BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on the Census Bureau’s new poverty, income, and health coverage data for 2015. We also covered the federal budget and taxes, Social Security, and health care.

- On the Census data, we previewed the 2015 figures. Following their release, Robert Greenstein highlighted the fact that poverty, income, and health coverage all improved in the same year for the first time since 1999. He also analyzed the new data, noting the safety net’s important poverty-reducing impact. Danilo Trisi found that safety net programs such as Social Security and SNAP (formerly food stamps) cut the poverty rate nearly in half in 2015. Chuck Marr explained that the Census data underscore the need to help the nation’s poorest age group by expanding the Child Tax Credit for very young poor children. Isaac Shapiro and Arloc Sherman showed that poverty fell and median incomes rose at the essentially the same pace in non-metro areas as in metro areas, correcting some news reports.

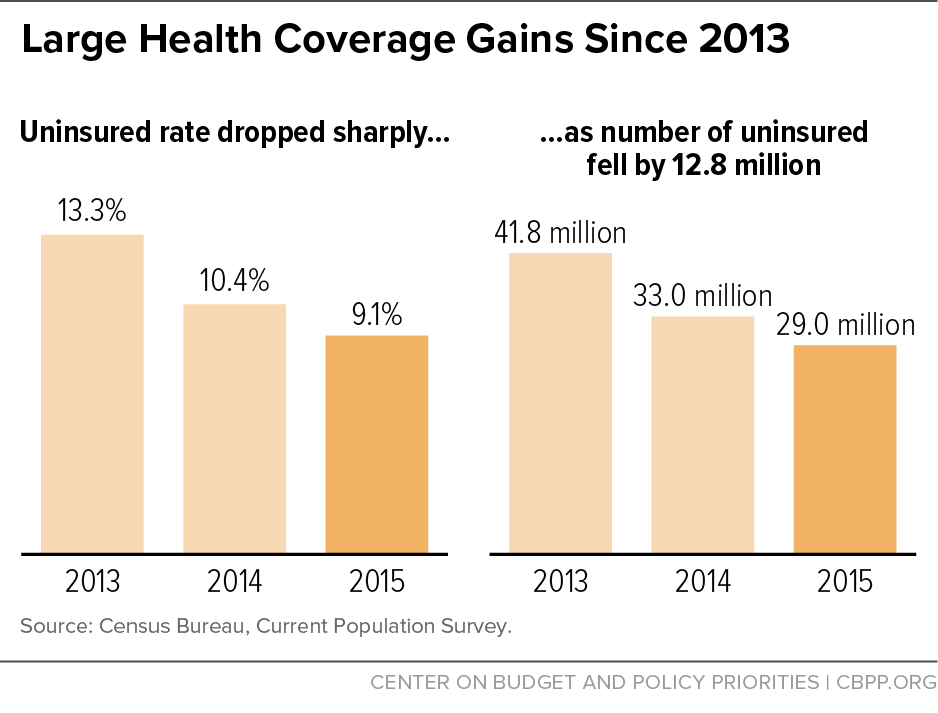

Matt Broaddus charted the large health coverage gains driven by health reform and noted the growing gap between the states that have adopted health reform’s Medicaid expansion and those that haven’t. He and Edwin Park also detailed the Census data on health coverage.

- On the federal budget and taxes, Richard Kogan reported that the decline in CBPP’s long-term debt projections since 2010 mostly reflects slower health care cost growth and lower interest rates. Chad Stone and Chye-Ching Huang cautioned that the Trump campaign’s use of “dynamic scoring” for its tax plan should be taken with more than a grain of salt. Stone explained why Mr. Trump’s expectations for economic growth are unrealistic. Kogan and David Reich showed that Trump’s “Penny Plan” would mean big cuts in domestic programs over time. Chuck Marr and Huang pointed out that the House GOP “Better Way” tax plan would overwhelmingly benefit the highest-income households. We also updated our state fact sheets on the Earned Income Tax Credit and Child Tax Credit.

- On Social Security, Kathleen Romig explained that funding cuts to the Social Security Administration are hurting applicants and beneficiaries in every state.

- On health care, Paul Van de Water cautioned against repealing health reform’s increase in the threshold for deducting medical expenses.

Chart of the week: Large Health Coverage Gains Since 2013

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Donald Trump Promises Tax Cuts, Offset by Robust Growth

Wall Street Journal

September 15, 2016

Obama asks the right question on Trump: ‘Huh?’

Washington Post

September 14, 2016

U.S. Census Report: Household Incomes Rise In 2015

NPR

September 13, 2016

America’s Inequality Problem: Real Income Gains Are Brief and Hard to Find

New York Times

September 13, 2016

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, Instagram, Medium, and YouTube.