BEYOND THE NUMBERS

In Case You Missed It . . .

This week at CBPP, we focused on the federal budget and taxes, state budgets and taxes, health, housing, food assistance, and Social Security.

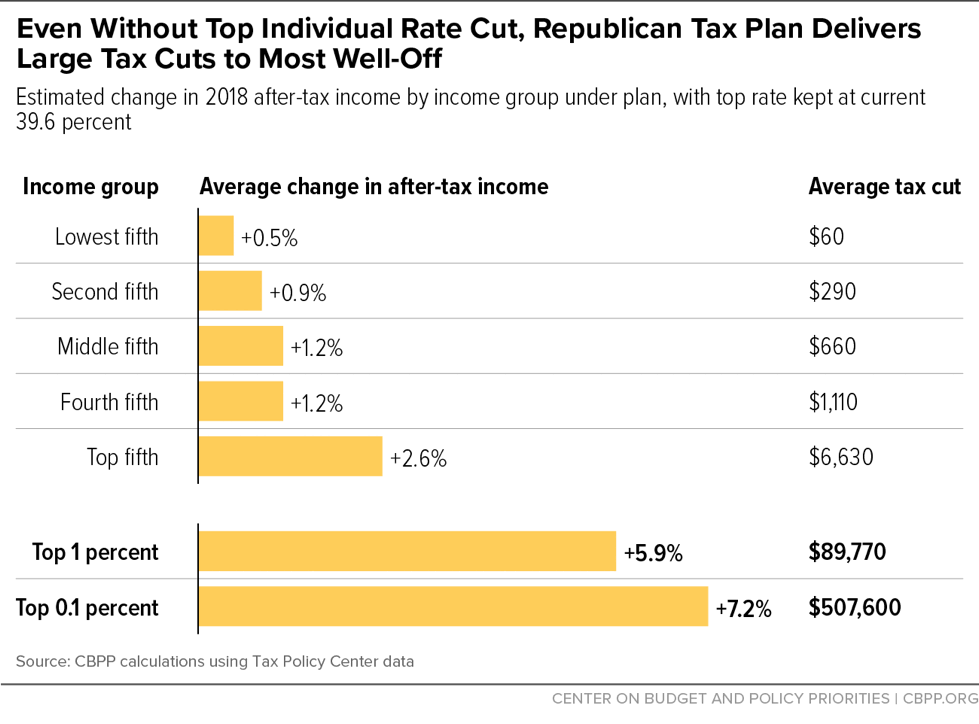

- On the federal budget and taxes, Robert Greenstein, Chye-Ching Huang, Chuck Marr, Emily Horton, and Roderick Taylor explained why the Republican tax plan’s proposed increase to the Child Tax Credit (CTC) would exclude millions of children in low-income families. Marr, Huang, and Brendan Duke detailed why the Republican tax plan would still disproportionally benefit the wealthiest households even if the top rate isn’t cut.

Greenstein warned that the congressional budget resolution is a major step toward ill-advised tax cuts that would drive up the deficit. Sharon Parrott summarized why these tax cuts would be ill-conceived and could lead to entitlement program cuts.

We updated our backgrounders on the legacy of the “Bush” tax cuts and the Child Tax Credit.

- On state budgets and taxes, Michael Leachman outlined why the Republican tax plan’s elimination of the state and local tax deduction to pay for tax cuts for the wealthy would be a bad deal for most Americans.

- On health, Aviva Aron-Dine highlighted a Congressional Budget Office analysis finding that the Bipartisan Health Care Stabilization Act from Senators Lamar Alexander and Patty Murray would lower federal costs and benefit consumers. Jesse Cross-Call and Matt Broaddus argued that adopting the Affordable Care Act’s (ACA) Medicaid expansion would greatly benefit Maine, contrary to Governor Paul LePage’s claims. Hannah Katch, Jessica Schubel, and Shelby Gonzales described how the Trump Administration and Congress can ensure that those affected by the recent hurricanes have access to health care.

Sarah Lueck called for Iowa to investigate ways to strengthen its insurance market now that it has withdrawn its harmful “1332 waiver” request. Anna Bailey detailed why West Virginia’s new Medicaid waiver to improve outcomes for beneficiaries with substance use disorders promotes Medicaid’s core objectives.

We posted a new Sabotage Watch entry on the Trump Administration’s continued efforts to undermine the ACA.

- On housing, Douglas Rice and Lissette Flores advised that Congress add funding to prevent housing vouchers from being cut in 2018. Rice also broke down how these cuts would affect each state.

- On food assistance, Elizabeth Wolkomir explained that policymakers should not only help Puerto Rico meet its immediate needs in the aftermath of Hurricane Maria but also promote the island’s longer-term recovery.

- On Social Security, we updated our backgrounder on the Supplemental Security Income program.

Chart of the Week – Even Without Top Individual Rate Cut, Republican Tax Plan Delivers Large Tax Cuts to Most Well-Off

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Congress quietly passed a budget outline with $1.8 trillion in health care cuts

Vox

October 26, 2017

Ivanka Trump, Supposed Champion Of Working Women, Backs Tax Plan That Forgets Them

The Huffington Post

October 26, 2017

Why You Shouldn't Count On The Promised $4,000 'Raise' From GOP Tax Plan

NPR

October 24, 2017

Iowa Withdraws Request to Leave Obamacare Market

The New York Times

October 23, 2017

Three things to remember about the rhetoric surrounding the Trump tax plan

The Washington Post

October 23, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.