BEYOND THE NUMBERS

In Case You Missed It...

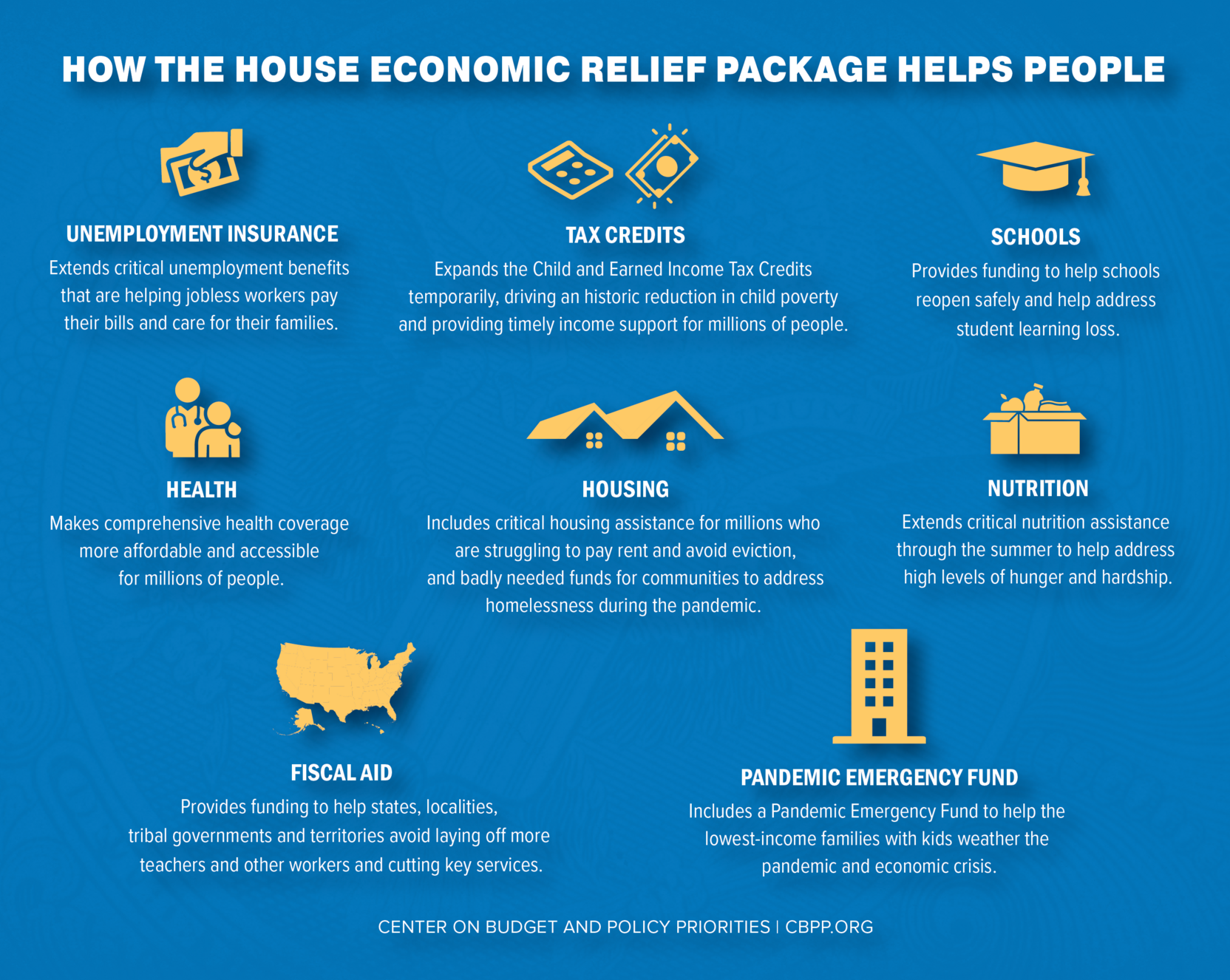

CBPP’s main focus this week was the proposed COVID-19 relief under the budget resolution. We released several analyses of its key components, including an overview excerpting these pieces:

- On federal taxes, Chuck Marr, Kris Cox, Stephanie Hingtgen, Katie Windham, and Arloc Sherman examined the package’s critical expansions of the Child Tax Credit and the Earned Income Tax Credit.

- On health, Tara Straw, Sarah Lueck, Hannah Katch, Judith Solomon, Matt Broaddus, and Gideon Lukens detailed how the health provisions of the package would improve access to health coverage, and Lueck authored a summary of the paper.

- On state budgets and taxes, Michael Leachman noted that the proposal provides critical fiscal relief for states, localities, tribal nations, and territories. Nicholas Johnson and Victoria Jackson analyzed the proposed, and much-needed, K-12 education funding.

- On housing, Douglas Rice and Ann Oliva outlined how a housing assistance provision would prevent millions of evictions and help people experiencing homelessness.

- On the economy, Chad Stone discussed the package’s important Unemployment Insurance extensions.

- On food assistance, Dottie Rosenbaum, Zoë Neuberger, Brynne Keith-Jennings, and Catlin Nchako detailed how its nutrition provisions would reduce high levels of hunger and hardship and Joseph Llobrera authored a related blog post.

- On family income support, LaDonna Pavetti demonstrated how the plan’s emergency fund for the Temporary Assistance for Needy Families program would help families with the lowest incomes.

We also released pieces touching on other areas of state budgets and taxes, immigration, health, poverty and inequality, the economy, and Social Security.

- On state budgets and taxes, Leachman and Erica Williams reported how states can learn from the Great Recession and adopt forward-looking, antiracist policies.

- On immigration, Shelby Gonzales urged policymakers to quickly implement President Biden’s directive to review the harmful Trump-era “public charge” regulations.

- On health, Katch outlined how the Trump Administration’s last-minute approval of Tennessee’s Medicaid demonstration conflicts with the Biden Administration’s health care goals.

- On poverty and inequality, we updated our fact sheet tracking the COVID-19 recession’s effects on food, housing, and employment hardships.

- On the economy, we updated our chart book tracking the post-Great Recession economy and our backgrounder on how many weeks of unemployment compensation are available.

- On Social Security, we updated our explainer of Supplemental Security Income and our chart book on Social Security Disability Insurance.

Chart of the Week — How the House Economic Package Helps People

A variety of news outlets featured CBPP’s work and experts this past week. Here are some of the highlights:

Congress is moving to lengthen Medicaid coverage for new moms

Washington Post

February 12, 2021

What to know about the latest stimulus plan’s proposed $400 unemployment boost

CNBC

February 11, 2021

The Radically Simple New Approach to Helping Families: Send Parents Money

New York Times

February 9, 2021

Democrats' $3,000 child tax credit idea is about lifting 4 million kids out of poverty

CNN

February 10, 2021

Child Tax Credit: Here’s how the Democrats’ $3,600-per-child plan would work

USA Today

February 9, 2021

More children are going hungry during the coronavirus pandemic

CBS News

February 9, 2021

Food banks struggling to feed hungry during Covid look forward to Biden's fixes to SNAP program

NBC News

February 7, 2021

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.