With a recent blockbuster story by the investigative nonprofit ProPublica,[1] and follow-up stories in leading TV and print media,[2] it is clearer than ever that some of the nation’s wealthiest individuals pay little or no income tax each year. This growing recognition comes as policymakers need to raise substantial additional revenue to rebuild the nation’s decaying infrastructure and address glaring economic and racial inequities that COVID-19 and the deepest economic downturn since the Great Depression both highlighted and exacerbated. As they seek to raise more revenue, policymakers should look to increase taxes on the nation’s wealthiest households, which not only enjoy enormous tax breaks but also have done extremely well in recent decades while incomes for most others have risen much less.

The main federal tax is the individual income tax, which accounts for roughly half of all federal revenue and which tens of millions of middle-class people pay throughout the year as employers withhold taxes from their paychecks. To a great degree, however, the income tax is essentially voluntary for the nation’s richest people. Much of their income comes in the form of gains in the value of their stocks and other assets, and they can avoid taxes on those gains if they hold on to their assets rather than sell them. When high-income households do pay tax on their income from their assets — such as capital gains and dividends — they pay at tax rates that are far lower than the tax rates they would pay on wages and salaries.

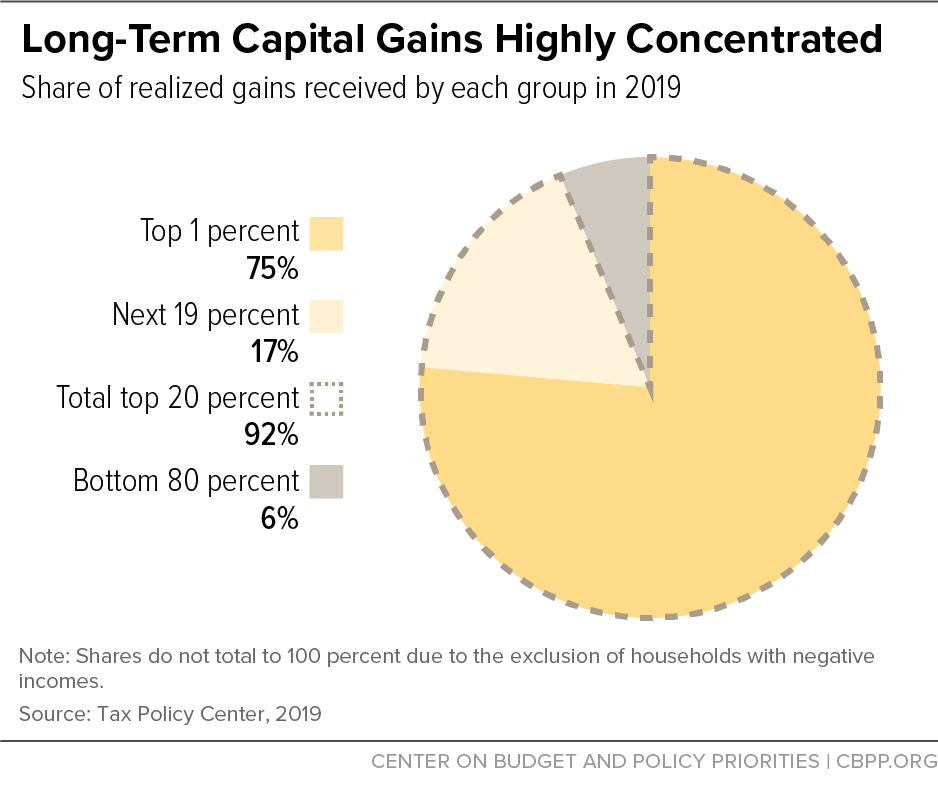

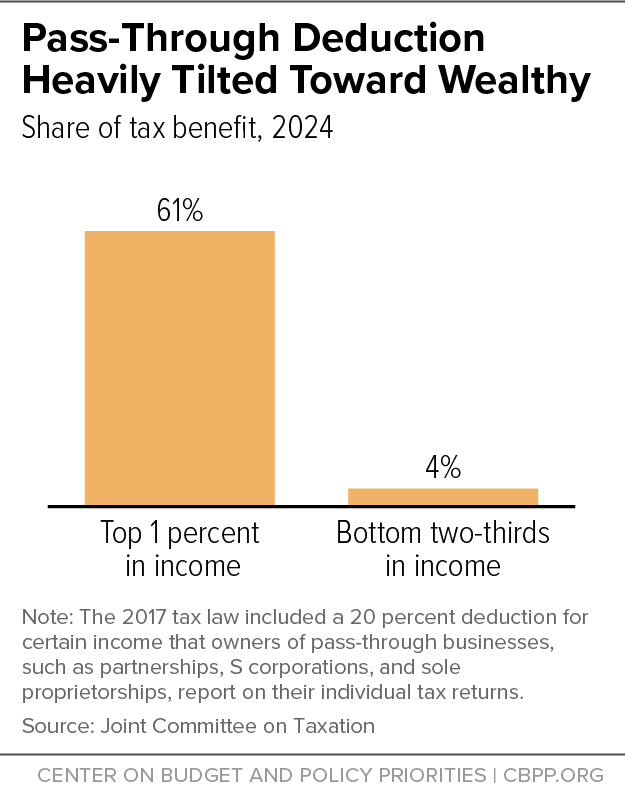

These tax breaks, which policymakers have expanded in recent years, help to widen the enormous gaps in income and wealth between the nation’s richest people and everyone else. The top 1 percent of households in terms of income receive the vast majority of capital gains and a large chunk of dividend income, and they are reaping most of the benefits of a new deduction, enacted in the 2017 tax-cut law, for what’s known as “pass-through” income, which the owners of partnerships and certain other businesses report on their individual tax returns.

To address these flaws in the tax code, the President and Congress should:

- Make more income of the wealthiest households (e.g., their unrealized capital gains) taxable each year, or at least at some point — as it would be under President Biden’s proposal to tax people’s capital gains that have escaped taxation throughout their lifetimes when they die.

- Reduce tax breaks tied to the income of the wealthiest households — such as Biden’s proposal to eliminate the lower tax rates on capital gains and dividends for those with incomes over $1 million, to tax that income at the same top tax rate as for salaries and interest, and to eliminate the deduction for pass-through income created in 2017. A surtax on the incomes of millionaires should also be strongly considered.

- Bolster other taxes, such as the corporate income tax and the estate tax, that fall most heavily on the wealthiest households.

By itself, no single one of these proposals would ensure that wealthy tax filers pay a fair amount of taxes. Together, however, they would represent a modest step in that direction, as discussed in detail below.

Wealthy people and corporations benefit from federal investments, and it makes sense for them to pay more to finance investments that strengthen the economy. Government investment benefits businesses directly by developing technologies businesses then use to generate wealth. For example, the National Science Foundation and Defense Department contributed significantly to the technological foundation of many internet-based companies such as Amazon, Google, and Facebook — and the personal wealth of their executives.[3] These kinds of investments continue today, with research underway, for example, on quantum computing supported by the National Science Foundation and the Argonne National Lab.[4]

Government investment also benefits businesses indirectly. For example, businesses need an educated and healthy workforce, infrastructure such as ports and highways, and laws and standards promoting fair competition in the marketplace. That’s why businesses and wealthy people will benefit from new investments in recovery legislation to rebuild infrastructure and strengthen higher education, among other things.

Finally, it is both necessary and fair to ask those who have enjoyed great financial success to help pay for investments — like child care, education, health care, and nutrition assistance — that can broaden opportunity for others. Of special note, due to historical racial barriers to economic opportunity and continuing discrimination, households of color are overrepresented at the lower end of the income and wealth scales while white households are overrepresented at the top. In 2019, Latino and Black households represented 24 percent of all households but less than 1 percent of the wealthiest 1 percent.[5] A tax system that allows the very wealthy — who are disproportionately white — to pay little and then underfunds government services that could give people with low incomes — who are disproportionately people of color — a fair shot at success constitutes a major roadblock to narrowing glaring racial and ethnic disparities stemming from racism and other forms of discrimination.[6]

“In 2007,” ProPublica wrote in early June, “Jeff Bezos, then a multibillionaire and now the world’s richest man, did not pay a penny in federal income taxes. He achieved the feat again in 2011. In 2018, Tesla founder Elon Musk, the second-richest person in the world, also paid no federal income taxes.”

The ProPublica report, its authors suggested, “demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most. The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

As a CBPP report explained, wealthy households enjoy a huge tax advantage over non-wealthy taxpayers: much of their annual increase in wealth — i.e., their income — isn’t taxable under current law.[7] This means that they can pay extremely low effective income tax rates. For example, Amazon’s filings with the Securities and Exchange Commission (SEC) show that CEO Jeff Bezos received an annual salary of $81,840 as of 2020,[8] which is subject to ordinary income taxes each year.[9] As founder, however, Bezos owns a significant share of Amazon stock,[10] and the value of his holdings grew by more than $100 billion between 2010 and 2018.[11] This $100 billion in income is only taxed when — or if — Bezos decides to sell some of his stock. Bezos sold Amazon shares worth roughly $6.3 billion between 2009 and 2018, according to SEC filings,[12] but the tax code ignores the rest of his $100 billion gain. Thus, his tax bill on a decade of stock sales likely was about $1.5 billion, or less than 1.5 percent of his increase in wealth due to the appreciation of his Amazon stock.

Wealthy households accumulate a very large share of capital gains (increases in the value of stocks, bonds, real estate, or other assets), but they don’t have to pay tax on those gains until, or unless, they “realize” these gains — usually by selling an appreciated asset. That characteristic of the tax code is known as “deferral.” And, under a provision known as “stepped-up basis,” the income tax that they would have owed on any deferred or unrealized capital gain is erased when they die. As a result, much of the lifelong increases in wealth of the nation’s wealthiest people is never subject to the income tax.[13]

Income, according to the textbook definition, is the sum of one’s consumption and change in net worth.[14] That includes both realized and unrealized capital gains because, as leading tax economists Joel Slemrod and Jon Bakija explain, “whether you sell the asset does not matter because an increase in the value of assets you own increases your purchasing power.”[15] Added Martin Sullivan, chief economist at Tax Analysts, “unrealized gain is a change in wealth. Unrealized gain is economic income. Unrealized does not mean unreal. The wealthy can see it very clearly on their brokerage statements, even if the IRS will not see it on tax returns.”[16]

In addition, the wealthy can do more than watch their untaxed income grow. They can use it to finance their often lavish lifestyles. “It is a simple fact that billionaires in America can live very extraordinarily well completely tax-free off their wealth,” law professor Edward J. McCaffery writes.[17] They can borrow large sums against their holdings (i.e., their unrealized capital gains) without generating “taxable” income. Larry Ellison, Oracle’s chief executive officer and one of the world’s richest people, pledged part of his Oracle stock as collateral for a $10 billion credit line.[18] Similarly, ProPublica noted, “last year Tesla reported that [Elon] Musk had pledged some 92 million shares, which were worth about $57.7 billion as of May 29, 2021, as collateral for personal loans.”[19] And the Wall Street Journal recently reported, “Banks say their wealthy clients are borrowing more than ever before, often using loans backed by their portfolios of stocks and bonds.” As one financial advisor quoted in the story said, “[t]he tax benefits are stunning.”[20]

Consider, by contrast, how the tax code treats a source of deferred income for middle-class people. About half of people contribute to retirement accounts, and the median account balance was a modest $60,000 in 2016.[21] Under a typical 401(k) plan, a person sets aside an average of about $5,000 a year from their paychecks on a pre-tax basis.[22] As with unrealized capital gains, account holders do not pay tax each year on their gains. Similarities in the tax treatment of capital gains and retirement accounts end later in life, however.

Starting at age 72 (or at 70 ½ if one reached that age prior to January 1, 2020), retirement account holders must take mandatory distributions — about $4,000 annually for every $100,000 in account balance (increasing with the age of the holder) — in part so that they can’t use their accounts as tax shelters. The money is all taxed at ordinary income tax rates, not at the lower capital gains rates. If, moreover, an account holder dies with an account balance and leaves it to a family member other than a spouse (or certain other beneficiaries), the family member must liquidate the account over a ten-year period and pay taxes on the distributions in each of those ten years.[23]

In sum, although the individual income tax is the main federal tax, it’s essentially a voluntary tax for the nation’s richest people and they go to great lengths to avoid paying it. That cries out for a response from policymakers. As Betsey Stevenson, a member of President Obama’s Council of Economic Advisers and now a University of Michigan economics professor, recently put it, “a fair income tax would tax everyone’s total income including unrealized capital gains.”[24]

Policymakers can change the tax code in several ways to treat some or all of the unrealized capital gains of the wealthiest households as taxable income. One is to make the gains taxable each year, as Senate Finance Committee Chairman Ron Wyden and others have proposed by shifting to a so-called “mark-to-market” system for taxing capital gains.[25]

President Biden proposes a more modest approach. He would leave deferral in place so that, each year, wealthy people with large unrealized capital gains would continue to pay no tax on the increase in their wealth (that is, on this income) while they are alive. Instead, Biden would require that the wealthiest people pay income taxes on this untaxed income from unrealized capital gains when they die. Specifically, his proposal would eliminate “stepped-up basis” at death for unrealized capital gains of more than $1 million for an individual or $2 million for a married couple (while retaining the current exemption of up to $500,000 for personal residences).[26]

By letting wealthy people avoid paying tax on their unrealized gains during their lifetime, the Biden proposal to tax these gains at death would still result in a lower effective tax rate than if the gains were taxed each year, just as wage earnings are taxed each year. The conservative Tax Foundation has noted the benefit of deferral to wealthy households, explaining in 2019 that deferral “matters a great deal. This is because deferral allows a taxpayer to delay paying tax for years even while the asset appreciates and earns income.”[27]

Opponents of reducing the large tax advantages that those with capital gains enjoy often claim that family farmers and small businesses will be hurt, sometimes arguing that a family farm or business will have to be sold in order to pay the taxes owed. But there are ways to make sure this doesn’t happen. The Biden proposal provides special treatment for family farms and small businesses. Unlike the unrealized gains on publicly held stock, the appreciation in the value of family-owned farms and small businesses would not face taxation until the interest in the farm or business is sold or it ceases to be family-owned and operated. As Treasury Secretary Janet Yellen told the Senate Finance Committee:

[T]he President’s proposal would enable a family to hold onto its farm and to pass it down through generations without paying any — any tax on that. . . . [T]he same would be true for small businesses. As long as the property remains within the family, there would be no taxes collected.[28]

Too often sound proposals to scale back large tax breaks on income from wealth are derailed by overblown arguments that family farms and small businesses will be hurt. The Biden plan shows that legitimate concerns about family farms and small businesses can be addressed while ensuring that very wealthy people pay at least some taxes on the capital gains that currently escape taxation.

This year’s recovery legislation provides an opportunity for policymakers, at a minimum, to end the egregious loophole that erases a lifetime’s worth of deferred tax due on potentially vast amounts of income. As Harry “Hank” Gutman, former chief of staff of the Joint Committee on Taxation, recently told the House Ways and Means Committee: “try as one might, no one can create a plausible tax, social, or economic policy justification for [stepped-up basis], which creates vertical and horizontal inequity, impedes sound economic behavior and produces a significant revenue loss.”

Policymakers also should consider reforming the preferential tax treatment of stock buybacks, in which a corporation distributes profits to shareholders by offering to buy back a certain number of shares, raising the stock’s price and thereby increasing wealth for all stockholders’ (whether selling as part of the buyback or not). This policy would be an incremental step toward taxing unrealized capital gains.

Stock buybacks have tax advantages over dividends, the traditional way in which corporations distribute profits to shareholders. When a corporation pays dividends, shareholders recognize the dividends as income and pay tax on them. In a stock buyback, shareholders who sell their shares to the corporation at a gain recognize capital gain income — but shareholders who choose not to sell their shares see the value of their shares rise. The deferral benefit means that their wealth increases, but they do not have to pay tax on that increase.

Moreover, foreign shareholders are generally subject to U.S. tax on dividends (through withholding) but not on most capital gains, including those gains that accrue from stock buybacks. As the Tax Policy Center’s Steve Rosenthal recently explained, the share of publicly traded U.S. stocks held by foreign investors has tripled to 30 percent since the late 1990s, so “treating buybacks as dividends is more important than ever” in ensuring that foreign shareholders pay taxes.[29]

Professors Daniel Hemel and Gregg Polsky have proposed to treat stock buybacks similarly to dividends.[30] Under their proposal, a stock buyback would trigger an imputed dividend for shareholders — that is, shareholders would be taxed as if they had received dividend income[31] and foreign shareholders would be subject to withholding. Policymakers could make adjustments for households with incomes below $400,000 annually in line with President Biden’s promise not to raise taxes on these people.

The tax treatment of buybacks has received some interest from policymakers, including Senator Marco Rubio in 2019.[32] It warrants a renewed focus in the wake of the ProPublica article. As ProPublica noted, many of the companies owned by the nation’s wealthiest people, such as Google, Facebook, and Amazon, do not pay dividends,[33] while each has pursued stock buybacks to some extent.

As discussed above, much of wealthy people’s annual income is not taxed. Wealthy people also enjoy another broad tax advantage: significant streams of their income that are taxed often enjoy special tax breaks or discounted tax rates. Prominent among these are realized capital gains and dividends, carried interest, and pass-through business income. All three of these are potential areas of reform. Policymakers should also consider enacting a surtax on high-income people.

Realized Capital Gains and Dividends

Realized capital gains and dividends are both heavily concentrated among the affluent. The top 1 percent of households received 75 percent of taxable long-term capital gains in 2019, according to the Tax Policy Center. (See Figure 1.) More than half went to the highest-income 0.1 percent of households — those with annual incomes of more than $3.8 million.[34] (This income figure excludes unrealized capital gains; if annual unrealized gains were included, the average income of this group would be even higher.) Before the supply-side tax cuts of the 1980s, the tax rate on capital gains was 35 percent (close to the top tax rate on salary and interest income in recent years, which has been 37 or 39.6 percent). Today, the top tax rate on capital gains is a much lower 23.8 percent. Moreover, as noted above, effective tax rates on capital gains are even lower than these statutory rates because taxpayers can avoid taxes altogether by holding, rather than selling, their assets until death (or reduce them by deferring sales rather than selling immediately).

Dividend income is also highly concentrated at the top, with 46 percent of it flowing to the top 1 percent of households in terms of income and 28 percent to the top 0.1 percent. Nearly 89 percent of the top 0.1 percent of households have dividend income, compared to just 7.9 percent of the bottom 60 percent.

Prior to 2003, the tax code taxed dividends at the same rates as salary and interest income. That changed when President George W. Bush and Congress cut the tax rate on dividends. Today, most dividends are taxed at the same 23.8 percent rate as long-term capital gains. The 2003 tax cut on dividends cost the federal government an estimated $126 billion in revenue over ten years[35] but delivered little of the economic benefit that its proponents promised.[36] It “caused zero change in corporate investment and employee compensation” while providing a windfall to high-income people, according to a landmark study by University of California, Berkeley Professor Danny Yagan (now chief economist at the Office of Management and Budget).[37]

President Biden has proposed to eliminate the special tax rate discount for capital gains and dividend income for those with incomes above $1 million and to tax these income streams at the same top rate — 39.6 percent — as he would tax income from salaries and interest under his American Families Plan.[38]

The carried interest loophole enables certain very wealthy taxpayers to avoid paying ordinary income rates on income derived from their jobs. Managers of private equity and other investment funds typically receive a 2 percent management fee and a 20 percent carried interest fee — that is, 20 percent of the fund’s profits — as compensation for their ordinary services in managing fund assets. The 2 percent management fee is taxed like wages and salaries. The carried interest fee is taxed at the lower capital gains rate, even though it is payment in exchange for services rendered, and is not a form of capital income because the private equity managers aren’t reaping benefits based on being an investor.

As a result, people who work at these types of firms are taxed at much lower rates than employees of investment banking firms who do similar work but receive a salary — and at lower rates than people who work for wages and salaries in nearly every other industry. As University of California, Irvine School of Law Professor Victor Fleisher noted, “this quirk in the tax law allows some of the richest workers in the country to pay tax on their labor income at a low rate.”[39]

Some private equity managers have even found ways to convert the 2 percent management fee into carried interest as well. As University of Georgia School of Law Professor Gregg Polsky highlighted: “Private equity managers regularly attempt to convert their fixed annual two percent management fees into additional carried interest through so-called ‘management fee conversions.’ The tax result, if this technique is successful, is the conversion of current ordinary income into deferred capital gains.”[40] As he recently told the New York Times, “it’s like laundering your fees into capital gains” and “they put magic words into a document to turn ordinary income into capital gains. They have zero economic substance, and they get away with it.”[41]

The carried interest loophole means that private equity and investment fund managers may be taxed at rates as low as 23.8 percent on income from their ordinary services. This income can amount to millions of dollars annually and is no different than the income that other professionals receive in exchange for services provided.

Carried interest should be taxed at the same rate as wages. To be sure, if the tax rate for capital gains and wage income were the same, then the carried interest loophole wouldn’t matter. But even if the Biden proposal to equalize rates is adopted, Congress should still classify carried interest as earnings to be taxed at the regular tax rate so that if a future Congress cuts the capital gains rate, those receiving carried interest income won’t automatically get a tax cut.

The 2017 law included a 20 percent deduction for certain income that owners of pass-through businesses — such as partnerships, S corporations, and sole proprietorships — report on their individual tax returns, which previously was generally taxed at the same rates as labor income (income from work, such as wages and salaries). The deduction lowers the marginal income tax rate on qualifying pass-through business income well below the top rate on labor income. The benefits of this 20 percent deduction are, similarly, heavily tilted toward the wealthy. About 61 percent of its tax benefits will go to the top 1 percent of households in 2024, according to the Joint Committee on Taxation. (See Figure 2.) Wealthy households benefit the most from this deduction because they receive most pass-through income, they get a much larger share of their income from pass-throughs than middle-income households, and they receive the largest tax break per dollar of income deducted (since they are in the top income brackets).

President Biden’s campaign proposal to phase out the deduction for households with more than $400,000 in income would raise $143 billion, almost exclusively from the top 1 percent, before the deduction expires at the end of 2025 (as it’s currently slated to), the Tax Policy Center estimated.[42]

Policymakers could combine the Biden proposal to eliminate lower tax rates on realized capital gains and dividends for high-income households with his campaign proposal to phase out the pass-through deduction and, as a result, eliminate the special tax advantages that the wealthiest people enjoy on their taxable income.

A surtax on AGI of over $1 million is another policy tool for raising revenues. A surtax can work in combination with other tax policies to ensure that very high-income households pay a fair amount of taxes. It would raise substantial revenue and is easy for taxpayers to understand. In 2009, the House passed a 5.4 percent tax on AGIs above $500,000 for individuals and $1 million for joint filers that would have raised $460 billion over ten years, according to the Joint Committee on Taxation.[43] Two years later, Senate Democrats proposed a 5.6 percent surtax on AGIs above $500,000 for individuals and $1,000,000 for couples as part of the American Jobs Act.[44] In recent weeks, Senator Chris Van Hollen, Rep. Don Beyer, and other lawmakers introduced legislation for a millionaires’ surtax, which would impose a 10 percent tax on AGIs above $1 million for individuals and $2 million for couples.[45]

Even if Congress were to enact President Biden’s proposal to close the stepped-up basis loophole by taxing unrealized capital gains when a person dies (along with the Hemel-Polsky stock buyback proposal), much of the income of the wealthiest people in the country would still escape individual income taxation each year. As a result, there is plenty of room for Congress to bolster other federal taxes, including the corporate income tax and estate and gift tax, which are both highly progressive taxes, and closing a Medicare tax loophole for wealthy pass-through owners.

The 2017 tax law sharply reduced the corporate income tax rate from 35 percent to 21 percent.[46] There are many reasons for policymakers to revisit this tax cut and adopt the Biden corporate tax proposals. The ProPublica article should add urgency to enact the Biden corporate tax rate increase to 28 percent and the Biden international tax changes to address the long-standing and continued rampant profit shifting to tax havens. The Biden plan seeks, for instance, to strengthen the current minimum tax on certain foreign profits to ensure that more of the foreign income of U.S. multinationals faces the tax, and that it’s taxed at a higher rate.[47]

The burden of a corporate rate increase would fall mostly on corporate shareholders. “[T]he corporate tax is one of the most progressive taxes in our tax system,” Treasury Deputy Assistant Secretary Kimberly Clausing told the Senate Finance Committee recently. She added, “economic models from organizations as varied as the U.S. Treasury, the Joint Committee on Taxation, the Congressional Budget Office, the Tax Policy Center, and the American Enterprise Institute all agree that the vast majority of the corporate tax burden falls on the owners of capital and those with excess profits.”[48] Treasury, for example, estimates that 82 percent of the corporate income tax falls on capital (63 percent on corporate equity and 18 percent on owners of all capital) and 18 percent on labor.[49]

Raising the corporate tax rate thus is another way to ensure that the nation’s wealthiest people pay a fairer amount of taxes. That’s similarly the case for foreign shareholders, who (as noted above) do not pay tax on capital gains from selling stock and now own more than 30 percent of the stock of publicly traded companies.

While raising the corporate tax rate is perhaps the most obvious way to use the corporate tax to shift tax burdens to wealthy taxpayers, the Biden proposals for international taxation are also vitally important to achieve that goal. As ProPublica highlighted, several companies owned by the nation’s wealthiest people, such as Facebook and Google, have worked aggressively to shift their profits to low-tax jurisdictions. To the extent that such profit shifting is successful, many ultra-wealthy corporate owners avoid paying corporate taxes. The President’s proposed global minimum tax and corresponding international tax changes are designed to impose a tax floor on these profits. That would subject more income of the wealthiest households to federal tax, albeit indirectly.

If the tax system were working well at the top end, wealthy people would pay a fair amount of tax each year on their economic income and their wealthy heirs would pay a fair amount of tax on their inherited windfalls of income. Neither side of this equation is working today. As the ProPublica story vividly displayed, many of the wealthiest people pay little tax during their lives. In addition, over the course of a number of decades, policymakers have eviscerated the estate tax so much that Gary Cohn, then-director of President Trump’s National Economic Council, reportedly told Senate Democrats in 2017, “Only morons pay the estate tax.”[50]

Today, fewer than 1 in 1,000 estates (i.e., only the very wealthiest) owe any estate tax, and the first $23.4 million in value is often tax-free even for these estates. Moreover, the few estates that are large enough to potentially face the tax can use loopholes to reduce or eliminate their tax liability. Wealthy people, for instance, use special funds (grantor retained annuity trusts, or GRATs) to shelter massive sums from the estate tax. Casino owner Sheldon Adelson, who recently died, passed $7.9 billion to his heirs tax-free “by shuffling his company stock in and out of more than 30 trusts.”[51]

The wealthy also artificially value their estates at less than their true value to avoid paying the estate tax. One way is through the “minority ownership discount,” which enables an estate that owns a minority share of a business to value — and therefore pay estate taxes on — the estate’s share of the business below its fair market value.[52] IRS researchers analyzing the estate tax returns of Forbes magazine’s annual list of the 400 wealthiest Americans later concluded that, on average, their wealth as reported for tax purposes was roughly half of Forbes’ estimate of it.[53]

Restoring the rules in place in 2009, when the first $3.5 million of an estate’s value ($7 million for a couple) was exempt from the tax and the top rate was 45 percent, would raise about $220 billion over ten years, according to the Tax Policy Center. Policymakers should restore these parameters and eliminate the well-reported loopholes that have accumulated over the years.[54]

Certain owners of pass-through businesses can avoid both the 3.8 percent Medicare SECA (Self-Employment Contributions Act) tax and the net investment income tax (NIIT), which taxes unearned or passive forms of income such as capital gains and dividends. Sole proprietors, for example, pay SECA taxes on all the earnings of their businesses, but S corporation owners only pay such taxes on their businesses’ earnings that they characterize as “reasonable compensation.” For “active” owners, the remaining amounts — characterized as profits — are not subject to SECA taxes or the NIIT. Policymakers should adopt the President’s proposal to ensure that all pass-through income of high-income people is subject to the 3.8 Medicare tax, either through the NIIT or SECA.[55]