BEYOND THE NUMBERS

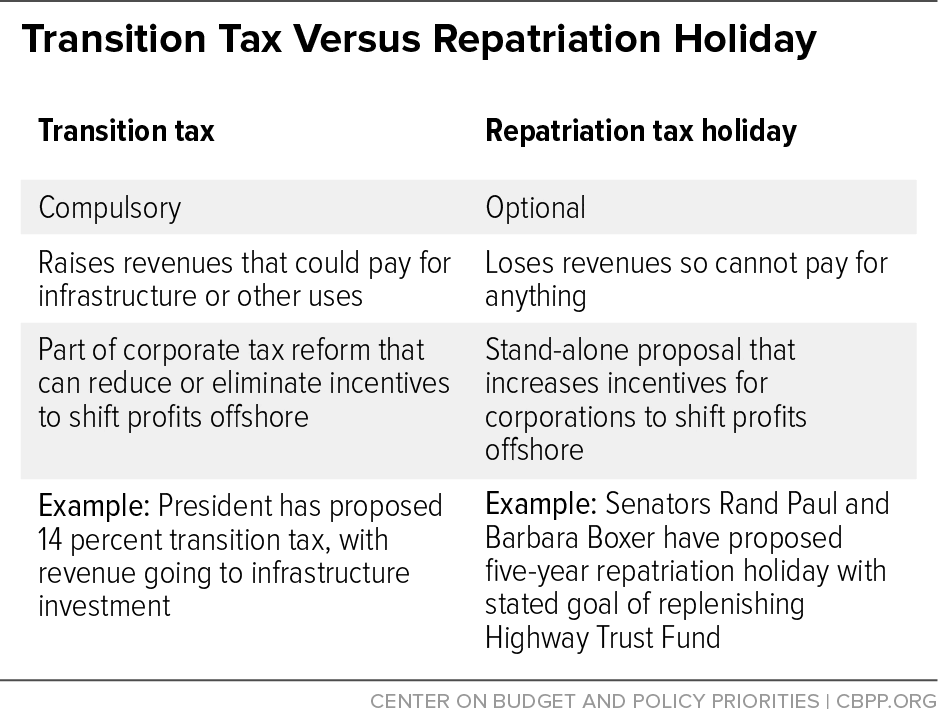

A House subcommittee hearing tomorrow will explore tapping U.S. multinational corporations’ roughly $2 trillion stockpile of foreign earnings, which have never faced U.S. tax, to help pay for infrastructure investments. But, of two prominent proposals that may come up — a “repatriation tax holiday” and a “transition tax” — only the latter actually raises revenue. A repatriation tax holiday loses significant revenue, so it can’t help pay for highways or anything else (see chart).

Here are the main differences between the two proposals (for more, see our short explainer and our paper on a repatriation holiday):

-

A repatriation tax holiday is designed to encourage multinationals to return overseas profits to the United States by offering them a temporary, sharply reduced U.S. tax rate on those profits. It’s a stand-alone policy — not part of corporate tax reform — and voluntary for multinationals. And, it would encourage them to shift more profits offshore in hope of more tax holidays. That’s why Congress, in enacting a repatriation holiday in 2004, explicitly warned that it should be a one-time event. A second holiday is therefore poor policy and would raise deficits.

For example, the repatriation holiday that Senators Rand Paul and Barbara Boxer have proposed to “pay for” replenishing the Highway Trust Fund would actually lose $118 billion over 2015 to 2025, the non-partisan Joint Committee on Taxation estimates.

-

A transition tax is a compulsory tax on offshore profits that have never faced U.S. tax. Also, it would be levied as part of a corporate tax reform that would tax multinationals’ offshore profits differently going forward and could reduce or eliminate incentives to avoid U.S. taxes by reporting profits offshore. If set at an adequate rate, a transition tax is sound policy that would raise revenues.

The President has called for a 14 percent transition tax as part of his corporate tax reform proposal. While we favor a higher rate, the President’s proposal raises significant revenue that he would use for infrastructure. The Administration has made clear that it doesn’t support a repatriation holiday.

A hybrid proposal called “deemed repatriation” may also arise at the hearing. Like a transition tax, it would be compulsory; but unlike a transition tax, it would be a stand-alone measure. Any “deemed repatriation” rate would have to be high enough to avoid giving multinationals even more reason to shift future profits overseas. Otherwise, it would worsen tax avoidance and bleed revenues in later years.