BEYOND THE NUMBERS

After several years of lower poverty rates, higher income, and broader health coverage, gains slowed — and in some cases stalled — in the states in 2017, new Census data show. For example, fewer states reduced their share of people below the federal poverty line (about $25,000 for a family of four), according to new state data from the American Community Survey. Because policy decisions affect whether people get a real shot at economic opportunity and communities thrive, states should do what they can to reverse the decline in progress.

Today’s data show that:

- Poverty fell in 21 states in 2017 and rose in two (Delaware and West Virginia), compared to 2016 when it fell in 25 states and rose in just one.

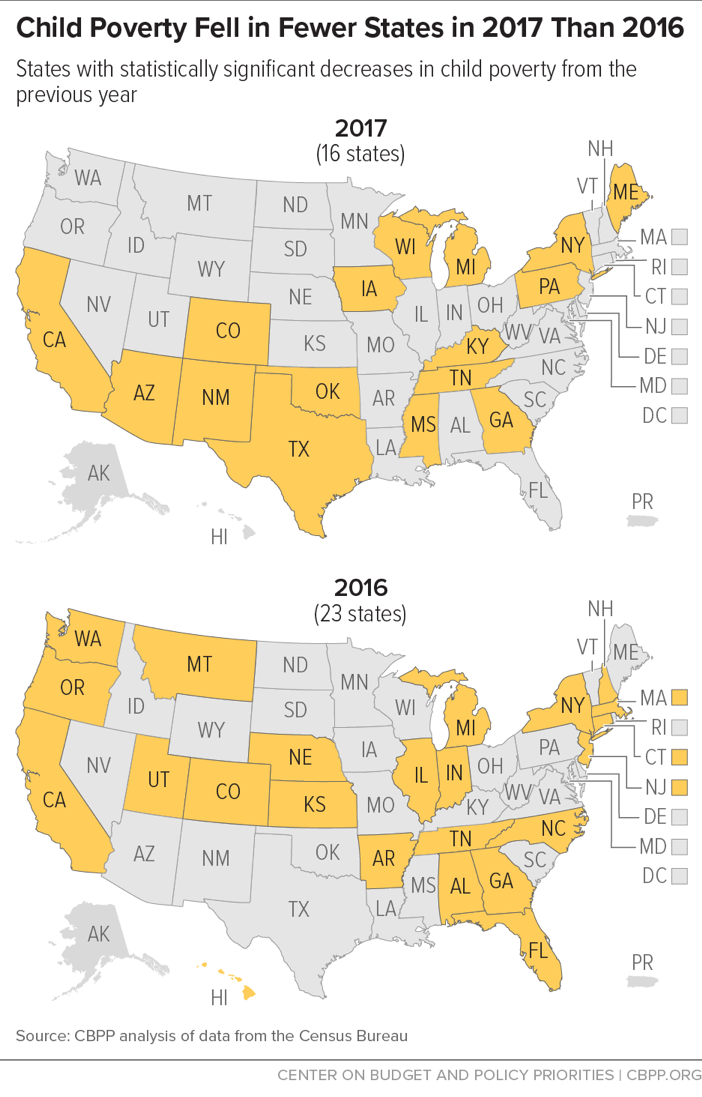

- Child poverty, in particular, fell in 16 states in 2017, compared with 23 in 2016. It rose in one state, New Hampshire. (See chart.)

- Fewer states saw incomes rise, likely due in part to a slowdown in employment gains, and income gains were not shared equally across racial and ethnic groups, as I’ve explained.

With federal policymakers considering trillions in additional tax cuts and deep cuts to food and economic security programs that keep millions of Americans out of poverty, it’s critical that states use their tools to boost progress, rather than let it stall. To build thriving and resilient communities and economies, states can:

- Invest in education and health to boost productivity and empower individuals to reach their potential. For example, states can target education dollars to early learning, smaller class sizes, and improved teacher quality to improve education outcomes, especially for students of color or low income.

- Launch public infrastructure projects to create jobs, spur growth, and promote equity. Building and repairing roads, bridges, public transit, school buildings, and other physical assets creates jobs and can also promote equity when targeted to communities with the greatest need.

- Boost household incomes for shared prosperity. States can help families make ends meet and improve children’s life chances by enacting or expanding state earned income tax credits and raising minimum wages. They also can remove barriers to work by providing child care and transportation assistance, and by reducing incarceration for non-violent offenders and taking an inclusive approach to immigrants with an undocumented status.

- Reform the tax code. Scrapping ineffective, special interest tax breaks, incentives, and loopholes and asking the wealthiest to pay their fair share would generate new dollars for education, income supports, and infrastructure projects.