off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

In Case You Missed It…

| By

CBPP

This week at CBPP we focused on the safety net, health, poverty and inequality, federal taxes, state budgets and taxes, housing, Social Security, and the economy.

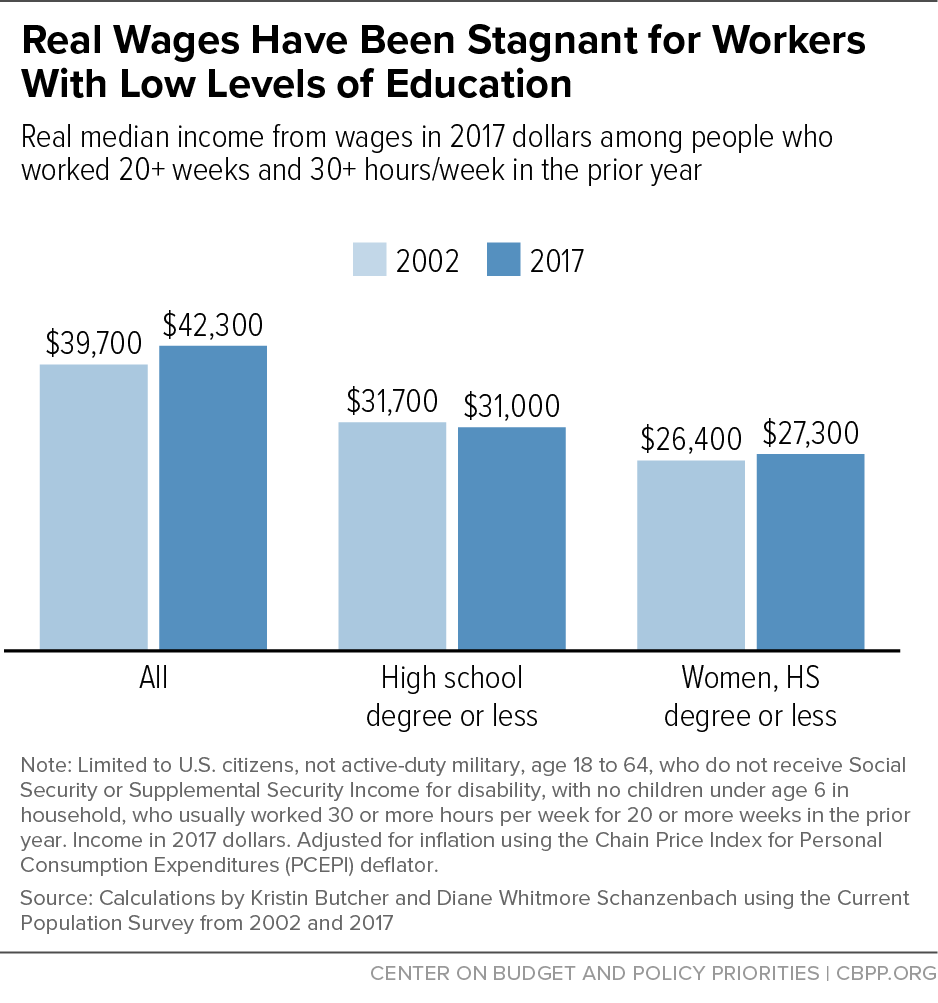

- On the safety net, we released a number of materials highlighting the flaws of proposals to take assistance away from people not able to meet work requirements. We published an analysis from economists Kristin F. Butcher and Diane Whitmore Schanzenbach finding that most people in the low-wage labor market — those likely subject to the requirements — work substantial hours, and in volatile jobs. Brynne Keith-Jennings highlighted those findings in a report summary and blog post. She also cited a new paper from the Economic Policy Institute, which demonstrated that work requirement proposals ignore the realities of the low-wage labor market and would do little to boost employment.

- On health, Tara Straw explained that three health-related bills before the House would cut taxes for the wealthy and corporations while doing little to help consumers. Sarah Lueck explored three factors that will determine the damage from expanding association health plans.

- On poverty and inequality, Tazra Mitchell presented approaches to designing a federally funded subsidized jobs program that would help disadvantaged workers gain a toehold in the labor market. She also highlighted those approaches in a blog post.

- On federal taxes, Brendan Duke found that House Republicans’ “Tax Reform 2.0” framework is fiscally irresponsible, regressive, and provides even more opportunities to game the tax code than the original 2017 tax law.

- On state budgets and taxes, Samantha Waxman showed that states expanding their earned income tax credits (EITCs) will help millions of workers and their families. We released a fact sheet explaining how state EITCs help build opportunities for people of color and women. We also updated our backgrounder on what state tax dollars pay for.

- On housing, Douglas Rice noted that the Senate’s fiscal year 2019 appropriations package for the Department of Housing and Urban Development (HUD) deserves strong support. We also released an infographic explaining how a plan from Rep. Dennis Ross would raise rents on HUD-assisted households.

- On Social Security, we updated our backgrounder explaining the Social Security trust funds.

- On the economy, we updated our backgrounder on the number of weeks of unemployment compensation available in each state.

Chart of the Week: Real Wages Have Been Stagnant for Workers With Low Levels of Education

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

The Republican push for welfare “work requirements,” cartoonsplained

Vox

July 26, 2018

The Downsides of Property Tax Caps

Governing

July 26, 2018

In Our ‘Winner-Take-Most’ Economy, the Wealth Is Not Spreading

New York Times

July 26, 2018

How Washington could actually make housing more affordable

CNN

July 24, 2018

Don’t miss any of our posts, papers, or charts – follow us on Twitter, Facebook, and Instagram.

Stay up to date

Receive the latest news and reports from the Center