Republican Leaders’ Tax Plan Would Deliver Large Tax Cuts to the Wealthiest Americans Even if It Doesn’t Cut the Top Rate

End Notes

[1] U.S. Department of the Treasury, “Unified Framework for Fixing Our Broken Tax Code,” September 27, 2017, https://www.treasury.gov/press-center/press-releases/Documents/Tax-Framework.pdf.

[2] Lindsey McPherson, “Tax Bill Will Include 4th Tax Bracket on High-Income Earners, Ryan Says,” Roll Call, October 20, 2017, https://www.rollcall.com/news/politics/tax-bill-will-include-4th-tax-bracket-on-high-income-earners-ryan-says/?utm_source=news-alert&utm_medium=email&utm_campaign=newsletters.

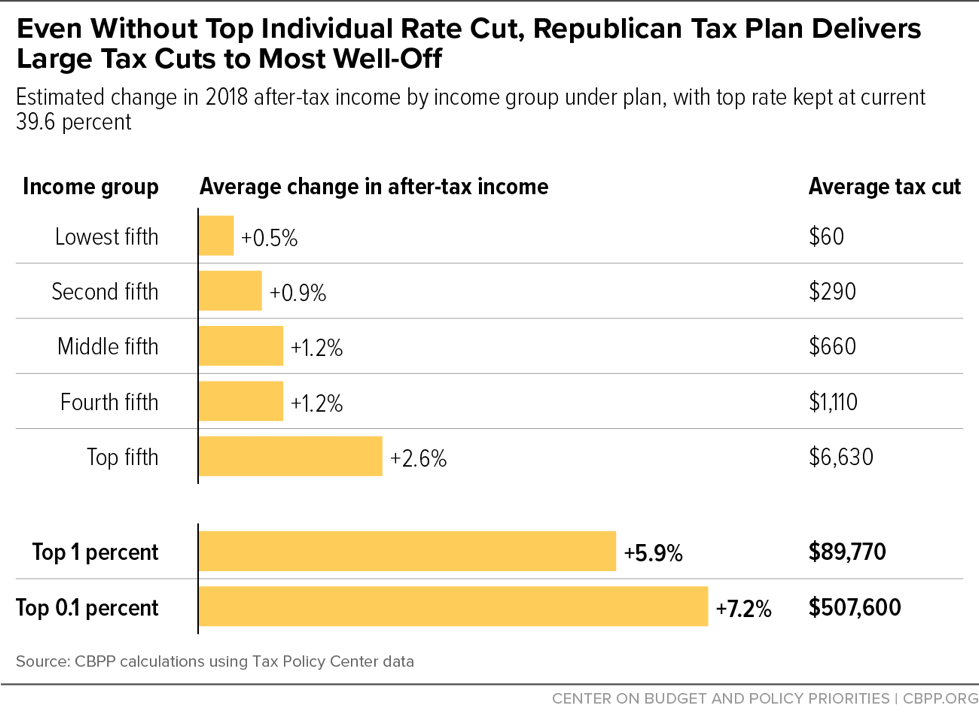

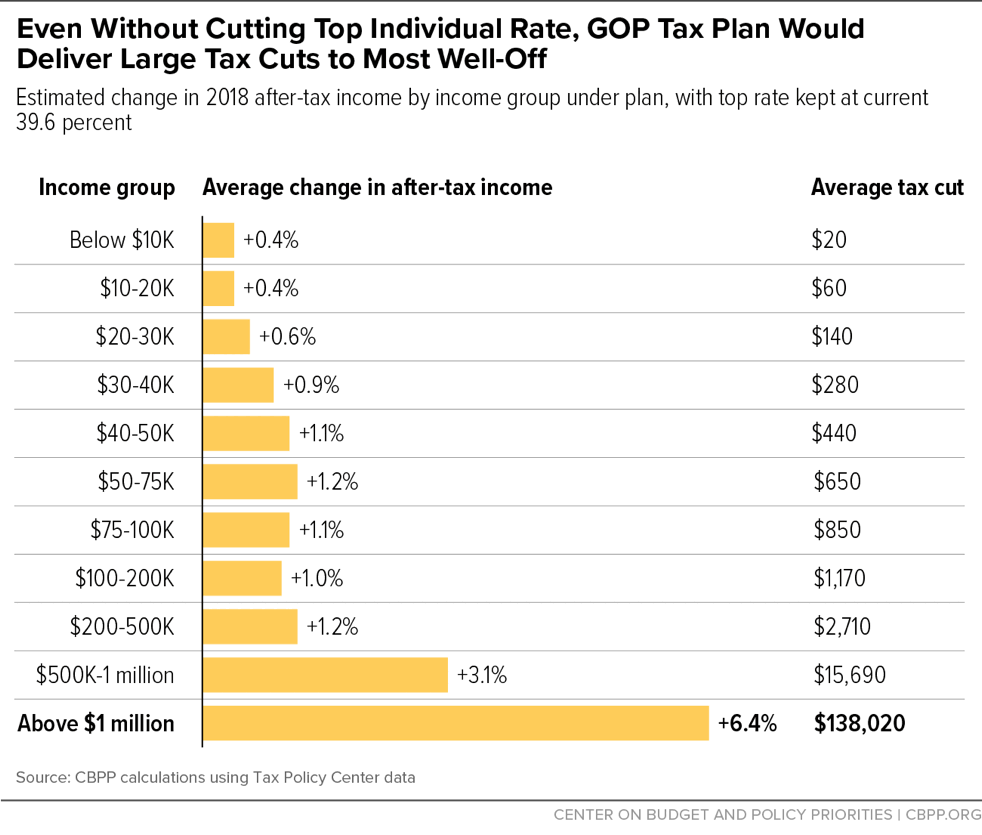

[3] The Tax Policy Center (TPC) estimated the effects of the Republican tax framework for 2018 and 2027. This analysis focuses on 2018 because the method for estimating the effects of the tax framework while holding the top rate at 39.6 percent relies on TPC data that are available for 2018 but not 2027 (see footnote 22 for details). It is important to note that TPC estimated that the GOP tax-cut plan with a 35 percent top rate would be significantly more tilted to the top in 2027 than in 2018: the top 1 percent would receive 53 percent of net tax cuts in 2018 compared to 80 percent in 2027. If the GOP framework plan is modified so the top tax rate remains unchanged, we would expect the share of benefits going to the wealthiest households to be higher in 2027 than the figures that we report here for 2018.

[4] Jonathan Swan, “Million dollar bracket in the works for GOP tax plan,” Axios, October 22, 2017, https://www.axios.com/million-dollar-bracket-in-the-works-for-gop-tax-plan-2499930587.html.

[5] In an interview with CNBC, Ryan stated that “we’re not talking about raising rates. It's already the top statutory rate, 39.6 percent. So, nobody’s talking about going up above that.” See CNBC, “CNBC Transcript: Speaker Paul Ryan on ‘Squawk Box’ Today,” September 28, 2017, https://www.cnbc.com/2017/09/28/cnbc-transcript-speaker-paul-ryan-on-squawk-box-today.html.

[6] Swan 2017. For an analysis of this proposal, see Steve Wamhoff, “GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent,” Institute on Taxation and Economic Policy (ITEP), October 24, 2017, https://itep.org/gop-tax-plan-will-mainly-benefit-millionaires-even-if-top-rate-remains-39-6-percent/. There are some differences between ITEP’s and TPC’s analyses of the original GOP plan for the dollar amount and share of tax cuts going to millionaires, though they are qualitatively similar.

[7] Ibid., U.S. Department of the Treasury.

[8] Tax Policy Center, “A Preliminary Analysis of the Unified Framework,” September 29, 2017, http://www.taxpolicycenter.org/publications/preliminary-analysis-unified-framework.

[9] Wall Street Journal Editorial Board, “Tax Policy Center Propaganda,” October 1, 2017, https://www.wsj.com/articles/tax-policy-center-propaganda-1506889612.

[10] Senate Committee on Finance, “Hatch Opening Statement at Finance Committee Hearing on International Tax Reform,” October 3, 2017, https://www.finance.senate.gov/imo/media/doc/10.3.17%20Hatch%20Opening%20Statement%20at%20Finance%20Committee%20Hearing%20on%20International%20Tax%20Reform.pdf; Emily Schillinger, September 29, 2017, https://twitter.com/ELSchillinger/status/913853036157693952.

[11] Nolan D. McCaskill, “Trump: Rich people won’t benefit ‘at all’ from tax plan,” Politico, September 13, 2017, www.politico.com/story/2017/09/13/trump-rich-people-tax-plan-242671.

[12] Elizabeth Gurdus, “EXCLUSIVE: Steve Mnuchin says there will be ‘no absolute tax cut for the upper class,’” CNBC, November 30, 2016, https://www.cnbc.com/2016/11/30/exclusive-steve-mnuchin-no-absolute-tax-cut-for-the-upper-class.html

[13] According to the Congressional Budget Office (CBO), pass-through income amounts to about a quarter (23 percent) of total income of the top 1 percent. See CBO, “The Distribution of Household Income and Federal Taxes, 2013,” June 8, 2016, https://www.cbo.gov/publication/51361.

[14] Tax Policy Center Table T17-0166.

[15] Note that the average annual tax cut for the top 400 households as a result of this provision would rise to $5.5 million if the top rate stayed at 39.6 percent because the value of the pass-through rate cut would rise. These estimates do not account for the increase in tax avoidance by high-income filers that would also occur. Chuck Marr, “Despite President’s Promise, Emerging Details Point to Large Tax Cut for Wealthiest,” CBPP, September 26, 2017, https://www.cbpp.org/blog/despite-presidents-promise-emerging-details-point-to-large-tax-cut-for-wealthiest.

[16] Chye-Ching Huang and Chloe Cho, “Ten Facts You Should Know About the Federal Estate Tax,” CBPP, updated May 5, 2017, https://www.cbpp.org/research/federal-tax/ten-facts-you-should-know-about-the-federal-estate-tax.

[17] Joint Committee on Taxation, “Revenue Estimate Request,” March 24, 2015, https://democrats-waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/114-0191.pdf.

[18] Tax Policy Center Table T17-0180.

[19] Senate Budget Committee hearing, June 13, 2017. Mnuchin has made similar comments on many other occasions: House Appropriations Committee hearing, June 12, 2017; Senate Finance Committee hearing, May 25, 2017; House Ways & Means Committee hearing, May 24, 2017; CNBC interview, May 23, 2017, http://www.cnbc.com/2017/05/23/read-the-full-transcript-of-cnbcs-interview-with-treasury-secretary-steve-mnuchin.html; CBS News Interview, April 27, 2017, http://www.cbsnews.com/news/steven-mnuchin-trump-tax-plan-full-transcript/.

[20] Chye-Ching Huang and Brandon DeBot, “Corporate Tax Cuts Skew to Shareholders and CEOs, Not Workers as Administration Claims,” updated August 16, 2017, https://www.cbpp.org/research/federal-tax/corporate-tax-cuts-skew-to-shareholders-and-ceos-not-workers-as-administration.

[21] Ibid.

[22] Tax Policy Center Tables T17-0224, T17-0225, T17-058, and T17-0159. Tables T17-058 and T17-059 provide the 2018 distributional impact of reducing individual income-tax rates to 10, 25, and 35 percent without any other changes. To estimate the distributional impact of a GOP tax plan without a reduction in the top rate to 35 percent in the income percentile analysis, we subtract the average tax cut that households in the top 1 percent and the top 0.1 percent would receive as a result of the changes in individual tax rates from the tax cut they would receive under the entire GOP leaders’ tax plan (Table T17-0158)). For the income level analysis, we subtract the average tax cut for households making above $500,000 (Table T17-0159).

[23] Chuck Marr, Brandon DeBot, and Emily Horton, “How Tax Reform Can Raise Working-Class Incomes,” CBPP, updated October 13, 2017, https://www.cbpp.org/research/federal-tax/how-tax-reform-can-raise-working-class-incomes.

[24] In its analysis of rate reductions (TPC Tables T17-058, and T17-0159), TPC estimates of reducing the top rate from 39.6 percent to 35 percent includes the effects of this rate reduction on pass-through income. We used this estimate for backing out the effects of the top rate reduction in the GOP plan.