BEYOND THE NUMBERS

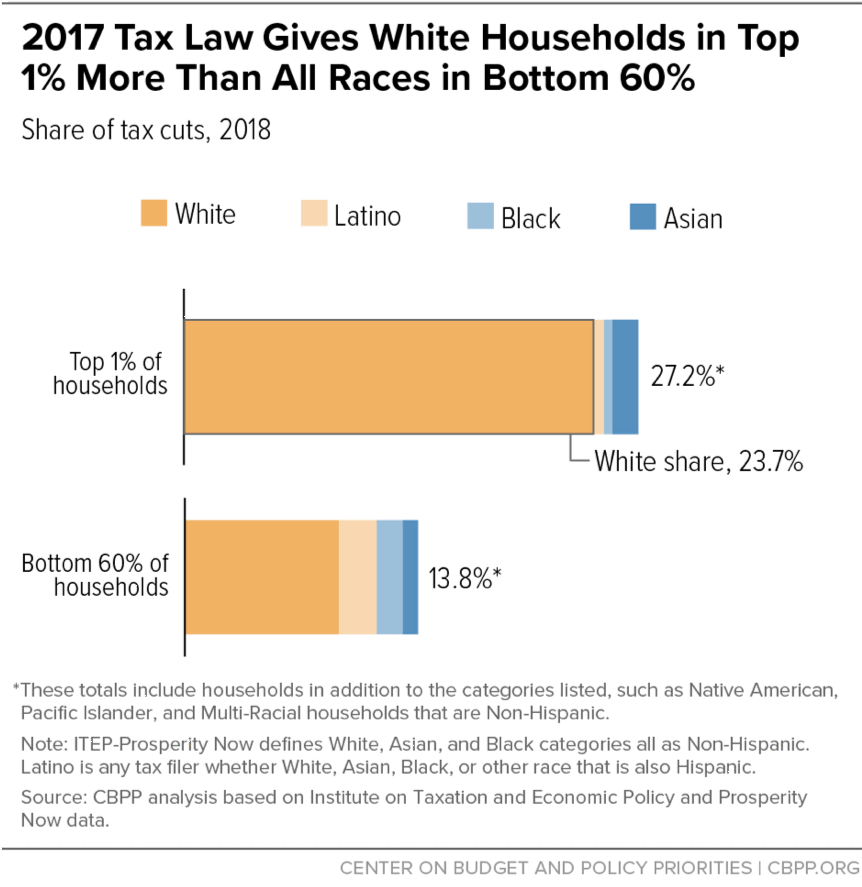

ITEP-Prosperity Now: 2017 Tax Law Gives White Households in Top 1% More Than All Races in Bottom 60%

We’ve explained that the 2017 tax law largely ignored working-class families, instead delivering large tax cuts to the most well-off and large, profitable corporations. A new analysis from the Institute on Taxation and Economic Policy (ITEP) and Prosperity Now shows that that’s particularly troubling for Black and Latino households:

- “White families are three times more likely than Latino and Black families to be among the nation’s top earners” — that is, among the top 1 percent — the report finds. These highest-income White households make up just 0.8 percent of all households, but they receive 23.7 percent of the total tax cuts, far more than the 13.8 percent that the bottom 60 percent of households of all races receives. (See chart.)

- The law, by contrast, treats low- and moderate-income households largely as an afterthought. It delivers tax cuts worth only about 1.1 percent of pre-tax income for households in the bottom 60 percent, while households in the top 1 percent get a boost worth 2.6 percent of their vastly higher incomes. This skew to the already well-off is especially troubling for Black and Latino households, which are disproportionately represented in the bottom 60 percent. Black households make up 10.2 percent of all households but 12.5 percent of those in the bottom 60 percent; Latino households make up 11.9 percent of all households but 14.2 percent of those in the bottom 60 percent.

Today’s income and wealth distribution, in which households of color are overrepresented on the bottom rungs while White households are overrepresented at the top, reflects many decades of policy choices and the nation’s long history of racial barriers. These factors include barriers to high-quality education and jobs for households of color and the deliberate residential segregation of households of color from White households. And, as CBPP’s new report on higher education points out, well-documented discrimination in hiring and salary practices holds back many workers of color, including graduates from highly selective colleges. The ITEP-Prosperity Now report explains that under current trends, it’ll take the median Latino family over 2,000 years just to match the current wealth (financial and housing assets) of the median White household, and Black families will never catch up with White families’ current level.

The 2017 tax law worsened these racial inequities because its core provisions are highly tilted to households at the top. Its deep cut in the corporate tax rate will mostly benefit wealthy shareholders and highly compensated employees such as CEOs. It also showers large tax benefits on heirs to multi-million-dollar estates, lowers the top income tax rate, weakens the Alternative Minimum Tax, and creates a special deduction for “pass-through” business income (the incomes that the owners of certain businesses pay on their individual tax returns).

Low- and moderate-income working families, in contrast, get relatively little from the law. For example, its Child Tax Credit (CTC) increase largely or entirely excludes 11 million children in low-income working families. In addition, the law not only does nothing to strengthen the Earned Income Tax Credit (EITC), which boosts working families’ incomes, it actually weakens it over time.

The 2017 tax law’s ultimate impact on working-class Black and Latino households could be even worse than the report suggests:

- Due to data limitations, the ITEP-Prosperity Now numbers don’t reflect a provision that specifically targeted immigrant families: eliminating the CTC for 1 million children in low-income working families because they lack a Social Security number. These children are overwhelmingly “Dreamers” with undocumented status whose parents brought them to the United States.

- The tax law will add $1.9 trillion to deficits over ten years, at a time when the nation needs more revenues as the baby boom generation moves deeper into retirement. Sooner or later, these higher deficits are likely to create pressure for cuts to programs that help low- and moderate-income families meet basic needs or that represent investments in lower-income communities. In fact, some lawmakers who supported the 2017 tax cuts are now calling for cuts to programs like Medicaid.

Meanwhile, the gain for households at the very top, which are disproportionately White, could be greater than the report estimates. The tax law creates new opportunities for high-income filers who can afford high-priced tax advice to game the tax code to avoid taxes, such as its large cut in the estate tax and the new “pass-through” deduction. And tax planning experts may find other ways to game the tax code that current estimates don’t yet reflect.

The 2017 tax law was a large step in in the wrong direction, and lawmakers should fundamentally restructure it. Future federal tax changes should focus on expanding opportunity for low-and moderate-income households and reducing racial inequities, such as by bolstering the EITC and CTC, and on raising the revenues needed to meet national needs in a fiscally responsible way (including financing investments that can help reduce poverty, inequality, and racial inequities such as well-designed investments in education, infrastructure, and nutrition, and in ways to create better-paying jobs and make health care more affordable).