BEYOND THE NUMBERS

Update, May 11, 2018: we've updated the graphic.

A bill from Rep. Dennis Ross would allow large rent increases for low-income people assisted through the Housing Choice Voucher and Public Housing programs, including working families, the elderly, and people with disabilities. The great majority of those affected have incomes below the poverty line. As I testified at a recent hearing on the bill, the increases would undermine rental assistance programs that research shows are effective and efficient, would cause hardship and homelessness, and are poorly designed to advance their purported goal of supporting work.

The bill would allow rent increases in two ways:

- For elderly and disabled households (those in which the head or the head’s spouse is elderly or has a disability), it would permit the Department of Housing and Urban Development (HUD) to eliminate income deductions that reduce their rents and to raise the share of their income that they must pay in rent above the current 30 percent, with no limit. The Trump Administration would almost certainly use this authority to eliminate deductions, since its own proposal would do so (in addition to raising tenant rents in other ways). Eliminating deductions would raise rents for virtually every elderly and disabled household in the affected programs, with the largest increases falling on those with high out-of-pocket medical expenses (which now are deductible).

HUD isn’t now seeking to raise the percentage of income that the elderly and people with disabilities must pay in rent, but it proposed to increase it to 35 percent last year and might revive that plan if the Ross bill became law.

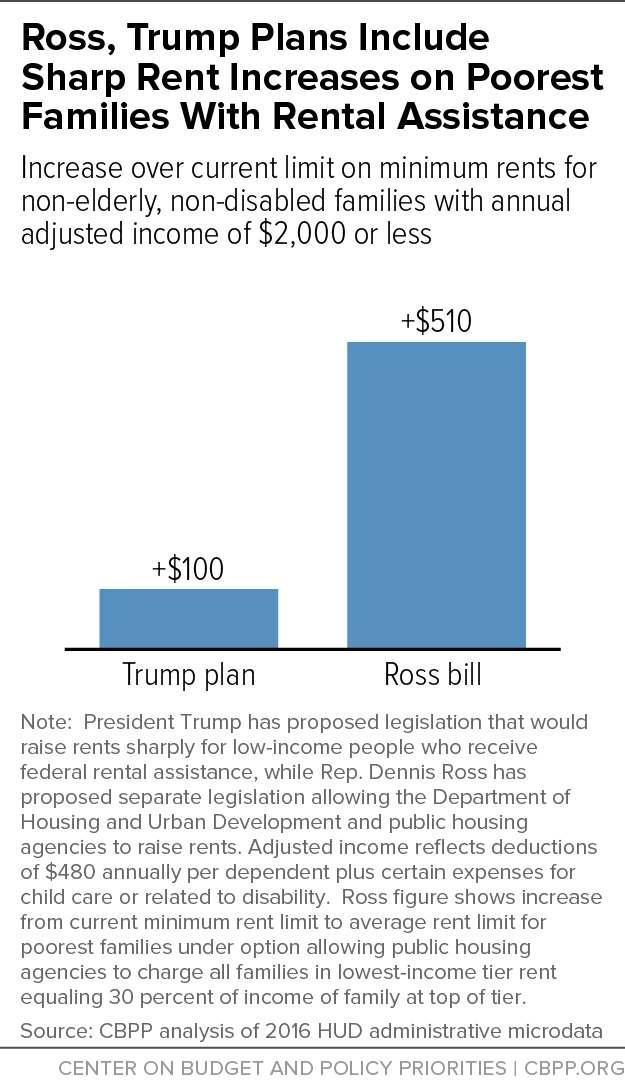

- For non-elderly, non-disabled households, it would allow state and local housing agencies to choose from a menu of alternative rent rules or design their own rules, which would take effect if HUD didn’t disapprove them within 90 days. Several of the alternatives would allow very large rent increases. For example, a “tiered rent” option, would allow agencies to raise rents by a net total of $4.5 billion for the 1.4 million families it could apply to, including by raising the minimum rent for families with little or no income by over $500 a month, on average — far exceeding the Trump plan’s already large rent increase for these families (see graph). Even if housing agencies opted to set rents significantly below the maximum permitted, many families could be placed at risk of eviction and homelessness.

The bill’s proponents claim it would support work, but there’s no evidence it would do so and it could have the opposite effect. That’s because many of its provisions — such as options for agencies to eliminate the deduction for child care expenses and to establish subsidy “cliffs” that would raise rents sharply in response to small increases in earnings — would weaken work incentives. Policymakers who want to help rental assistance recipients succeed in the workforce should focus instead on expanding HUD’s Family Self-Sufficiency program and Jobs Plus initiative, both of which have shown promising results using service coordination and incentives to support work without placing families at risk of hardship.

In addition, the bill would make it difficult and expensive for HUD to provide the monitoring and oversight needed to ensure that taxpayer funds are properly spent, since it would allow each of the nearly 3,800 housing agencies nationwide to choose its own rules for calculating subsidies. This complex patchwork of rules would also make it harder for voucher holders to move from one community to another — including moving to low-poverty neighborhoods with strong schools, which research shows has major long-term benefits for children.

Furthermore, the Ross bill would raise the risk of large cuts to federal rental assistance funding. If it were enacted, proponents of funding cuts would likely claim the bill makes it possible to reduce funding without forcing agencies to assist fewer families or cut back on public housing maintenance and repairs, since the bill would allow housing agencies to shift billions of dollars in costs to low-income tenants by charging them higher rents. (The Administration has similarly claimed that the large rent increases it has proposed would ease the impact of the sharp funding cuts in its budget.) If funding were cut, many housing agencies that didn’t want to raise rents would nevertheless feel compelled to do so.

The Ross bill is also poorly timed. Policymakers enacted substantial bipartisan reforms to rent rules in 2016 that HUD hasn’t yet implemented, and they directed HUD to conduct two major evaluations that will rigorously test most of the alternative policies the bill proposes. Congress shouldn’t consider major further changes to rent rules — let alone changes as harmful and risky as those in the Ross bill — until the recent reforms have had a chance to work and HUD has completed its evaluations.