their business against their non-business income in a given year. Any excess losses above the limitation can be carried forward to future years. Under the 2017 law, as amended by the American Rescue Plan, this policy is scheduled to expire at the end of 2026. Making the provision permanent will raise $170 billion over ten years.

Further action still needed. The high-income components of BBB described above represent sound policy and will raise $650 billion over ten years. The legislation, however, fails to address a significant flaw in the tax code that allows many extremely wealthy people to pay little or no individual income tax — the federal government’s main tax, raising roughly half of federal revenue. Currently, when an investor holds an asset (such as stock), they owe no income tax on its annual appreciation, which represents economic income to the stockholder. Such taxes are typically paid only when the asset is sold, and if the investor holds the asset until death, neither the investor nor their heirs ever owe capital gains tax on its growth in value during the investor’s lifetime.[6] A major ProPublica investigation brought public attention to this flaw in the tax code.[7]

We can use the example of Amazon CEO Jeff Bezos to illustrate this issue because Amazon’s filings with the Securities and Exchange Commission are publicly available. Those filings show that he received an annual salary of roughly $80,000 as of 2020,[8] which is subject to ordinary income taxes each year.[9] As founder, however, Bezos owns a significant amount of Amazon stock,[10] and the value of his holdings grew by more than $10 billion a year from 2010 to 2018, on average.[11] If he doesn’t sell any of these shares in a given year, he pays no tax on their growth in value that year; as a result, he is essentially taxed as if he were a typical middle-income person instead of one of the country’s wealthiest people. The recent “billionaires’ tax” proposal would take a first step toward addressing this fundamental unfairness by taxing the annual appreciation of certain assets each year. But the proposal was dropped from the BBB package, so this issue remains unfinished business for federal policymakers.[12]

International tax reforms. Following a major push by the Biden Administration after negotiations faltered under the Trump Administration,[13] 136 countries representing more than 90 percent of the world’s economy recently agreed to enact major reforms to the international tax system.[14] The deal represents years of negotiations between members of the Organisation for Economic Co-operation and Development (OECD), an organization of 37 mostly Western nations with advanced economies.

The OECD agreement — which has been formally endorsed by the G20, a group of the 20 countries with the largest economies[15] — is intended, in part, to curtail the international “race to the bottom” on corporate taxes. Corporate tax rates have declined steadily among OECD countries in recent decades — from an average statutory rate of 43 percent in 1985 to just 21.7 percent in 2019[16] — as countries lower their rates to attract companies at the expense of other nations. The result is that all nations see a reduction in revenues from corporations that benefit from, and should contribute to, public investments.

A key feature of the agreement is a 15 percent global minimum tax on companies’ foreign profits. It will ensure that large corporations pay at least a 15 percent tax rate on profits earned outside their home country and will limit multinationals’ ability to avoid taxes by shifting profits to low-tax countries (known as “tax havens”). If the company records profits in a country that doesn’t impose at least a 15 percent rate, the company’s home country will collect a “top up” tax to make sure that income is taxed at a 15 percent rate.

The OECD minimum tax includes features that are stronger than the existing U.S. minimum corporate tax (the tax on global intangible low-taxed income or GILTI, established by the 2017 tax law), and BBB includes several provisions to bring the U.S. into alignment with the deal. These are important policies to enact even in the absence of the OECD agreement.[17] In particular, BBB strengthens GILTI by raising the tax rate on foreign profits to 15 percent (from 10.5 percent today) and requires that corporations calculate the minimum tax in each country in which they operate instead of on an aggregate global basis, which will prevent companies from avoiding GILTI by “blending” taxes and income in low- and high-tax countries.

BBB also strengthens another part of the 2017 law: the Base Erosion and Anti-Abuse Tax (BEAT), which is intended to prevent large multinational corporations from avoiding U.S. tax by shifting profits out of the country. BBB makes the BEAT a more robust deterrent against profit shifting by, for example, ensuring that more types of profit-shifting payments are penalized and raising the applicable penalty tax rate. It also narrows the scope of the BEAT by targeting the tax to foreign-parented multinational corporations.

Together, BBB’s changes to the international tax system will reduce the U.S. tax code’s favorable treatment of offshore profits and investments, raise an estimated $350 billion in revenue over ten years, and cement the U.S.’s position as a leader in international taxation. They also will provide a model for other countries as they implement their own minimum taxes.

Corporate minimum tax on “book” profits. BBB will ensure that large, profitable corporations — those with at least $1 billion in financial statement profits on average over three years — pay at least a minimum amount of tax.

Corporations are required to calculate their income separately for tax purposes (that is, in accordance with the tax code’s rules) and for purposes of preparing a financial statement for their shareholders. This financial statement income, or “book” income, is often much higher than taxable income. And it may better represent a company’s true economic position than taxable income, which can allow even very profitable businesses to use special tax preferences to reduce their taxable income to zero.

BBB imposes a 15 percent tax on this “book” income, with adjustments to allow corporations to use certain tax deductions and credits, such as credits for renewable energy and R&D to reduce book income. The minimum tax will raise an estimated $325 billion over ten years.

Stock buybacks. BBB imposes an excise tax of 1 percent of the value of repurchased stock on publicly traded U.S. corporations. This provision will raise $125 billion over ten years.

Corporations have two basic ways to distribute profits to their shareholders: issue dividends (the traditional route) or offer to buy back a certain number of their own shares, which in turn raises the value of remaining stocks held by individuals and institutions. While these are economically similar,[18] they are taxed differently. Dividends are generally taxable when shareholders receive them. Under a stock buyback, in contrast, shareholders who sell their shares to the corporation at a gain owe capital gains tax but shareholders who don’t sell their shares — typically the overwhelming proportion — see the value of their shares rise but don’t pay tax on the gain until they sell the shares. Their wealth increases but their taxes don’t. By imposing a 1 percent excise tax on share buybacks, this provision is designed to correct this tax policy inefficiency.[19]

Moreover, foreign shareholders are generally subject to U.S. tax on dividends but not on most capital gains, including gains accruing from stock buybacks. The share of publicly traded U.S. stocks held by foreign investors has tripled to 30 percent since the late 1990s, so “treating buybacks as dividends is more important than ever” in ensuring that foreign shareholders pay taxes, according to the Tax Policy Center’s Steve Rosenthal.[20]

Further action still needed. President Biden has proposed to raise the corporate tax rate to 28 percent, which the House Ways and Means Committee adjusted to 26.5 percent. During the negotiating process, this proposal was dropped, leaving in place the 2017 tax cut’s deep, costly cut in the corporate rate to 21 percent. As CBPP has explained previously, the corporate tax cut failed to deliver the promised gains in economic growth, job creation, or wage growth, so it’s highly unlikely that partially reversing them would have large deleterious effects.[21] Policymakers should revisit this proposal when it works to extend the critical investments made in this legislation.

Several factors have coalesced to create an urgent need for a multi-year rebuilding of the IRS to address the roughly $600 billion annual gap between taxes legally owed and taxes paid. BBB provides roughly $80 billion over ten years for this essential task. Critically, the legislation establishes a multi-year, mandatory funding stream (that is, funding provided directly in authorizing law)[22] to provide the IRS with the certainty it needs to rebuild its audit staff and make long-term commitments to technology upgrades.

Overall IRS funding is down one-fifth since 2010, and a decade of budget cuts has severely undermined the agency’s ability to perform its fundamental jobs of enforcing the nation’s tax laws and helping taxpayers navigate a tax system that relies on voluntary compliance. Since 2010, the IRS’s computer systems have become more outdated and the number of revenue agents — auditors uniquely qualified to process the complex returns of high-income individuals and corporations — has fallen by 39 percent. Rebuilding the ranks of these sophisticated auditors is needed to implement the Biden proposal to increase audits at the high end of the income scale and of complex businesses.

BBB delivers the essential funding — $45 billion for enforcement and $27 billion for corresponding operations support, along with $5 billion for systems modernization[23] — to build the capacity to narrow the tax gap. Unfortunately, it does not include the other integral part of the President’s comprehensive proposal to close the tax gap: improved information reporting.

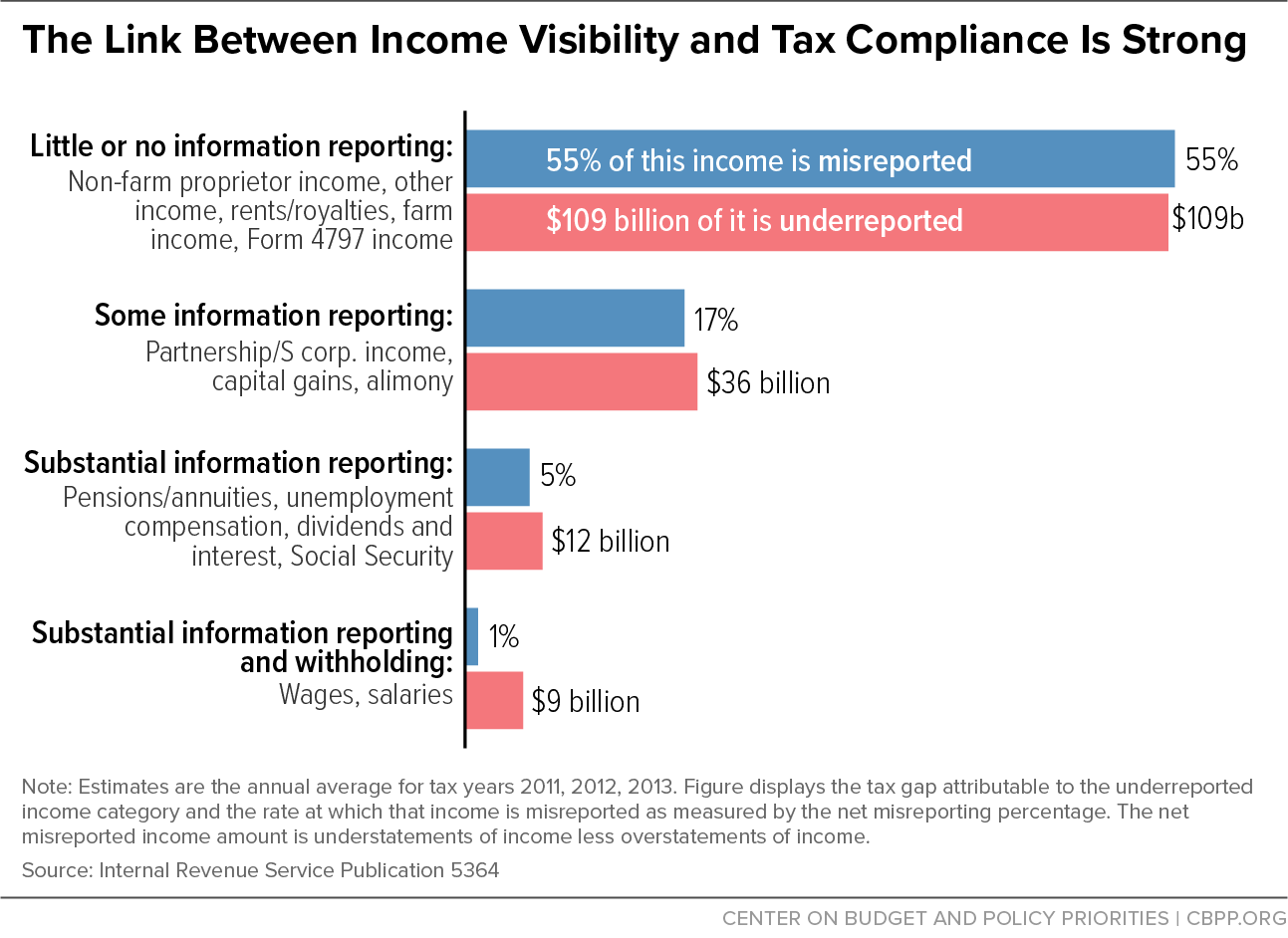

As Figure 1 illustrates, our voluntary tax compliance system relies on third-party information to function. For income that’s subject to substantial information reporting, such as wages (which employers report to the IRS using W-2 forms), compliance is near perfect. But for certain streams of income where the IRS has little or no third-party information, more than half of income goes unreported.

The President proposed requiring banks to add two minimal, readily available pieces of information to a common form (1099-INT) that they already provide the IRS with interest income on various accounts: the overall amount of money flowing into an account each year and the overall money flowing out. The proposal would not have placed any new burdens on taxpayers but would have enabled the IRS to target individuals who appear to have large amounts of unreported income for audits.

Unfortunately, the banking industry mounted a misinformation campaign against the proposal that led policymakers to drop the provision from BBB. After the legislation is enacted, the Treasury and relevant congressional committees should examine the industry’s misinformation, debunk it, and renew the effort to provide the IRS with the information it needs to enforce the tax code on behalf of honest taxpayers.