BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on federal taxes, the federal budget, health, and food assistance.

- On federal taxes, Chuck Marr, Joel Friedman, and Chye-Ching Huang laid out why the House Republican tax bill is fiscally irresponsible. Marr, Huang, Arloc Sherman, and Emily Horton found that the bill’s increase in the Child Tax Credit excludes thousands of children in low-income working families in every state.

Chye-Ching Huang summarized the Joint Committee on Taxation’s finding that the tax bill before the Senate Finance Committee would benefit the well-off and raise taxes for millions of low- and middle-income Americans. Huang, Guillermo Herrera, and Brendan Duke showed that the revised Senate bill is even more skewed to the wealthy than the original bill. Huang also noted that the bill’s “pass-through” tax cut favors the biggest businesses and wealthiest owners. Jacob Leibenluft and Huang analyzed how revisions to the Senate bill made its fundamental tradeoffs of big tax cuts for the top and little gain for low- and moderate-income families even harsher. Joel Friedman explained that the bill could prove costlier than the official estimate.

Chuck Marr, Chye-Ching Huang, Sharon Parrott, Arloc Sherman, Emily Horton, and Vincent Palacios found that the revised Senate bill’s Child Tax Credit increase provides only token help to millions of children in low-income working families. Marr lamented that the revisions to the bill’s child credit provision didn’t prioritize the families that most need help. We rounded up our analyses and social media graphics on the Senate bill.

Sharon Parrott identified the same basic flaws in both the Senate and House tax bills. Chad Stone said that the GOP’s claims that their tax cuts will give American workers a large pay raise are unrealistic.

- On the federal budget, Anna Bailey argued that the federal government should fully fund grants that help states improve their corrections systems. Peggy Bailey warned that failure to raise spending caps would threaten mental health resources.

- On health, Aviva Aron-Dine found that the revised Senate tax bill would add 13 million people to the uninsured in order to pay for tax cuts of nearly $100,000 per year for the top 0.1 percent of households. Tara Straw noted that, contrary to Republican claims, repealing the Affordable Care Act’s (ACA) individual mandate (as the revised Senate tax bill would do) would harm low- and moderate-income people. Aron-Dine debunked the specific claim that the massive coverage losses from repealing the mandate wouldn’t be harmful. Aron-Dine and Edwin Park pointed out that passing the individual market reform package introduced by Senators Lamar Alexander and Patty Murray wouldn’t undo the severe harm incurred by repealing the mandate.

Shelby Gonzales reported that sign-ups for coverage in the ACA marketplace are outpacing last year, despite Trump Administration sabotage. Tara Straw explained why removing caps on repayments of ACA tax credits would reduce coverage and put many families at financial risk.

On Medicaid, Matt Broaddus cited new research showing that expanding Medicaid improves low-income people’s financial health. Hannah Katch analyzed a new policy from the Centers for Medicare & Medicaid Services (CMS) allowing states to cut Medicaid for people who can’t work. Jessica Schubel found that CMS’ new policy toward state Medicaid waivers won’t ensure that these waivers further the program’s objectives. Peggy Bailey explained why for Utah, a Medicaid expansion is a better choice than a flawed and limited waiver.

- On food assistance, Elizabeth Wolkomir warned that as Puerto Rico recovers from Hurricane Maria, it needs more food assistance than its capped Nutrition Assistance Program block grant provides. We updated our state-by-state data resource list on SNAP (formerly food stamps).

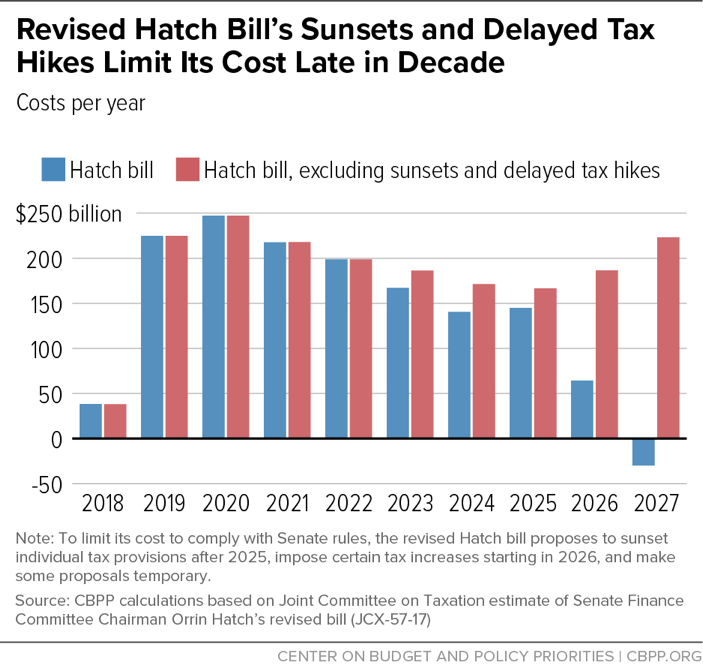

Chart of the Week – Revised Hatch Bill’s Sunsets and Delayed Tax Hikes Limit Its Cost Late in Decade

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Who Really Gets a Tax Increase if the Individual Mandate Goes Away?

New York Times

November 17, 2017

How proposed tax reform would impact young people

Teen Vogue

November 16, 2017

Senate Republicans’ new $2,000 child tax credit helps them — but doesn’t really help the poor

Vox

November 15, 2017

The most compelling criticism of Trump tax plan

Washington Post

November 13, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.