BEYOND THE NUMBERS

The Kansas Supreme Court ruled today that state funding for education is inadequate and set a June 30 deadline for lawmakers to raise revenue for schools. Kansas’ failure to adequately fund education is just part of the damaging fallout from the huge tax cuts that the state enacted in 2012.

The court ruled that the state’s school funding system, which the legislature devised two years ago, fails to comply with the state’s constitution, which requires lawmakers to “make suitable provision for finance of the educational interests of the state.” It pointedly noted that “not only is the State failing to provide approximately one-fourth of all its public school K-12 students with the basic skills of both reading and math, but . . . it is also leaving behind significant groups of harder-to-educate students.”

While the court didn’t indicate how much more funding is needed, the amount likely reaches into the hundreds of millions of dollars, in a state where revenue already has fallen far short of what’s needed to maintain existing funding levels for schools and other services.

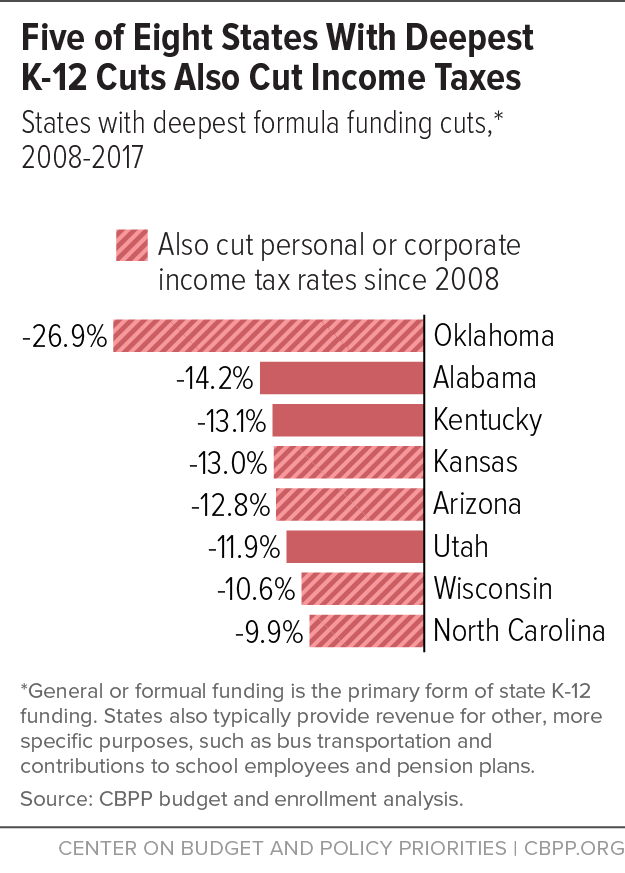

Kansas’ cuts in school funding since the Great Recession hit are among the nation’s deepest, with state general aid per student 13 percent below the 2008 level. Most of the other states with the biggest K-12 cuts also cut income tax rates in recent years (see chart).

Besides making it very hard for Kansas to restore school funding, the massive revenue loss from the tax cuts has wreaked havoc on the state’s budget in other ways. To balance its budget, the state has employed gimmicks and one-time revenue, delayed road projects, cut services, and nearly drained funds it had set aside to prepare for the next recession. Two bond rating agencies downgraded Kansas due to its budget problems. Meanwhile, job growth has lagged far behind job growth nationally, and the hoped-for economic boom shows no signs of materializing.

Just last week, Kansas lawmakers came very close to overriding Governor Sam Brownback’s veto of a bill to reverse most of the tax cuts. Today’s court decision is further evidence that lawmakers were on the right track.