BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on federal taxes, state budgets and taxes, health, poverty and inequality, housing, and the economy.

- On federal taxes, Chye-Ching Huang warned that weakening and then repealing the estate tax, as House Ways and Means Chairman Kevin Brady’s new tax bill would do, would give millions to the wealthiest heirs. Before the bill’s release, Jacob Leibenluft, Huang, and Michael Leachman explained why it would likely contain the same basic flaws as earlier versions of the plan.

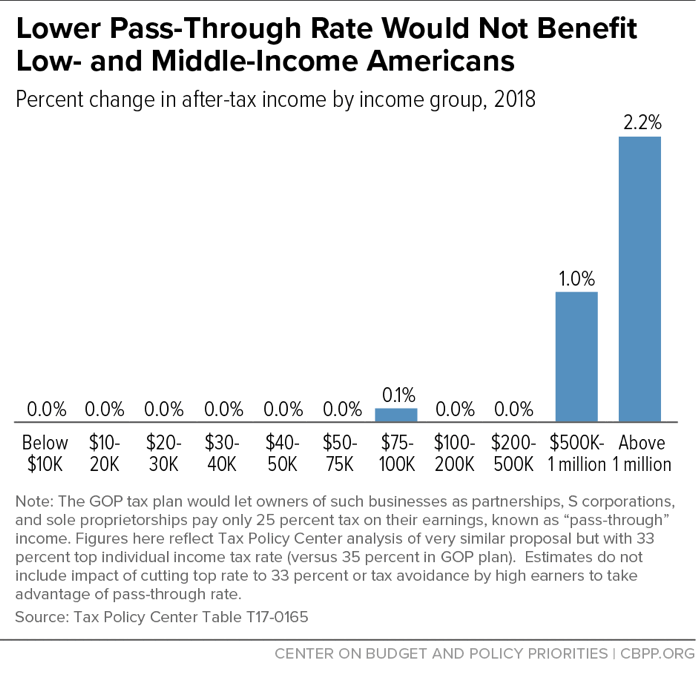

Chye-Ching Huang and Chloe Cho updated their report on ten facts you should know about the federal estate tax. We updated our brief on how the Republican leadership tax plan announced in September violates the “Mnuchin rule” by delivering large tax cuts to high-income households, and our brief on how repealing the estate tax would only benefit the heirs of the largest estates. Chuck Marr, Huang, Brandon DeBot, and Guillermo Herrera updated their paper detailing how the “pass-through” tax break in the September Republican leadership tax plan would be costly and encourage tax avoidance.

- On state budgets and taxes, Michael Leachman laid out how the House tax bill’s changes to state and local tax deductions would hurt states and explained why a proposed “compromise” would be nearly as harmful to states as fully repealing the deductions. Samantha Waxman reflected on the problems that Colorado’s Taxpayer Bill of Rights has caused the state over the past 25 years.

- On health, Judy Solomon advised on what to watch for in Trump Administration actions on state Medicaid waivers. Jesse Cross-Call debunked Maine Governor Paul LePage’s claim that adopting the Affordable Care Act’s (ACA) Medicaid expansion would threaten care for people with disabilities. Tara Straw pointed out that up to 688,000 people would lose insurance under the House bill to extend funding for the Children’s Health Insurance Program (CHIP) and community health centers. Cross-Call warned that without new federal CHIP funds, states will soon cut health coverage for children. Paul Van de Water raised concerns over the House bill’s proposed increase in Medicare’s income-related premiums.

Also, Tara Straw and Aviva Aron-Dine assessed the outlook for marketplace open enrollment, which began November 1. Shelby Gonzales highlighted five things to know as open enrollment begins. We updated our Sabotage Watch tracker on efforts to undermine the ACA.

- On poverty and inequality, Zoë Neuberger and Dorothy Rosenbaum partnered with Sonal Ambegaokar at Social Interest Solutions to detail opportunities to streamline enrollment across public benefit programs. Our related interactive graphic illustrates these cross-enrollment opportunities.

- On housing, Will Fischer pointed to a new report that reinforces concerns about the Department of Housing and Urban Development’s (HUD) Moving to Work demonstration. Douglas Rice explained how budget caps, not rent aid, are forcing HUD to make budget cuts.

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the Week – Lower Pass-Through Rate Would Not Benefit Low- and Middle-Income Americans

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

2 winners and 3 losers from the Republican tax bill

Vox

November 2, 2017

The GOP Tax Plan Takes From Orphans, Gives to Trust-Fund Kids

New York

November 2, 2017

Ivanka Trump is spearheading an expansion of tax relief for parents, and the GOP is fighting her

Business Insider

November 2, 2017

Past-Due Premiums, Missing Tax Forms May Hamstring Marketplace Customers

Kaiser Health News

October 31, 2017

Trump tax reform 2017: Will the plan affect you? 5 things to know about tax cuts & the middle class

Mic

October 30, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.