BEYOND THE NUMBERS

Tax Season Roundup

As the April 17 tax filing deadline approaches, we’ve issued a series of tax-related papers, posts, and graphics, most notably showing why the new federal tax law is fundamentally flawed and requires basic restructuring.

Paper: New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring

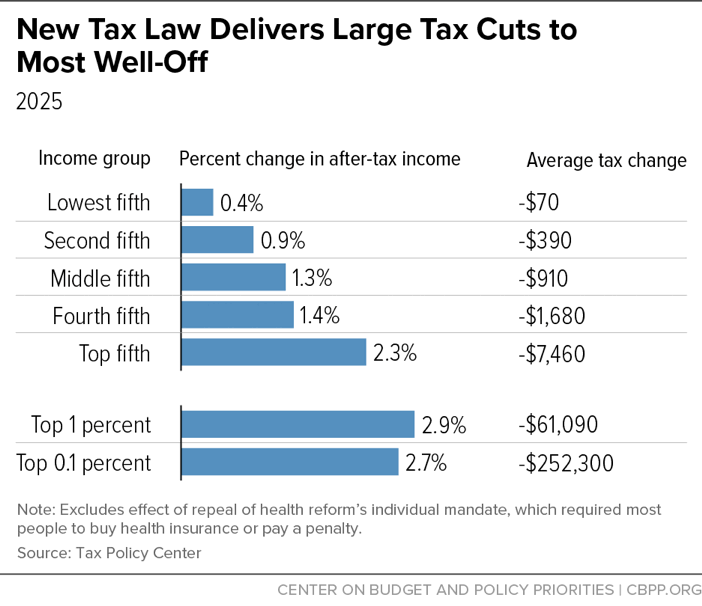

The major tax legislation enacted last December delivers windfall gains to wealthy households and profitable corporations, shrinks revenue at a time when the nation will require more revenue, and creates many new tax loopholes, shelters, and other opportunities to “game” the system. Instead of pursuing minor fixes or technical corrections, policymakers should set a new course and pursue true tax reform.

Two-page briefs on new tax law:

- New Tax Law Is Fundamentally Flawed

- New Tax Law Tilted Toward Wealthy and Corporations

- New Tax Law Shrinks Revenue When More Revenue Is Needed

- New Tax Law Invites Rampant Tax Sheltering and Gaming

CBPP charts and graphics on new tax law:

- As Tax Day Approaches, These Charts Show Why the New Tax Law Is Fundamentally Flawed

- Social Media Graphics on Federal Taxes

New Tax Law Disproportionately Helps Wealthiest in Every State

In states across the country, the wealthiest families are disproportionately benefitting from the new federal tax law. In fact, in every state except three, the top 1 percent of households are receiving a bigger share of their state’s tax cut dollars than the entire bottom 60 percent. Even in those other three states, the tax benefits remain extremely lopsided.

Tax Day 2018: Top State Tax Charts

State taxes help lay the foundation for economic opportunity and broad prosperity for families, businesses, and communities by funding the public investments essential for long-term economic growth. State tax dollars support fund education (K-12 and beyond) and health care, and other critical services such as transportation, public assistance, corrections, care for residents with disabilities, police, state parks, and general aid to local governments.