BEYOND THE NUMBERS

Update, March 2, 2020: we’ve updated this post.

Some 19.3 million low-income adults who aren’t raising dependent children — the lone group that’s taxed into, or deeper into, poverty — would get a sizable increase in their Earned Income Tax Credit (EITC) through the proposed Working Families Tax Relief Act, and these adults would come from every state in America.

They would include (per the state-by-state table below), 2.3 million in California, 1.5 million in Texas, 1.4 million in Florida, 745,000 in Ohio, 643,000 in Michigan, 633,000 in Georgia, 429,000 in Arizona, and 256,000 in Oklahoma.

The Working Families Relief Act, which was introduced this year in the Senate by Sherrod Brown, Michael Bennet, Richard Durbin, and Ron Wyden (with 42 co-sponsors) and in the House by Dan Kildee and Dwight Evans, would raise the maximum EITC for childless adults from roughly $530 today to $2,100.

It would reduce the number of workers aged 19 to 67 (other than full-time students) whom the federal tax code taxes into, or deeper into, poverty by about 91 percent — from 5.51 million today to fewer than 500,000.

The House Ways and Means Committee, in effect, made a down payment on this approach last month when it passed Chairman Richard Neal's Economic Mobility Act, which would expand the EITC for childless adults in 2019 and 2020.

For low- and moderate-income families with children, the EITC is an anti-poverty, income-boosting powerhouse. Childless adults who work hard at low-wage jobs face the same wage pressures as their co-workers with children. Yet even for those who qualify for it, the EITC is too small to give them a similar income lift — leaving some in this group taxed into, or deeper into, poverty.

The standard deduction, EITC, and Child Tax Credit are set at levels that ensure that families with children don’t have net income and payroll federal tax liability if they earn poverty-level wages. As a result, no families with children are taxed into poverty. Single childless adults, in contrast, begin owing income tax when their earnings are below the poverty line, and they receive little or no EITC. They also face significant payroll taxes.

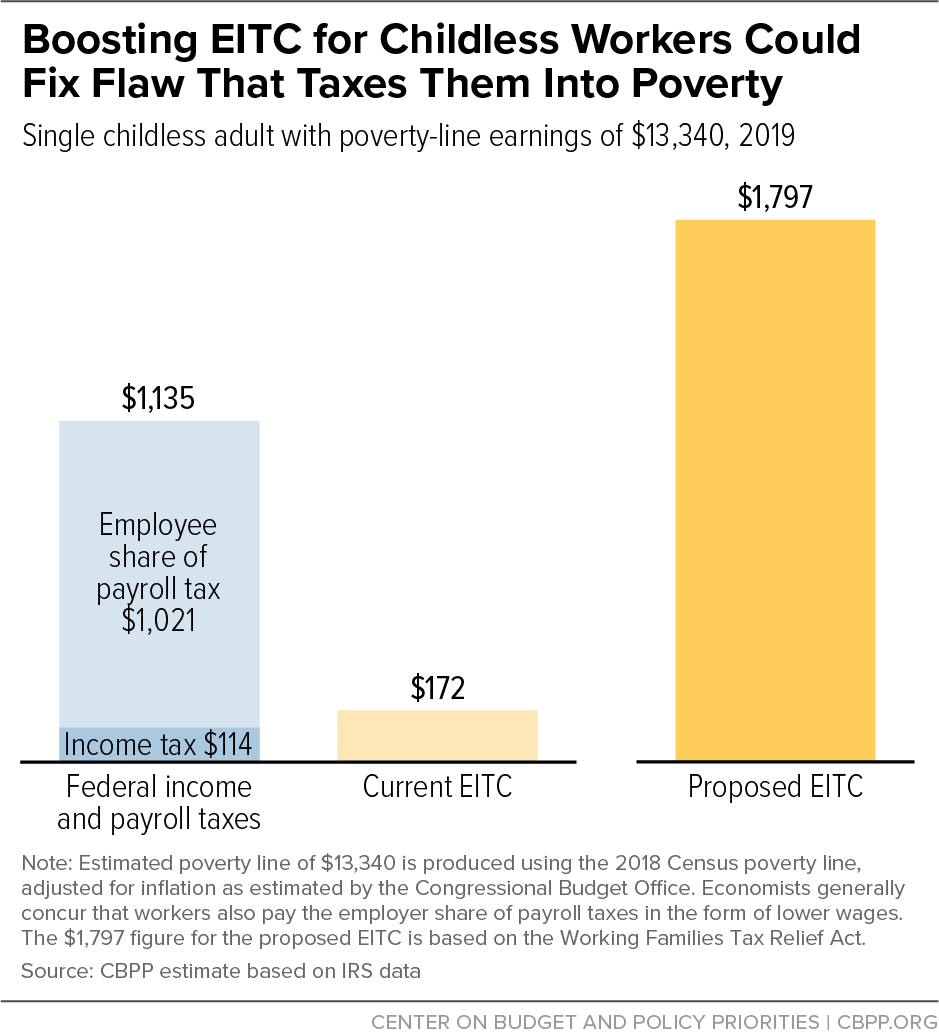

Consider a 25-year-old single woman who works roughly 35 hours a week as a retail salesperson and earns the federal minimum wage of $7.25 an hour. Her annual earnings of $13,340 are just at the poverty line. But federal taxes push her down into poverty:

Some $1,021 — 7.65 percent of her earnings — are withheld for Social Security and Medicare payroll taxes. She can claim a $12,200 standard deduction, leaving her with $1,140 in taxable income. Since she’s in the 10 percent tax bracket, she owes $114 in federal income tax. Thus, her combined federal income and payroll liability (before the EITC) is $1,135. She is eligible for a small EITC of $172. So, her net federal income and payroll tax liability is $963.

In short, federal taxes drive this woman $963 into poverty. The drafters of the Working Families Tax Relief Act made fixing this tax code flaw a top priority. Under the legislation, this woman’s EITC would rise to $1,797 and her after-tax income would rise to $662 above the poverty line.

The legislation would also give an EITC to many other working people who’ve been excluded in the past, such as young people who recently graduated high school and are starting out in the job market. It would lower the eligibility age from 25 to 19, to include this group. Similarly, people aged 65 to 67 and working for low wages would also be eligible.

In addition to extending the age limits, the legislation would extend to workers somewhat higher up the income scale. A childless adult working full-time for $8 an hour is now excluded from the EITC. Under the legislation, a childless adult making $10 an hour working full time as a cook would receive an EITC of about $730.

This important legislation would boost the incomes of childless adults in every state who work hard at low-wage jobs but are paid too little. It would fix a glaring flaw in the tax code and put the EITC’s anti-poverty power on the side of this group that’s now mostly excluded.

| TABLE 1 | |

|---|---|

| Childless Workers Who Would Benefit From Working Families Tax Relief Act, by State | |

| State | Number of Childless Workers |

| Total U.S. | 19,332,600 |

| Alabama | 311,100 |

| Alaska | 47,000 |

| Arizona | 429,400 |

| Arkansas | 190,500 |

| California | 2,254,500 |

| Colorado | 336,000 |

| Connecticut | 167,100 |

| Delaware | 49,500 |

| Dist. of Columbia | 37,300 |

| Florida | 1,434,300 |

| Georgia | 633,000 |

| Hawaii | 82,200 |

| Idaho | 120,400 |

| Illinois | 691,300 |

| Indiana | 417,100 |

| Iowa | 185,400 |

| Kansas | 176,000 |

| Kentucky | 292,300 |

| Louisiana | 316,500 |

| Maine | 97,700 |

| Maryland | 284,600 |

| Massachusetts | 334,700 |

| Michigan | 642,500 |

| Minnesota | 313,800 |

| Mississippi | 190,300 |

| Missouri | 408,300 |

| Montana | 88,800 |

| Nebraska | 106,400 |

| Nevada | 191,800 |

| New Hampshire | 71,600 |

| New Jersey | 411,800 |

| New Mexico | 148,900 |

| New York | 1,106,300 |

| North Carolina | 657,300 |

| North Dakota | 41,900 |

| Ohio | 744,900 |

| Oklahoma | 255,800 |

| Oregon | 293,800 |

| Pennsylvania | 743,300 |

| Rhode Island | 56,700 |

| South Carolina | 344,000 |

| South Dakota | 54,800 |

| Tennessee | 439,800 |

| Texas | 1,532,600 |

| Utah | 157,400 |

| Vermont | 41,500 |

| Virginia | 478,800 |

| Washington | 416,300 |

| West Virginia | 119,300 |

| Wisconsin | 348,900 |

| Wyoming | 37,300 |

Source: CBPP estimates based on 2015-2017 American Community Survey data and March 2018 Current Population Survey data.