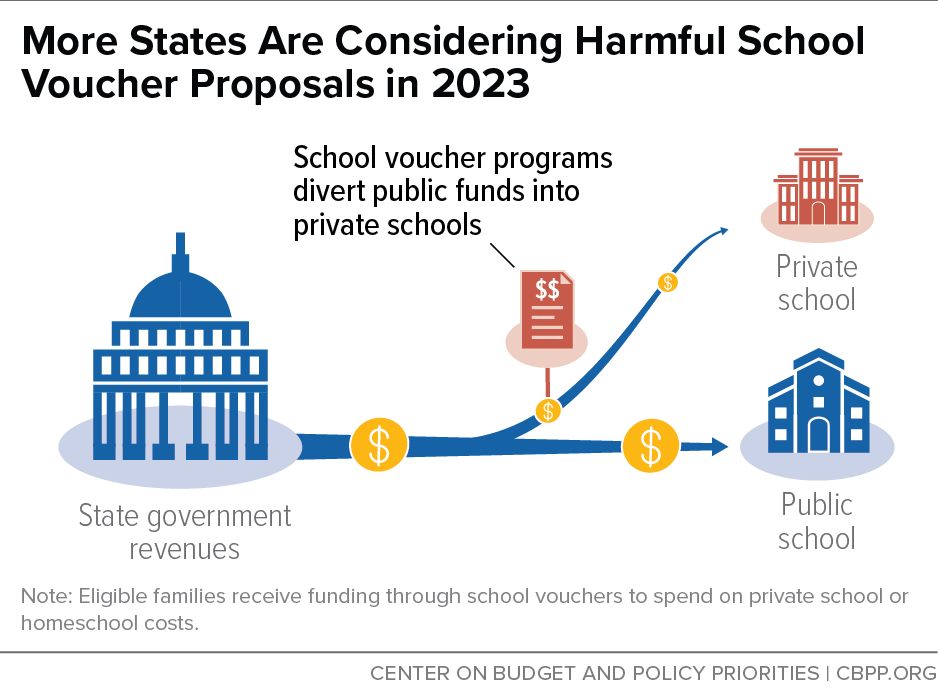

State Policymakers Should Reject K-12 School Voucher Plans

Proposals Would Undermine Public Schools

End Notes

[1] Anya Kamenetz, “The education culture war is raging. But for most parents, it’s background noise,” National Public Radio, April 29, 2022, https://www.npr.org/2022/04/29/1094782769/parent-poll-school-culture-wars; and Edward Graham, “Educators Push Back Against School Vouchers Legislation,” National Education Association, February 17, 2022, https://www.nea.org/advocating-for-change/new-from-nea/educators-push-back-against-school-voucher-legislation.

[2] Michael Leachman et al., “Advancing Racial Equity With State Tax Policy,” CBPP, November 15, 2018, https://www.cbpp.org/research/state-budget-and-tax/advancing-racial-equity-with-state-tax-policy; Sequoia Carrillo and Pooja Salhotra, “The U.S. student population is more diverse, but schools are still highly segregated,” NPR, July 14, 2022, https://www.npr.org/2022/07/14/1111060299/school-segregation-report.

[3] Chris Ford, Stephanie Johnson, and Lisette Partelow, “The Racist Origins of Private School Vouchers,” Center for American Progress, July 12, 2017, https://cdn.americanprogress.org/content/uploads/2017/07/12184850/VoucherSegregation-brief2.pdf.

[4] Briana Jones and Laura Goren, “Don’t Repeat Virginia’s History of Divesting from Public Schools,” The Commonwealth Institute, March 1, 2023, https://thecommonwealthinstitute.org/the-half-sheet/dont-repeat-virginias-history-of-divesting-from-public-schools/.

[5] CBPP, “State Budgets Basics,” revised May 24, 2022, https://www.cbpp.org/research/state-budget-and-tax/state-budgets-basics.

[6] Mary McKillip and Norin Dollard, “Florida’s Hidden Voucher Expansion: Over $1 Billion from Public Schools to Fund Private Education,” Florida Policy Institute and Education Law Center, September 2022, https://uploads-ssl.webflow.com/5cd5801dfdf7e5927800fb7f/6329b85d1c60404f4b2897e2_2022_ELC_REPORT_final.pdf.

[7] Adrienne Fischer, Chris Duncombe, and Eric Syverson, “50-State Comparison: K-12 and Special Education Funding,” Education Commission of the States, October 13, 2021, https://www.ecs.org/50-state-comparison-k-12-and-special-education-funding/.

[8] Stephen Owens, “School Vouchers: Myth vs. Fact,” Georgia Budget and Policy Institute, March 5, 2021, https://gbpi.org/school-vouchers-myth-vs-fact/; and Common Good Iowa, “The voucher diversion: How it works,” January 2023, 230119__Fact_sheet__Vouchers_056C4C55DC5D5.pdf (commongoodiowa.org).

[9] Samuel Abrams and Steven Koutsavlis, “The Fiscal Consequences of Private School Vouchers,” The Southern Poverty Law Center, Education Law Center, and Public Funds Public Schools, March 2023, https://pfps.org/assets/uploads/SPLC_ELC_PFPS_2023Report_Final.pdf.

[10] Howard Fischer, “Most applying for Arizona’s vouchers already go to private schools,” Arizona Daily Star, updated November 1, 2022, https://tucson.com/news/local/education/most-applying-for-arizona-vouchers-already-go-to-private-schools/article_34d75b9a-2968-11ed-812b-f7dad22200b5.html.

[11] Ethan Dewitt, “Most education freedom account recipients not leaving public schools, department says,” New Hampshire Bulletin, March 28, 2022, https://newhampshirebulletin.com/briefs/most-education-freedom-account-recipients-not-leaving-public-schools-department-says/.

[12] Edgar Mendez, “75% of state voucher program applicants already attend private school,” Milwaukee Journal Sentinel, May 20, 2014, https://archive.jsonline.com/news/education/75-of-state-voucher-program-applicants-already-attend-private-school-b99274333z1-259980701.html/.

[13] Blythe Bernhard and Jack Suntrup, “Missouri lawmakers look to expand tax-credit voucher program mostly serving religious schools,” St. Louis Post-Dispatch, January 15, 2023, https://www.stltoday.com/news/local/education/missouri-lawmakers-look-to-expand-tax-credit-voucher-program-mostly-serving-religious-schools/article_ef0b7afb-6805-586b-a668-67b2d10ecd64.html.

[14] Carl Davis, “Tax Avoidance Continues to Fuel School Privatization Efforts,” Institute on Taxation and Economic Policy,” March 3, 2023, https://itep.org/tax-avoidance-fuels-school-vouchers-privatization-efforts/; and Linda Sugin, ”Tax Benefits and Fairness in K-12 Education, Georgetown Law Journal, 140, March 3, 2023, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4377638.

[15] Josephine Lee, “Pawns in the Voucher Scheme,” Texas Observer, February 7, 2023, https://www.texasobserver.org/voucher-program-arizona-privitization-public-schools-disabilities/.

[16] Carl Davis, op. cit.

[17] Bryce Shreve and Amber Smith, “Kentucky Supreme Court unanimously strikes down school choice law,” Spectrum News, updated December 15, 2022, https://spectrumnews1.com/ky/louisville/news/2022/12/15/kentucky-supreme-court-school-choice-ruling.

[18] Sylvia Allegretto, “The teacher pay penalty has hit a new high,” Economic Policy Institute, August 16, 2022, https://www.epi.org/publication/teacher-pay-penalty-2022/.

[19] Abrams and Koutsalvis, op cit.

[20] Norín Dollard and Mary McKillip, “The Cost of Universal Vouchers: Three Factors to Consider in Analyzing Fiscal Impacts of CS/HB 1,” Florida Policy Institute and Education Law Center, March 1, 2023, https://www.floridapolicy.org/posts/the-cost-of-universal-vouchers-three-factors-to-consider-in-analyzing-fiscal-impacts-of-cs-hb-1.

[21] Ryan Dailey, “Florida House says school voucher plan would cost $209 million next year. Critics disagree – by billions,” South Florida Sun-Sentinel, February 23, 2023, https://www.sun-sentinel.com/news/politics/fl-ne-nsf-florida-school-vouchers-cost-millions-20230223-zbuhjj7jp5da3lcmvwcuq66m7i-story.html.

[22] Adopt the Opportunity Scholarships Act of 2023, LB 753, https://www.nebraskalegislature.gov/bills/view_bill.php?DocumentID=50326.

[23] Texas Parental Empowerment Act of 2023, SB 176, https://capitol.texas.gov/BillLookup/History.aspx?LegSess=88R&Bill=SB176.

[24] Texas Senate Bill 1474 of 2023, https://capitol.texas.gov/BillLookup/Text.aspx?LegSess=88R&Bill=SB1474.

[25] Kansas State Education Budget for Fiscal Year 2024, SB 83, http://www.kslegislature.org/li/b2023_24/measures/sb83/.

[26] Andrew Bahl and Jason Tidd, “Laura Kelly’s budget boosts special education funding, state worker pay. Here’s what to know,” Topeka Capital-Journal, January 12, 2023, https://www.cjonline.com/story/news/state/2023/01/12/gov-laura-kelly-kansas-republicans-to-face-off-over-state-budget/69782467007/.

[27] Students First Act of 2023, HF 68, https://www.legis.iowa.gov/legislation/BillBook?ga=90&ba=HF68.

[28] Funding for Teacher Salaries and Optional Education Opportunities Act of 2023, HB 215, https://le.utah.gov/~2023/bills/static/HB0215.html.

[29] LEARNS Act of 2023, SB 294, https://www.arkleg.state.ar.us/Bills/Detail?id=SB294&chamber=Senate&ddBienniumSession=2023%2F2023R.

[30] Austin Bailey, “Arkansas LEARNS omnibus education and voucher bill zooms through committee despite questions, could become law within days,” Arkansas Times, February 22, 2023, https://arktimes.com/arkansas-blog/2023/02/22/sen-breanne-davis-presents-omnibus-education-bill-says-educators-and-opponents-lied-about-it.

[31] AP News, “New Arizona governor wants to undo school voucher expansion,” January 13, 2023, https://apnews.com/article/politics-doug-ducey-katie-hobbs-arizona-phoenix-a34be626074ef4d4ded987f841ff9aa8.

[32] Jovanka Palacios, “From Idaho To Texas: Voucher’s Rocky Road to Nowhere,” March 1, 2023, https://www.reformaustin.org/texas-legislature/from-idaho-to-texas-vouchers-rocky-road-to-nowhere/.

[33] Bayliss Fiddiman and Jessica Yin, “The Danger Private School Voucher Programs Pose to Civil Rights,” Center for American Progress, May 13, 2019, https://www.americanprogress.org/article/danger-private-school-voucher-programs-pose-civil-rights/.

[34] National Coalition for Public Education, “Vouchers Do not Adequately Service Students with Disabilities,” https://www.ncpecoalition.org/students-with-disabilities.

[35] Tawnell Hobbs, “Do School Vouchers Work? Milwaukee’s Experiment Suggests an Answer,” Wall Street Journal, January 28, 2018, https://www.wsj.com/articles/do-school-vouchers-work-milwaukees-experiment-suggests-an-answer-1517162799.

[36] Jose DelReal and Emma Brown, “Where school choice isn’t an option, rural public schools worry they’ll be left behind,” Washington Post, https://www.washingtonpost.com/national/where-school-choice-isnt-an-option-rural-public-schools-worry-theyll-be-left-behind/2017/02/10/03e7146a-ef23-11e6-9973-c5efb7ccfb0d_story.html; and Brian Lopez, “Texas Republicans are trying to sell school choice measures, but rural conservatives aren’t buying,” Texas Tribune, August 8, 2022, https://www.texastribune.org/2022/08/08/texas-school-choice-legislation/.

[37] American Civil Liberties Union, “Florida Department of Education Complaint on Behalf of Clinton Stanley Jr.” updated December 6, 2018, https://www.aclu.org/cases/florida-department-education-complaint-behalf-clinton-stanley-jr.

[38] Rebecca Klein, “These Schools Get Millions of Tax Dollars To Discriminate Against LGBTQ Students,” HuffPost, updated December 16, 2017, https://www.huffpost.com/entry/discrimination-lgbt-private-religious-schools_n_5a32a45de4b00dbbcb5ba0be.

[39] Rob O’Dell, “Arizona Prop. 305 to expand school vouchers defeated,” Arizona Central, updated November 7, 2018, https://www.azcentral.com/story/news/politics/elections/2018/11/06/arizona-prop-305-results-voters-decide-school-vouchers/1809291002/.

[40] Cortney Tanner, “Controversial Utah voucher bill passes final vote. What’s next?” Salt Lake Tribune, January 26, 2023, https://www.sltrib.com/news/education/2023/01/26/controversial-utah-voucher-bill/.

[41] Utah Code 204-7-102, https://vote.utah.gov/instructions-for-a-statewide-referendum/.

[42] C. Kirabo Jackson, Rucker Johnson, and Claudia Persico, “The Effects of School Spending on Educational and Economic Outcomes: Evidence from School Finance Reforms,” National Bureau of Economic Research, January 2015, https://www.nber.org/system/files/working_papers/w20847/w20847.pdf; and Jennifer Ma, Matea Pender, and Meredith Welch, ”Education Pays 2019: The Benefits of Higher Education for Individuals and Society,” College Board, 2019, https://research.collegeboard.org/media/pdf/education-pays-2019-full-report.pdf.

[43] CBPP, “State Revenue Options for Advancing Equity and Prosperity,” https://www.cbpp.org/research/state-budget-and-tax/state-revenue-options-for-advancing-equity-and-prosperity.

[44] Iris Hinh, “State Must Address K-12 Unfinished Learning for an Equitable Recovery,” CBPP, March 18, 2022, https://www.cbpp.org/blog/states-must-address-k-12-unfinished-learning-for-an-equitable-recovery.