BEYOND THE NUMBERS

Child tax credits (CTCs) are an important way that policymakers can help families make ends meet, help children thrive now and in the future, and help families and communities recover from the pandemic. The federal credit should be expanded, and states should also create and improve their own CTCs (among other tax credits that help households with low incomes).

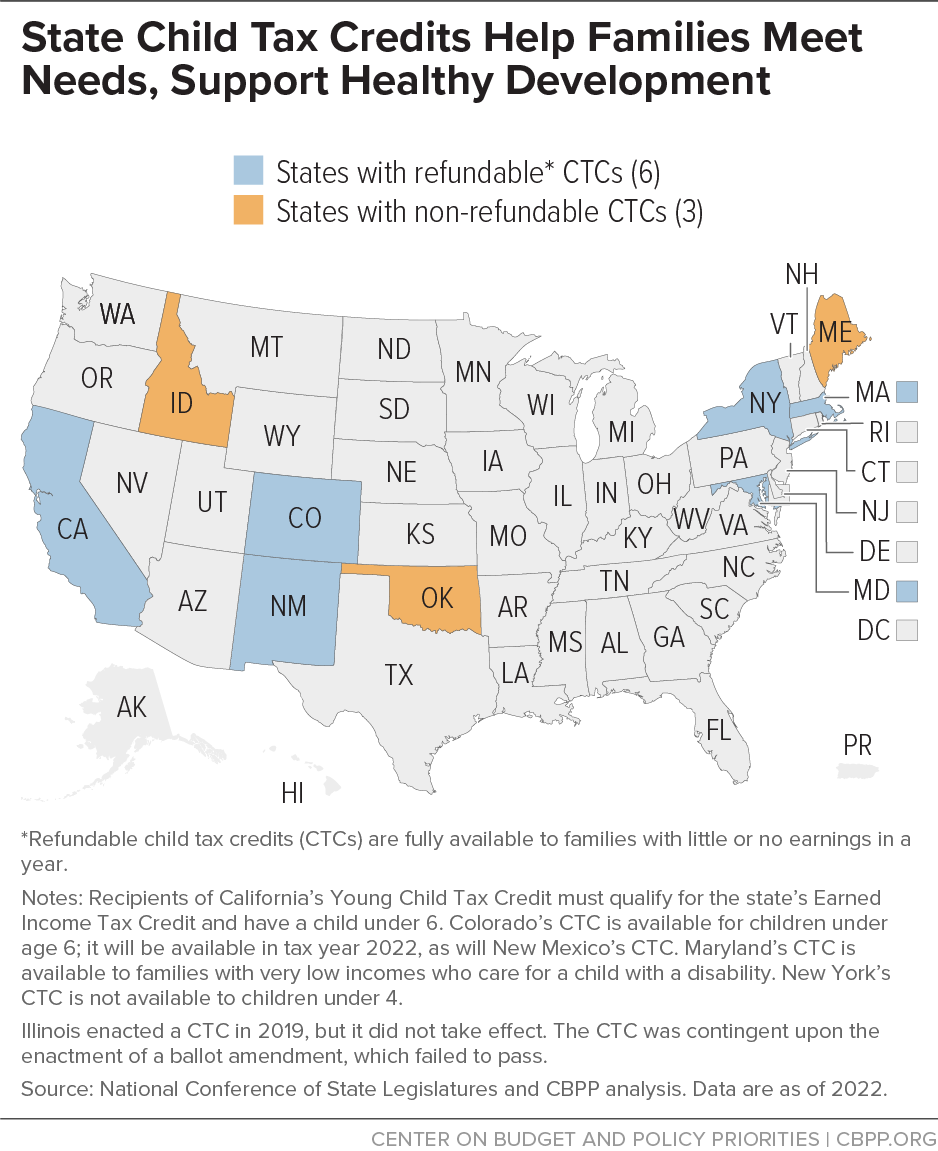

Nine states have already enacted and funded a CTC (see map), and states continue to enact new credits and improve existing ones. Last year, Colorado implemented and funded its CTC, which families will be able to claim for the first time when they file their 2022 taxes early next year, and Maryland created a new Child Tax Credit for families with children with disabilities. New Mexico recently created a credit worth a maximum of $175 per child this year; the full credit is available to families with low or no earnings (also known as a “fully refundable” credit).

More states should follow because child tax credits:

- Reduce poverty and help families afford the basics. Research has found that the monthly CTC payments provided through the American Rescue Plan sharply reduced monthly child poverty and helped families to afford basic needs such as food, utilities, clothing, rent, and education-related costs. CBPP estimated that the Rescue Plan’s 2021 federal CTC expansion in the Rescue Plan will lift 4.1 million children, including 1.2 million Black and 1.7 million Latino children, above the federal poverty line. These credits are crucial for making meaningful progress in addressing poverty and long-standing racial disparities.

- Support healthy child development and families. Additional income, such as from refundable credits like the CTC, is associated with improved health, a number of studies find. Research suggests that additional income may lead to significant improvements in access to nutritious foods, maternal and infant health, the number of years of education children complete, and reduced stress on families with low incomes. Cash supports like the CTC have also been linked with infants’ brain development, which is a fundamental foundation for early language, cognitive, and social and emotional skills.

- Boost local and state economies. Tax credits like the CTC help families who are paid low wages afford necessities and in turn, support local businesses and state economies. And, as noted above, the additional income that state CTCs provide improves families’ economic security and children’s educational outcomes, which can lead to larger earnings later in life and increase people’s ability to contribute to neighborhoods and state economies as workers, entrepreneurs, innovators, and community members.

Federal and state child tax credits are an effective way to target tax reductions to people and communities that could most use the help. People of color, immigrants, and women are among those who have been disproportionately impacted by the economic downturn. Rising food and energy prices also continue to strain families’ budgets, making it harder for them to afford basics like food, gas, and rent. With most state tax systems already asking the most as a share of income from families earning the least, a child tax credit that works for low-income families can help make the tax code fairer while easing the strain on families’ budgets.

Unfortunately, a number of states are considering income tax cuts that would mostly benefit wealthy households and profitable corporations. That won’t help those most affected by the COVID-19 crisis. Enacting costly and permanent tax cuts based on temporary budget surpluses would erode revenue for crucial community assets such as quality K-12 schools, affordable health care, and functional infrastructure while further widening racial and economic inequities.

Instead, state policymakers should shift toward equitable, targeted approaches to helping families meet basic needs through improving or expanding tax credits like CTCs. In addition to creating new credits in states that don’t yet have one, states have a number of options to expand and improve their existing child tax credits. They should ensure these credits are available to children in families with low or no earnings, extend eligibility to children who may be claimed as tax dependents using an Individual Taxpayer Identification Number, and remove limitations such as New York’s credit being unavailable for children under 4.

The costs of enacting or improving existing credits are also typically small enough that states may be able to absorb them without raising additional revenue. If they must raise modest additional resources, states can choose from a range of sensible ways to do so. Either way, the substantial long-term benefits of child tax credits for families, communities, and local economies are worthwhile.