BEYOND THE NUMBERS

The Department of Health and Human Services (HHS) announced yesterday which groups will receive navigator funds in the 34 states where the federal government runs the Affordable Care Act (ACA) marketplace. But the Trump Administration’s sharp cuts in overall navigator funding in the last two years mean that many consumers who buy insurance through HealthCare.gov will be on their own to complete the complex application and enrollment process to get affordable health coverage. The defunding of navigator programs erects another obstacle to enrollment in the ACA marketplaces, even as new Census figures show that progress in reducing the uninsured rate stalled in 2017, likely due in part to other Administration efforts to undermine the ACA.

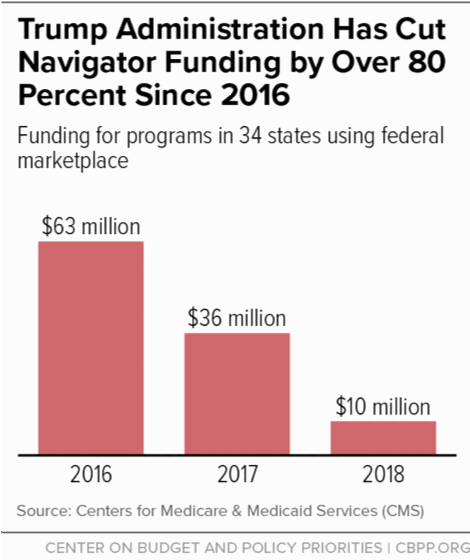

HHS has slashed navigator funding by over 80 percent since 2016, leaving only $10 million to thinly spread across states where 8.7 million consumers signed up for marketplace coverage last year. That’s down from $36 million in 2017 and $63 million in 2016 (see chart).

Navigator programs raise awareness about the availability of marketplace plans, help people apply for federal subsidies, provide impartial information about plan options, and help consumers with other important issues, including filing appeals and submitting documentation to prove their eligibility. The ACA requires all marketplaces to have navigators to help people enroll, but many marketplace consumers will find it difficult — and, in some cases, impossible — to find help from an unbiased source this year:

- Funding is spread too thin. It will be next to impossible for organizations to adequately provide services with such limited funding. In Florida, for example, over 1.7 million people signed up for marketplace coverage last year — the most in any state — and five groups received nearly $6.6 million in navigator funding. This year a single group will receive $1.25 million to serve the entire state. In New Jersey, one organization will receive only $400,000 to serve the entire state, compared to $600,000 last year and nearly $2 million in 2016. Nine states will receive $100,000 or less in total navigator funding.

- Many states will have areas with no navigator services and three states won’t have any navigators at all. In Texas, navigator coverage will fall far short of the previous, near statewide coverage, shrinking from nine navigator groups last year to just two this year. Areas such as San Antonio, Dallas, Fort Worth, Austin, Corpus Christi, Waco, and the entire Texas panhandle will lose navigator coverage this year. Three states — Iowa, Montana, and New Hampshire — will have no navigator entity next year at all.

HHS claims that agents and brokers reimbursed by health insurers can offset the loss of navigator programs. But unlike navigators, who are required to provide fair and impartial information about all marketplace health plan options, agents and brokers promote the plans that pay them. Navigators also provide services that agents and brokers generally don’t, such as helping eligible individuals enroll in Medicaid or the Children’s Health Insurance Program. And navigator outreach programs are designed to reach vulnerable and hard-to-reach communities where other assistance often isn’t available. Without these programs, many people won’t get the impartial assistance they need to obtain and maintain health coverage that meets their unique needs.

Moreover, HHS is encouraging navigators to inform people about the “full range of coverage options available to them,” including plans “such as association health plans and short-term, limited-duration insurance,” which are exempt from many ACA consumer protections that shield people — particularly those who have pre-existing conditions — from high out-of-pocket costs and substandard benefits. The Trump Administration has changed the rules for both association health plans and short-term plans to promote these skimpier forms of coverage as an alternative to ACA plans.