- Home

- Poverty And Inequality

- New Data: Millions Struggling To Eat And...

New Data: Millions Struggling to Eat and Pay Rent

Joblessness Continues to Affect Tens of Millions

"These data underscore the urgent need for federal policymakers to agree on further robust relief measures."

Millions of households are having serious trouble affording food and are falling behind on the rent, the Census Bureau’s Household Pulse Survey for September 2-14 shows. Twenty-three million adults reported that their household didn’t get enough to eat, and an estimated 1 in 4 renters with children lived in a household that was behind on rent. Also, data for August show that some 35 million people — including 9 million children — either met the federal definition of “unemployed” (which understates the actual number of jobless workers) or lived with an unemployed family member, according to Census’ latest Current Population Survey.

These data underscore the urgent need for federal policymakers to agree on further robust relief measures. The measures enacted earlier this year — such as expanded unemployment benefits and stimulus payments — mitigated hardship but were temporary and had significant shortcomings. Without a new relief package, hardship likely will rise and grow more severe, endangering children’s long-term health and educational outcomes.

Data Show Widespread Food, Housing Hardships

Food Hardship

Millions of people live in households with serious difficulty getting enough to eat, the latest Household Pulse data show, with rates of food hardship sharply above pre-crisis levels:

- About 23 million adults — 10.5 percent of all adults — reported that their household sometimes or often had “not enough to eat” in the last seven days. This was several times the pre-pandemic rate: a recent survey released by the Agriculture Department found that 3.7 percent of adults reported that their household had “not enough to eat” over the full 12 months of 2019.[1]

- When asked why, 80 percent said they “couldn’t afford to buy more food,” rather than (or in addition to) non-financial factors such as lack of transportation or safety concerns due to the pandemic.

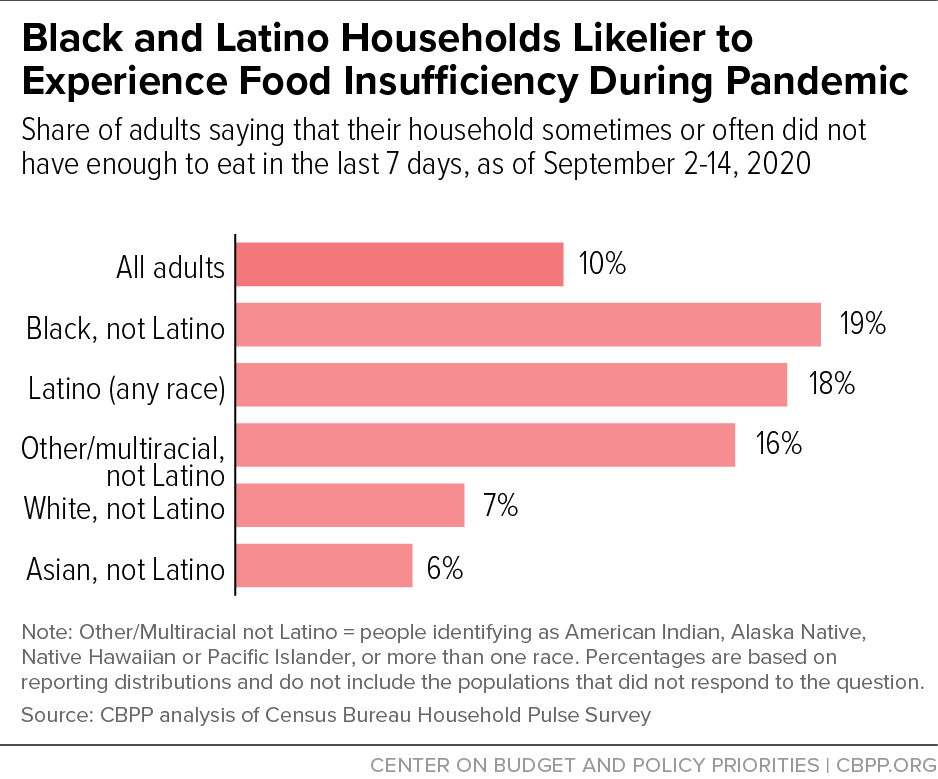

- Black and Latino adults were more than twice as likely to report that their household didn’t get enough to eat (19 percent for Black respondents and 18 percent for Latino respondents) as white respondents (7 percent). (See Figure 1.)

- Adults in households with children were likelier to report that the household didn’t get enough to eat: 14 percent, compared to 8 percent for households without children.

- Some 9 to 14 percent of adults with children reported that their children sometimes or often didn’t eat enough in the last seven days because they couldn’t afford it, well above the pre-pandemic figure. Households typically first scale back on food for adults before cutting back on what children have to eat. (The range reflects the different ways to measure food hardship in the Household Pulse Survey.)

Table 1 includes state-by-state data on the number of adults reporting that their household didn’t get enough to eat and the number of adults reporting that the children in their household weren’t getting enough to eat. (To improve reliability, these data are averaged over the survey done in late August and the most recent survey done in September.)

The Census Bureau released more detailed data from the Pulse survey collected in August 19-31. Analysis of those data shows that between 7 and 11 million children live in a household where children did not eat enough because the household couldn’t afford it. Note that the Household Pulse Survey was designed to provide data on adult well-being, not precise counts of children, so these figures are approximations.

Families are struggling to afford food for a variety of reasons, including loss of jobs and income, higher food prices, inadequate food assistance benefits, and higher costs because children are home and missing out on meals at school and child care programs. While some school-aged children attending schools with in-person instruction have regained access to on-site school meals, many other children have not, including those too young for school and those whose schools rely on remote instruction. The government funding bill passed by the House yesterday includes important provisions to extend and expand school meal replacement benefits (Pandemic EBT) and extend flexibilities in SNAP, WIC, and school meals. These are important steps, but Congress needs to do more to provide comprehensive relief to the millions of Americans struggling to make ends meet.

The Families First Coronavirus Response Act provided temporary increases in SNAP benefits that have helped many families, but the poorest 40 percent of SNAP households, including at least 5 million children, were left out of this increase in benefits, leaving them particularly vulnerable to food hardships.

Housing Hardship

The Household Pulse data also show that millions are behind on rent. Unfortunately, there are two concerns with the housing questions. First, the Census Bureau changed the wording of the question starting with the late-August survey, making the results non-comparable to earlier weeks of the Pulse survey. Second, a large share of Pulse survey respondents chose not to answer the housing questions in the latest survey. This “non-response” is higher among groups that are younger, have lower levels of education, and identify as Black or Latino — groups that are more likely to struggle to afford rent due to longstanding inequities that often stem from structural racism in education, employment, and housing. For these reasons, the Pulse data likely understate the number of people behind on rent.

Even with these issues, however, the data indicate that millions are having difficulty paying rent:

- One in 6 adult renters — or 17 percent — reported that they lived in a household that was not caught up on rent. That translates to roughly 13 million renters after adjusting for underreporting in the Pulse survey.[2]

- Renters of color were more likely to report that their household was not caught up on rent: about 1 in 4 Black (25 percent) and Asian (24 percent) renters and 1 in 5 Latino (22 percent) renters said they were not caught up on rent, compared to just 1 in 9 white (12 percent) renters.

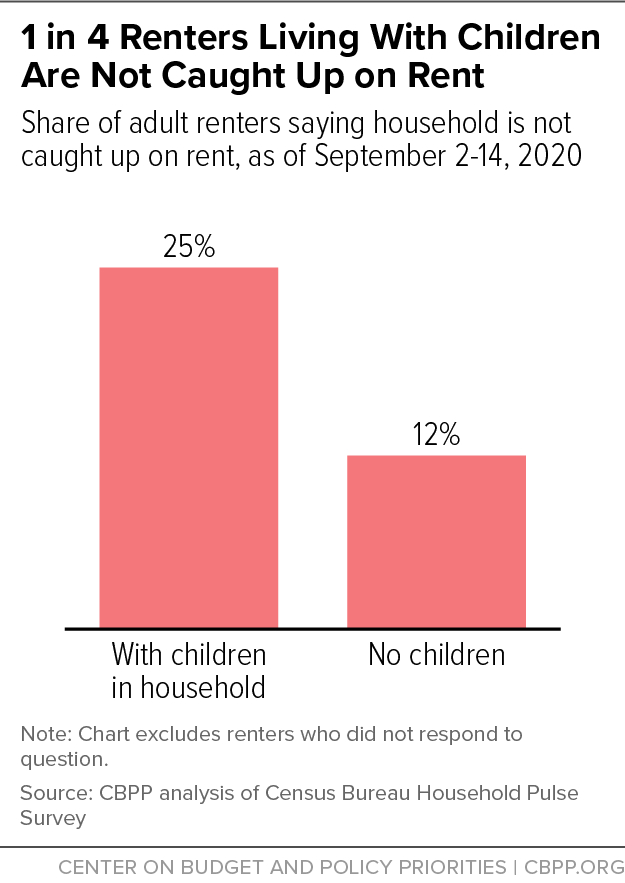

- Households with children were twice as likely to be facing challenges paying rent than households without children. Some 25 percent of renters who are parents or otherwise live with children are not caught up on rent, compared to 12 percent of adults not living with anyone under age 18. (See Figure 2.)

The Centers for Disease Control and Prevention has imposed a temporary moratorium on evictions, but this largely postpones (rather than prevents) evictions because it doesn’t provide struggling households with rental assistance. When the moratorium expires at the end of December, households will still owe back rent and associated late fees, putting them at serious risk of eviction, unless policymakers reach an agreement on a relief package that provides rental assistance.

Job Loss

Data from the Census Bureau’s monthly Current Population Survey released September 9 provide more detail on job losses between February and August:

- Some 35 million people either met the official definition of “unemployed” (meaning they actively looked for work in the last four weeks or were on temporary layoff) or lived with an unemployed family member in August. This figure includes 9 million children.

- The official definition of “unemployed” leaves out some workers sidelined by the crisis, such as those who are absent from their jobs without pay and jobless workers who want to work but aren’t currently looking for work (including people who have health concerns, are sick or caring for a sick relative, or need to care for their children because school or child care is closed). If we also include the family members of these workers, as many as 61 million people, or nearly 1 in 5 people in the country, live in families with a sidelined worker.

- Job losses are heavily concentrated among workers in low-paid industries and among workers who do not have a four-year college degree.[3] For example, the number of people aged 25 and over with a job fell by 2.5 percent between February and August for those with a four-year college degree, but by 10.9 percent for those with a high school diploma who lacked any college education. Because lower-paid workers use most of their earnings to pay the bills, these workers entered the crisis with lower savings that they can use to weather the crisis than higher-income workers did.

Despite continued high unemployment, the $600 federal supplement to weekly unemployment benefits expired in July, and the President’s executive action to extend a $300 weekly benefit was only in place for a handful of weeks due to lack of funding.

| TABLE 1 | ||||

|---|---|---|---|---|

| High Shares of Households Report Difficulty Getting Enough Food | ||||

|

Among adults; data collected August 19 to September 14. How to read this table: In the United States, over 22 million adults reported that their household sometimes or often didn’t have enough to eat in the last seven days. This represents 10 percent of all adults in the country. Over 11 million adults living with children reported that “the children were not eating enough because we just couldn’t afford enough food.” This represents 14 percent of adults living with children. |

||||

| Adults Reporting That Household Didn’t Have Enough to Eat | Adults Reporting That Children in Household Weren’t Eating Enough Because Couldn’t Afford Enough | |||

| State | Number | As a Percent of Adults | Number | As a Percent of Adults Living with Children |

| United States | 22,632,000 | 10% | 11,815,000 | 14% |

| Alabama | 434,000 | 14% | 214,000 | 17% |

| Alaska | 48,000 | 10% | 23,000 | 12% |

| Arizona | 526,000 | 11% | 269,000 | 15% |

| Arkansas | 228,000 | 11% | 110,000 | 14% |

| California | 2,814,000 | 11% | 1,746,000 | 16% |

| Colorado | 353,000 | 9% | 149,000 | 10% |

| Connecticut | 228,000 | 10% | 116,000 | 13% |

| Delaware | 67,000 | 10% | 36,000 | 16% |

| District of Columbia | 67,000 | 13% | 32,000 | 21% |

| Florida | 1,988,000 | 13% | 941,000 | 17% |

| Georgia | 728,000 | 11% | 475,000 | 17% |

| Hawai’i | 78,000 | 8% | 54,000 | 15% |

| Idaho | 91,000 | 7% | 37,000 | 8% |

| Illinois | 979,000 | 12% | 499,000 | 15% |

| Indiana | 483,000 | 11% | 232,000 | 13% |

| Iowa | 164,000 | 8% | 68,000 | 9% |

| Kansas | 196,000 | 10% | 95,000 | 13% |

| Kentucky | 364,000 | 12% | 141,000 | 13% |

| Louisiana | 424,000 | 14% | 214,000 | 18% |

| Maine | 63,000 | 7% | 24,000 | 8% |

| Maryland | 355,000 | 9% | 246,000 | 16% |

| Massachusetts | 383,000 | 8% | 195,000 | 12% |

| Michigan | 613,000 | 9% | 259,000 | 11% |

| Minnesota | 257,000 | 7% | 150,000 | 11% |

| Mississippi | 294,000 | 16% | 121,000 | 15% |

| Missouri | 400,000 | 10% | 167,000 | 11% |

| Montana | 49,000 | 7% | 32,000 | 12% |

| Nebraska | 109,000 | 9% | 58,000 | 12% |

| Nevada | 234,000 | 11% | 129,000 | 17% |

| New Hampshire | 61,000 | 6% | 20,000 | 6% |

| New Jersey | 601,000 | 10% | 288,000 | 13% |

| New Mexico | 172,000 | 12% | 91,000 | 16% |

| New York | 1,264,000 | 10% | 751,000 | 16% |

| North Carolina | 739,000 | 10% | 351,000 | 13% |

| North Dakota | 37,000 | 7% | 26,000 | 13% |

| Ohio | 847,000 | 11% | 356,000 | 13% |

| Oklahoma | 325,000 | 13% | 168,000 | 16% |

| Oregon | 261,000 | 9% | 112,000 | 11% |

| Pennsylvania | 683,000 | 8% | 344,000 | 12% |

| Rhode Island | 86,000 | 12% | 33,000 | 14% |

| South Carolina | 343,000 | 10% | 160,000 | 12% |

| South Dakota | 45,000 | 8% | 26,000 | 12% |

| Tennessee | 538,000 | 12% | 274,000 | 17% |

| Texas | 2,128,000 | 12% | 1,281,000 | 16% |

| Utah | 122,000 | 6% | 73,000 | 8% |

| Vermont | 19,000 | 4% | 11,000 | 8% |

| Virginia | 489,000 | 9% | 263,000 | 12% |

| Washington | 374,000 | 7% | 156,000 | 8% |

| West Virginia | 133,000 | 11% | 37,000 | 9% |

| Wisconsin | 309,000 | 8% | 139,000 | 10% |

| Wyoming | 38,000 | 10% | 20,000 | 14% |

Note: Figures are a two-week average. In the latest one-week data, 10.5 percent of all adults reported that their household “sometimes” or “often” in the last seven days had “not enough to eat,” while 14.3 percent of adults living with children reported that the children sometimes or often in the last seven days were “not eating enough because we just couldn't afford enough food.” As recommended by the Census Bureau, percentages exclude persons not replying to the question.

Source: Calculated by Center on Budget and Policy Priorities from Census Bureau’s Household Pulse Survey published tables “food2b,” “food3b,” and “food5,” for survey weeks 13 and 14; https://www.census.gov/programs-surveys/household-pulse-survey/data.html

Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships

SNAP Benefit Boost Would Get Needed Food Aid to the Poorest Participants, Who Have Been Left Out

End Notes

[1] Brynne Keith-Jennings, “Food Need Very High Compared to Pre-Pandemic Levels, Making Relief Imperative,” CBPP, September 10, 2020, https://www.cbpp.org/blog/food-need-very-high-compared-to-pre-pandemic-levels-making-relief-imperative.

[2] The latest Pulse survey estimates that 9.8 million adults are in households not caught up on rent. To adjust for non-response in the survey, we apply the share not caught up on rent, 17.4 percent, to the total number of adult renters, 73 million, in the March 2020 Current Population Survey to calculate an adjusted estimate.

[3] Chad Stone, “6 Signs That the Labor Market Remains in Deep Trouble,” CBPP, September 4, 2020, https://www.cbpp.org/blog/6-signs-that-the-labor-market-remains-in-deep-trouble.

More from the Authors

Areas of Expertise

Areas of Expertise

Areas of Expertise

Areas of Expertise

Recent Work: