off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Senate Health, Education, Labor, and Pensions Committee Chairman Lamar Alexander and other lawmakers introduced legislation earlier this week that would reinstate cost-sharing reduction (CSR) payments to insurers and provide federal funding for state reinsurance programs, among other changes. Much discussion has focused on a provision of the bill that would put new restrictions on abortion coverage in private health plans. But there are many other issues with the legislation. By worsening rather than improving affordability for moderate-income consumers, failing to address the greatest outstanding risk to the individual market, and reducing rather than expanding coverage, it fails the basic tests for a market stabilization bill.

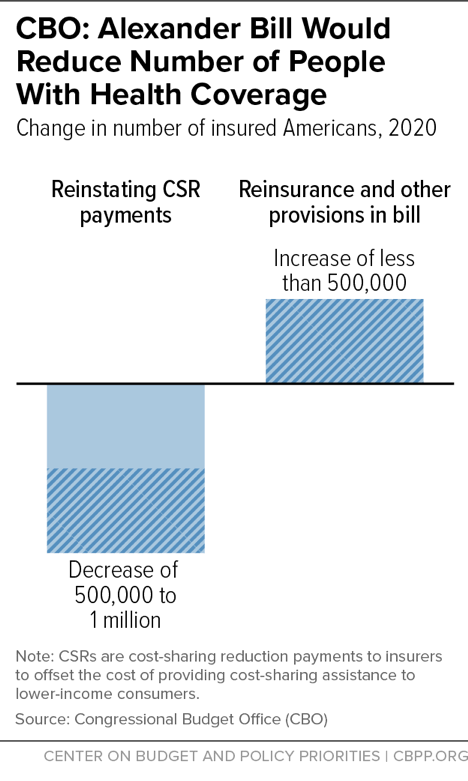

- The bill would increase the number of uninsured Americans, according to the Congressional Budget Office (CBO). One would expect legislation aimed at strengthening the individual market to increase health coverage, and in fact, the bill’s sponsors claimed that it would. Instead, its provision restoring CSR payments to insurers would reduce coverage by 500,000 to 1 million people in 2020 and 2021, CBO estimates, while its other provisions would increase coverage by less than 500,000 per year.

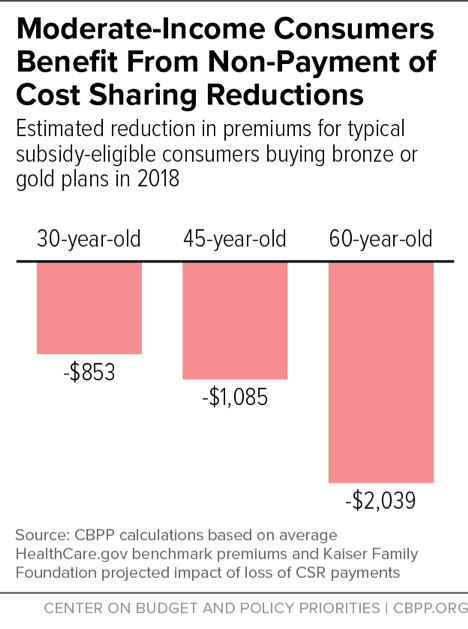

- The bill would increase costs for moderate-income consumers. The Trump Administration’s decision to stop CSR payments last fall ended up increasing the Affordable Care Act’s (ACA) premium tax credits — and thereby reducing premiums, other out-of-pocket costs, or both — for many moderate-income consumers who are eligible for the ACA subsidies. By restoring these payments, the Alexander bill could increase costs for up to 3.3 million HealthCare.gov consumers, in many cases by $1,000 or more per year.

- The reinsurance funding in the bill would be paid for entirely by reduced coverage and higher costs for moderate-income people. By providing funding for state reinsurance programs, the bill would reduce premiums for middle-income people (whose incomes are too high to qualify for subsidies), though not for subsidy-eligible consumers. That reinsurance funding would be offset by the $29 billion in savings from restoring CSR payments. CBO estimates that more than half of those savings come from reducing the number of moderate-income people with health insurance, with the rest from higher costs for people who keep their coverage.

- In fact, middle-income people would gain less in total premium reductions than low-income people would lose in reduced subsidies. The bill provides $30 billion over three years in federal reinsurance funding. But CBO estimates that net federal spending on reinsurance would be only about $20 billion (compared to the $29 billion saved from reducing coverage and raising costs for lower-income consumers), in large part because states would be unable to take full advantage of the reinsurance program in 2019 and would instead rely on the bill’s federal “fallback” approach. CBO further concludes that the premium savings for middle-income consumers would be less than the total federal resources available for reinsurance, because insurers would not fully pass the savings on to consumers.

- The design of the bill’s reinsurance program means that people in much of the country wouldn’t benefit. The bill includes a federal “fallback” reinsurance program only for 2019; in 2020 and 2021, its reinsurance funding would reduce premiums only in states that set up their own reinsurance programs. CBO estimates that about 40 percent of individual market consumers in 2020 (and 20 percent in 2021) would live in states where the bill’s reinsurance program would have no impact on premiums.

- The bill’s reinsurance proposal also drops a protection that an earlier bill included for people with pre-existing conditions. While the bill borrows most of its reinsurance proposal from earlier legislation introduced by Senators Susan Collins and Bill Nelson, it drops a provision requiring that state reinsurance programs maintain the ACA’s “single risk pool” protections. That provision was meant to preclude states from using federal reinsurance funding to set up old-style “high-risk pools.” Pre-ACA high-risk pools segregated people with pre-existing conditions in separate markets and had a track record of high premiums, unaffordable coverage, and limited benefits.

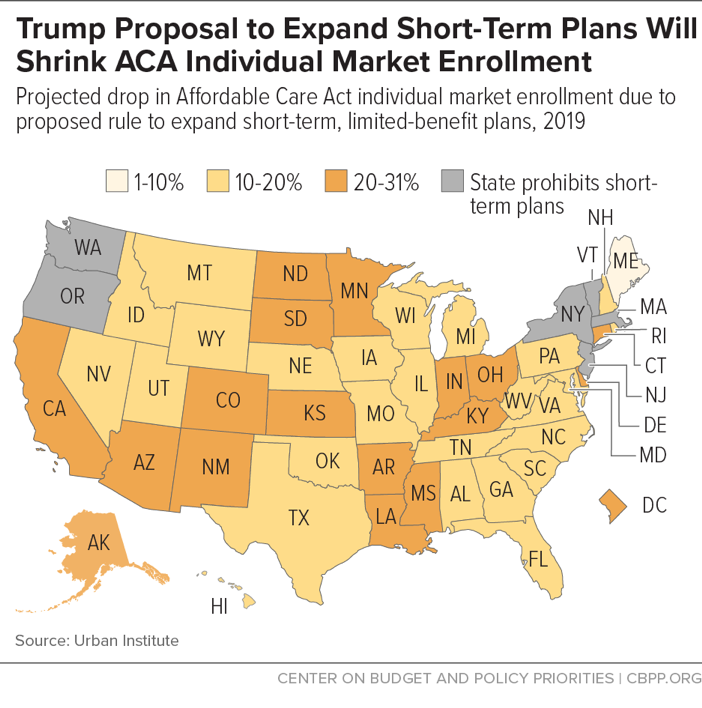

- The bill does nothing to address the harm to people with pre-existing conditions and the risks to individual market stability from the Trump Administration’s short-term plans rule. The proposed short-term plans rule would let insurers sell “short-term” plans lasting nearly one year that are exempt from the ACA’s consumer protections, including the prohibition on discrimination based on pre-existing conditions and the requirement to cover essential health benefits like maternity care and mental health and substance use disorder treatment. The rule would pull 2.1 million consumers out of the ACA individual market, the Urban Institute estimates, shrinking the market by almost 20 percent in affected states and worsening the risk pool, which would sharply increase costs for people with pre-existing conditions. The rule also creates tremendous uncertainty for insurers, threatening insurer participation and consumer choice.

- In fact, the bill could worsen the damage from short-term plans, by raising doubts about states’ ability to protect their own markets. The bill includes a concerning, ambiguous provision addressing state regulation of short-term plans. The provision isn’t needed to give states authority to regulate these plans – they already have it. Instead, some legal experts believe the new provision could be read to pre-empt states’ ability to block these plans or set limits and standards for them that are tougher than federal rules.

Topics:

Policy Basics

Health

Report

Individual Market Stabilization Proposals Should Avoid Raising Costs for Consumers

March 9, 2018

Blog

Policymakers Should Craft Reinsurance Proposals to Lower Premiums, Help More People

February 8, 2018

Stay up to date

Receive the latest news and reports from the Center