BEYOND THE NUMBERS

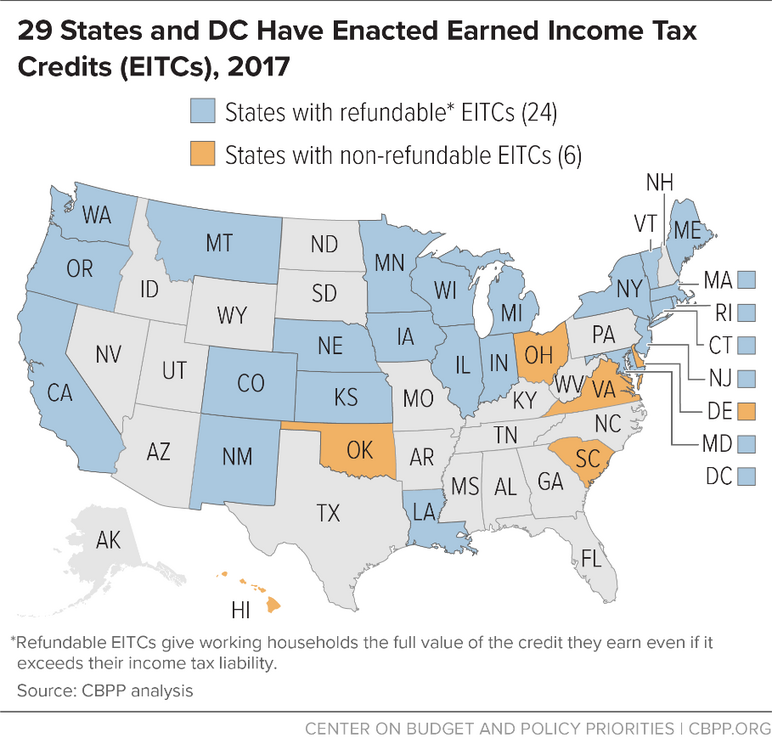

This has been a blockbuster year for state earned income tax credits (EITCs) — one of the most common-sense tools we have for helping low-income workers make ends meet. Three state legislatures adopted new EITCs in 2017, three expanded existing credits, and two took important steps to increase access to the credit. All told, 29 states and the District of Columbia now have their own EITCs (see map).

Here are the big wins from 2017:

- New credits. Montana passed a new refundable EITC that will help 80,000 low- and moderate-income families keep more of what they earn to meet their basic needs. Meanwhile, Hawaii and South Carolina created new non-refundable credits. Hawaii’s Working Family Credit will reach around 80,000 working households struggling to get by on low pay. South Carolina’s credit will reach about 124,000 such households. These credits will provide a modest benefit to many families, but because they’re non-refundable, workers won’t get the full value of the credit they’ve earned because they owe too little in income taxes.

- Expanded credits. Three states — California, Illinois, and Minnesota — substantially expanded their existing credits. California’s credit will reach 1.1 million more households, Illinois increased the value of its credit by 80 percent for the 994,000 working households that receive it, and Minnesota expanded eligibility to an estimated 41,500 young adults.

- Increased access to credits. Two states — Massachusetts and Oregon — took steps to ensure that more eligible workers claim their state credits. In Massachusetts, domestic violence survivors can now claim the EITC without filing taxes with their spouse. In Oregon, W-2 wage statements, workplace wage and hour posters, and the Department of Revenue’s website must all offer information about how to claim the EITC.

These state EITC gains will help ensure more broadly shared prosperity. State EITCs — alongside raises in the minimum wage — help families struggling on low wages afford the necessities, keep working, and meet their children’s needs. The credits also benefit local businesses because those getting the credit spend nearly every dollar they earn in their communities.