The Trump Administration’s budget plan for fiscal year 2021 mirrors its budgets of the last two years in the massive cuts it proposes for core public services that help struggling households afford the basics and access health care.[1] Although Congress has previously rejected many of these proposals, the budget merits attention, given the Administration’s continued push for these priorities and the scope of the damage that the budget would do — including its $1.6 trillion in cuts over ten years in programs that help people with low or modest incomes meet basic needs.

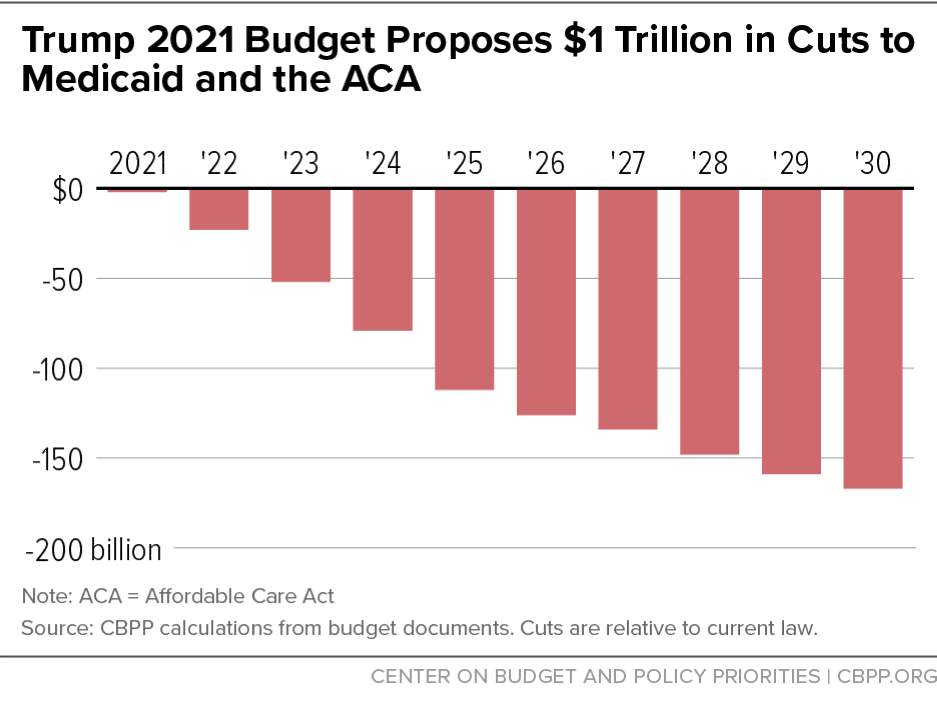

The President’s budget reflects the direction the Administration wants to take the country through legislative and executive actions. Indeed, while the budget’s call to cut $1 trillion from Medicaid and the Affordable Care Act (ACA) likely won’t be on the congressional agenda this year, the Administration has moved forward with administrative actions that advance some of the same goals on a more limited scale.

Another clear indication of the budget’s priorities is a proposal to extend beyond 2025 the costly 2017 tax cuts, which have given large windfalls to high-income individuals — even as the budget calls for cutting $1.2 trillion over the next decade from mandatory programs such as Medicaid and SNAP (formerly food stamps) that help low- and moderate-income households. And layered on top of these cuts are proposals for at least $360 billion in additional reductions in non-defense discretionary (NDD) programs designed to help low- and moderate-income people make ends meet or to improve their chances to succeed in the economy.

Low-income programs face $1.2 trillion, or 57 percent, of the budget’s proposed $2.2 trillion in ten-year cuts to mandatory programs, despite making up only a quarter of all federal spending on mandatory programs. Medicaid and related programs and SNAP face particularly deep cuts.

Under the budget, by the tenth year, 1 out of every 6 dollars for low-income mandatory programs will have disappeared. Think of this as a one-sixth cut in caseload, a one-sixth cut in per-household benefits, or some combination of the two.

Of the $1.5 trillion in ten-year spending cuts for NDD programs, at least $360 billion, or one-quarter, would come from low-income programs, which constitute a fifth of all NDD program expenditures.[2] The cuts are quite steep; by the tenth year, overall funding for low-income NDD programs will have fallen by two-fifths — and by more if veterans’ medical-care is shielded to some degree and doesn’t suffer budget cuts to the same extent as other NDD programs. (See box.)

Combining mandatory and NDD programs, the budget would cut $3.7 trillion over ten years, of which $1.6 trillion — or 44 percent — would come from low-income programs. This is well above the 24 percent of the budget that low-income spending constitutes under current law and policies. (See Table 1.)

| TABLE 1 |

|

|---|

| Ten-year totals, in billions of dollars |

|---|

| |

10-year total |

Low-moderate income amount |

Low-moderate income share |

|---|

| Non-defense discretionary (NDD) programs |

-1,455 |

-360 |

25% |

| Mandatory programs: |

|

|

|

| Medicaid and Affordable Care Act |

-1,016 |

-1,016 |

|

| SNAP (food stamps) |

-182 |

-182 |

|

| Other low-income (SSI, TANF, SSBG, child care, etc.) |

-110 |

-110 |

|

| Extend expiring refundable child care tax credits |

+65 |

+65 |

|

| Cut uncompensated hospital care, graduate medical education, including Medicare amounts |

-118 |

|

|

| Other Medicare payments |

-366 |

|

|

| Other |

-470 |

|

|

| Subtotal, mandatory programs |

-2,197 |

-1,243 |

57% |

| Total, NDD plus mandatory programs |

-3,652 |

-1,603 |

44% |

The longstanding commitment to funding important medical services for veterans would almost certainly cause even deeper cuts to other NDD programs than the cuts we estimate here. Policymakers surely wouldn’t apply the squeeze on NDD programs proportionally. History makes this clear: for example, while total NDD funding is basically the same in 2020 as it was in 2010, after accounting for inflation, veterans’ medical care increased by 48 percent over that period while the rest of NDD declined.

Suppose, then, that veterans’ medical care grows from its proposed 2021 level by 6 percent per year, its previous annual average growth rate. In that case, all other NDD programs, including the low-income ones, would shrink more rapidly than we assume: the low-income NDD expenditure cuts wouldn’t be $360 billion over ten years but $420 billion. By the tenth year, low-income NDD funding would fall not by two-fifths, but by half.

Budget Abandons Bipartisan Agreement on NDD Spending

The President’s budget calls for major cuts in non-defense programs funded through annual appropriations. This budget category, often called NDD funding, supports aid to education, environmental protection, low-income housing, scientific research, infrastructure, public health, national parks, justice and law enforcement, job training, and many other important services and investments.[3]

The budget abandons the bipartisan funding agreement Congress and the President reached last year, which called for a modest $5 billion (0.8 percent) increase for this category of programs from 2020 to 2021. The budget instead would cut NDD funding $46 billion below its 2020 level — a 7 percent overall reduction (or a 9 percent cut after accounting for inflation). This reduction would be spread throughout most non-defense agencies, with proposed inflation-adjusted cuts of 28 percent for the Environmental Protection Agency, 17 percent for the Department of Housing and Urban Development, 15 percent for the Department of Transportation, and 11 percent for the Department of Health and Human Services, to give a few examples.

The budget also envisions ever-deeper cuts in years after 2021, with the overall cut in NDD funding reaching 38 percent in inflation-adjusted terms by 2030. Measured relative to the size of the economy as projected by the Administration, NDD spending in 2030 will have fallen to a level well below the lowest on record back to 1962 — and likely back to the late 1920s, we estimate. Indeed, over the ten-year period covered by the budget, NDD spending would be cut by $1.5 trillion relative to the Office of Management and Budget’s “baseline,” essentially its inflation-adjusted 2020 level. And at least $360 billion of those cuts would come from low-income programs funded through annual appropriations, with deep cuts or outright eliminations proposed for the Low Income Home Energy Assistance Program (LIHEAP); the Jobs Corps; higher education for disadvantaged students;[4] community service employment; the Legal Services Corporation; and assisted housing programs (discussed below).

In addition to harsh NDD cuts, the budget would cut $1.2 trillion over the next decade from programs such as Medicaid, SNAP, and Supplemental Security Income (SSI).

Below we discuss cuts to key programs — both mandatory and discretionary — that would make it harder for low- and moderate-income families to access health care, buy nutritious food, have stable housing, or provide for their children’s needs. The Trump budget would:

The total Medicaid and ACA cuts would grow rapidly over time, to about $165 billion annually by 2030. (See Figure 1.) By 2030, the annual cuts to Medicaid and the ACA would be almost as large as the cuts that would result from simply eliminating the ACA’s Medicaid expansion and its premium tax credits that help people afford health insurance, as a lawsuit challenging the ACA that the Administration supports would do. Eliminating those programs would cause approximately 20 million people to lose coverage.

-

Cause millions of people to lose health coverage and increase health care costs or worsen access to care for millions more. The budget would cut $1 trillion from Medicaid and the ACA over ten years.[5] Its “allowance for the President’s health reform vision” calls for $844 billion in cuts (from 2021 through 2030); the budget indicates that the large majority of these cuts would come from Medicaid, including the ACA’s Medicaid expansion to low-income adults, while the rest of the cuts appear to come from other ACA coverage programs. The budget’s other Medicaid proposals account for another roughly $150 billion in cuts.

- Make it harder for struggling families to put food on the table. The budget proposes to cut SNAP by more than $180 billion — nearly 30 percent — over the next ten years by radically restructuring how benefits are delivered, taking SNAP away from millions of adults who are not working more than 20 hours a week, and reducing benefits for many other households.[6] The budget also includes two proposals that would curtail students’ access to free and reduced-price school meals. The proposed cuts come on top of nearly $50 billion in cuts in SNAP over ten years that the Administration is seeking through regulatory action, bringing the Administration’s total plan for cutting SNAP to about $230 billion over ten years, relative to current policies.

- Make it harder for hundreds of thousands of households to afford rent and utilities. Not counting losses due to inflation, the budget would cut housing assistance and community development aid next year by $8.6 billion, or 15.2 percent.[7] It would slash funding to operate, repair, and maintain public housing by $3.2 billion, or 43 percent, in 2021, preventing housing agencies from keeping hundreds of thousands of rental units in healthy, safe condition and thereby putting low-income residents at risk and accelerating the permanent loss of public housing developments. Such developments are a critical source of affordable homes for nearly 1 million households, mostly seniors and people with disabilities. The budget would also eliminate funding for about 160,000 Housing Choice Vouchers, which low-income seniors, families with children, and others use to rent decent, stable homes at an affordable cost. This enormous loss of affordable housing would undercut local efforts to reduce homelessness and meet other urgent housing needs. Overall, the budget would cut, rather than expand, funding for homelessness efforts, including funding to help homeless youth and victims of domestic violence.

- Cut disability benefits, causing hardship in families caring for children with disabilities. The Trump budget would reduce SSI benefits by $8 billion over ten years.[8] SSI protects the most vulnerable low-income people with disabilities, including children with Down syndrome, cerebral palsy, autism, intellectual disability, and blindness. Echoing a plan from House Republicans, the budget would cut benefits for families in which more than one member qualifies for SSI — for example, when children share a genetic disorder.[9] Some 70 percent of poor families caring for more than one child with disabilities already struggle to meet basic needs. These cuts would make their lives even harder.

- Reduce support for families with children living in poverty. The budget would cut the Temporary Assistance for Needy Families (TANF) program by $21 billion over ten years. Since its implementation in 1997, the TANF block grant has already lost considerable value due to inflation; the proposed cut would bring the total decline to 46 percent by 2021.[10] These cuts would leave many families with less assistance when they fall on hard times. The cuts include a 10 percent reduction in annual block grant funding for states and an end to the $608 million TANF Contingency Fund, which gives states additional funds at times of economic distress.[11] The budget also would impose new TANF spending restrictions, which together with the funding reductions would likely prompt states to cut basic assistance — the funds that go directly to poor families with children — as states have done in the past.[12] And, like TANF’s current work requirement, the proposed work requirement retains TANF’s rigid policy of conditioning a family’s benefits on the parent meeting certain hourly work or related requirements, which many families find challenging.

- Slice federal aid to state and local governments, which helps provide health care, K-12 education, and more.[13] Federal grants fund roughly 30 percent of state budgets across the country, and over 40 percent in some states, according to the most recent data. The proposed cuts to Medicaid and NDD funding in the Administration’s budget would especially affect states: Medicaid is the largest single source of federal funding to states, and NDD programs include most other grants to states, including funding for schools, child care, and housing assistance. States would probably respond to cuts of this depth primarily by reducing the services they provide to their residents. In the aftermath of the last recession, the most recent period when states were faced with a sharp decline in tax revenue, state spending cuts outpaced tax increases by nearly 3 to 1.[14]

The Trump budget contains unspecified NDD cuts, which we distribute proportionally between low-income programs and other programs in calculating the share of NDD cuts that fall on low-income programs.

As noted, the budget would cut NDD spending by $1.455 trillion over ten years. But of that cut, a large share is unspecified; the budget counts the full $1.455 trillion in spending cuts in reaching its bottom-line levels of spending, deficits, and debt — but assigns only 56 percent of the cuts to specific programs or agencies.

The budget assumes that funding for almost every NDD program will be frozen in nominal terms after 2021. The specific cuts in 2021 plus the freeze in all subsequent years together would reduce NDD spending by $818 billion over ten years. In addition, the budget assumes unspecified NDD cuts starting in 2022. These unspecified cuts would reduce NDD spending a further $637 billion through 2030, producing the budget’s ten-year total cut of $1.455 trillion. In our calculations, we assume that these unspecified NDD cuts would be spread across all NDD programs in proportion to the funding that remains in those programs after the specified cuts were made.

We do not show as cuts or increases a proposal that has no effect on government levels of personnel, pay, benefits, or services, but for technical reasons appears to cut discretionary spending and increase mandatory spending.

The federal Civil Service Retirement and Disability Trust Fund receives both contributions (payroll taxes) from civil servants and intragovernmental payments (considered “offsetting receipts”) that are made on the civil servants’ behalf by the federal agencies that employ them. Together, the civil servants’ payroll taxes and the offsetting receipts from the agencies are sufficient to keep the trust fund solvent indefinitely.

The budget proposes to increase the contributions made by civil servants (which is technically considered a tax increase). It also proposes that their employing agencies pay less into the trust fund. A technical accounting issue arises because the proposed reduction in agency payments is, by convention, treated as a reduction in discretionary spending, but the corresponding dollar-for-dollar reduction in offsetting receipts by the trust fund is, by convention, treated as an increase in mandatory spending.

In our analysis, we do not show the proposed reduction in agency payments to the trust fund as a discretionary cut, because this proposal, by itself, entails no reduction in program benefits or services, nor any reduction in the number of civilian employees or their wages or salaries. Analogously, we do not show the reduction in trust fund offsetting receipts as a mandatory spending increase; no retirement or disability benefits or payments would be increased.

For this reason, we show the ten-year NDD spending reduction as totaling $1.455 trillion, which does not include an $82 billion reduction in NDD agency payments to the trust fund. Likewise, we do not treat a $70 billion reduction in defense agency payments to the trust fund as a defense cut. (The Department of Defense is by far the largest employer of federal civil servants.) And, correspondingly, we show the ten-year mandatory spending reduction to be $2.262 trillion, a figure that does not include the $152 billion “increase” in mandatory spending resulting from the $152 billion reduction in trust fund offsetting receipts (the sum of the reduced payments to the trust fund by defense and NDD agencies).