BEYOND THE NUMBERS

While President Trump has repeatedly pledged to make child care more affordable, the child care proposal from his campaign wouldn’t do much to help the families who likely need it most, according to a new analysis that my colleague Emily Horton and I helped co-author for the Tax Policy Center (TPC).

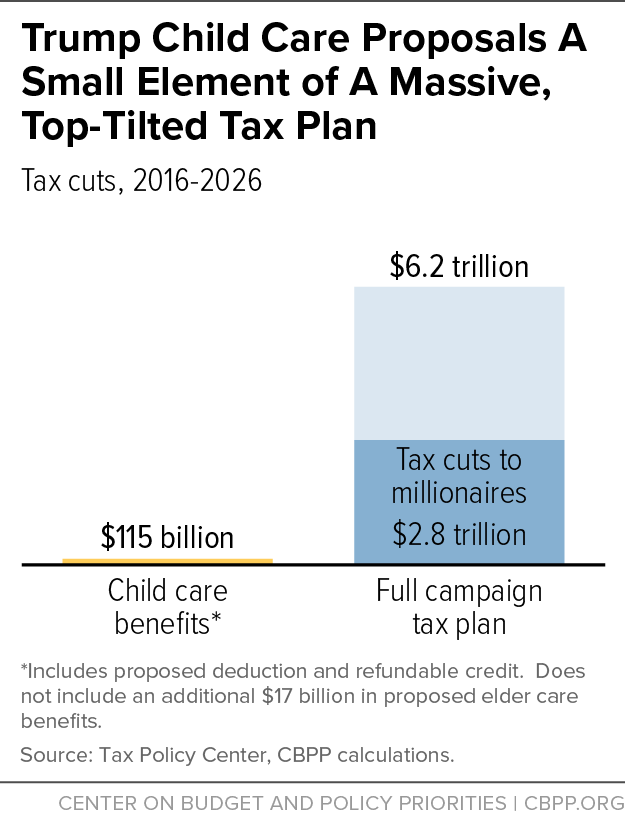

And his broader tax and budget policies would likely hurt many low- and moderate-income families. Trump’s campaign tax plan largely ignores struggling working families, giving roughly 20 times more in tax cuts to people with incomes over $1 million than its two main tax subsidies for child care. (See first graph.)

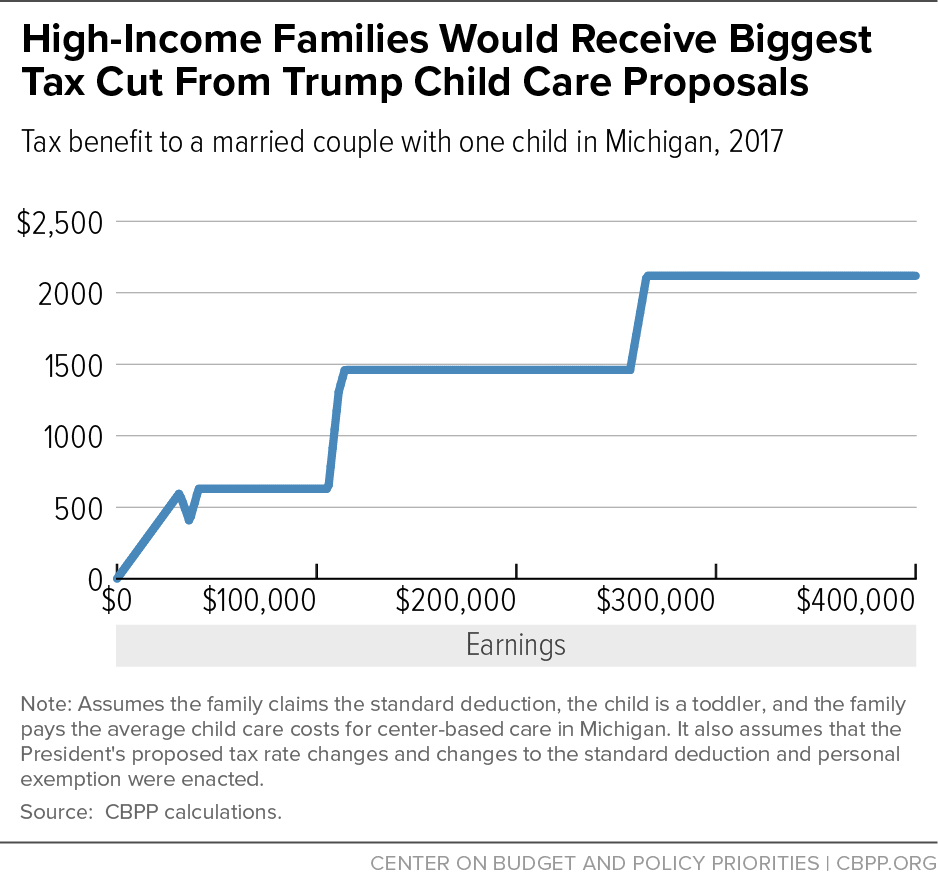

Even the child care tax breaks that Trump proposed do little for low- and moderate-income families. Families with incomes below $75,000 would receive just $60 each, on average, TPC estimates. Trump’s child care tax subsidies would instead flow mostly to higher-income families. More than 70 percent of their value would go to families with incomes over $100,000.

The plan would generally deliver a bigger tax break per dollar of child care costs to higher-income families than lower-income families because they’re in higher tax brackets. For example, a married couple with a toddler earning $30,000 and paying the average cost of center-based care in Michigan ($8,238) could receive $574 at most from the President’s proposal. If that couple had the same expenses but earned $250,000, their benefit would be $1,460 – nearly three times as high (see second graph).

Moreover, President Trump has proposed slashing a part of the budget that helps pay for child care subsidies and other vital programs for working families. His proposed $54 billion cut in non-defense discretionary (NDD) spending would be a massive reduction, coming on top of seven years of austere funding for NDD programs. That funding is an important source of support for child care assistance, along with a host of other investments in families, including Head Start, housing assistance, and the WIC nutrition program for low-income women, infants, and children.

Only about 15 percent of children eligible for federally funded child care subsidies receive them due to underfunding. Trump’s proposed cuts could worsen this situation, making it harder for working families to afford child care, while at the same time likely cutting other programs that help them meet other basic needs.