BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on health, housing, food assistance, federal taxes, state budgets and taxes, and the economy.

- On health, Jessica Schubel described how New Hampshire’s Medicaid waiver will reduce coverage and access to care. She also noted that American Indians and Alaska Natives would be disproportionately hurt by proposals to take away Medicaid from people not meeting work requirements.

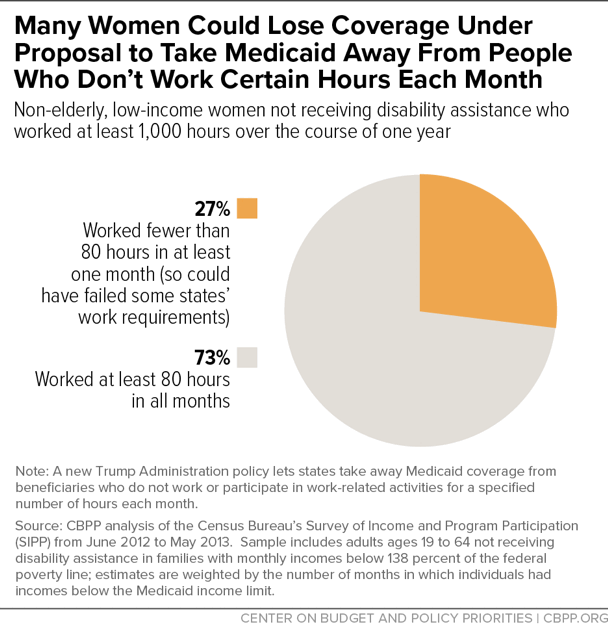

We released briefs on how taking away Medicaid coverage from people who do not work or participate in work-related activities for a specified number of hours each week would harm women and American Indians and Alaska Natives.

- On housing, Will Fischer explained that a bill from Rep. Dennis Ross would allow sharp rent increases on struggling low-income people. Alison Bell pointed to a suit by civil rights organizations over Housing and Urban Development Secretary Ben Carson’s suspension of the Affirmatively Furthering Fair Housing rule.

- On food assistance, Elizabeth Wolkomir warned that the House Agriculture Committee farm bill would impose a Supplemental Nutrition Assistance Program (SNAP) benefit cliff, taking assistance away from hundreds of thousands of low-income working households. Ed Bolen, Lexin Cai, Stacy Dean, Brynne Keith-Jennings, Catlin Nchako, Dorothy Rosenbaum, and Wolkomir updated their analysis of the bill’s proposed changes to SNAP, which would increase food insecurity and hardship. Dean testified before House subcommittees on SNAP’s program integrity and how the farm bill would affect it. Keith-Jennings showed that most SNAP recipients who can work, do work.

- On federal taxes, Chuck Marr argued that raising rents on low-income households while giving new tax breaks to the real estate industry reflects skewed priorities. We released a brief detailing how the 2017 tax law’s pass-through tax deduction benefits the wealthiest, loses needed revenue, and encourages tax avoidance.

- On state budgets and taxes, Michael Leachman explained how North Carolina’s deep tax cuts impede adequate school funding.

- On the economy, we updated our chart book on the legacy of the Great Recession. Timothy J. Bartik, Senior Economist at the W.E. Upjohn Institute for Employment Research, suggested policies that could help manufacturing-intensive communities increase job growth.

Chart of the Week – Many Women Could Lose Coverage Under Proposal to Take Medicaid Away From People Who Don’t Work Certain Hours Each Month

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Now House Republicans want to take food stamps from 35K New Jerseyans

NJ.com

May 11, 2018

Ants, termites, outdated or no textbooks: It’s about more than a paycheck for fed-up teachers in North Carolina

Washington Post

May 11, 2018

Gnawing Away at Health Care

New York Times

May 7, 2018

The obscure tax rule that’s stopping US states from paying teachers more

Quartz

May 5, 2018

50-something food-stamp recipients could face tough job search under proposed rules

McClatchy

May 4, 2018

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.