BEYOND THE NUMBERS

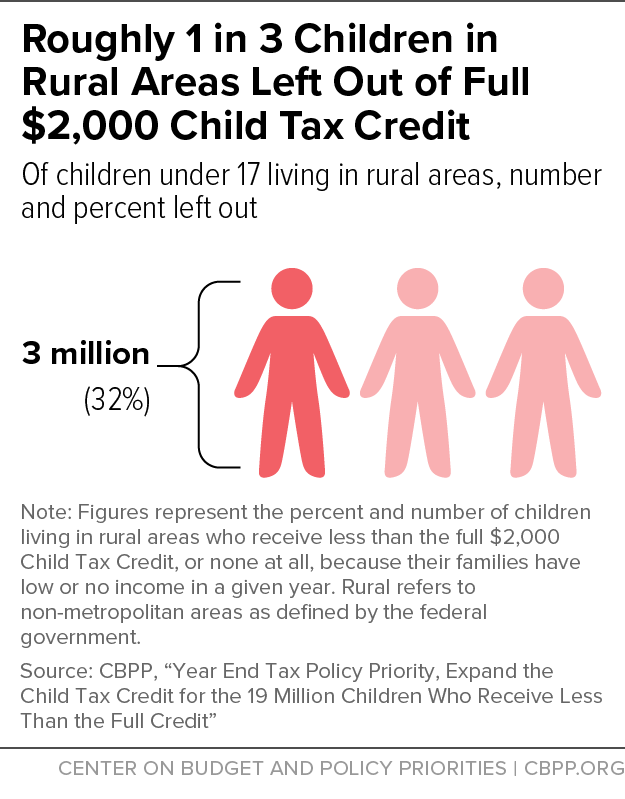

Under current law, an estimated 3 million children living in rural areas are left out of the full $2,000 Child Tax Credit because their families’ incomes are too low. Rural communities would benefit disproportionately from an expansion that makes the credit fully available to children in families with low incomes who currently receive less than the full amount or no credit at all. This crucial investment in children living in rural areas, which includes children of diverse racial and ethnic backgrounds, should be a bipartisan priority during year-end tax negotiations.

Additional income such as an expanded Child Tax Credit can improve children’s health, educational, and economic outcomes. But the credit’s design leaves rural (non-metropolitan) communities at a disadvantage. Under current law, a family with low income sees their Child Tax Credit amount increase as their earnings rise. Pay is generally lower in rural areas, with the median yearly wage for year-round workers roughly 20 percent lower than in metro areas. And, just like families in all parts of the country, there are times when parents living in rural communities are out of work altogether, including during recessions and when illness or injury leaves someone out of work for a period.

Roughly 1 in 3 children under age 17 living in rural areas receive less than the full credit because their families’ incomes are too low (see chart), while about 1 in 4 children living in metro areas don’t receive the full credit.

Children in families with higher incomes (up to $200,000 in households with single parents and up to $400,000 in households with married parents) receive the full value of the Child Tax Credit, while many children in families with low or no earnings are denied some or all of the credit. This upside-down policy gives less help to the children who need it most. Consider, for example:

- A single mother with two children who earns $15,000 working as a home health aide caring for older adults is denied $2,125 of the full Child Tax Credit (receiving just $1,875), while a single parent with two kids and a much higher income (up to $200,000) receives the full $4,000 credit.

- Similarly, a married couple — with one parent earning $27,000 working in a warehouse and the other parent caring for their three young children at home — is denied $2,215 of the full Child Tax Credit for three children, while higher income families receive a full $2,000 per child, or $6,000.

If Congress enables families with low incomes to receive the full credit amount (known as making the credit “fully refundable”), the resulting income boost would help many families in rural communities provide more financial security for their children, including by putting food on the table and paying the rent and utilities.

Children of all races and ethnicities in rural communities have a stake in Congress expanding the Child Tax Credit. Of the estimated 3 million children living in rural communities who are currently left out of the full credit, about 56 percent are white, 15 percent are Black, 18 percent are Latino, 7 percent are American Indian or Alaska Native (AIAN), less than 1 percent are Asian, and 4 percent are another race or multiple races. For each of these groups, higher shares of rural children than metro children are left out of the full credit because their families’ incomes are too low. That is, white children living in rural areas are more likely to be left out of the full credit than white children living in metro areas, just as Black, Latino, AIAN, and Asian children living in rural areas are more likely to be left out of the full credit than Black, Latino, AIAN, and Asian children living in metro areas.

The current Child Tax Credit shortchanges 1 in 3 children living in rural communities. Policymakers should come together to expand the Child Tax Credit in year-end legislation, especially for children in families with low incomes who are currently denied the full credit.

| TABLE 1 | |||

|---|---|---|---|

| Estimated Children Under 17 Left Out of the Full $2,000 Child Tax Credit, by State and Rural or Metro Residence | |||

| Children in rural areas left out | Of children living in rural areas, percent left out | Of children living in metro areas, percent left out | |

| Total U.S. | 3,028,000 | 32% | 26% |

| Alabama | 95,000 | 40% | 32% |

| Alaska | 16,000 | 27% | 17% |

| Arkansas | 95,000 | 39% | 30% |

| California | 46,000 | 31% | 28% |

| Colorado | 32,000 | 23% | 18% |

| Connecticut | 5,000 | 15% | 21% |

| Delaware | N/A | N/A | 25% |

| District of Columbia | N/A | N/A | 33% |

| Florida | 53,000 | 38% | 30% |

| Georgia | 150,000 | 39% | 29% |

| Hawai'i | 18,000 | 31% | 19% |

| Idaho | 37,000 | 26% | 22% |

| Illinois | 78,000 | 27% | 25% |

| Indiana | 88,000 | 27% | 26% |

| Iowa | 57,000 | 21% | 19% |

| Kansas | 53,000 | 26% | 22% |

| Kentucky | 140,000 | 37% | 28% |

| Louisiana | 77,000 | 45% | 36% |

| Maine | 26,000 | 28% | 16% |

| Michigan | 96,000 | 28% | 27% |

| Minnesota | 56,000 | 21% | 17% |

| Mississippi | 152,000 | 43% | 34% |

| Missouri | 109,000 | 34% | 24% |

| Nebraska | 32,000 | 21% | 19% |

| Nevada | 14,000 | 25% | 29% |

| New Hampshire | 17,000 | 20% | 14% |

| New Jersey | N/A | N/A | 21% |

| New Mexico | 61,000 | 39% | 36% |

| New York | 75,000 | 30% | 28% |

| North Carolina | 165,000 | 37% | 28% |

| North Dakota | 15,000 | 17% | 14% |

| Ohio | 146,000 | 30% | 27% |

| Oklahoma | 98,000 | 34% | 29% |

| Oregon | 40,000 | 30% | 22% |

| Pennsylvania | 76,000 | 29% | 25% |

| Rhode Island | N/A | N/A | 24% |

| South Carolina | 68,000 | 45% | 30% |

| South Dakota | 28,000 | 26% | 16% |

| Tennessee | 105,000 | 34% | 31% |

| Texas | 255,000 | 37% | 30% |

| Vermont | 15,000 | 22% | 14% |

| Virginia | 63,000 | 33% | 19% |

| Washington | 44,000 | 30% | 20% |

| West Virginia | 50,000 | 39% | 32% |

| Wisconsin | 62,000 | 21% | 21% |

| Wyoming | 17,000 | 18% | 16% |

Note: Estimates exclude Arizona, Maryland, Massachusetts, Montana, and Utah due to lack of reliable data on metro/non-metro residence.

Source: CBPP estimates based on U.S. Census Bureau’s 2017-2019 American Community Survey (ACS), using 2022 tax parameters and incomes adjusted for inflation to 2022 dollars, and Tax Policy Center. We started with a Tax Policy Center-based estimate of children left out and allocated it to states and metro/non-metro areas using the ACS (column 2); to estimate state-level metro/non-metro population (for calculating columns 3 and 4), we used an average of the 2017-2019 ACS population. For each of the 982 local geographic areas identified in the Census files, we used data from the Missouri Census Data Center on whether the area was metropolitan, non-metropolitan, or a mix; and, if mixed, what share of the population was non-metro under the Office of Management and Budget’s 2015 area definitions.