off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

November 1 marks the start of open enrollment for coverage in the Affordable Care Act (ACA) marketplaces. Despite repeated threats from the White House and congressional Republicans to repeal or undermine the ACA, people across the country should rest assured that they can enroll in comprehensive coverage for 2018. Here are a few things they should keep in mind as they shop for coverage:

- Everyone enrolled in a marketplace plan gets preventive benefits such as annual checkups at no cost, coverage for “essential health benefits” (like prescriptions and doctor visits, maternity care, and mental health treatment), and financial protection against significant medical costs due to illness or injury.

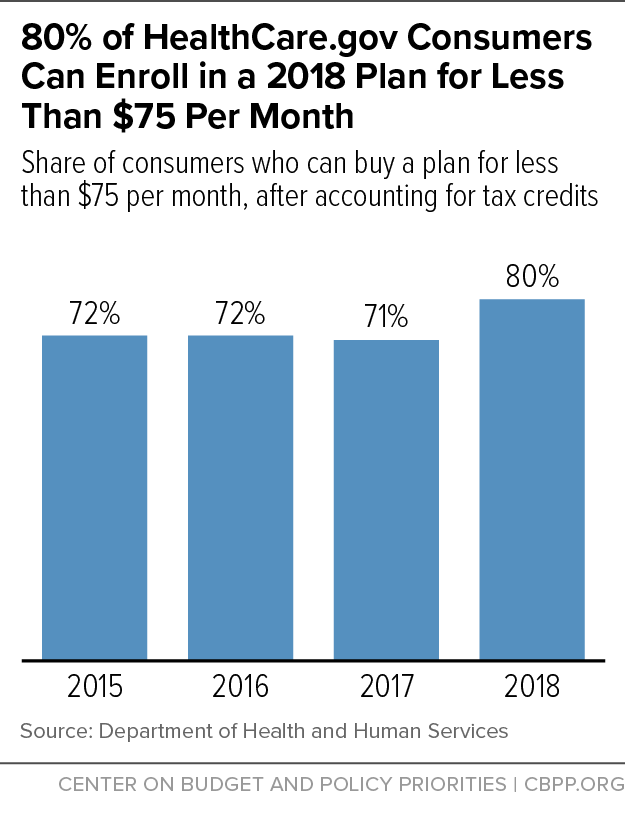

- The vast majority of marketplace customers are eligible for premium tax credits to help pay for their coverage. Eighty percent of enrollees will have the option to enroll in a plan that costs less than $75 per month after accounting for their tax credits (see chart). The tax credit amounts rise when premiums rise, so most people are protected if their premiums go up. Premium tax credits are only available to people who sign up in marketplace plans such as those available on HealthCare.gov or through a state-based marketplace.

- People already enrolled in a marketplace plan should shop for a plan anyway, because they may find a better deal. Even those who liked their 2017 plan might find a new plan that meets their needs but costs less.

- The open enrollment period is shorter this year than last, running only from November 1 to December 15. Consumers should shop early, and not wait to start their applications and seek assistance that they may need to enroll. If customers wait until the last minute, they could face long waits as they try to sign up online or they could even miss the opportunity to enroll. While eligible people can enroll in Medicaid and the Children’s Health Insurance Program at any time during the year, marketplace consumers must sign up for plans during open enrollment; only those who lose other coverage or experience significant life changes such as marriage can sign up after open enrollment ends.

- Trained and certified consumer assistance groups are available in many places across the country for those who want help completing the application and understanding plan options. Consumers can find help by visiting the Get Covered Connector website.

Topics:

Policy Basics

Health

Blog

Trump Administration Undermining Community Efforts to Help Marketplace Consumers

October 4, 2017

Blog

Trump Administration Slashing Funding for Marketplace Enrollment Assistance and Outreach

September 1, 2017

Stay up to date

Receive the latest news and reports from the Center