To fund the investments that would help build a more equitable recovery, President Biden is expected to ask the wealthiest households to pay a fairer amount in federal taxes. With the nation’s income and wealth more and more concentrated at the top over the last several decades — including during COVID-19 and its economic fall-out — and the nation facing significant investment needs, policymakers should reconsider how the tax code treats the most well-off.

The health and economic crises of the last year exposed glaring weaknesses in our economy and public policies that leave millions of people unprotected in bad economic times and prevent them from fully benefiting from a strong economy in good times. The American Rescue Plan Act, which built on the relief measures of 2020, provided important temporary measures to reduce the poverty and hardship that those crises generated.

Now, we have a historic opportunity to build on those temporary measures and help drive an equitable recovery in which all children can reach their full potential, workers in low-paid jobs and those with fewer job prospects have the supports to help them meet their needs and get ahead, and everyone has access to affordable health coverage. Achieving these goals requires attacking the nation’s long-standing economic and racial disparities, deeply rooted in racism and discrimination, that have led to starkly unequal opportunities and outcomes in education, employment, health, and housing.

During his campaign, the President advanced a range of proposals to scale back the generous tax breaks that enable the wealthiest households to avoid tax on much of their income and pay discounted tax rates when they do pay tax. He proposed, for instance, to reduce the tax benefits for capital gains and dividends — that is, to tax wealth more like the federal government taxes ordinary income — and to strengthen the tax on wealthy estates. He also proposed to provide the funds to enable the IRS to better ensure that wealthy people pay the taxes they owe. Some lawmakers have advanced proposals that include, for instance, a wealth tax or taxing capital gains as they accrue (rather than waiting until the assets are sold, which sometimes enables asset holders to avoid income taxes forever). We recommend that policymakers also consider a surtax on the adjusted gross incomes of very high-income people as another way to raise revenues, finance investments, and help prevent wealthy filers who benefit from preferential rates and other tax avoidance strategies from largely escaping the top income tax rate.

When evaluating the Biden plan, or other plans to raise taxes on the wealthiest households, policymakers should keep the following four points in mind:

- First, the incomes and wealth of people at the top have risen disproportionately in recent decades, and their fortunes surged even during the pandemic;

- Second, unlike households with incomes mainly from wages and salaries, the nation’s wealthiest people do not pay taxes annually on a large share of their income;

- Third, when wealthy people do pay tax it is often at special discounted rates. And, due to tax policy changes since the late 1990s — in particular, President George W. Bush’s tax cuts of 2001 and 2003 and the 2017 tax law — these tax advantages for wealthy people have expanded; and

- Fourth, deep cuts in IRS funding have caused audits of wealthy individuals to plummet and, new research finds, wealthy people engage in sophisticated tax evasion at far greater rates than previously estimated.

Income and wealth have grown increasingly concentrated at the top. The highest-income 1 percent of households received 13.5 percent of the nation’s total household income, after accounting for taxes and government transfers, in 2017, up from 7.4 percent in 1979, according to the Congressional Budget Office (CBO).[1] The share going to the bottom 80 percent fell over that period, from 58.6 to 53.0 percent.[2] In other words, most of the decline for the bottom 80 percent mirrored the increase for the top 1 percent.

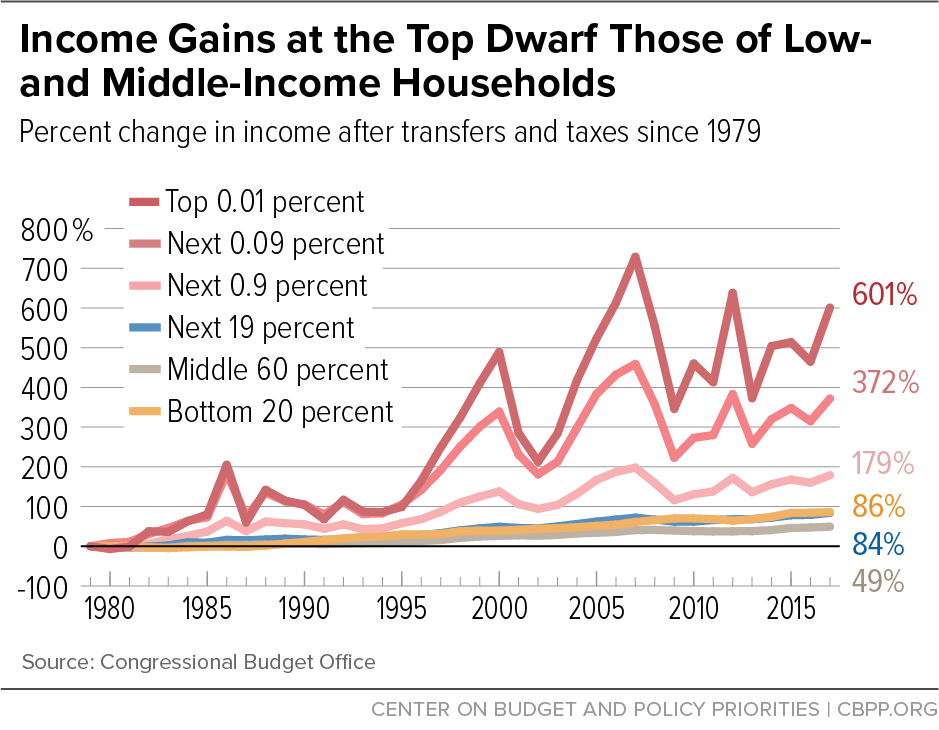

The average income of the top 0.01 percent rose by 601 percent in inflation-adjusted terms, from $4.7 million in 1979 to $33.3 million in 2017, CBO reported.[3] By contrast, the average inflation-adjusted income of people in the lowest 20 percent rose by just 86 percent, from $19,300 in 1979 to $35,900 in 2017.[4] (See Figure 1.)

Wealth inequality is even more pronounced than income inequality and also has grown in recent decades, according to the Federal Reserve’s Survey of Consumer Finances, the main source of data on the distribution of household wealth.[5] The wealthiest 1 percent of households held 38.2 percent of all net worth in 2019, up from 33.8 percent in 1983 — an increase of trillions of dollars.[6] Average net worth among the wealthiest 1 percent of tax units is $18 million.[7] By contrast, the share of the bottom 80 percent fell from 18.7 percent in 1983 to 11.1 percent over that period. (See Figure 2.)

Income and wealth concentration has an important racial dimension, as historical racial barriers to economic opportunity and continuing discrimination have played a substantial role in determining today’s income and wealth distribution. As a result, households of color are overrepresented among low-income and low-wealth households while white households are overrepresented among high-income and high-wealth households. For example, Latino and Black households represented 24 percent of all households in 2019, but they represented 32 percent of the least wealthy 60 percent of households and less than 1 percent of the wealthiest 1 percent.[8]

Furthermore, the economic fall-out from COVID-19 has proved harsh for many Americans, with millions — disproportionately Black, Latino, Indigenous, and immigrant households — continuing to report that they are not getting enough to eat or are behind on rent.[9] Employers added 916,000 jobs to their payrolls in March, which is very high by normal standards, but payroll employment remained 8.4 million jobs below its February 2020 level — and about 10 million jobs below what it would have been if the 2019 trend in job creation had continued, according to Jason Furman, the chairman of President Obama’s Council of Economic Advisers.[10]

And while millions of lower-income families and individuals continue to face financial hardship, those at the top in large measure prospered during these hard times — a dichotomy that has become known as the “K-shaped” recovery.[11] The wealthiest households have largely avoided the economic pain and, in fact, have seen their overall finances surge.

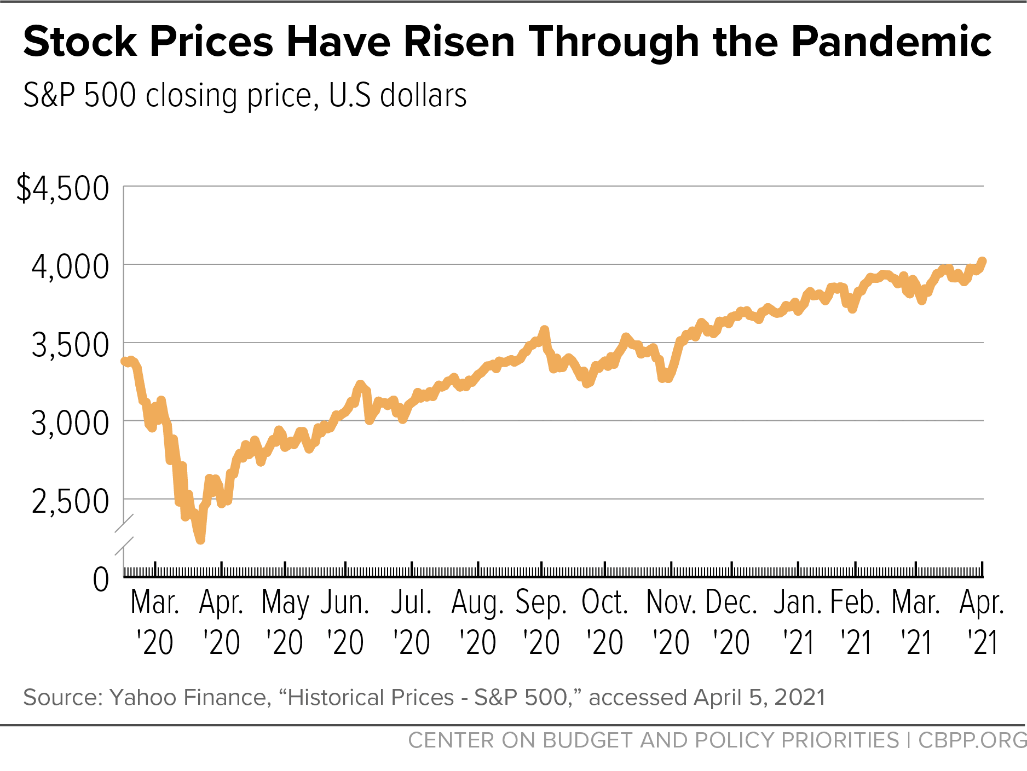

Take, for example, the stock market, where the ownership of corporate shares is concentrated at the top. On February 14, 2020, shortly before the pandemic-induced economic downturn, the S&P 500 Index stood at what was then its peak, 3,380.16. On April 1, 2021 (that is, a little over a year later), it had risen by 19 percent, to 4,019.87,[12] while the jobs market remained depressed over the same period. (See Figure 3.)

The ownership of corporate shares is not only highly concentrated at the top,[13] but it also has grown increasingly concentrated among the ultra-wealthy. “The wealthiest 0.1% and 1% of households now own about 17% and 50% of total household equities, respectively, up significantly from 13% and 39% in the late 1980’s,” according to Goldman Sachs senior economist Daan Struyven.[14]

High-income and high-wealth households enjoy generous tax benefits that can dramatically lower their tax bills and are generally unavailable to the vast majority of Americans.

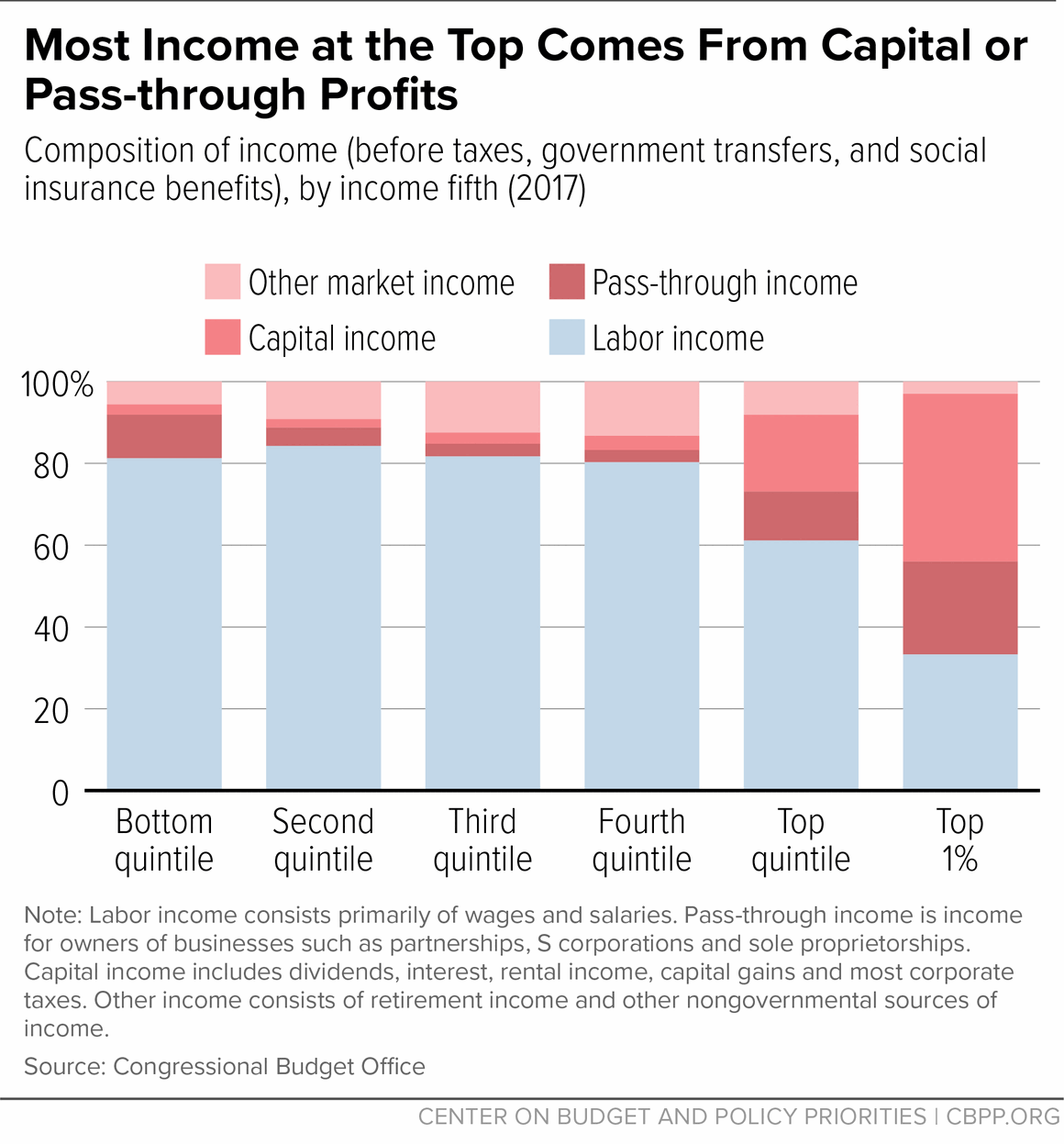

That’s because the vast majority of Americans receive more than three-quarters of their income from wages, salaries, and other forms of labor income (i.e., income from work). Employers withhold income and payroll taxes from their paychecks and, if their tax liability for the year exceeds the withheld taxes, they must pay the balance by tax day.

For the highest-income 1 percent of households, by contrast, capital income — most of which enjoys preferential tax rates (as discussed in more detail in the next section below) — constitutes 41 percent of their taxable incomes, while labor income makes up just 33 percent, CBO reports.[15] The overwhelming share of the remaining 26 percent is what’s known as “pass-through” business income,[16] which also enjoys special tax preferences. This means that most of the taxable income of the top 1 percent is subject to favorable tax rates. (See Figure 4.)

Moreover, CBO does not measure a key component of income of the very well off. That is, a substantial share of the income of the wealthiest households won’t face income taxes for years, if ever, because of two important tax advantages — deferral of unrealized capital gains and stepped-up basis:

Deferral of capital gains income. Unlike other types of income, like wages, a tax filer often can decide how much capital gain to claim on a tax return. That’s because a capital gain (that is, the increase in the value of an asset, such as corporate stock) is only taxed when it is “realized,” which is typically when the owner sells the asset. Only some capital gains are realized in any given year. The rest are deferred (because the asset isn’t sold), and the owner owes no immediate tax, even if the unrealized capital gain comprises a significant share of a household’s income, as reflected in the growth of its net worth. Deferring capital gains taxes gives three benefits to taxpayers who can do so:

- Instead of paying taxes each year on their capital gains, they can continue earning returns on the money that they otherwise would have paid in tax, and these returns compound over time.

- They can wait to sell assets until they would benefit in doing so for other tax reasons. They may wait, for example, until a year in which they will have large capital losses to offset the gains, or they may hold assets in hopes of a future capital gains tax cut.

- They can take advantage of other tax benefits for capital gains, such as stepped-up basis, which can eliminate their tax liability (as discussed below).

Deferral overwhelmingly benefits wealthy households. The capital income that wealthy households report on their tax returns represents only a small share of their total capital income (including unrealized gains), research shows, and that share declines as one moves up the wealth scale.[17] Consider Berkshire Hathaway Chairman Warren Buffett. His main asset, Berkshire Hathaway stock, rose in value by over 17 percent in 2010, from about $34.8 billion to $42 billion.[18] But, on his 2010 tax return (which he made public via a letter to then-U.S. House member Tim Huelskamp), Buffet’s adjusted gross income was $62.8 million, or less than 1 percent of that gain in value for Berkshire Hathaway stock.[19]

Mr. Buffet provides one example of how deferral enables very wealthy people to escape annual taxation on their dramatic capital gains. But it’s hardly the only one. As the Washington Post noted in March of 2021, “the wealth of nine of the country’s top titans has increased by more than $360 billion in the past year.”[20] Without policy changes, much of this wealth increase likely will not appear on income tax returns this year or next, if ever.

Stepped-up basis. One of the largest tax subsidies for capital gains is the so-called stepped-up basis tax break. If an investor holds an asset (such as stock) and passes it on to an heir, neither she nor her heir owes capital gains tax on its increase in value during her lifetime. (Technically, the asset’s basis — or the price paid for it — is “stepped up” to its fair market value at the time of inheritance.) Stepped-up basis encourages wealthy people to turn as much of their income into capital gains as possible and hold assets until their death, when a lifetime of gains become permanently exempt from income tax.

Combined with deferral, stepped-up basis enables large corporate stockholders and other wealthy investors to pay no income tax on the increase in an asset’s value during their lifetimes and pass on the assets to heirs, who pay no income tax on those inheritances. Former Apple CEO Steve Jobs, for instance, received an annual salary of just $1, as Apple reported in its Securities and Exchange Commission filings.[21] He also received Apple stock, however, that was worth $75 million in the early 2000s.[22] He likely paid income tax on the value of those shares when he received them as income. But because he never sold the shares during his lifetime, he never paid capital gains taxes on the massive gain as Apple’s stock skyrocketed.[23] At his death, his Apple stock was worth roughly $2 billion, and that gain was entirely and permanently exempt from income tax.

One way to address the tax avoidance problems of capital gains deferral would be with a “mark-to-market” tax system, as Senate Finance Committee Chairman Ron Wyden has proposed.[24] Under such a system of taxing capital gains, if a wealthy investor bought publicly traded stock on January 1 for $1,000 a share and the stock’s trading price was $1,100 on December 31, the investor would pay capital gains tax on the $100 increase per share even if she didn’t sell the stock that year — effectively requiring those who hold capital investments to pay tax on the gains in those investments annually, just like those with wage income pay their taxes annually. Alternatively, policymakers could impose a wealth tax on a wealthy taxpayer’s overall stock of capital (without regard to actual gains or losses from wealth), which would similarly ensure that wealthy households pay taxes on their substantial assets each year.

A far more modest approach, which President Biden adopted during his campaign, would be to repeal stepped-up basis. That would enable wealthy people to avoid tax on unrealized capital gains throughout their lives but require them to pay taxes on those deferred capital gains at death.

Some will assert that such a tax, when combined with the estate tax, would amount to double taxation on the same income. This argument is flawed, however.

First, there is no double taxation because there are (at least) two people involved: the decedent and heir(s). The decedent has income that has accrued tax-free over a lifetime (the deferred, unrealized capital gain), which itself confers a tremendous tax advantage, and, at death, the decedent would pay that deferred tax. The estate tax would then apply to the remaining inheritance that flows to the heir, who is a separate person for legal and tax purposes. Though technically levied on the estate, the estate tax effectively falls on heirs, research shows.[25] Furthermore, heirs owe no income tax on their inheritances — even though other types of earned and unearned income, such as lottery or gambling winnings, face income taxes. All in all, the decedent pays tax on a lifetime of accrued gain, and the heir pays tax on her windfall inheritance — and, thus, there is no double taxation.

Further, what matters is the overall level of taxation on a given income stream, not the number of taxes that applies to it. Under the current system, the average tax rate on inheritances is only 2 percent, or one-seventh of the average tax rate on income from work and savings.[26] The flawed “double taxation” argument should not distract policymakers from ensuring that wealthy people and their heirs pay a fairer amount of tax on their income streams.

When the wealthy do pay taxes on their income, they often pay at a low rate because capital and certain business income — which make up most of wealthy households’ incomes — are taxed at a far lower rate than wage income. Moreover, the top income tax rate — which applies not only to wages and salaries but also to, for example, interest and stock options — is well below the post-World War II average of 59 percent.[27]

These preferential rates largely reflect the view that lower tax rates — particularly on capital income and inheritances — will spur capital investment that, in turn, will strengthen economic growth and “lift all boats.” This view is the product of a macroeconomic theory known as “supply-side” economics — and, more pejoratively, it’s also been termed “trickle-down” economics.

Supporters of supply-side economics have pressed for ever-lower tax rates on wealthy households for more than four decades, which helps to explain why the tax code includes so many provisions that provide far greater benefits to those at the top than to other taxpayers. Mounting evidence, however, demonstrates that such tax policies do little for the economy while doing a lot to expand income and wealth disparities.

“Major reforms reducing taxes on the rich,” a recent study of such tax cuts around the world found, “lead to higher income inequality as measured by the top 1% share of pre-tax national income. The effect remains stable in the medium term. In contrast, such reforms do not have any significant effect on economic growth and unemployment.”[28]

Early evidence from the 2017 tax cuts likewise indicates little or no boost in economic growth, investment, or wages. “On the whole,” the Congressional Research Service reported, “the growth effects tend to show a relatively small (if any) first-year effect on the economy.”[29] In February of 2020, Jason Furman, chairman of President Obama’s Council of Economic Advisers, told the House Ways and Means Committee, “The macroeconomic data to date appear to rule out the immediate and large effects on investment that were predicted by many cheerleaders of the 2017 tax law and provide no reason to update the ex ante projections of minimal longer-term growth effects made by a range of economic modelers.”[30]

Nevertheless, U.S. policymakers have substantially reduced taxes for wealthy households in recent decades. From the mid-1990s through 2017, the average federal tax rate — that is, the share of a household’s income it actually pays in taxes — for the top 0.01 percent has fallen by almost a fifth.[31] (And these figures don’t capture the effect of the 2017 tax law, which delivered windfall tax cuts to wealthy households.[32]) Most prominently, the 2001 and 2003 Bush tax cuts reduced individual income tax rates, taxes on capital gains and dividends, and the tax on estates, all of which provided the largest tax benefits to the highest-income taxpayers. The 2017 tax cuts under President Trump dramatically cut the corporate tax rate, cut the top individual income tax rate, further weakened the estate tax, and created a big new tax deduction on “pass-through” business income (business income from partnerships, S corporations, and sole proprietorships). A disproportionate share of these tax benefits flowed to households at the top.[33]

All of that tax cutting also significantly reduced federal revenues. Federal revenues as a share of the economy (gross domestic product, or GDP) stood at 20 percent in 2000. In 2019, at a similar peak in the business cycle, federal revenues had fallen to just 16.3 percent of GDP (representing a decline of roughly $785 billion in that year) — which is far too low to support the kinds of investments needed for a 21st century economy that broadens opportunity, supports workers and helps those out of work, and ensures health care for everyone.

Here is a look at how significant tax advantages for wealthy people have expanded in recent decades:

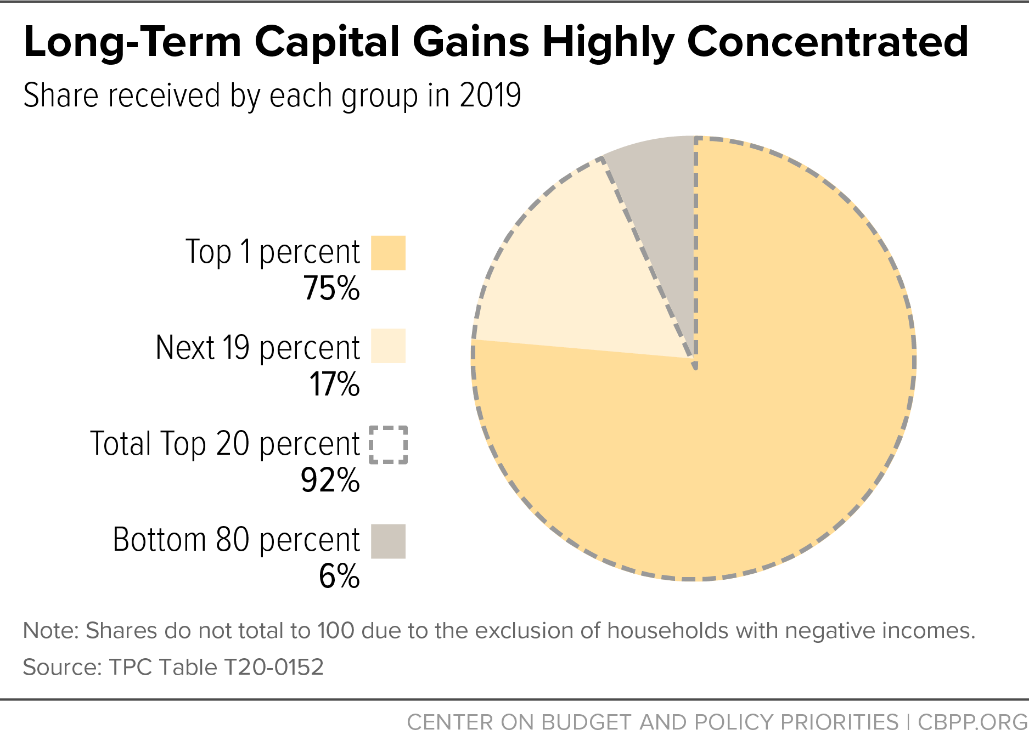

Capital gains rate. Capital gains income is extremely concentrated at the top. In fact, the top 1 percent of households received 75 percent of the taxable long-term capital gains[34] in 2019, according to the Tax Policy Center. (See Figure 5.) More than half went to the top 0.1 percent. And while 4 in 5 households in the top 0.1 percent reported taxable capital gains income in 2019, fewer than 1 in 20 households in the bottom 60 percent did so.[35] (These figures do not include unrealized capital gains, as discussed earlier, which likely are even more concentrated at the top.)

In the mid-1970s, the top tax rate on capital gains was 35 percent. It fell to 28 percent a decade later, to 20 percent in 1997, and to 15 percent in 2003.[36] The rate rose to 20 percent in 2013, and the Affordable Care Act of 2010 imposed an additional 3.8 percent Net Investment Income Tax (NIIT) on the capital gains of high-income people. Today, the combined top tax rate on capital gains is 23.8 percent, which is more than ten percentage points below where it stood in the 1970s and below today’s top rate on labor income.

Tax rate of dividends. Dividend income is also highly concentrated at the top, with 46 percent of it flowing to the top 1 percent of households and 28 percent to the top 0.1 percent.[37] Nearly 89 percent of the top 0.1 percent of households have dividend income, compared to just 7.9 percent of the bottom 60 percent of households.[38]

Historically, policymakers taxed dividends at the same rates as wage and salary income. That changed in 2003, when they temporarily cut the top rate on qualified dividends[39] from 38.6 percent to 15 percent; they later set a permanent rate of 20 percent. Like capital gains, dividends are subject to the 3.8 percent NIIT. Therefore, qualified dividends are taxed at the same special low rate as long-term capital gains.

Proponents argue that a low tax rate on dividends promotes investment and job creation, but a landmark study by University of California at Berkeley Professor Danny Yagan (now chief economist at the Office of Management and Budget) found that the 2003 dividend tax cut “caused zero change in corporate investment and employee compensation”[40] while providing a windfall to high-income people.

Pass-through income. The 2017 tax law created a 20 percent deduction for certain pass-through income, which “passes through” the business and is taxed on the individual tax returns of the business owners at the same individual rates that they would pay if they earned the income directly.

Proponents of this deduction often pinpoint small businesses as the intended beneficiaries, and most pass-through businesses are indeed small and typically make modest profits. Pass-through income, however, is highly concentrated at the top. Take partnerships, a common pass-through structure, for instance: 69 percent of partnership income flows to the top 1 percent of households.[41] Many large, profitable businesses are structured as pass-through businesses — including financial firms such as hedge funds and private equity firms, real estate businesses, oil and gas companies, and large multinational law and accounting firms — and they generate most pass-through income.

Moreover, the deduction is worth much more to high-income business owners than to small business owners with modest incomes because the former are in higher tax brackets. And because high-income households receive the bulk of pass-through income, the deduction’s tax benefits are heavily tilted to the top as well: 61 percent of the tax benefits will go to the top 1 percent of households in 2024, the Joint Committee on Taxation estimates, while just 4 percent will go to the bottom two-thirds of households.[42]

The 20 percent deduction gives qualifying filers a 7.4-percentage-point tax rate reduction on certain pass-through income. So, while the top income tax rate is currently 37 percent for wages and salaries, it’s just 29.6 percent for pass-through income that qualifies for the deduction.[43] That lower rate encourages pass-through owners to recharacterize their labor compensation as pass-through profits (by, for example, forming an S corporation to receive income rather than a paycheck), which can enable them to avoid the top rate on even more of their labor income.

Tax-free inheritances of wealthy heirs. The 1997 budget law,[44] the Bush tax cuts,[45] and the 2017 tax law all reflected the Republican priority to maximize the amount of money that wealthy people can pass on to their heirs tax-free. Most recently, the 2017 tax law doubled the amount that a wealthy couple can pass tax free to heirs, from $11 million to $22 million, and that amount was indexed to inflation. Consequently, the exemption is $23.4 million in 2021.

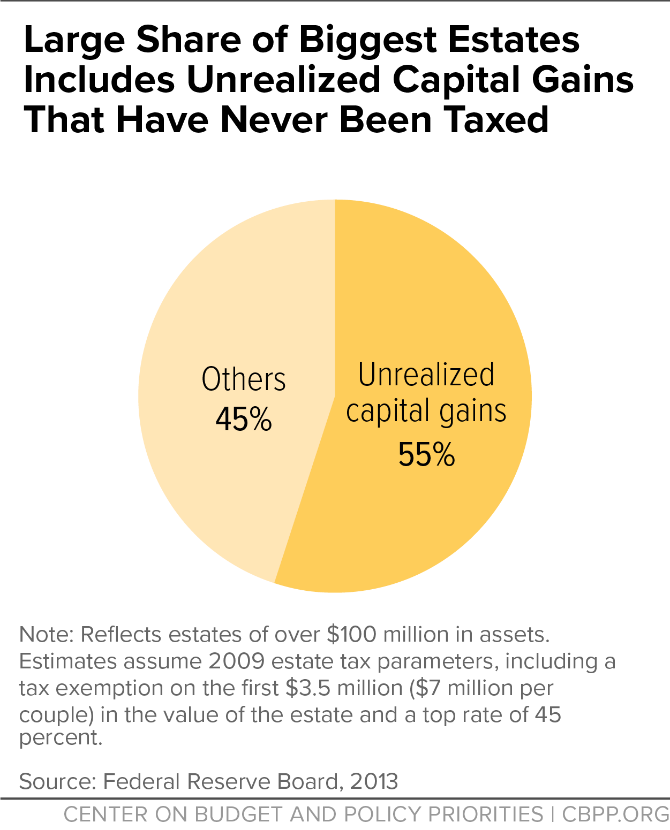

As a result, fewer than 1 in 1,000 estates (i.e., only the very wealthiest) owe any estate tax — and, per the exemption explained above, the first $23.4 million is tax-free even for these estates. Moreover, the few estates that are large enough to potentially face the tax can use loopholes to reduce or eliminate their estate tax liability, such as by artificially valuing their estates at less than their true value. (For example, the “minority ownership discount” enables an estate that owns a minority share of a business to value — and therefore pay estate taxes on — the estate’s share of business below its fair market value.[46]) IRS researchers analyzing the estate tax returns of members of Forbes magazine’s annual list of the 400 wealthiest Americans who later died concluded that, on average, their wealth as reported for tax purposes was roughly half of Forbes’ estimate of their wealth.[47] (See Figure 6.) Strengthening the estate tax would help offset inequality by taxing more of the windfalls that heirs receive.

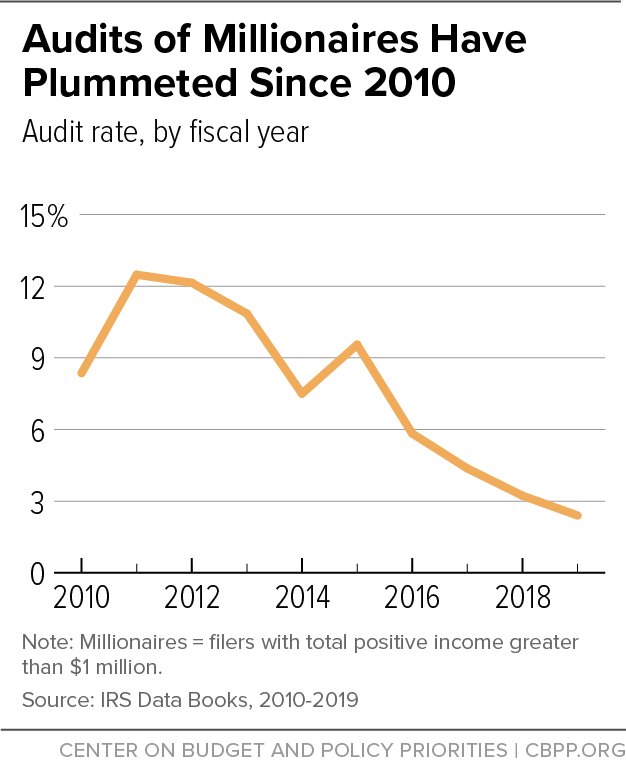

Policymakers have cut the IRS budget dramatically since 2010, particularly funding for enforcement. As a result, the IRS now has 30 percent fewer enforcement staff than in 2010. And the number of revenue agents — auditors uniquely qualified to process the complex returns of high-income individuals and corporations — has shrunk by 39 percent. As the audit staff shrunk, audit rates fell sharply, particularly of wealthy individuals and large corporations. The audit rate for millionaires fell by 71 percent between 2010 and 2019, from 8.4 percent to just 2.4 percent. (See Figure 7.)

The gutting of IRS enforcement is particularly troubling because hundreds of billions of dollars in legally owed taxes each year go uncollected. The IRS’ most recent estimates of the gross “tax gap” — between what taxpayers owe and what they voluntarily pay on time — suggest that taxpayers did not pay $441 billion per year from 2011 to 2013.[48] Even after accounting for subsequent enforcement measures, the IRS still failed to collect $381 billion in each of those years. Just last week, however, IRS Commissioner Charles Rettig told Congress that the annual tax gap could actually exceed $1 trillion annually.[49]

Meanwhile, new research from IRS researchers and outside economists suggests that existing IRS tax gap estimates vastly understate wealthy households’ share of the tax gap. That’s because the IRS estimates the tax gap using data collected from random audits, which are not well-suited for detecting sophisticated forms of evasion and therefore “do not capture most tax evasion through offshore accounts and pass-through businesses, both of which are quantitatively important at the top.” By more fully accounting for these types of tax evasion, researchers estimate that the top 1 percent likely underreports around 20 percent of their income, far higher than IRS tax gap estimates suggest.[50]

Moreover, though the tax gap is intended to capture unlawful tax evasion[51] — which includes intentional steps to dodge taxes — it does not attempt to measure lawful tax avoidance, by taking advantage of tax breaks available under current law. But the most well-resourced filers can afford creative tax advisors, litigators, and lobbyists to aggressively push the boundary between the two, as recent reporting illustrates.[52]

A rebuilt IRS could restore public trust in the tax system by responding in a timely, effective manner to taxpayer questions and enforcing the nation’s tax laws fully so that everyone pays the taxes they owe, just as the vast majority of taxpayers and businesses do voluntarily. That the wealthy, who can best afford the lawyers and accountants to structure their income to avoid taxation, can benefit from a weak IRS only compounds this unfairness. Moreover, a rebuilt and modernized IRS would help restore the nation’s depleted revenue base — collecting taxes that are legally owed — to fund national priorities, such as the priorities that will be included in upcoming recovery legislation.[53]