BEYOND THE NUMBERS

Republican presidential candidate Donald Trump has repeatedly (here and here) said the United States is a high-tax country. As he put it recently, “If you look at what’s going on, we have the highest taxes anywhere in the world. We pay more business tax, we pay more personal tax. We have the highest taxes in the world.” The truth is the opposite.

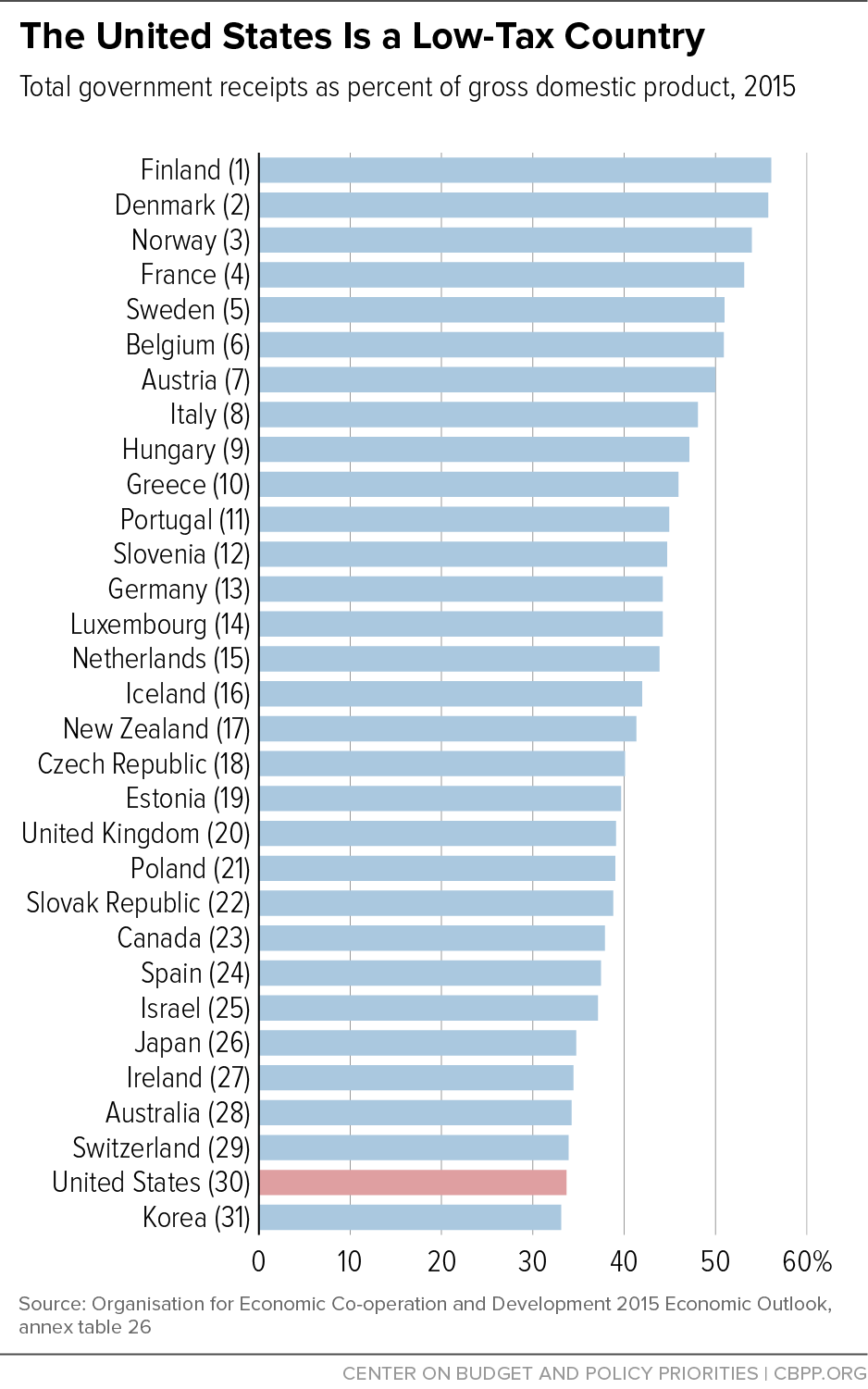

In fact, the United States is a low-tax country, collecting less in taxes as a share of the economy than virtually any other member of the Organisation for Economic Co-operation and Development (OECD), as the graph shows. In addition, U.S. corporate taxes as a share of the economy are below the OECD average.

These figures reflect the U.S. tax system today — from which Mr. Trump’s tax plan would shrink tax revenues by $9.5 trillion over ten years, according to the Urban-Brookings Tax Policy Center.