BEYOND THE NUMBERS

Reducing Marketplace Premiums, Closing Coverage Gap Can Avert Large Rise in Uninsured

Millions of people will see steep increases in the price they pay for health coverage when they shop this fall — and many will become or remain uninsured — unless Congress acts in upcoming economic legislation to extend premium tax credit enhancements and close the Medicaid coverage gap in states that haven’t adopted the Affordable Care Act’s (ACA) Medicaid expansion.

These two steps are particularly critical because families already face rising costs for other basics, such as food, utilities, and housing, and because they would help minimize coverage losses after the Medicaid “continuous coverage” requirement imposed during the COVID-19 public health emergency ends.

The premium tax credit enhancements, part of the 2021 American Rescue Plan, reduce or eliminate premiums for most marketplace enrollees. They have prompted a surge in enrollment in the ACA marketplaces: a record 14.5 million people selected marketplace plans in the open enrollment period for 2022 coverage, up from 12 million in 2021 and 11.4 million in 2020. For people who used the federal HealthCare.gov platform to enroll, average monthly premiums for 2022 coverage fell by 23 percent compared to premiums charged during open enrollment for 2021 coverage, which preceded the Rescue Plan.

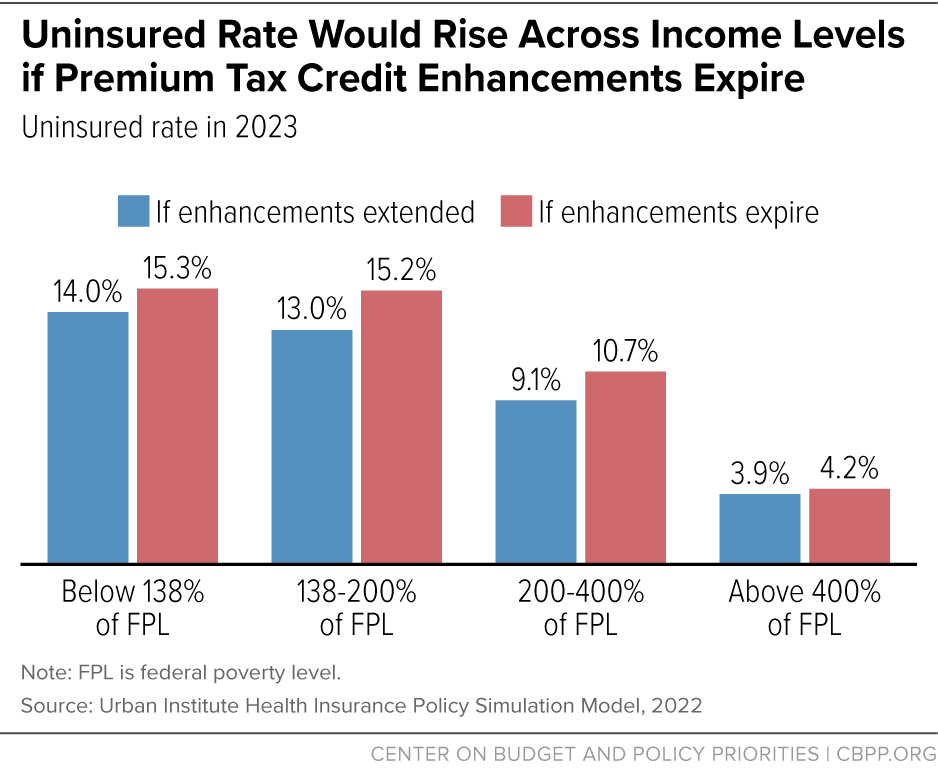

If the tax credit enhancements expire, the prices people must pay for coverage will rise — and, as a result, so will the number of uninsured. Over 3 million more people will be uninsured next year if the enhancements are not extended, the Urban Institute estimates. Coverage losses would be largest among people with low and moderate incomes, many of whom now pay $0 or very little per month for coverage. And people who stay in marketplace plans would face significant new burdens; those with incomes between 150 and 400 percent of the poverty line (about $19,000-$52,000 for an individual), for example, would pay an average of $1,000 more per year.

People in the Medicaid coverage gap face a different problem that keeps them uninsured. A full eight years after most states began covering low-income adults in Medicaid as the ACA called for, about 2.2 million uninsured people in the 12 states that haven’t expanded Medicaid fall in a coverage gap because they don’t qualify for marketplace financial assistance or for Medicaid. This group includes parents, people in low-paid jobs often in front-line industries, caregivers, veterans, people with disabilities, and other adults with incomes below the poverty line.

Closing the coverage gap would ensure that low-income adults, regardless of where they live, have a pathway to affordable health coverage. It would help address the current crisis in Black maternal health, expand access to much-needed mental health care and substance use disorder treatment, and help protect people from medical debt. Beyond benefiting the people directly gaining coverage, it would also benefit communities by helping stabilize rural and community health providers, which have a diverse group of patients and serve communities with significant gaps in health care access.

Closing the coverage gap is also one of the most important steps Congress can take to advance health equity in economic legislation. People of color make up about 60 percent of those in the coverage gap. That’s partly due to economic, educational, and housing injustices that lead to higher poverty rates for people of color and over-representation in low-paid jobs that don’t offer employer coverage. Also, many non-expansion states have a long history of policy decisions, based on racist views of who deserves to get health services, that restricted access to coverage in the past and still do today.

Closing the coverage gap and extending the premium tax credit enhancements would also help minimize coverage losses associated with the unwinding of Medicaid’s “continuous coverage” requirement, which bars Medicaid agencies from disenrolling anyone from Medicaid unless they ask to be disenrolled, move out of state, or die. The requirement has allowed many people to retain Medicaid coverage without interruption during the pandemic, but when the public health emergency ends, states will resume their usual eligibility checks. If Congress doesn’t close the Medicaid coverage gap, more people in non-expansion states with incomes below the poverty line will become ineligible for Medicaid when the state re-evaluates their circumstances. This includes large numbers of young adults who have turned 19 and thus no longer qualify for Medicaid as children, people who received Medicaid during their pregnancy but are past their state’s postpartum eligibility timeline, and parents whose income has risen above their state’s very low income thresholds.

And in both expansion and non-expansion states, some people whose incomes have increased will lose Medicaid coverage when their eligibility is redetermined and instead be eligible for marketplace financial assistance. But if the premium tax credit enhancements expire, some may find marketplace coverage unaffordable.

Time is running short. To protect people from price spikes when they look for marketplace plans this fall and to provide coverage options for people who otherwise would be uninsured, Congress should include both provisions in economic legislation and enact it this summer.