BEYOND THE NUMBERS

The 2018 government funding bill, which the House and Senate have now passed, doesn’t include enough Internal Revenue Service (IRS) funding. That’s particularly glaring as the IRS starts implementing a new tax law that creates massive new tax avoidance opportunities and will affect virtually every individual and business taxpayer in America.

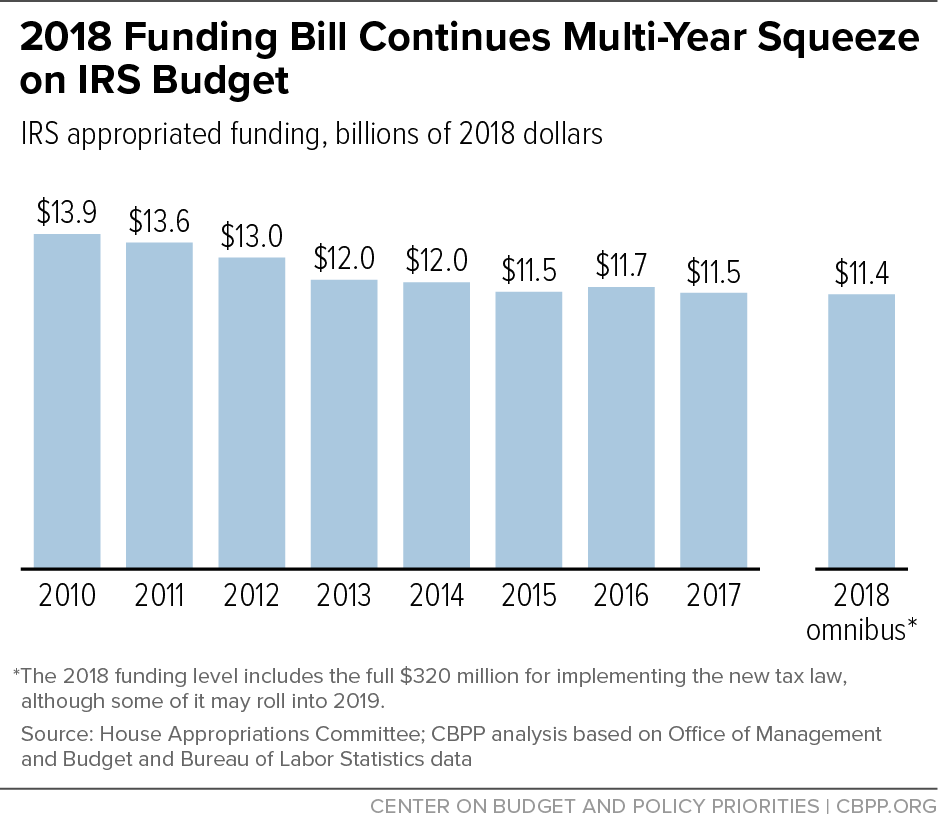

Given some of the law’s features and the hasty way it was crafted, it will likely fuel aggressive efforts by some businesses and wealthy individuals to push the law’s outer limits, and possibly beyond, to minimize their taxes. Despite the once-in-a-generation enforcement challenge that the law poses, the bill leaves enforcement funding at roughly the same level as in 2017 — and down $1.5 billion (23 percent) since 2010 in inflation-adjusted terms.

Deep cuts to IRS enforcement capacity since 2010 magnify the challenge of enforcing the new tax law. Due to funding cuts, IRS has lost roughly 14,000 enforcement employees — more than a quarter of its enforcement staff — since 2010.

Underfunding enforcement is penny-wise and pound-foolish. The Trump Administration has emphasized the need to provide more resources for IRS enforcement — most recently in the President’s 2019 budget, which requested roughly $15 billion more over ten years beyond the annual caps on total discretionary funding to boost enforcement capacity. The Treasury Department estimated that those additional enforcement resources would ultimately generate $4 in revenues for every $1 in expenses and indirectly increase revenues even more by deterring noncompliance. But the bill did not fulfill that request to expand — or even to restore — IRS enforcement capacity.

To implement the new tax law, the IRS will also need to provide extensive guidance to taxpayers, update its systems and forms, and expand customer service. The 2018 funding bill, however, provides just $320 million from 2018 through 2019 for the IRS to implement the law. At the same time, it cuts all other IRS funding by $124 million, leaving overall IRS funding a full $2.5 billion — 18 percent — below the 2010 level, adjusted for inflation. (See chart. We include in the 2018 funding level the full $320 million for implementing the new tax law, although some of it may roll into 2019.)

Policymakers need to recognize the depth of the IRS’s budget and workforce depletion, as well as the multi-year and multi-dimensional nature of the response required to successfully implement and enforce the new tax law. Rather than continue squeezing the agency’s funding, policymakers should give the IRS sufficient resources to perform its core functions of collecting revenues and enforcing the nation’s tax laws.