BEYOND THE NUMBERS

As we’ve written, establishing a renters’ tax credit would enable more families with incomes around or below the poverty line to afford decent, stable housing. It would also help address the mismatch in federal housing spending, most of which goes to families with little need for assistance. The new credit would complement the existing Low-Income Housing Tax Credit (LIHTC) — an effective subsidy for development of affordable housing — by reducing rents in LIHTC projects and other properties to levels the lowest-income families can afford.

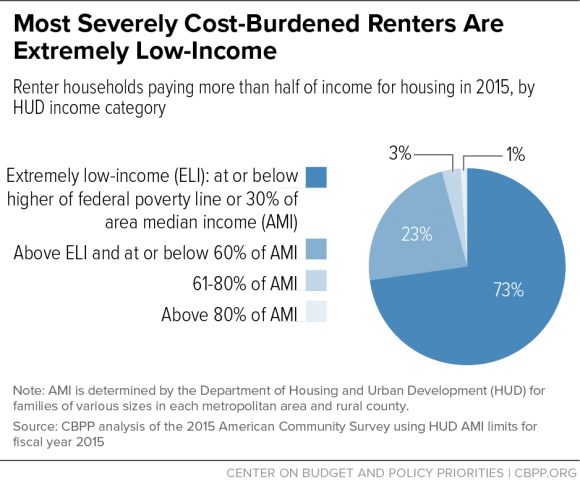

The nation’s most pressing housing needs are heavily concentrated among extremely low-income families, defined by federal policy as those below the poverty line or 30 percent of the local median income. These families, which include low-wage workers like cashiers and food workers along with the poorest elderly and disabled people, account for close to three-fourths of renters who pay more than half of their income for housing (see chart).

Because extremely low-income families must spend so much of their income on housing, they often struggle to pay for other basic needs like food and medicine. And they’re likelier than other families to experience eviction or homelessness.

States could allocate the proposed renters’ credits to owners and developers of rental housing in order to make units affordable to extremely low-income families, who would pay no more than 30 percent of their income for rent and utilities. The renters’ credit could be used in projects that were built or rehabilitated through LIHTC, or in any other modest, decent-quality rental housing.

The renters’ credit would be a good complement for LIHTC, which allows states to provide credits for developing housing with rents that are affordable to a family with income at 60 percent of the local median but often are well above what extremely low-income families can afford. It’s hard for states or developers to make LIHTC rents affordable to extremely low-income families even if they wish to do so, because LIHTC only subsidizes construction and renovation costs, while many of the lowest-income families can’t afford rents sufficient to cover even the ongoing costs of operating a unit (such as maintenance, insurance, and utilities).

As a result, rents in LIHTC developments are rarely affordable to extremely low-income families unless the family also has a housing voucher or other rental assistance — but three in four eligible families receive no rental assistance due to funding limitations.

Senator Maria Cantwell and Representative Pat Tiberi recently introduced bills that, along with other changes to LIHTC, would give states more flexibility to reduce LIHTC rents. These changes wouldn’t, however, dedicate resources to serving the lowest-income families, so states would have to choose between building more total LIHTC units or building fewer units but making some of them affordable to lower-income families. In addition, even if states used the new flexibility, the changes would permit rents that — while lower than regular LIHTC rent limits — are still above what many families at the bottom of the income scale can afford. And finally, the new options could only be used in developments that are undergoing major construction or rehabilitation through LIHTC, a small share of the overall rental stock.

For these reasons, the Cantwell and Tiberi provisions, while worthwhile and important, aren’t alternatives to the renters’ credit. LIHTC and the renters’ credit serve different purposes, and both are needed to make housing affordable to the neediest Americans.