BEYOND THE NUMBERS

Update, July 31: We’ve clarified the description of Maryland’s EITC expansion.

Seven states boosted — or will soon boost — their Earned Income Tax Credits (EITCs) this year to help low-wage working families meet basic needs. These state EITC expansions will supplement the federal EITC’s well-documented long-term positive effects on children, improve racial and gender equity, and improve the nation’s economic prospects.

This year’s gains include:

- Larger credits. Louisiana, Massachusetts, New Jersey, and Vermont all expanded their credits. These improvements will help an estimated 1.5 million working households struggling on low wages keep more of what they earn. Louisiana increased its credit from 3.5 to 5 percent of the federal credit for the nearly 500,000 working households receiving it. Massachusetts increased its EITC from 23 to 30 percent of the federal credit. New Jersey’s increase, from 35 to 40 percent of the federal credit, will reach nearly 600,000 working households. Vermont’s increase, from 32 to 36 percent of the federal credit, will help around 40,000 households.

- Expanded access to credits. California and Maryland expanded access to the EITC for workers without children in the home. Californians aged 18 and older without dependents can now receive the credit, and the credit’s income limit will increase for workers with and without children in the home. These changes will benefit an estimated 700,000 working households. In Maryland, an estimated 40,000 workers – mostly ages 18-24 - without dependents can now receive the credit. Workers without children in the home are the sole group that the federal tax system pushes into — or further into — poverty; these promising changes will help young people entering the workforce get a better start and help older workers make ends meet.

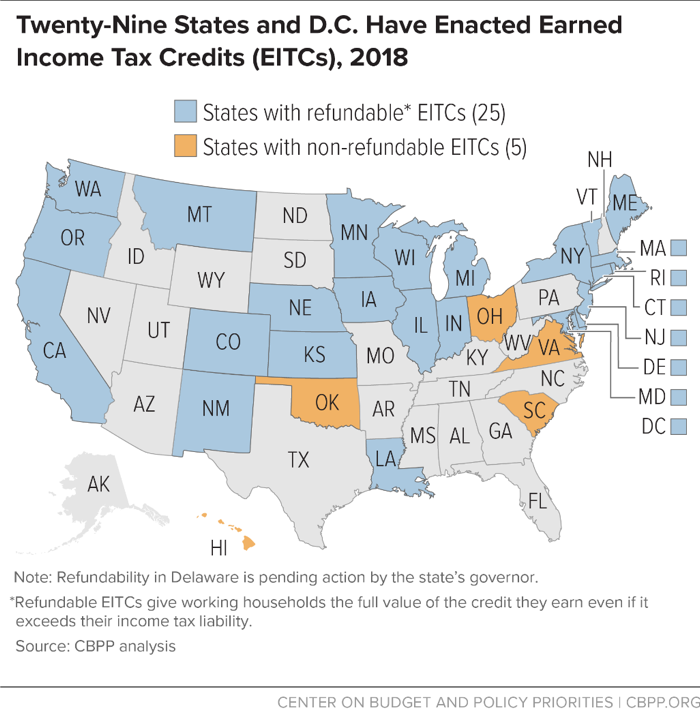

- Refundable credits. Delaware lawmakers voted to make the state’s credit refundable, meaning that working households will get the full value of the credit they earn even if it exceeds their state income tax liability. The governor is expected to sign the bill. While it will shrink the credit to 5.9 percent of the federal credit from 20 percent (to offset the cost of refundability), it will extend the credit to more than 30,000 added households. For example, a single mother with two children working half time at the Delaware minimum wage of $8.25 per hour isn’t eligible for the current credit because she earns too little to owe state income tax, though she owes payroll and other taxes. Under the new law, she’ll receive a credit of $195. The change also will expand the credit for many other low-earning workers who now receive only a small EITC. For instance, a mother of two working full time at the minimum wage now receives an $87 EITC but will qualify for $337 under the new law.

Strong state EITCs — alongside raises in the minimum wage — help families struggling on low wages keep working and make ends meet. That helps build stronger future economies; research shows that when economically struggling parents can better provide for their children’s needs, their children do better and go further in school and earn more as adults. State EITCs also help give local businesses a boost because families getting the EITC spend nearly every dollar they earn in their communities. And state EITCs improve racial and gender equity because they’re targeted to the lowest-earning workers, where women and people of color are disproportionally represented. With so many benefits, the momentum around state EITCs is worth celebrating.