BEYOND THE NUMBERS

President Trump is expected to make his case for GOP tax plans at a small business event later today. But no matter how much the President and congressional Republicans invoke small businesses and typical workers in their sales pitch for their tax plans, their actual tax and budget policies would do little to help such businesses and workers — and could even hurt them — as these resources explain:

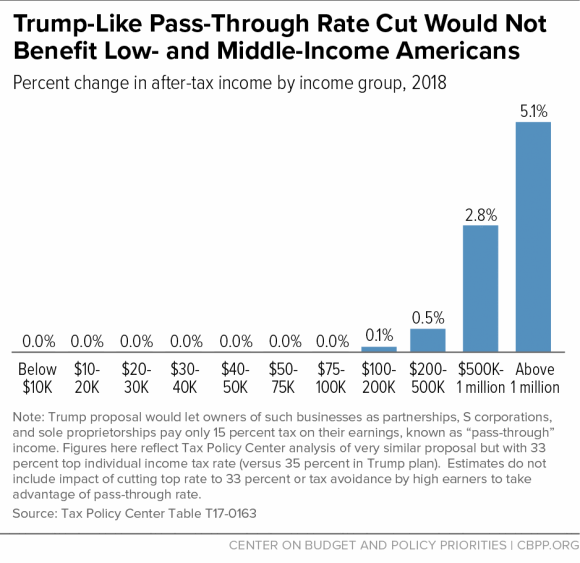

- A special rate cut for “pass-through” businesses would overwhelmingly benefit the wealthy and tax avoiders, not small businesses. A major way that proponents of the GOP tax plans claim they help small business is through a special, much lower top rate for “pass-through” business income — income from businesses such as partnerships, S corporations, and sole proprietorships that filers claim on their individual tax returns and that is currently taxed at the same rates as wages and salaries. Both the Administration and the House GOP “Better Way” plans would sharply cut the top rate on this income, from 39.6 percent to 15 and 25 percent, respectively — well below the plans’ proposed top individual income tax rates of 35 and 33 percent.

Some proponents say the tax cut would be a boon for small businesses. But most small businesses are small — despite what prominent congressional Republicans have said, very few small business owners pay the top rate of 39.6 percent. More than 70 percent of filers with pass-through income already face rates at or below 15 percent, so they’d get no benefit from the proposal (see chart).

In reality, a pass-through tax cut would provide a massive windfall to the very wealthy (it’s sometimes been referred to as the “Trump loophole” because President Trump exemplifies the type of business owner whom it would most benefit). About 68 percent of the tax cut on existing pass-through income would flow to millionaires, including real estate investors, hedge fund managers, investment bankers, and the like. Additionally, high earners would likely engage in tax avoidance by reclassifying their salaries as pass-through income to take advantage of the lower rate.

For more, see:

-

Eliminating the estate tax would be a boon to the heirs of the nation’s wealthiest estates, not to small farms and small businesses. Proponents of repealing or scaling back the estate tax often assert that doing so would help small business owners and farms. But only about 50 small farms and businesses nationwide face any estate tax in a typical year, and those that do pay an effective rate of 6 percent. That’s mainly because the estate tax exempts $11 million in assets per couple — the same reason why repealing it would be a windfall for the heirs of the nation’s wealthiest 0.2 percent of estates.

For more, see:

- A “territorial” corporate tax system could put small and domestic businesses at a competitive disadvantage. President Trump and House Budget Committee Chairman Diane Black have proposed a territorial tax system: U.S.-based multinational corporations wouldn’t pay U.S. corporate taxes on their foreign profits, while domestic businesses would face a 15 percent rate. That could make U.S. domestic and small businesses less competitive relative to large U.S. multinationals.

Large U.S. multinationals can pay tax lawyers millions in fees to find ways to report on their tax forms that they earned their U.S. profits offshore in order to get the zero tax rate on “foreign” profits under a territorial system. That would give them a huge tax advantage over U.S. businesses — including small businesses — that don’t have foreign operations and can’t orchestrate complex tax avoidance maneuvers. The tax avoidance savings that corporations would reap would favor profitable U.S. multinationals, especially those in industries that can easily move profits overseas, such as pharmaceuticals and software.

For more, see:

-

Paying for the Trump and “Better Way” tax cuts for the affluent and large corporations could hurt education, infrastructure, and other federal investments critical to the economy and small businesses. These tax plans propose large, costly tax cuts that overwhelmingly flow to the wealthy and large profitable corporations, but they lack credible ways to fully offset the cost by scaling back tax breaks or raising other sources of revenue. Instead, President Trump’s budget and Chairman Black’s House Budget Committee plan would pair tax cuts with cuts to domestic investments that could weaken the economy and harm small businesses over time. For example, the Trump budget proposes substantial cuts in areas including job training, education, and infrastructure.

For more, see: