BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on the federal budget and taxes, health, state budgets and taxes, poverty and inequality, Social Security, food assistance, and the economy.

-

On the federal budget and taxes, Joel Friedman, Chye-Ching Huang, David Reich, Paul Van de Water, and Sharon Parrott found that the proposed Senate budget is likely to leave millions of Americans worse off. Parrott explained that the Republican tax and budget agenda would leave most low- and middle-income children worse off. Richard Kogan compared the Trump, House, and Senate budgets and listed five key points about the House budget.

Huang and Friedman documented Senate Republicans’ first big step towards a $1.5 trillion revenue-losing tax cut. Huang and Brendan Duke pointed out that the vast majority of Americans would likely lose from that tax cut once it’s paid for. Marr expanded on how the Republican leaders’ tax framework specifies large tax cuts aimed at profitable corporations and wealthy households while offering only vague promises for lower- and middle-income working families.

We released a brief explaining how the pass-through tax break would benefit the wealthiest and encourage tax avoidance and updated a brief on a territorial tax system. We also updated our primer on where our federal tax dollars go.

- On health, Van de Water, Edwin Park, Jesse Cross-Call, Judith Solomon, and Shelby Gonzales, assessed the new House Republican bill that would extend funding for the Children’s Health Insurance Program and temporarily increase federal Medicaid funding for Puerto Rico and the U.S. Virgin Islands. Park explained why the bill’s Medicaid funding for Puerto Rico and the Virgin Islands falls far short. Kyle Hayes clarified that despite claims, Medicaid expansion is crucial to addressing the opioid epidemic. Hannah Katch laid out why this is particularly true for states. Gonzales revealed how the Trump Administration is undermining community efforts to help marketplace consumers. Tara Straw cautioned that shortening the marketplace grace period would boost the number of uninsured. Van de Water advised against repealing the Independent Payment Advisory Board, a presidentially appointed commission charged with developing ways to slow the growth of Medicare spending.

- On state budgets and taxes, Erica Williams mapped out how states can build thriving economies, distilling these into four steps. Elizabeth McNichol and Samantha Waxman reported that 22 states faced revenue shortfalls in 2017, despite the growing economy.

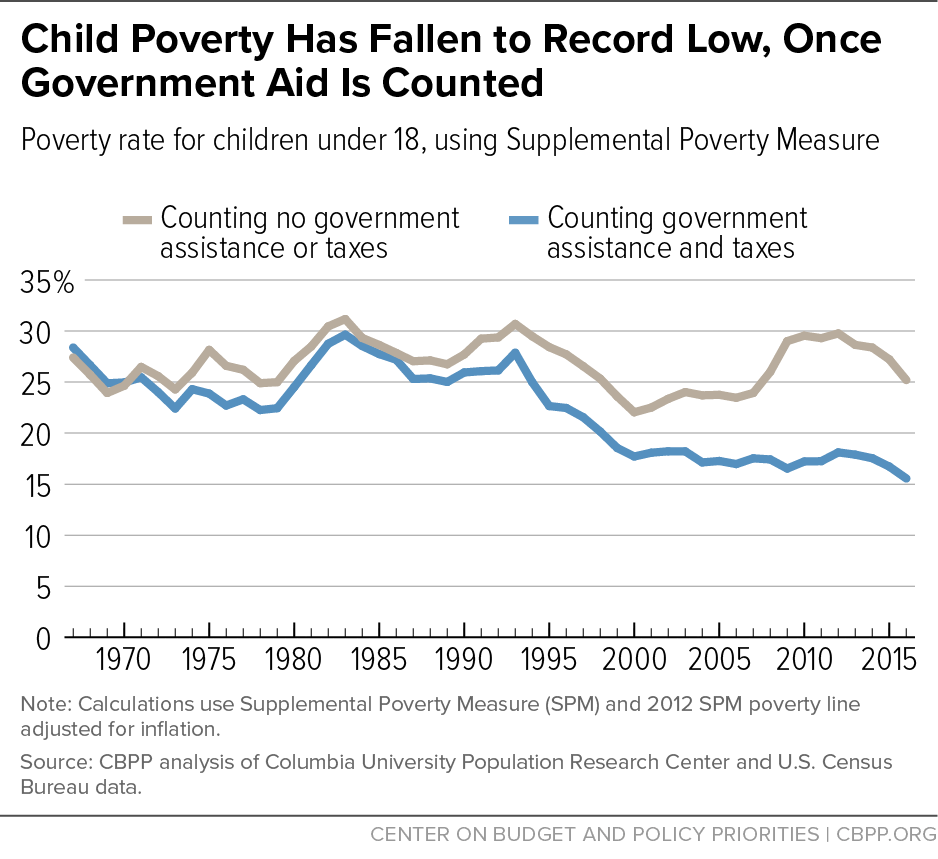

- On poverty and inequality, Isaac Shapiro and Danilo Trisi showed that child poverty has fallen to a record low, due largely to stronger government policies.

- On Social Security, Kathleen Romig warned that more cuts to Social Security Administration funding would further degrade service.

- On food assistance, Elizabeth Wolkomir noted that the U.S. Agriculture Department approved Puerto Rico’s request to let participants in the territory’s Nutrition Assistance Program use their nutrition benefits to buy hot foods. We updated our backgrounder on SNAP (formerly food stamps).

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the week – Child Poverty Has Fallen to Record Low, Once Government Aid is Counted

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

America's Child-Poverty Rate Has Hit a Record Low

The Atlantic

October 5, 2017

Republicans Hammer Out Child Tax Credit Details

Wall Street Journal

October 4, 2017

What the Senate Republican budget actually means for health care

Vox

October 4, 2017

This Is What a Real Middle-Class Tax Cut Would Look Like

The Atlantic

October 3, 2017

Trump's Tax Plan Has Echoes Of The Kansas Tax Cut Experiment

NPR

September 30, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.