BEYOND THE NUMBERS

Vast Majority of Americans Would Likely Lose From GOP’s Tax Bills, If GOP Use Spending Cuts to Pay for Them

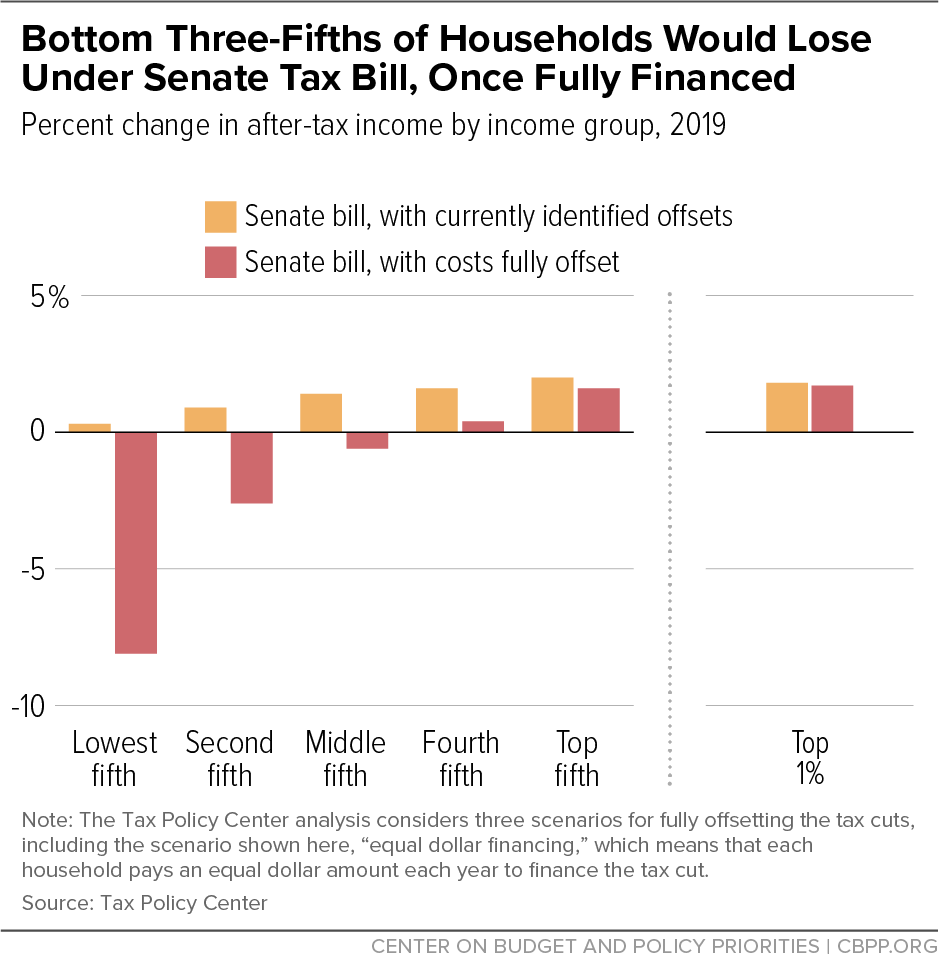

The House- and Senate-passed Republican tax bills would directly hurt millions of low- and middle-income families by raising their taxes, delivering token or no Child Tax Credit increases, and (in the Senate’s case) leaving millions more uninsured. But that may be just the start of the harm. Paying for their $1.5 trillion in tax cuts that go overwhelmingly to the wealthy and profitable corporations could leave most low- and middle-income families worse off, a new Tax Policy Center (TPC) analysis shows:

If you consider plausible ways of financing either the House or the Senate bill, most low- and middle-income households would eventually end up worse off than if the bill did not become law. In other words, they would lose more from inevitable future spending cuts or tax hikes necessary to eventually offset the costs of the tax bill than they would gain from the tax cuts themselves.

Take the Senate bill. In 2019, it would deliver tax cuts of 1.8 percent of after-tax income ($28,430) to the top 1 percent of households (with incomes above $746,100) while the bottom 60 percent (with incomes below $87,400) would see, on average, a 1 percent increase in after-tax income ($350). And the bill would add $1.45 trillion to deficits over ten years.

If policymakers ultimately pay for the Senate bill with the types of spending cuts that most closely reflect GOP lawmakers’ priorities — the types that they’ve included in their recent budget plans — the bottom 60 percent of households would be net losers, on average, the TPC analysis shows. High-income filers would continue to gain, on net (see chart):

If GOP lawmakers ultimately pay for their 2019 tax cuts this way:

- The bottom fifth (with incomes below $25,400) would lose on average about $1,170 each, amounting to an 8.1 percent reduction in their after-tax incomes. Some 99.9 percent of households in the bottom fifth would lose on net.

- The middle fifth (with incomes between $49,600 and $87,400) would lose on average about $370 each, amounting to a 0.6 percent reduction in their after-tax incomes. Some 66 percent of households in the middle fifth would lose on net.

- The bottom 60 percent (with incomes below $87,400) would lose on average about $860 each, amounting to a 2.6 percent reduction in their after-tax incomes. Some 90 percent of households in the bottom 60 percent would lose.

- The bottom four-fifths (with incomes below $150,100) would lose on average about $630 each, amounting to a 1.4 percent reduction in their after-tax incomes. Some 79 percent of households in the bottom 80 percent would lose.

Moreover, these estimates understate the potential harm to low-and moderate-income Americans from the GOP tax bills, for two reasons:

- TPC’s figures assume that all households eventually pay for the tax cuts equally. But GOP lawmakers’ budgets and recent statements make clear that they will seek spending cuts that would fall even harder on low- and moderate-income households. As TPC notes:

A scenario more regressive than equal-per-household financing would most accurately characterize the policy preferences embedded in recent proposals by the Trump Administration and Congressional Republicans – for example, the Trump Administration’s budget, the budget resolutions passed by the House and Senate, and the House’s passage of deep Medicaid cuts as part of efforts to bring about health care reform. Additionally, several Republicans have indicated that the next step after tax reform is to cut spending in programs such as Medicare and Social Security.

- The TPC analysis doesn’t include the Senate bill’s direct harm to health coverage. To help pay for its corporate tax cuts, the bill would permanently repeal the Affordable Care Act’s individual mandate, the requirement that most people get health insurance or pay a penalty. All of the savings from repeal would come because fewer people would be insured, which would lower federal costs for Medicaid and for federal tax credits that help people buy insurance. Repeal would cause 13 million more people to become uninsured and premiums to rise by an average of 10 percent in the individual market, the Congressional Budget Office estimates. As the TPC report notes, “Including that provision would produce results that are substantially more regressive […].”

As we’ve explained, the GOP tax bill that House and Senate conferees are finalizing would be step one of a proposed two-step fiscal agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then decrying the enlarged deficits that those tax cuts fuel — and insisting that they necessitate program cuts mainly affecting low- and middle-income families. Republican leaders have chosen to split this agenda into separate pieces of legislation — but by showing the two steps together, the TPC analysis shows starkly what most Americans stand to lose if it is ultimately enacted in full.