BEYOND THE NUMBERS

Social Security benefits are a perennial target for cuts as policymakers seek to strengthen the program’s long-run solvency. Some lawmakers and opinion leaders mistakenly regard the program’s benefits as lavish. But here are the facts, as our updated report explains:

- Social Security benefits are modest. The average benefit for the “big three” groups of recipients — retired workers, disabled workers, and aged widows — is only about $1,300 a month, or $15,500 a year. Nearly 98 percent of retirees get less than $2,500 a month.

- Most beneficiaries have little significant income from other sources. Social Security is the main source of retirement income for two-thirds of elderly beneficiaries, and the only source of income for one-fifth. Minorities and unmarried people are especially reliant on Social Security.

For most seniors, Social Security will be the only source of income that’s guaranteed to last as long as they live and to keep up with inflation. Coverage under employer-sponsored, defined-benefit pension plans — a traditional mainstay of retirement income — has fallen precipitously. Most firms have switched to defined-contribution plans that shift the financial risks to their employees.

Half of people age 65-74 have no retirement savings. And as the rest try to stretch their modest savings in 401(k)s or other accounts (which can produce volatile and uncertain returns) to cover their full lifespan (whose length they can't predict), Social Security's guarantee of lifelong, inflation-adjusted income is even more important.

- Social Security benefits in the United States are low compared with other advanced countries. Most other developed countries have more generous public pensions than the United States. The United States ranks 31st out of the 34 members of the Organisation for Economic Co-operation and Development (OECD) in the percentage of past earnings that the public-pension system replaces for a median worker.

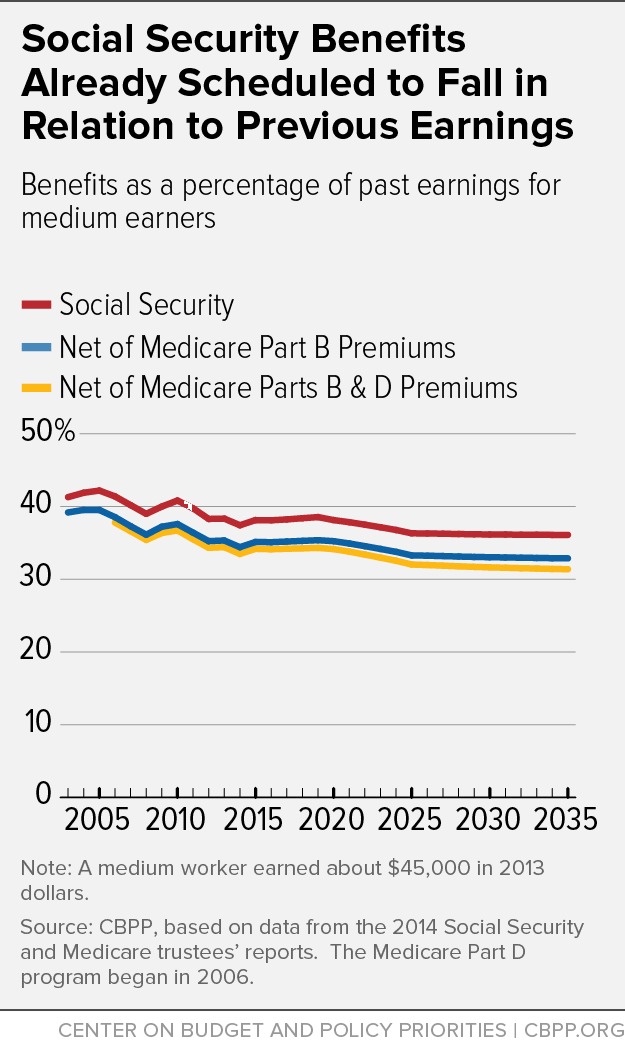

Future retirees already face a squeeze from a rising Social Security retirement age (which amounts to an across-the-board cut in benefits) and escalating Medicare premiums. Many financial planners advise their clients to aim for a retirement portfolio — from Social Security, pensions, and savings — that’ll replace 70 percent of their pre-retirement income. Social Security will get them only partly toward that goal.

For a medium worker (earning about $45,000 in 2013 dollars) who retires at age 65 today, Social Security replaces only about 39 percent of earnings — or 36 percent after subtracting Medicare premiums. And that figure will slip as the program's age for full benefits (sometimes called the “normal retirement age”), which recently rose from 65 to 66, will soon rise to 67 and Medicare premiums take a bigger bite. By 2030, that retiree's check will replace just 32 percent of past earnings, after subtracting Medicare premiums. (See graph.)

All of those facts argue for limiting any cuts in future benefits — a position that draws broad support from people of all ages and incomes.