BEYOND THE NUMBERS

Enacting a major expansion of the Housing Choice Voucher Program in recovery legislation is the single most important housing policy lawmakers can adopt to help people with low incomes afford housing and reduce homelessness, housing instability, and overcrowding — and would also do much to cut poverty and reduce racial and ethnic disparities. Some skeptics of expansion argue that housing shortages would prevent new vouchers from being used, but evidence suggests that rental markets could readily absorb many additional vouchers — particularly if they’re part of a balanced investment package that also funds development of new affordable housing.

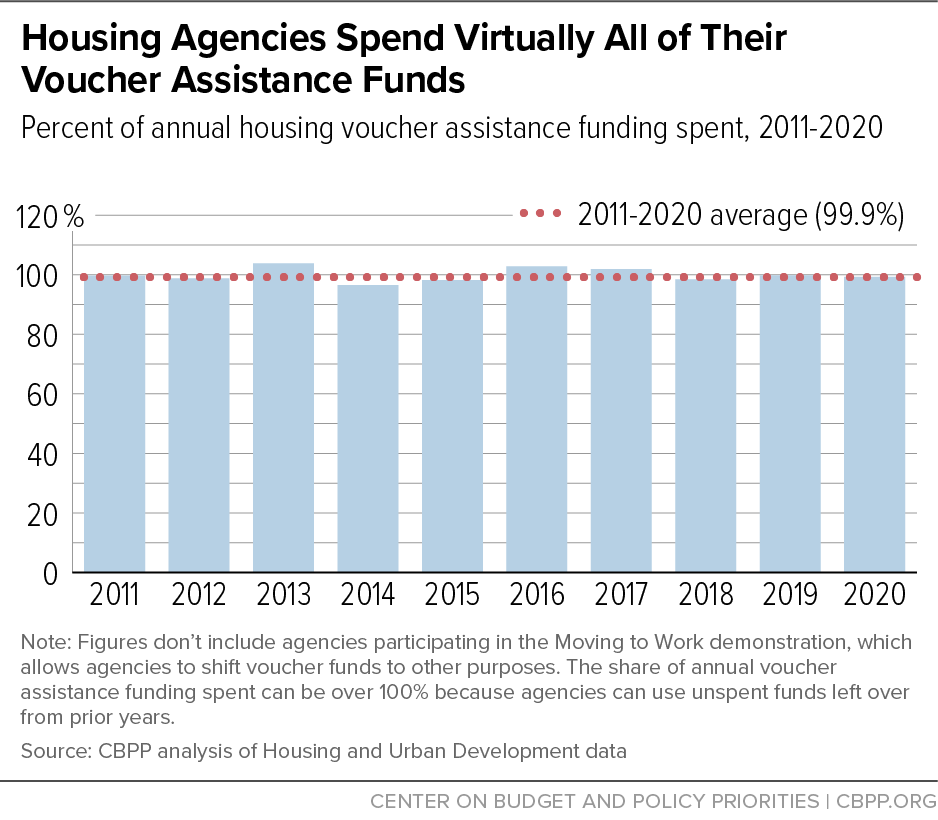

Vouchers assist 2.3 million households, mainly by helping them rent units of their choice in the private market. Only 1 in 4 families eligible for vouchers receives any kind of federal rental assistance, but this is due to inadequate funding for the program, not because housing shortages cause funded vouchers to be left unused. Virtually every dollar lawmakers have provided for vouchers over the last decade has been put to use. Voucher agencies sometimes spend modestly less than 100 percent of their voucher funding for the year and sometimes modestly more (by drawing down reserves). From 2011 to 2020, agencies spent on average 99.9 percent of the funding they received (see chart), and even in 2020 — when the pandemic disrupted program operations — this figure was 99.3 percent.

If lawmakers expand the voucher program substantially, the available information suggests, these vouchers too would be used. There are more than 3 million vacant units for rent in the United States and most renters live in markets where average rental vacancy rates in recent years exceed 5 percent, a common benchmark for markets where housing is relatively easy to find. Moreover, most voucher holders were already renting a housing unit before they got their voucher, but were struggling to afford it. The voucher lowers their rent burden to a level they can afford without diverting resources from other basic needs and reduces the chances they will be evicted if they face an income loss or an unexpected bill. Vouchers can provide urgently needed assistance to help these families keep their homes without filling up additional units.

Research on past voucher expansions provides more evidence that rental markets can absorb many additional vouchers relatively easily. The last major voucher expansion added 450,000 vouchers from 1998 to 2002, when the overall number of rental units was substantially smaller than today. Economists would expect that if demand from vouchers overwhelmed the available housing supply, rent would rise substantially in areas that receive large voucher allocations, but a well-designed study found no overall link between this voucher expansion and market rents.

Some individual families can’t find units where they can use their vouchers in part because some landlords refuse to accept them, and it’s important that federal, state, and local policymakers take steps to help more families use vouchers and give them broader choice about where they live. But state and local agencies that administer vouchers take this into account by issuing somewhat more vouchers than they plan to use, so even if some families don’t use their vouchers the agencies still assist the full number of families they can afford to help with their funds — and they would assist many more if they had the resources to do so.

Importantly, some parts of the country face serious housing shortages that make it harder for voucher holders and other renters to find units they can rent. But even in these areas, vouchers assist large numbers of families effectively and at some well-run housing agencies more than 80 percent of families issued vouchers succeed in using them.

Policymakers should address housing shortages through steps such as funding affordable housing construction and easing regulatory barriers to development. President Biden’s American Jobs Plan commendably includes large-scale funding to build new affordable housing. But affordable housing development subsidies rarely make housing affordable to the great majority of low-income people who struggle to pay rent, so it will be important to pair measures to increase housing supply with a major expansion of the voucher program.