BEYOND THE NUMBERS

Social Security faces a significant — though manageable — long-term funding shortfall. If policymakers address it by reducing benefits, those cuts must be limited and carefully targeted to avoid causing significant hardship. And they’d almost certainly be phased in slowly, which means they could not produce significant savings for many years. Instead, policymakers should close the shortfall mainly by raising Social Security’s tax revenues.

Our new paper outlines three approaches to raising payroll taxes that would improve Social Security’s solvency:

- Raising or eliminating Social Security’s cap on taxable wages, now $118,500 a year.

- Expanding compensation subject to Social Security payroll taxes to include fringe benefits such as employer-sponsored health insurance and flexible spending accounts.

- Increasing the Social Security payroll tax rate on employers and employees.

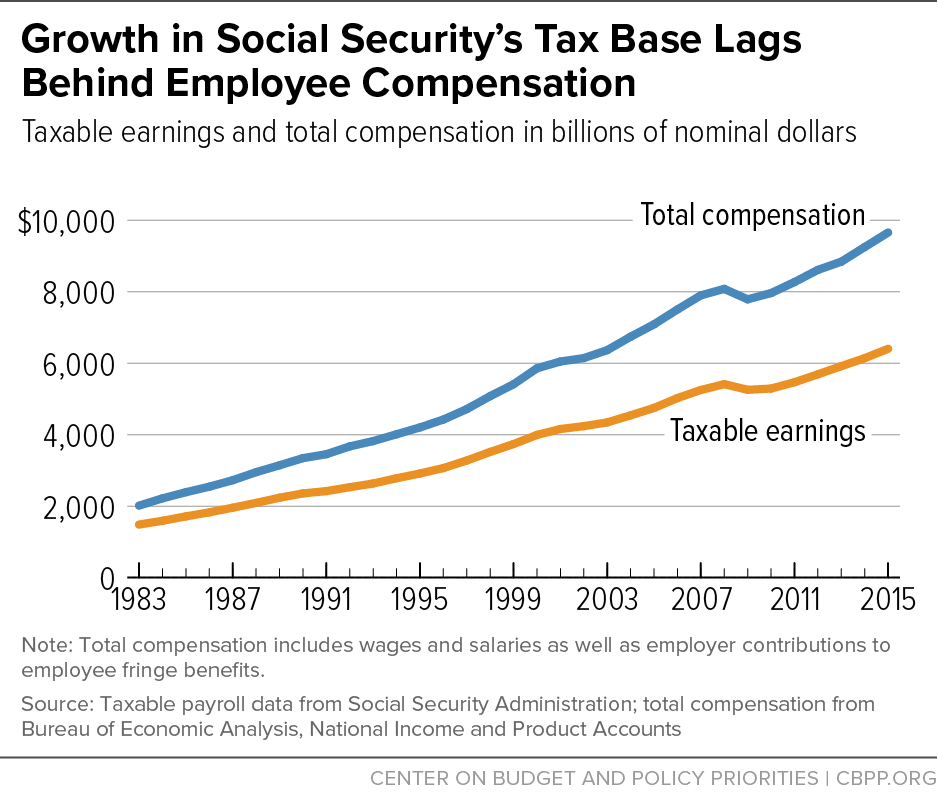

Recent trends justify raising Social Security’s payroll tax revenue. Social Security’s tax base has eroded since the last time policymakers addressed solvency in 1983, as the chart shows. In 1983, nearly three-quarters of employees’ compensation was subject to Social Security payroll taxes; in 2015, less than two-thirds was.

Increased inequality drives this trend. As the earnings of the top 1 percent — and especially the top 0.1 percent — have grown rapidly over the past several decades, a greater share of earnings have risen above Social Security’s tax cap.

At the same time, an increasing share of compensation has been paid not in wages but in fringe benefits that are exempt from Social Security taxes, including health insurance and flexible spending accounts. For example, the tax exemption for employer-sponsored health insurance cost Social Security about $100 billion in forgone payroll taxes in 2015. Expanding Social Security’s wage base to include contributions to these benefits would broaden the tax base, improve workers’ Social Security benefits, and bolster solvency.

Most Americans oppose cutting Social Security benefits and support boosting the program’s revenues. More than 70 percent of registered voters say Social Security benefits shouldn’t be cut, and more than 80 percent agree that “it is critical to preserve Social Security even if it means increasing Social Security taxes paid by working Americans.”