BEYOND THE NUMBERS

Governors and lawmakers in numerous states have proposed creating or expanding state Earned Income Tax Credits (EITCs) this year. By approving these proposals, states can build on the federal EITC’s well-documented, long-term benefits for children while improving racial and gender equity and thus the nation’s economic prospects.

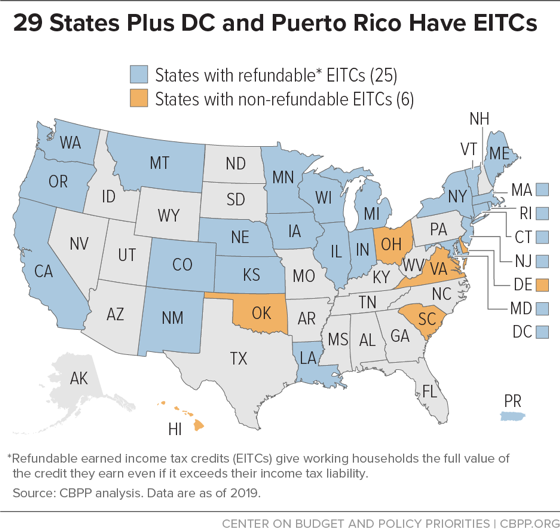

Twenty-nine states plus the District of Columbia and Puerto Rico have created a state EITC to help low-wage working households meet basic needs (see map). States without EITCs should enact them, and those with EITCs should expand them — particularly states with non-refundable credits, which don’t give workers the full value of the credit they’ve earned if it exceeds what they owe in state income tax.

Proposals include:

- Enacting a new credit. A West Virginia proposal would create a state EITC worth 15 percent of the federal credit; one in Missouri would create a 20 percent credit.

- Making the credit refundable. Refundability is key to the EITC’s ability to boost incomes and reduce hardship because it enables the credit to offset other state and local taxes, which take a substantial share of the income of families paid low wages. In Delaware, Governor John Carney and lawmakers have agreed on a refundability proposal. Similarly, Hawaii Governor David Ige and lawmakers have announced a package of proposals including a higher minimum wage, investments in affordable housing, and a permanent and refundable EITC.

- Providing equal access to immigrant families. People who are undocumented make sizable contributions to their local communities as well as their state’s economy and finances. Like other residents, they work, pay taxes, and shop at local businesses. Recognizing those contributions, a New Mexico bill to expand the state’s credit would enable undocumented New Mexicans to receive it.

- Extending the credit to workers without children in the home. The federal EITC largely leaves out workers not raising children in their home, even though they’re integral to their communities and local economies — and many are non-custodial parents or future parents. That’s a big reason why these workers are the lone group that the federal tax code pushes into, or deeper into, poverty. Several New Jersey proposals would increase the state’s EITC for workers not raising children in the home and lower the EITC eligibility age for these workers (currently 25). Also, the New Mexico bill noted above would extend eligibility for the state’s EITC to young workers aged 18 to 24 without children in the home.

- Expanding the credit. Colorado lawmakers are proposing to double the state’s EITC and implement a refundable state Child Tax Credit that the state passed but never funded. And Rhode Island Governor Gina Raimondo’s budget would raise the EITC to 20 percent.

- Implementing the credit. A Washington proposal would finally implement the Working Families Tax Credit, enacted in 2008, while extending it to groups such as immigrant workers who are undocumented (and thus ineligible for the federal credit) and workers aged 19 to 70 without children in the home. In total, 967,000 households would benefit.

State EITCs help working families paid low wages afford the very things that allow them to continue working, like child care and transportation. They also help children from economically struggling families do better and go further in school because the additional resources help parents better meet their needs. By investing in an EITC, states can make a big difference for children and families and for their communities.