Federal taxes on middle-income Americans are near historic lows,[1] according to the latest available data. That’s true both for federal income taxes and total federal taxes.[2]

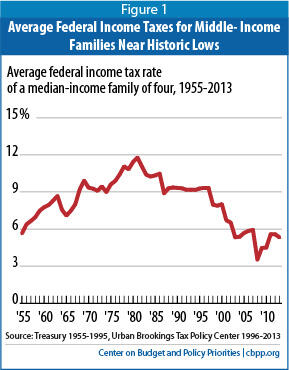

- Income taxes: A family of four in the exact middle of the income spectrum filing its taxes for 2013 this filing season paid only 5.3 percent of its 2013 income in federal income taxes, according to estimates from the Urban-Brookings Tax Policy Center (TPC).[3] Average income tax rates for these typical families have been lower during the Bush and Obama Administrations than at any time since the 1950s. (See Figure 1.) As discussed below, 2009 and 2010 were particularly low because of the temporary Making Work Pay Tax Credit.

- Overall federal taxes: Overall federal taxes — which include income, payroll, and excise taxes, and imputed corporate taxes — on middle-income households in 2009 were at their lowest levels in decades, according to the latest data from the Congressional Budget Office (CBO).

Federal income taxes on middle-income families have declined significantly in recent decades. In 1998-2000, the years before the 2001 tax cut enacted by President Bush and Congress, the median-income family of four paid roughly 8.0 percent of its income in individual income taxes, according to TPC estimates — a smaller share than in any year since 1967.

[4] The Bush tax cuts further reduced taxes for middle-income taxpayers, and the 2012 “fiscal cliff” bill (the American Taxpayer Relief Act) made these middle-income tax cuts permanent. TPC estimates that the median-income family of four paid 5.3 percent of its 2013 income in federal income taxes when it filed its return this year.

The 5.3 percent rate (as well as the other rates discussed here for 2013 and other years) is the effective tax rate, or the percentage of its income that a family pays in taxes. It is well below the 15 percent marginal tax rate — the rate paid on a filer’s next dollar of income — that a family of four in the exact middle of the income spectrum faces. A family’s effective tax rate typically is significantly lower than its marginal tax rate because the family takes the standard deduction (or, in some cases, itemized deductions), personal exemptions, and tax credits such as the child tax credit, and because a portion of the family’s taxable income is taxed at lower rates. (For the median-income family, some of its income is not taxed, some is taxed at a 10 percent rate, and some is taxed at a 15 percent rate.)

Figure 1 shows that while the overall trend in a typical family’s effective tax rate has been downward, the 2013 rate is above the rates for 2008-2010. This is because of the expiration of the Recovery Rebate Credit of 2008 and Making Work Pay Tax Credit of 2009 and 2010.

In 2008, policymakers enacted a one-time income tax rebate up to a maximum of $1,200 for married couples filing jointly.[5] The following year they enacted the Making Work Pay Tax Credit as part of the 2009 Recovery Act; it provided an income tax credit of up to $800 to married couples ($400 to single filers) in 2009 and 2010.

In 2011, policymakers shifted their tax-cutting stimulus focus from the income tax to the Social Security payroll tax. They allowed the income-tax-based Making Work Pay credit to expire and, in its place for 2011 and 2012, cut the employee portion of the Social Security payroll tax from 6.2 percent to 4.2 percent of workers’ Social Security taxable earnings (which were capped at $110,100 in 2012). The payroll tax cut did not adversely affect Social Security’s finances because general revenue transfers to the Social Security trust funds offset the loss of payroll tax revenue.

This payroll tax cut expired at the end of 2012. This was the most significant tax change for most people in 2013 (Table 1 highlights the tax cut’s value for workers in various occupations). A number of studies, including estimates by the Congressional Budget Office, suggest that the expiration of the payroll tax cut contributed to slower consumption and gross domestic product (GDP) growth in 2013.[6]

Table 1

Effect of Payroll Tax Cut in 2012 |

| Occupation | Average Salary* | Amount of Payroll Tax Cut |

| Cashier | $20,370 | $407 |

| Home health aide | $21,830 | $437 |

| Hairdresser | $26,790 | $536 |

| Truck Driver | $40,360 | $807 |

| Machinist | $40,860 | $817 |

| Plumber | $52,950 | $1,059 |

| Electrician | $53,030 | $1,061 |

| Nurse | $67,930 | $1,359 |

| Computer Programmer | $78,260 | $1,565 |

| Real Estate Broker | $80,220 | $1,604 |

| Marketing Manager | $129,870 | $2,202** |

| * Bureau of Labor Statistics May 2012 National Occupational Employment and Wage Estimates, http://www.bls.gov/oes/current/oes_nat.htm.

** The maximum amount of wages subject to the payroll tax in 2012 was $110,100, which implies a maximum tax cut under the payroll tax provision of $2,202. See http://www.ssa.gov/OACT/COLA/autoAdj.html for more information.

Source: Bureau of Labor Statistics, CBPP analysis. |

While income taxes on middle-class households have declined in recent years, so, too, have overall federal taxes.

Households in the middle fifth of the income spectrum paid an average of 11.5 percent of their income in overall federal taxes in 2010, the latest year for which data are available, according to CBO.[7] This is the lowest on record in data that go back to 1979. When CBO publishes data for more recent years (such as 2013), overall federal average tax rates on this middle group will likely be higher — though still low historically — because they will reflect the expiration of the temporary income and payroll tax cuts discussed above.

Most Americans pay more in payroll taxes, which support Social Security and Medicare, than they do in income taxes. In a typical, non-recession year (that is, one without a temporary tax cut), payroll taxes amount to about 9 percent of income for households in the middle quintile, according to CBO.[8]