BEYOND THE NUMBERS

Energy-producing states that rely heavily on volatile energy-related tax revenues offer a cautionary tale for other states, our new report shows. The short-sighted fiscal actions that energy-producing states took — and things they didn’t do — show how better budget practices would help lawmakers in any state preserve the public investment that communities need to thrive, like schools, health care, roads, and much more — in bad times and good.

Revenue declines that cause budget problems are not limited to energy states, of course. Energy states that rely heavily on energy-related revenues, however, are particularly susceptible to revenue declines because when energy prices fall, energy-related revenues fall with them.

Wise states can draw three lessons from energy states to prepare for, and mitigate, their own revenue declines:

- Avoid ineffective tax cuts and incentives that deplete revenues,

- Build up budget reserves that states can tap to protect public investment and strengthen the economy, and,

- Diversify revenue sources, including sales, excise, and/or income taxes to improve the stability of tax collections.

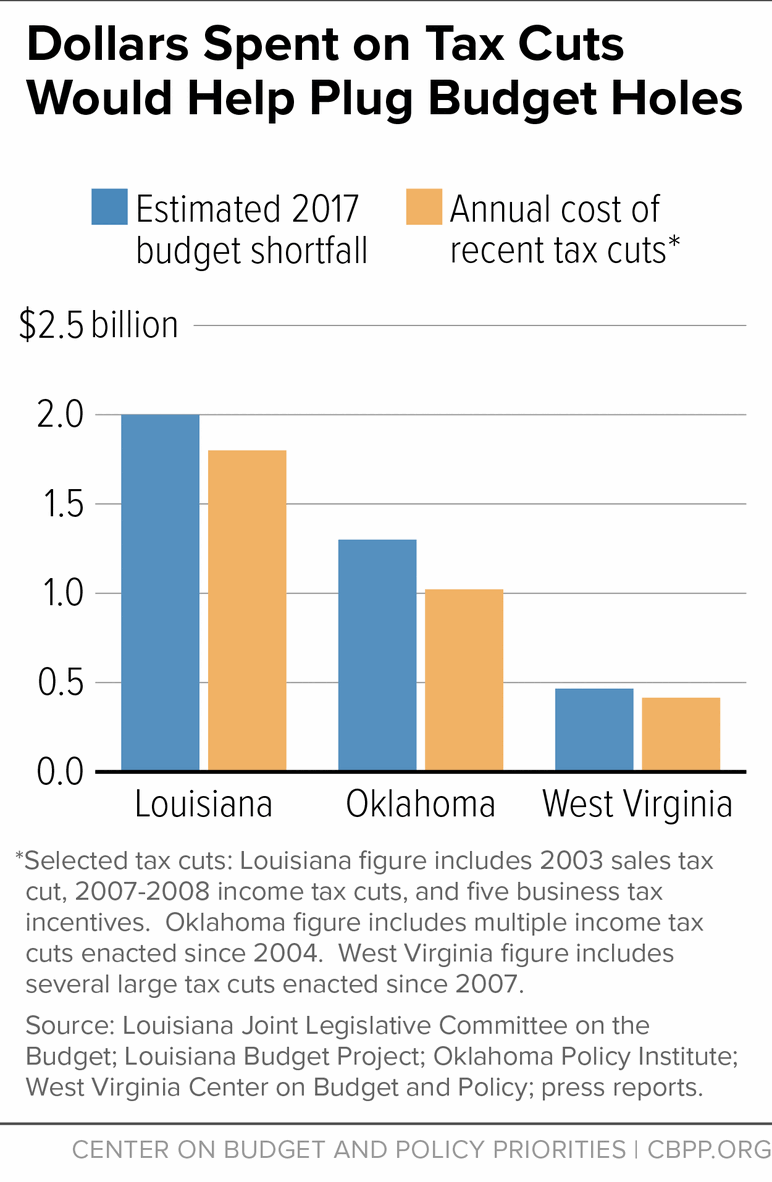

For example, tax cuts, not energy prices, in three energy-producing states — Louisiana, Oklahoma, and West Virginia — first fueled their fiscal woes, as the chart illustrates. Tax cuts or tax breaks, some enacted a decade ago, nearly equal or exceed the budget shortfalls those states faced when the full impact of the oil price decline hit their revenues.

Louisiana, for example, made poor, avoidable fiscal policy decisions well before the recent energy bust. In 2007 and 2008, lawmakers repealed income tax increases intended to offset a sales tax cut that’s still in effect. The revenue impact of rolling back the income tax increases now costs the state about $800 million a year. Plus, the cost of a handful of business tax incentives has ballooned to more than $1 billion a year.

Louisiana addressed these problems with temporary measures that simply kicked the can down the road. The state now must address a projected $340 million shortfall in the 2017 budget as well as an estimated $1.5 billion gap when the temporary tax increases expire in 2018. These problems have real consequences for the state’s residents and its economy. If earlier proposals to close budget shortfalls resurface, 34,000 fewer students could receive college financial aid, nine hospitals that care for the poor and uninsured could close, and other investments in the state’s schools, roads, and more will likely be cut.

In addition to avoiding short-sighted tax cuts like these, states should build adequate and accessible reserves to protect public services and other state economic activity from revenue booms and busts.

Finally, states should rely on a good mix of revenues to help protect public investment in schools, roads, and other critical services. Overreliance on a single tax revenue source such as severance tax revenues from extracting natural resources can leave states in a budget hole, as the energy-producing states know well.