BEYOND THE NUMBERS

With the 2019 legislative season starting in most states, some states are discussing whether to raise personal income tax rates on their highest-income households (sometimes called a “millionaires’ tax”) to help fund schools, infrastructure, and other public investments. Our new report shows why that makes sense.

Targeted income tax hikes at the top can generate significant revenues for states to invest in their long-term success — without harming their ability to grow their economies and create jobs in the short term.

Millionaires’ taxes are becoming increasingly common, with states such as California, Minnesota, and Maryland using them to minimize harmful program cuts when the economy slows and states still must balance their budgets, or to make bold new investments like expanding early education or boosting college access. In some cases, these policies only affect annual incomes above $1 million, although in several states the higher rates kick in at lower thresholds.

The trend looks likely to continue:

- New York lawmakers will likely consider making their state’s millionaires’ tax, enacted in 2009, permanent in order to preserve about $4 billion in annual funding for public services.

- Illinois policymakers are considering this approach as part of a broader push to replace the state’s regressive flat tax with a fairer graduated system.

- New Jersey, which raised rates on incomes above $5 million in 2018, may weigh another rate increase for high earners below that level.

- Maine might take another look at the policy as well, after conservative lawmakers overturned a ballot initiative that voters approved in 2016 to raise taxes on top earners.

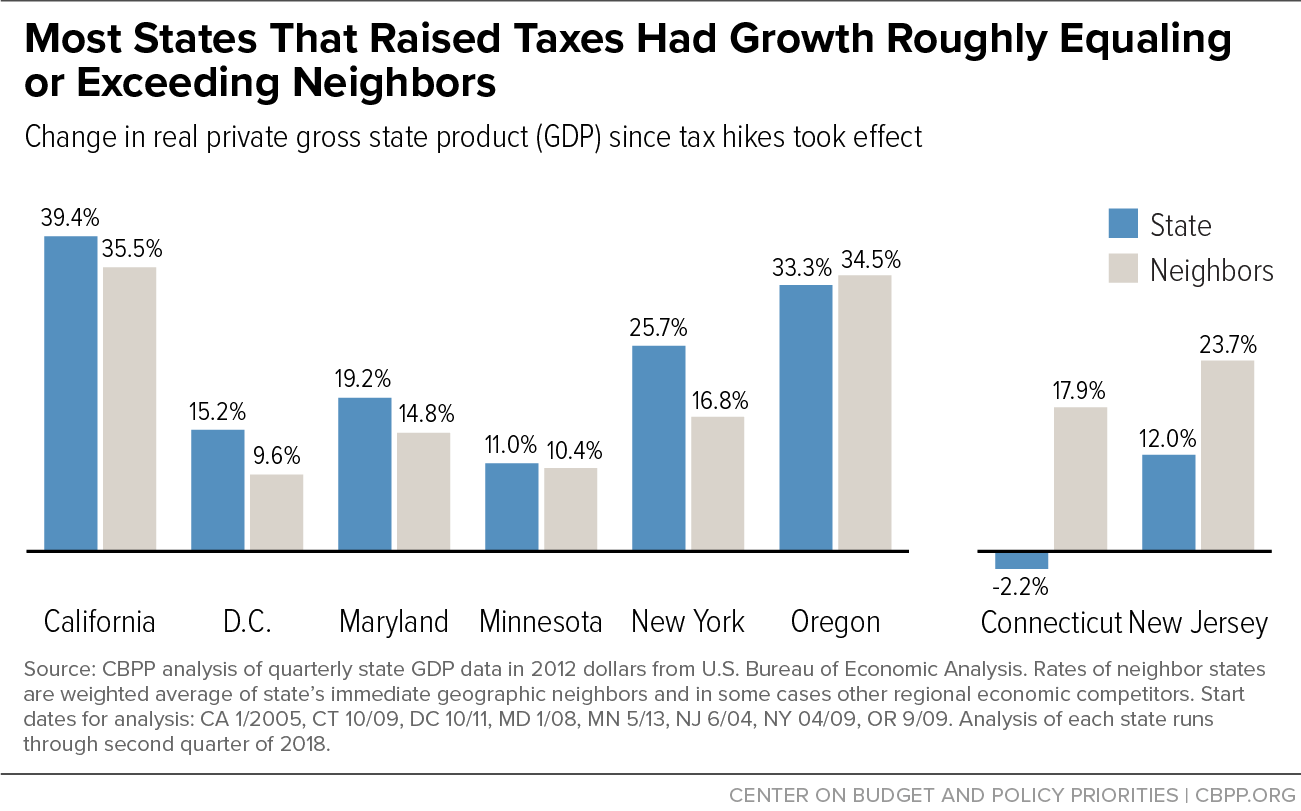

Targeted income tax hikes at the top don’t harm a state’s ability to compete economically with its neighbors, real-world experience shows. Of the eight states (including the District of Columbia) that have enacted lasting millionaires’ taxes since 2000:

- seven have had per capita personal income growth at least as strong as their neighbors since raising taxes;

- six have had growth in private-sector gross domestic product about as good as or better than their neighbors (see chart); and

- five added jobs at least as quickly as their neighbors.

These states’ experiences mirror expert research, which generally finds that tax differences between states, including differences in personal income tax rates, only minimally affect state economic growth. “The vast majority of the academic studies that examined the relationship between state and local taxes and economic growth found little or no effect,” the authors of a comprehensive literature review in 2018 concluded.

Meanwhile, millionaires’ taxes raise money to invest in good schools and income-boosting policies like state earned income tax credits, with revenue coming from the small number of taxpayers who can best afford the cost and who have done extraordinarily well in recent decades as income and wealth have become increasingly concentrated at the top.