BEYOND THE NUMBERS

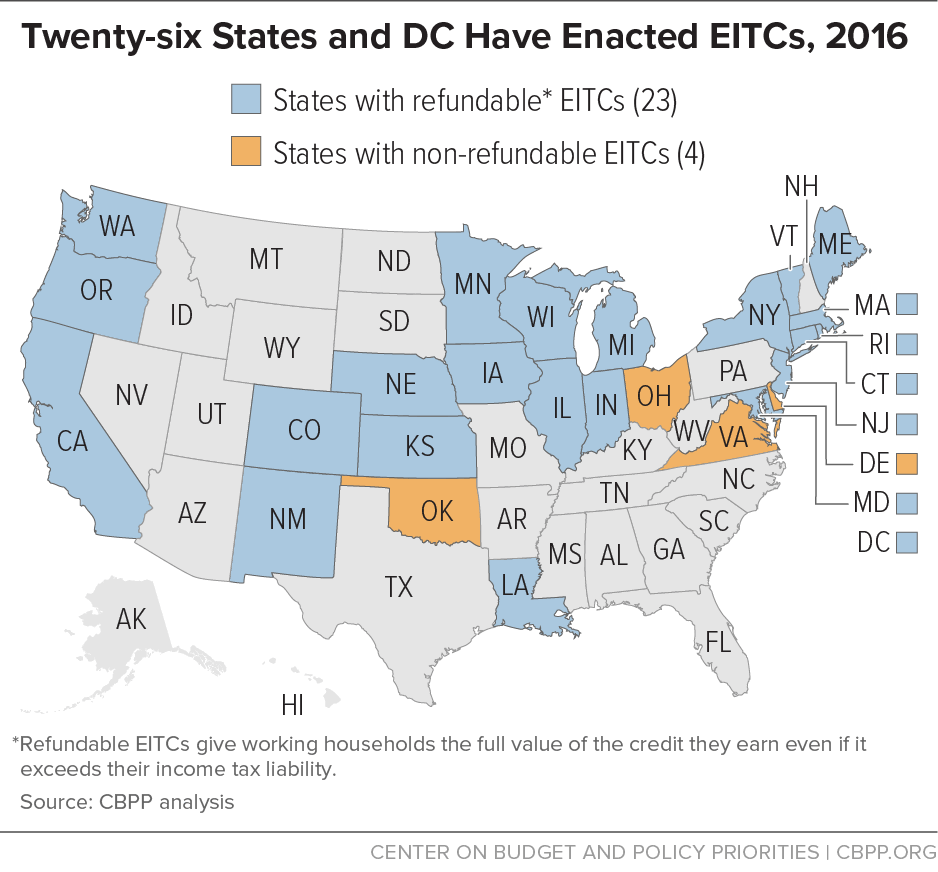

State legislative sessions are starting amid great uncertainty about potential changes in federal policies that could leave millions of struggling families with less support to meet basic needs like food, housing, and health care. So state policymakers should bolster state services for these families. States can help people keep working, boost incomes, reduce financial hardship, and help build an economy that works for everyone by creating or expanding a state Earned Income Tax Credit (EITC). Twenty-six states plus Washington, D.C. have such a credit to help working families share in economic gains and get on a path to prosperity.

State EITCs, which eliminate some or all of a family’s state income taxes and offset other taxes, are a sensible way to help working families make ends meet. They build on the success of the federal EITC by helping families afford the things they need to keep working, like child care and transportation.

EITCs also help working parents better meet their children’s needs. Studies show that when families with low incomes get an income boost, their young children tend to do better and go further in school, and the greater skills they acquire tend to raise their earnings in adulthood. That means a stronger future economy.

State EITCs also make state tax systems fairer. In almost every state, low- and moderate-income families pay more in state and local taxes, as a share of their income, than upper-income families. That’s because states and localities rely heavily on sales, excise, and property taxes, which fall more heavily on low-income families. States that have increased their reliance on these taxes in recent years by cutting income taxes should consider a state EITC to address the negative impact on lower-income families.

Because state EITCs are well targeted to low- and moderate-income working families, they cost less than other tax cuts that states often consider. For a relatively modest investment, states can make a big difference in the lives of working families.

Better yet, state lawmakers should pair their adoption or expansion of a state EITC with a stronger minimum wage. As our newly updated paper explains, advancing both policies allows policymakers to reach more working people, do more to help working families cover both daily and one-time expenses, and spread the cost of boosting incomes across the public and private sectors. Over the past couple of years, states like Maryland, Minnesota, Oregon, and Rhode Island, as well as the District of Columbia, have done just that.